BNB Hits All-Time High as U.S. Firms Pile In With Crypto Treasury Strategies

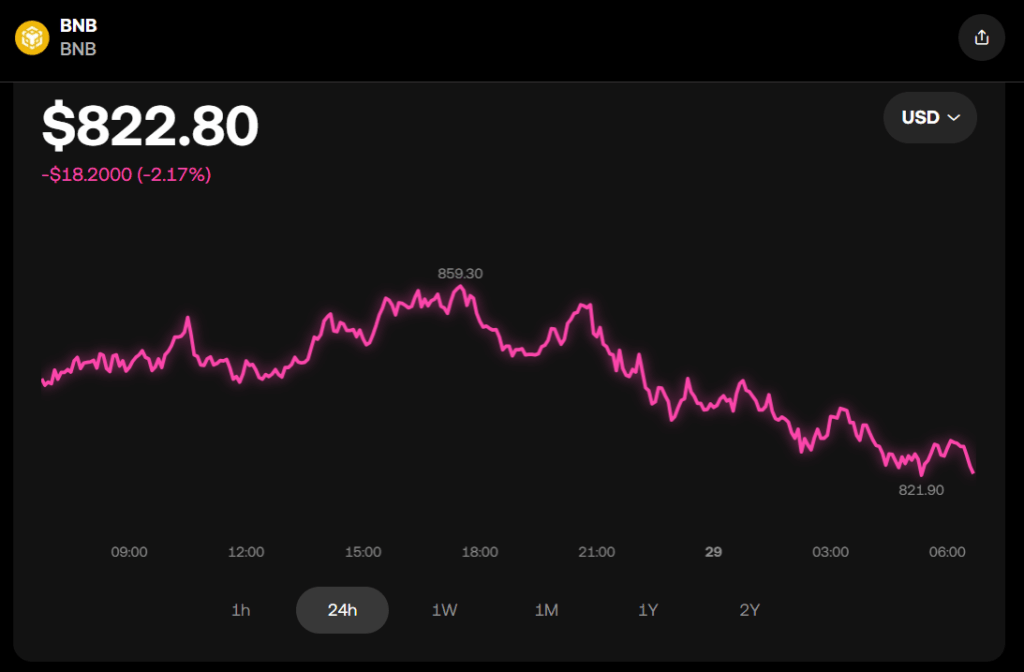

- BNB hit a new all-time high of $860, driven by institutional adoption and treasury strategy announcements from U.S.-listed companies.

- CEA Industries led the charge with a $500M BNB raise, backed by Binance co-founder CZ’s family office, while other firms like LIMN, WINT, and Nano Labs committed hundreds of millions to BNB.

- BNB’s role in corporate treasury diversification has fueled its outperformance, highlighting its growing status as a store of value.

BNB, the native token of the BNB Chain, soared to a record-breaking high of $860 on Monday before settling near $840. It outperformed the broader crypto market, registering a 9% weekly gain, making it the top-performing asset among the top 10 cryptocurrencies (excluding stablecoins). The rally was fueled by a wave of U.S.-listed companies adopting BNB as part of their long-term crypto treasury strategies.

Institutional Momentum Builds Behind BNB

The surge was catalyzed by a series of high-profile announcements from publicly traded companies. CEA Industries (VAPE) led the charge, revealing plans to raise $500 million for its BNB treasury, backed by Yzi Labs—Binance co-founder Changpeng Zhao’s family office. The announcement sent VAPE’s stock soaring over 700%, and the fundraising may expand to $1.2 billion, solidifying its goal of becoming the largest U.S.-listed BNB-holding company.

Pharma and Tech Join the BNB Frenzy

The momentum didn’t stop there. Liminatus Pharma (LIMN) announced the creation of a new subsidiary, “American BNB Strategy,” with a mandate to invest up to $500 million in BNB. Similarly, Windtree Therapeutics (WINT) committed up to $700 million for BNB acquisitions last week. Tech firm Nano Labs also entered the scene, revealing a $100 million BNB purchase over the weekend after previously disclosing crypto treasury intentions.

BNB’s Treasury Use Case Gains Serious Legitimacy

This growing institutional appetite for BNB is reinforcing its status not just as a utility token for the Binance ecosystem, but as a legitimate store of value. The coordinated moves from multiple U.S. firms signal a new chapter for crypto treasury adoption, with BNB taking center stage. These developments place additional spotlight on the BNB Chain and suggest that other large-cap tokens may see similar attention as corporate treasury diversification strategies evolve.

The post BNB Hits All-Time High as U.S. Firms Pile In With Crypto Treasury Strategies first appeared on BlockNews.

BNB Hits All-Time High as U.S. Firms Pile In With Crypto Treasury Strategies

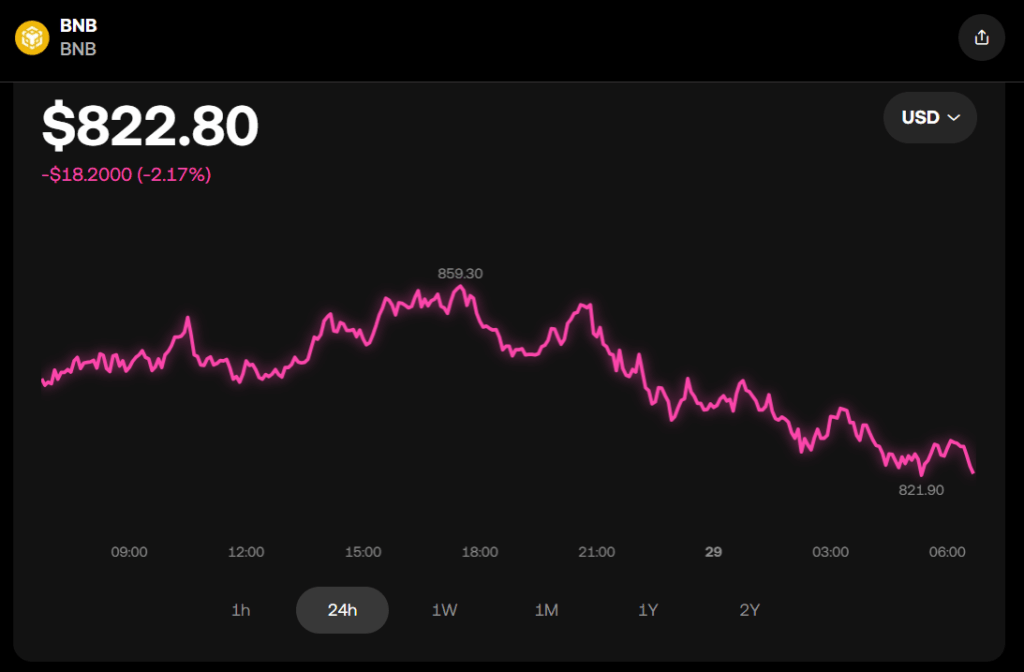

- BNB hit a new all-time high of $860, driven by institutional adoption and treasury strategy announcements from U.S.-listed companies.

- CEA Industries led the charge with a $500M BNB raise, backed by Binance co-founder CZ’s family office, while other firms like LIMN, WINT, and Nano Labs committed hundreds of millions to BNB.

- BNB’s role in corporate treasury diversification has fueled its outperformance, highlighting its growing status as a store of value.

BNB, the native token of the BNB Chain, soared to a record-breaking high of $860 on Monday before settling near $840. It outperformed the broader crypto market, registering a 9% weekly gain, making it the top-performing asset among the top 10 cryptocurrencies (excluding stablecoins). The rally was fueled by a wave of U.S.-listed companies adopting BNB as part of their long-term crypto treasury strategies.

Institutional Momentum Builds Behind BNB

The surge was catalyzed by a series of high-profile announcements from publicly traded companies. CEA Industries (VAPE) led the charge, revealing plans to raise $500 million for its BNB treasury, backed by Yzi Labs—Binance co-founder Changpeng Zhao’s family office. The announcement sent VAPE’s stock soaring over 700%, and the fundraising may expand to $1.2 billion, solidifying its goal of becoming the largest U.S.-listed BNB-holding company.

Pharma and Tech Join the BNB Frenzy

The momentum didn’t stop there. Liminatus Pharma (LIMN) announced the creation of a new subsidiary, “American BNB Strategy,” with a mandate to invest up to $500 million in BNB. Similarly, Windtree Therapeutics (WINT) committed up to $700 million for BNB acquisitions last week. Tech firm Nano Labs also entered the scene, revealing a $100 million BNB purchase over the weekend after previously disclosing crypto treasury intentions.

BNB’s Treasury Use Case Gains Serious Legitimacy

This growing institutional appetite for BNB is reinforcing its status not just as a utility token for the Binance ecosystem, but as a legitimate store of value. The coordinated moves from multiple U.S. firms signal a new chapter for crypto treasury adoption, with BNB taking center stage. These developments place additional spotlight on the BNB Chain and suggest that other large-cap tokens may see similar attention as corporate treasury diversification strategies evolve.

The post BNB Hits All-Time High as U.S. Firms Pile In With Crypto Treasury Strategies first appeared on BlockNews.