Crypto Market Yearly Report 2023: An In-Depth Analysis and Insights

The post Crypto Market Yearly Report 2023: An In-Depth Analysis and Insights appeared first on Coinpedia Fintech News

2023 has been a highly volatile year for Bitcoin and the entire crypto market. Starting the year on a bullish rally like a tracer bullet to being on a collision course, pulling back for the entire Summer, and finally recovering and forming a new 52W high in 2023.

Catalyzing the significant price movements in the crypto markets, the recent developments in the world market have led to a domino effect in Bitcoin. Fortunately, it ends on a bullish note in 2023.

The volatility in the Global markets due to ongoing conflicts around the world, the failing banking systems, the U.S. economy on high alert driving sharp changes in interest rates, and the rising interest of big shot Investment Institutions into Bitcoin and hoping for a Bitcoin Spot ETF were the driving force behind this year’s price movement.

Now that we know the driving factors for this year’s Crypto market let’s look at it in detail to understand the upcoming price movement. Cracking the code with previous price movements, let’s find out if Bitcoin can hit the $100,000 mark in 2024. And what you should expect in the crypto market in the coming months.

Bitcoin Price Movement In 2023

At the end of 2023, the crypto market has shown signs of stabilization and growth. Bitcoin, in particular, has experienced significant price movements throughout the year.

Starting the year at around $16,000 lowest price point since November 2020, Bitcoin’s price surged to nearly $24,000 in January, dropped to around $20,000 in mid-year, and experienced fluctuations in response to various market stimuli, including regulatory news and global economic trends.

However, the growing anticipations of Bitcoin spot ETF approval and the hopes of a bull run in 2024 due to the Bitcoin Halving event keep the buyers eager and ready to pay the extra premium. Fueled by some extra bullish sentiments like the upcoming Bitcoin halving event, the potential rate cuts in 2024, and more, the bull run is gaining momentum.

By the end of the year, Bitcoin’s price movement reflected a more mature and resilient market, with the Uptober rally prolonging the uptrend to reach cross $40,000, to form the 52W high at $44,729, a significant recovery within a year.

But before coming to the present bull run in Bitcoin, let us look at the entire year.

A Bullish Year For Crypto

Commencing 2023 on a bullish note, Bitcoin, the leading cryptocurrency, saw a remarkable rise in the first quarter. Starting the year at $16,508, the BTC price trend kept an overall positive monthly growth, leading to 4-consecutive bullish candles in the monthly chart. The bullish growth over the 4-month phase accounts for an increase of 78%.

Ethereum, the second-largest cryptocurrency by market capitalization, also witnessed substantial growth. Making six consecutive bullish candles, the ETH price jumped from $1,195 to $1,945, a 62% increase in the first half of 2023.

This positive trend was primarily attributed to easing macroeconomic pressures and shifting investor sentiment. Analysts pointed to the Federal Reserve’s potential slowdown in rate hikes as a key driver of this optimism, fostering a bullish sentiment among investors and contributing to the market’s upward trajectory.

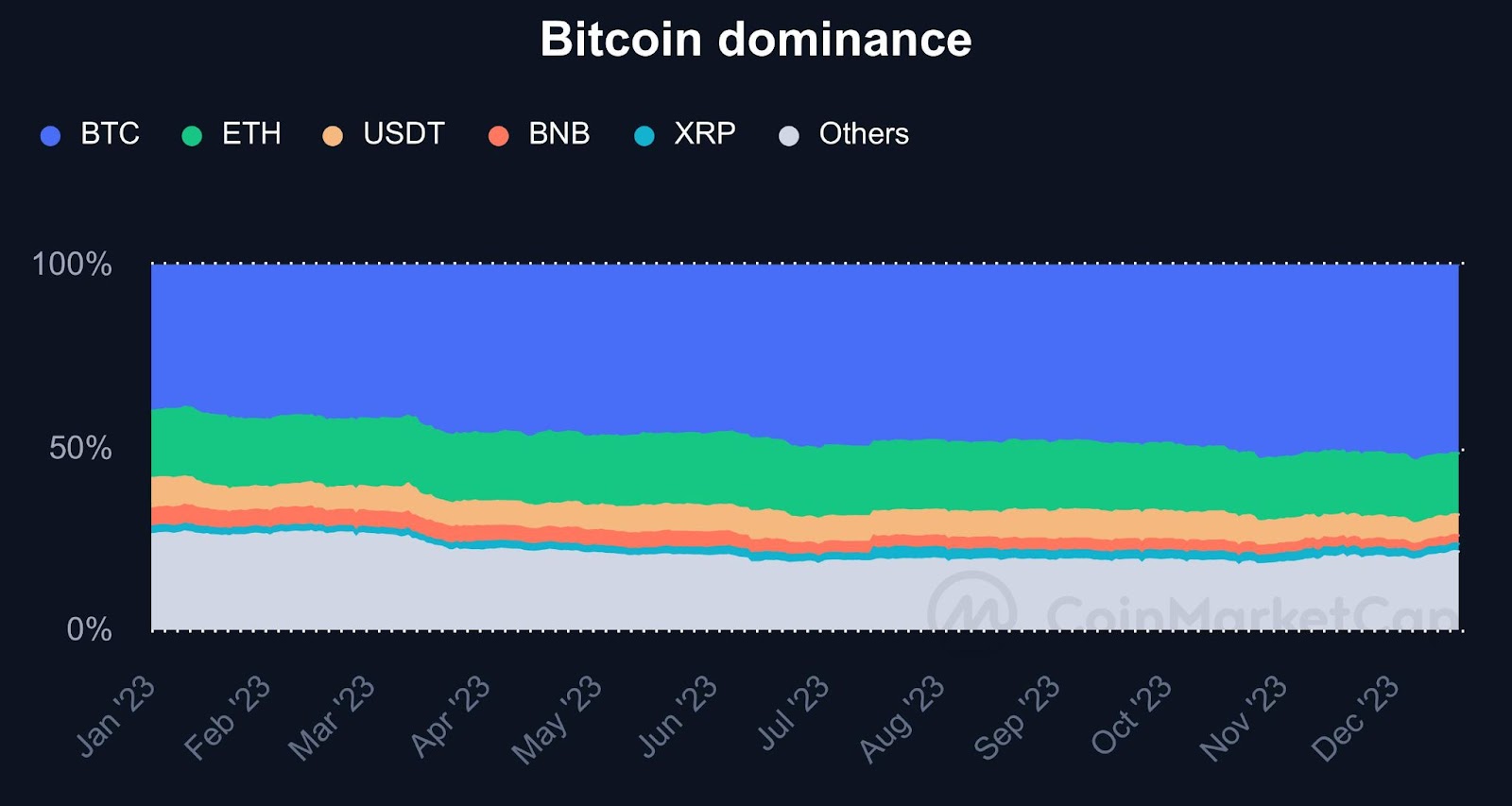

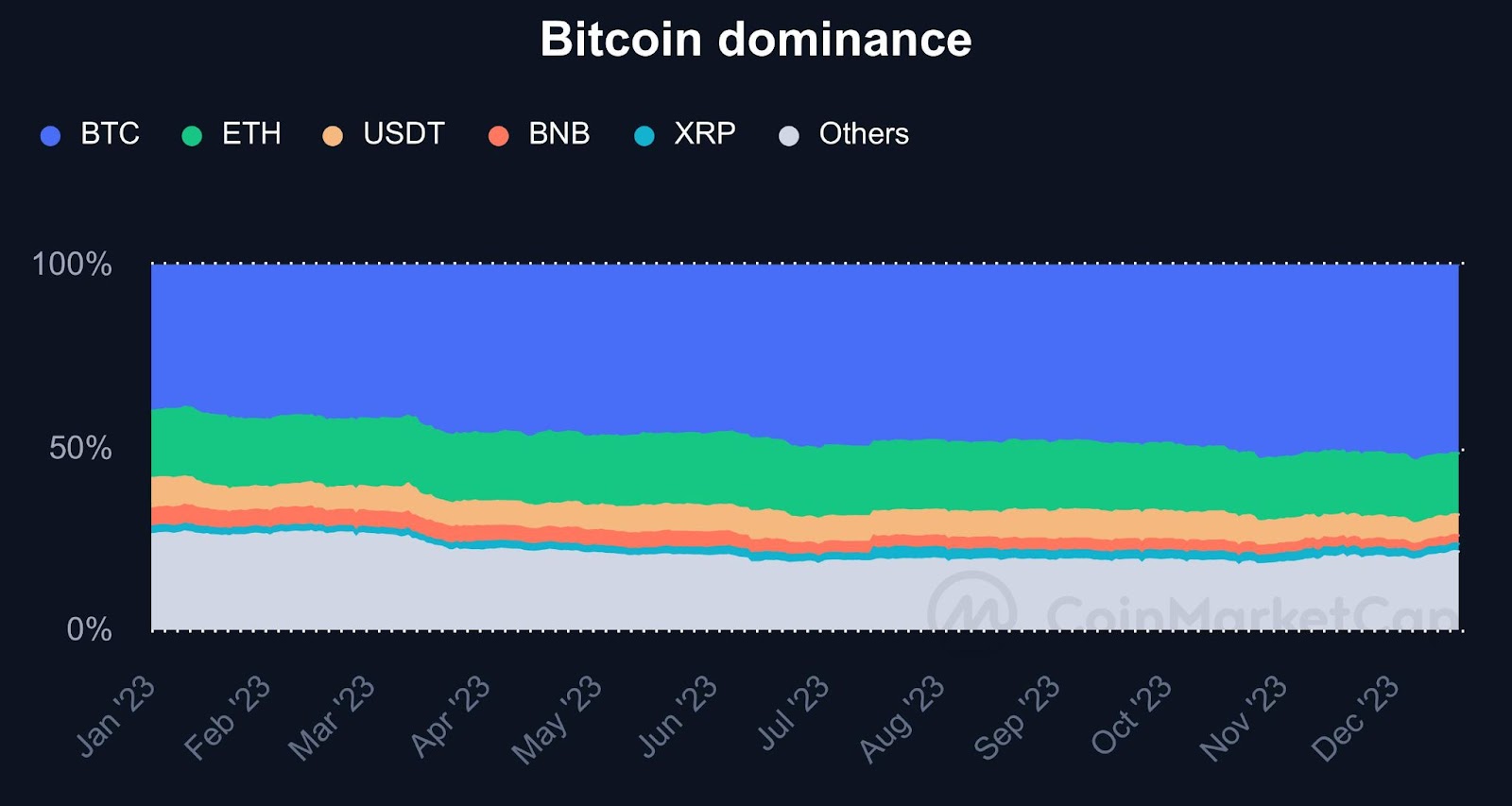

Bitcoin’s grip on the crypto market has tightened in 2023. We kicked off the year with Bitcoin holding a substantial 40% of the market, with Ethereum trailing at 18.43% and USDT securing a solid 8.30%. Flash forward, and Bitcoin has bulldozed past the 50% threshold at 51.68%. Ethereum’s slice has shrunk to 16.77%, and USDT has dipped to 5.71%, while the combined might of the altcoins has dwindled from 32% to 26%.

On the emotional barometer of the market—the Crypto Fear and Greed Index—we’ve ridden a wave from a neutral 59% to the depths of fear at 31.83% in September. But now, we’re surfing in the greed zone at a bullish 69.79%, a sign that optimism is back with a vengeance.

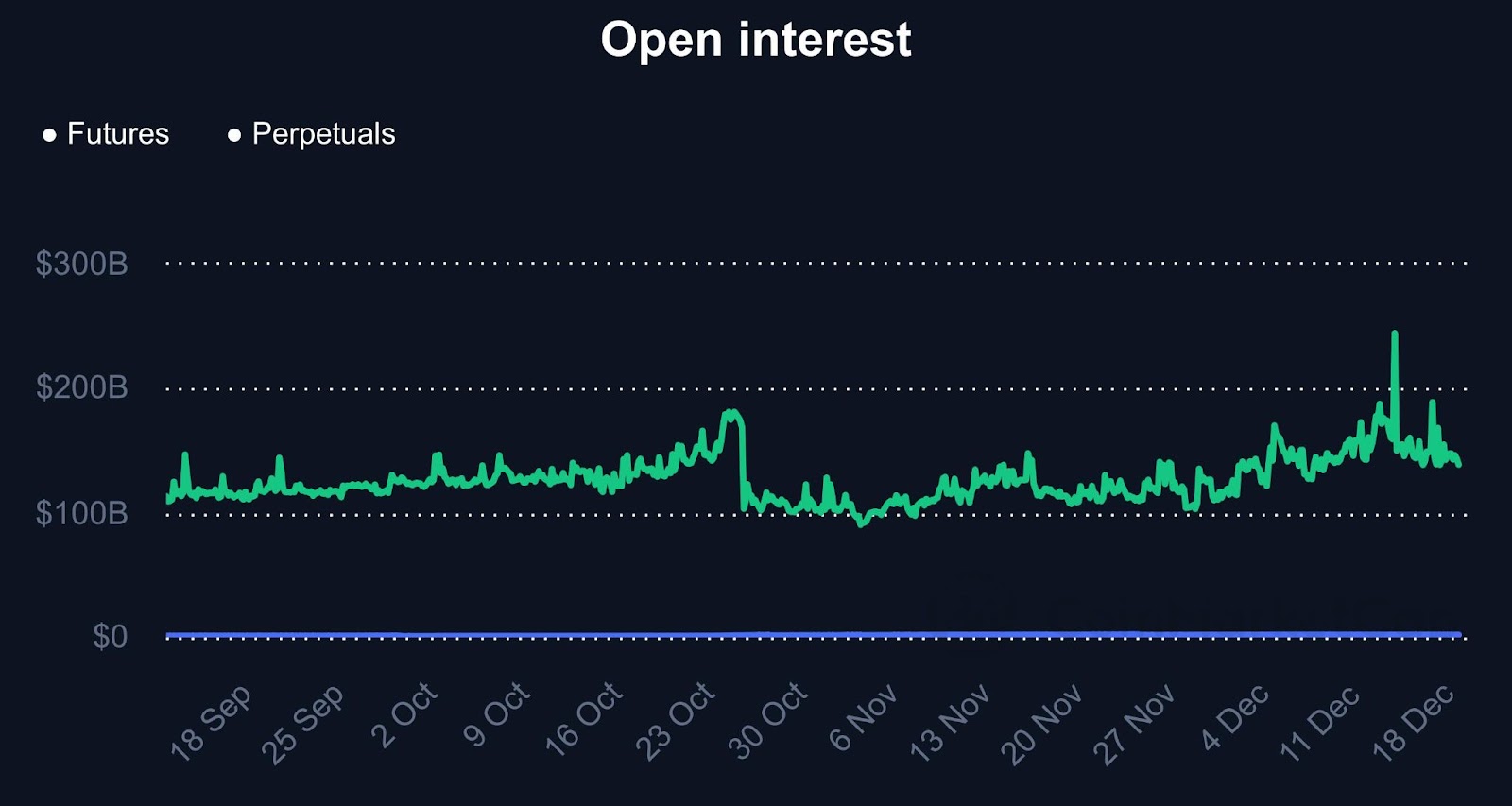

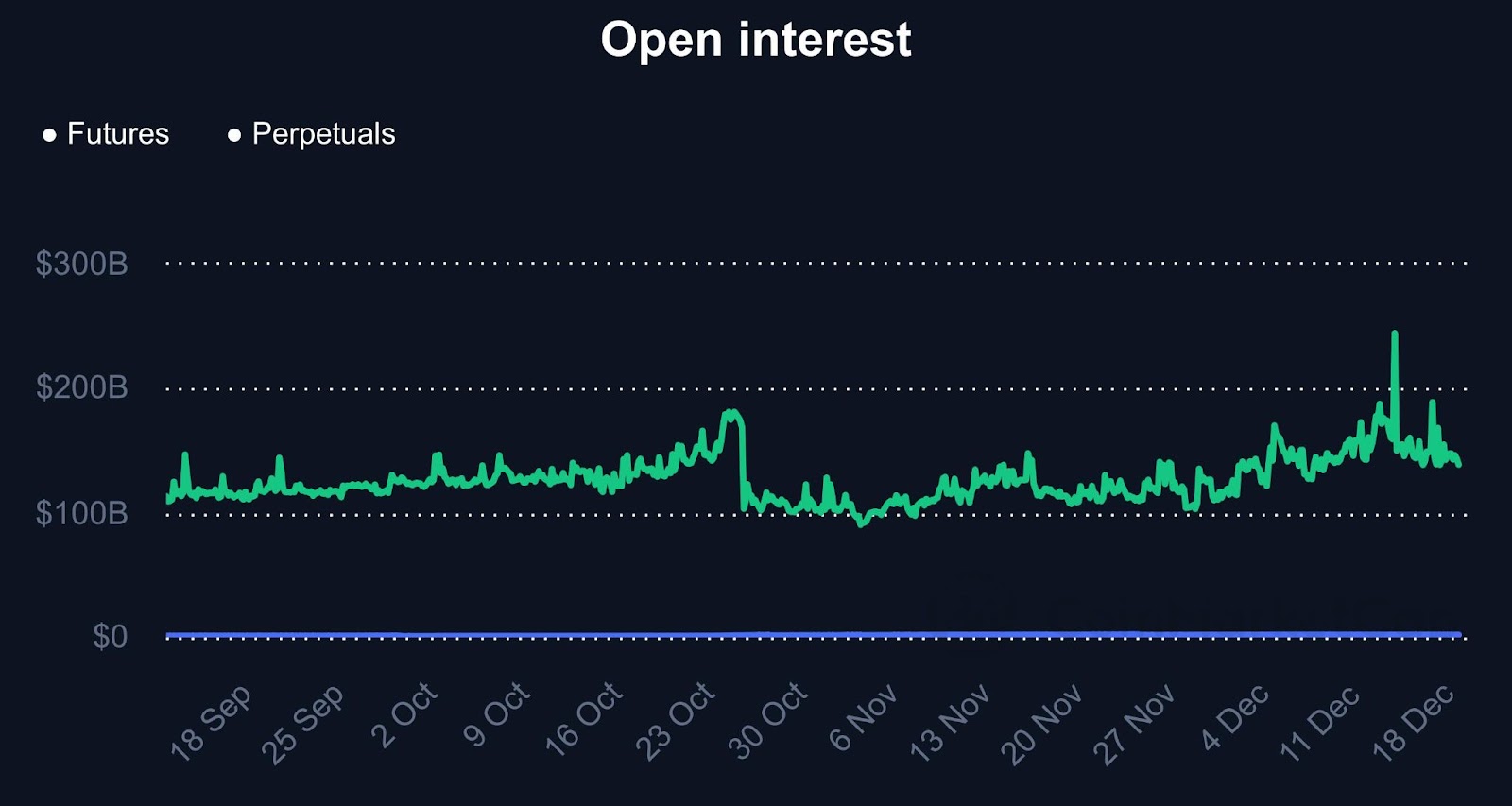

In the derivatives arena, open interest has been a rollercoaster. The futures market has soared from $1.28 billion to $2.30 billion, while perpetuals have seen a steep climb from $109 billion to $139 billion despite severe ups and downs.

BRC – 20 Tokens

In 2023, the BRC-20 token standard, built on the Bitcoin blockchain leveraging the Ordinals protocol, marked a pivotal shift in utilizing Bitcoin. This new class of fungible tokens allowed for functionalities akin to the ERC-20 standard on Ethereum but with the security and widespread adoption of Bitcoin.

The rise of BRC-20 tokens on the Bitcoin blockchain has sparked diverse social sentiments reminiscent of last year’s DeFi token frenzy. Investors are showing speculative interest, eyeing BRC-20 tokens for potential gains, yet wary of their volatility and unproven long-term value. Hence, the high enthusiasm among investors is drawn to the potential applications of these tokens.

The crypto community remains divided: some view BRC-20 as a valuable innovation for Bitcoin, enhancing its utility beyond mere transactions. Meanwhile, others see it as a deviation from Bitcoin’s original intent, potentially leading to increased transaction fees and network congestion.

Key developments and their implications for BRC-20 in 2023 included:

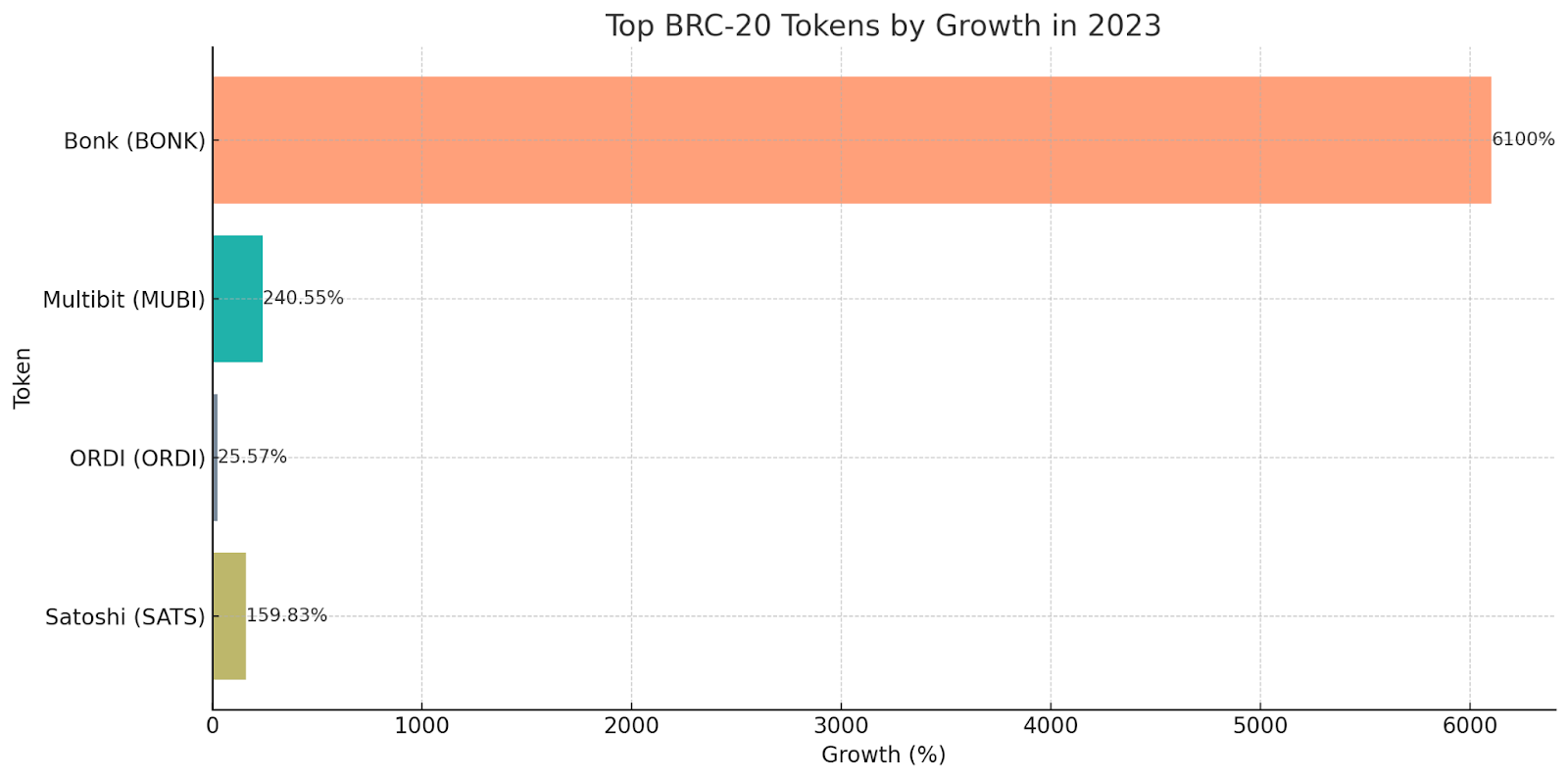

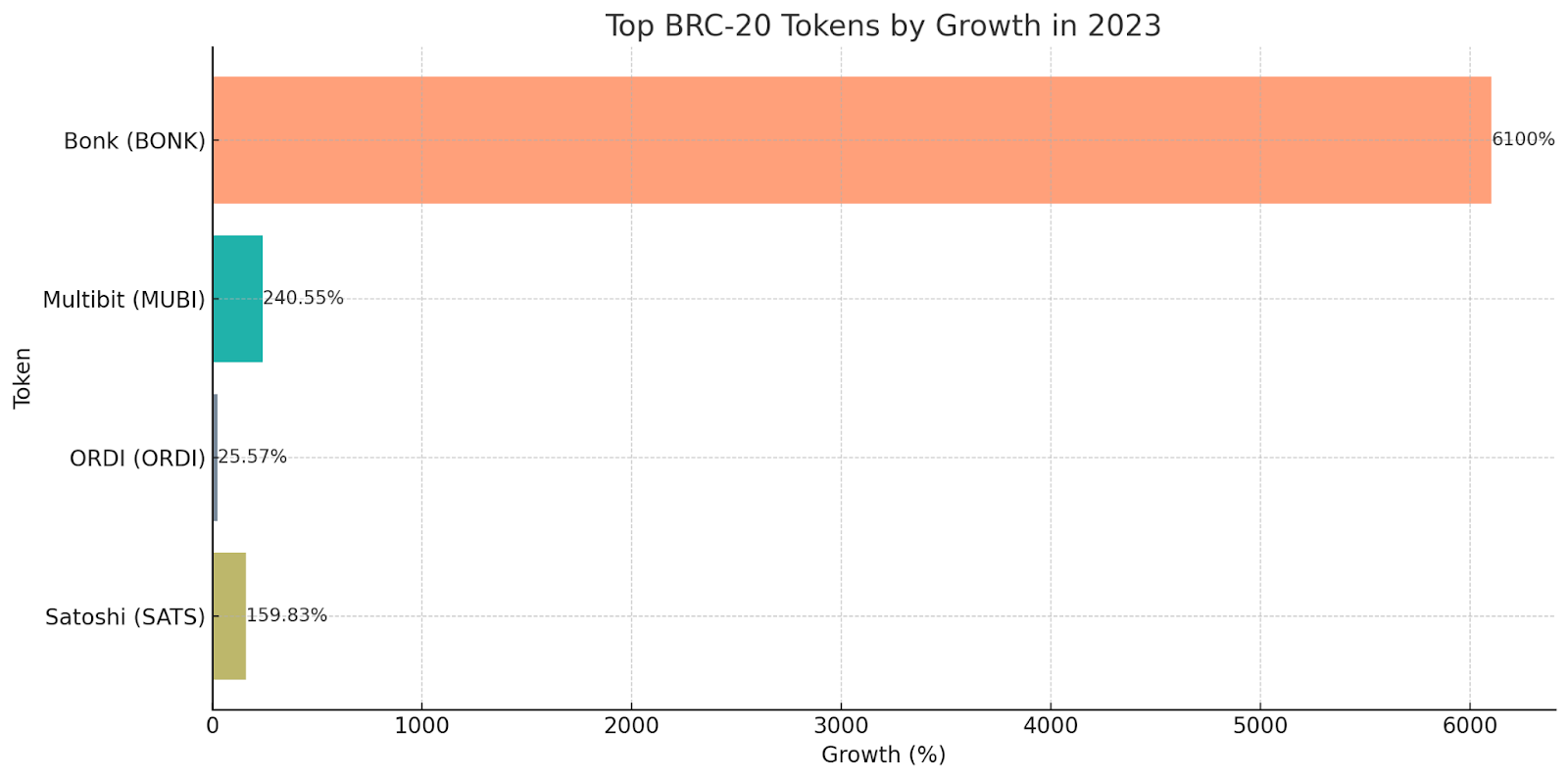

- High Returns: BRC-20 tokens experienced substantial growth, with some tokens like Bonk (BONK) seeing a meteoric rise of over 6,100% within a year. This surge reflected the market’s appetite for innovative uses of the Bitcoin blockchain.

- Innovative Protocol Use: The use of the Ordinals protocol by BRC-20 showcased a novel application of Bitcoin’s infrastructure, going beyond NFTs and tapping into the demand for fungible assets on this primary blockchain.

- Future Aspects: BRC-20’s potential extends into DeFi, governance, and crowdfunding on the Bitcoin blockchain. The focus on leveraging Bitcoin’s robust security and user base could redefine the blockchain’s role in the broader cryptocurrency ecosystem.

Top Blockchain Performance in 2023

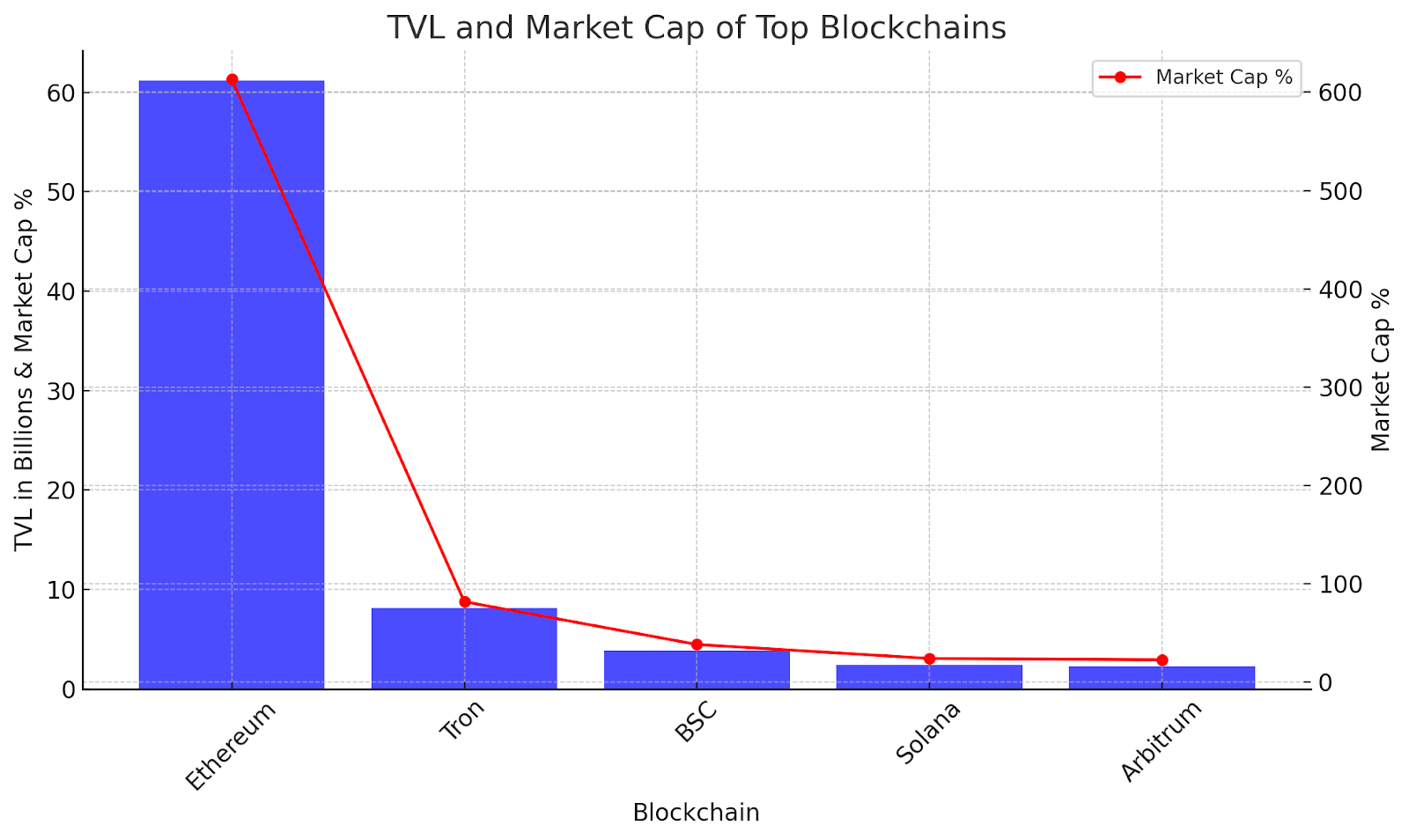

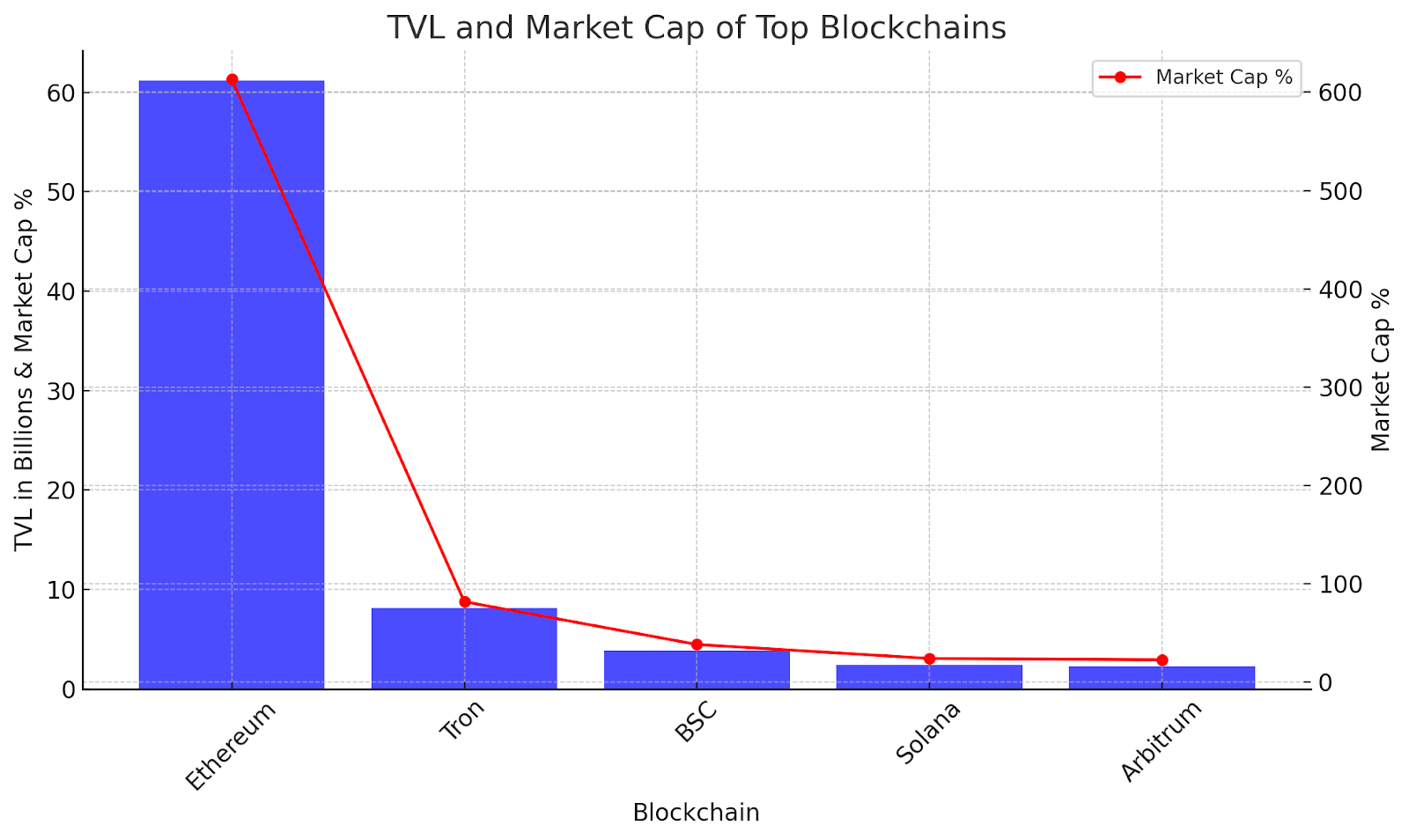

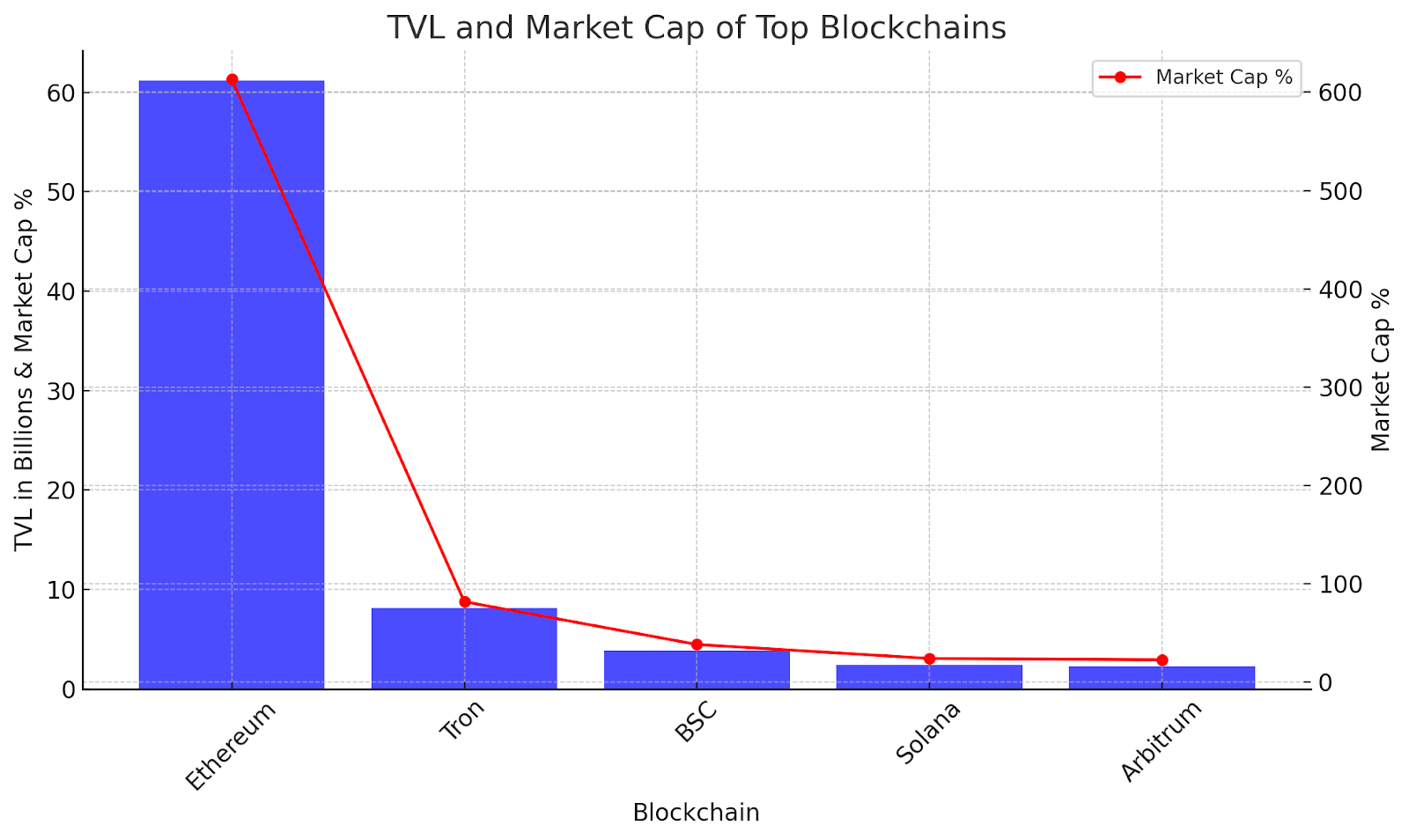

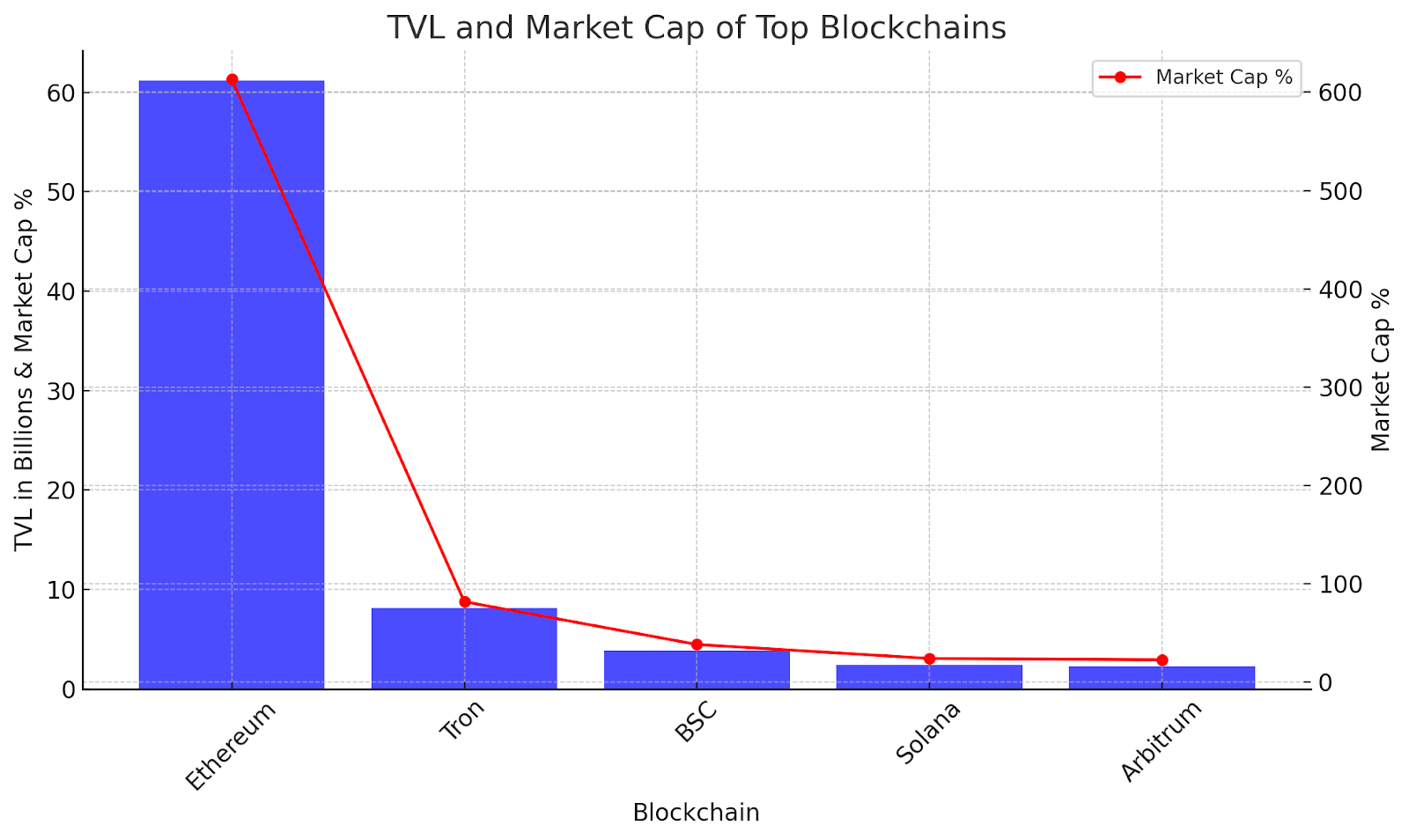

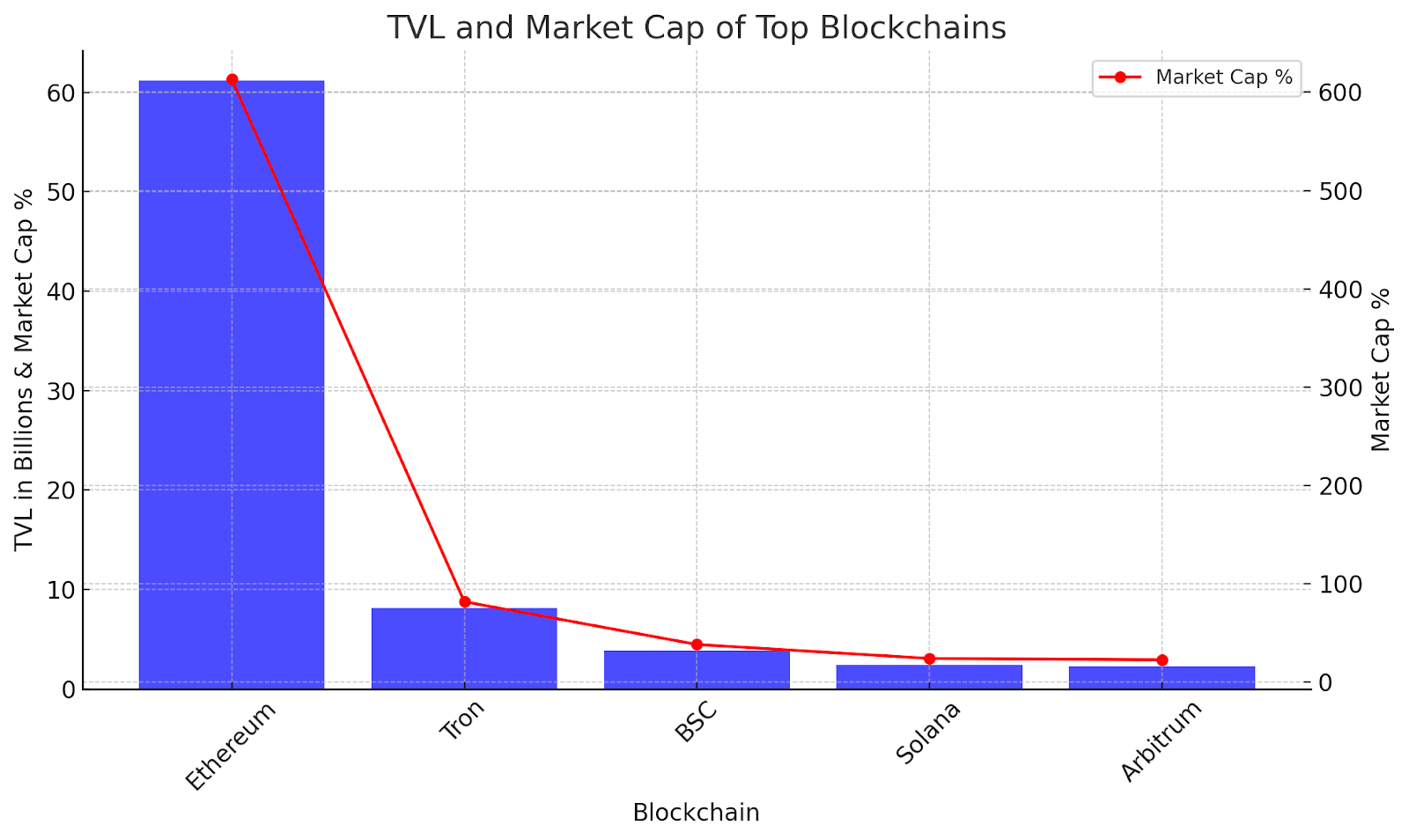

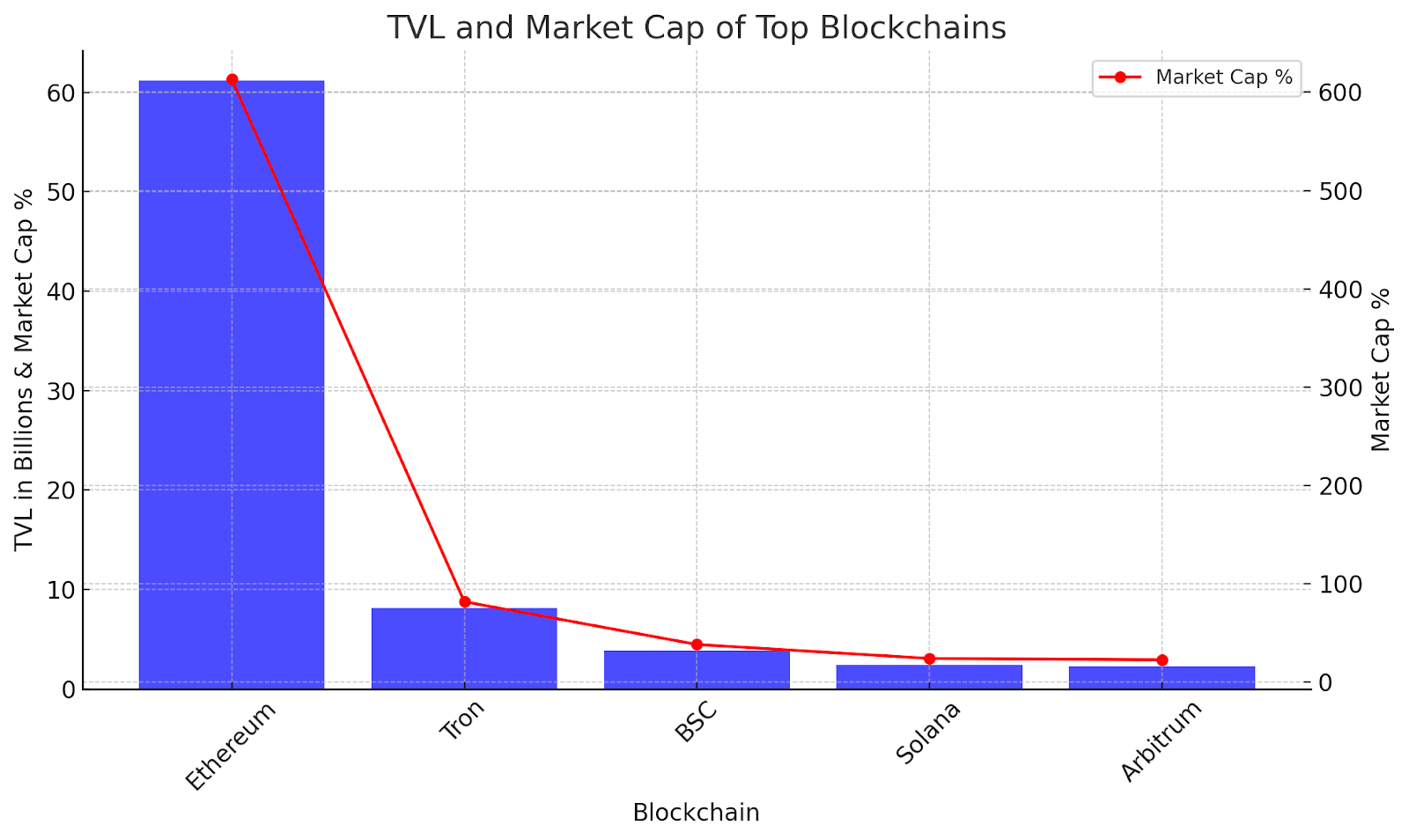

2023 has been a wild ride in the blockchain universe! The total value locked (TVL) in the market skyrocketed from $56.99 Billion at the year’s start to an impressive $93.2 Billion. That’s a massive jump! What does this mean? It indicates growing trust and investment in blockchain technologies—a sign that the crypto world is expanding its influence!

Comparison of Ecosystems

- Ethereum: Dominating the scene with a staggering 69.75% dominance and a TVL of $61.18 billion. Its market cap stands at an impressive 613.03% of the total.

- Tron: With 8.75% dominance and a TVL of $8.17 billion, Tron takes a significant spot. Its market cap is 81.86% of the total.

- BSC (Binance Smart Chain): Holding its ground with 4.14% dominance and a TVL of $3.83 billion. BSC’s market cap contributes to 38.38% of the total.

- Solana: A key player with 2.70% dominance and a TVL of $2.41 billion. Solana’s market cap is 24.15% of the total.

- Arbitrum: Marking its presence with 2.96% dominance and a TVL of $2.28 billion. Arbitrum’s market cap accounts for 22.85% of the total.

DeFi Market

Liquid Staking Tops The Sectoral Growth

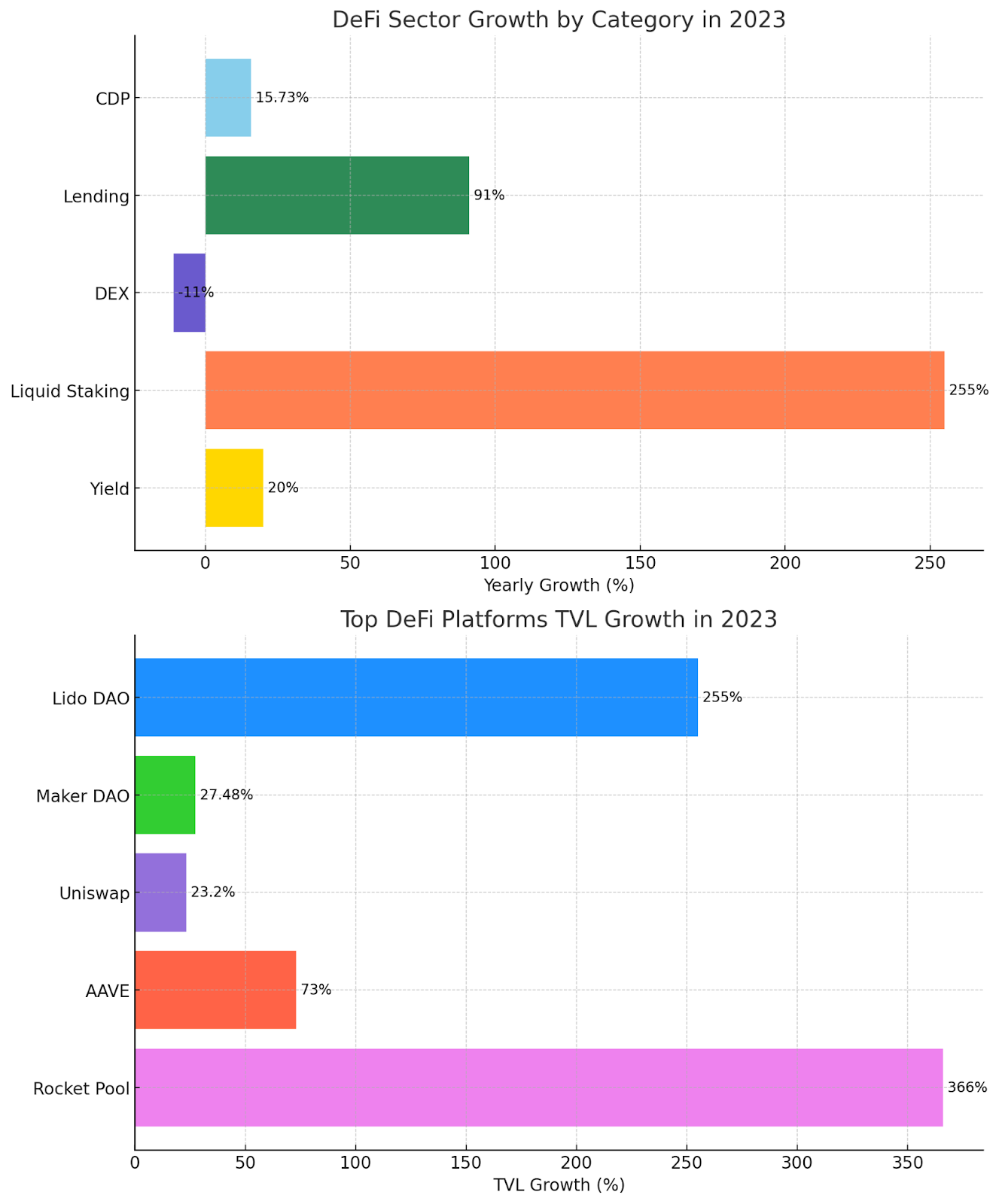

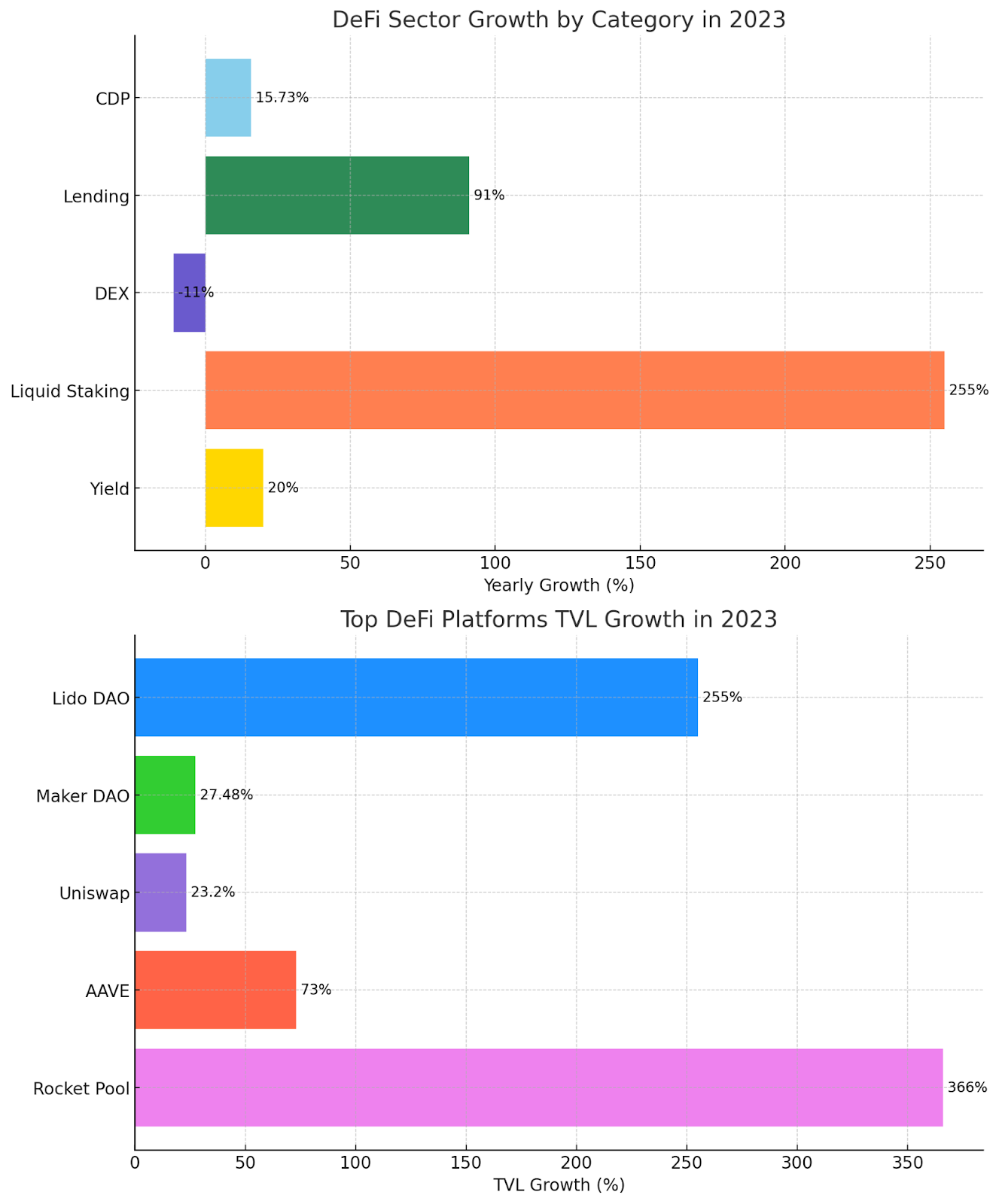

The DeFi sector 2023 has showcased significant growth, with a 32% year-over-year increase, pushing the market cap beyond $50 billion. DeFi’s diverse ecosystem saw varied performances across its sub-sectors:

- Collateralized Debt Positions (CDPs) increased by 15.73%, indicating a steady trust in blockchain-based collateral management.

- Lending, an essential DeFi function, jumped by 91%, reflecting a surge in decentralized borrowing and lending activities.

- However, decentralized Exchanges (DEXs) experienced an 11% decline, suggesting a shift in the liquidity provision landscape.

- Liquid Staking dominated, capturing 28% of the total value locked (TVL) with a striking 255% growth, spearheaded by Lido DAO.

- Yield farming also saw a stable rise of 20%, with Convex Finance contributing significantly to this sector’s value.

Top DeFi platforms like Rocket Pool and Lido DAO stood out with TVL growths of 366% and 255%, respectively. Despite some fluctuations, the overall momentum of DeFi is positive, with platforms like AAVE and Maker DAO showing solid growth and resilience in 2023.

Performance Of Top DeFi Tokens by Market Cap

- Avalanche (AVAX): 274.28% return

- Chainlink (LINK/USD): 12.63% return

- Injective Protocol (INJ/USD): 453.36% return

- Internet Computer (ICP/USD): 16.77% return

- Uniswap (UNI/USD): -4.68% return

The Injective Protocol token (INJ/USD) has the highest return among the group, exceeding 450%, which could indicate a significant development in the project or a substantial increase in adoption and demand. Avalanche (AVAX) also shows strong performance, with more than a 270% return, suggesting robust growth and key ecosystem advancements. In contrast, Uniswap (UNI/USD) experienced a slight decline in 2023.

Metaverse

In the captivating realm of the metaverse, 2023 has been a year of dynamic growth and expansion. The total market capitalization is a remarkable $12.29 billion, with an active 24-hour trading volume of $1.25 billion. The trailblazing tokens are at the forefront of this vibrant sector: SAND from Sandbox, MANA from Decentraland, and AXS from Axie Infinity.

SAND has made a solid mark with a year-to-date growth of 21.44%, showcasing its growing influence in the metaverse landscape. MANA, not to be outdone, has soared even higher, registering an impressive 51.49% growth, reflecting its robust position in the market. Meanwhile, AXS from Axie Infinity has charted a more modest course, with a growth of 3.19%.

These tokens are more than just digital assets; they represent the burgeoning potential of the metaverse – a digital universe where creativity, economy, and technology converge. The growth figures of these tokens are a clear indicator of the sector’s momentum and the increasing interest of investors and users alike.

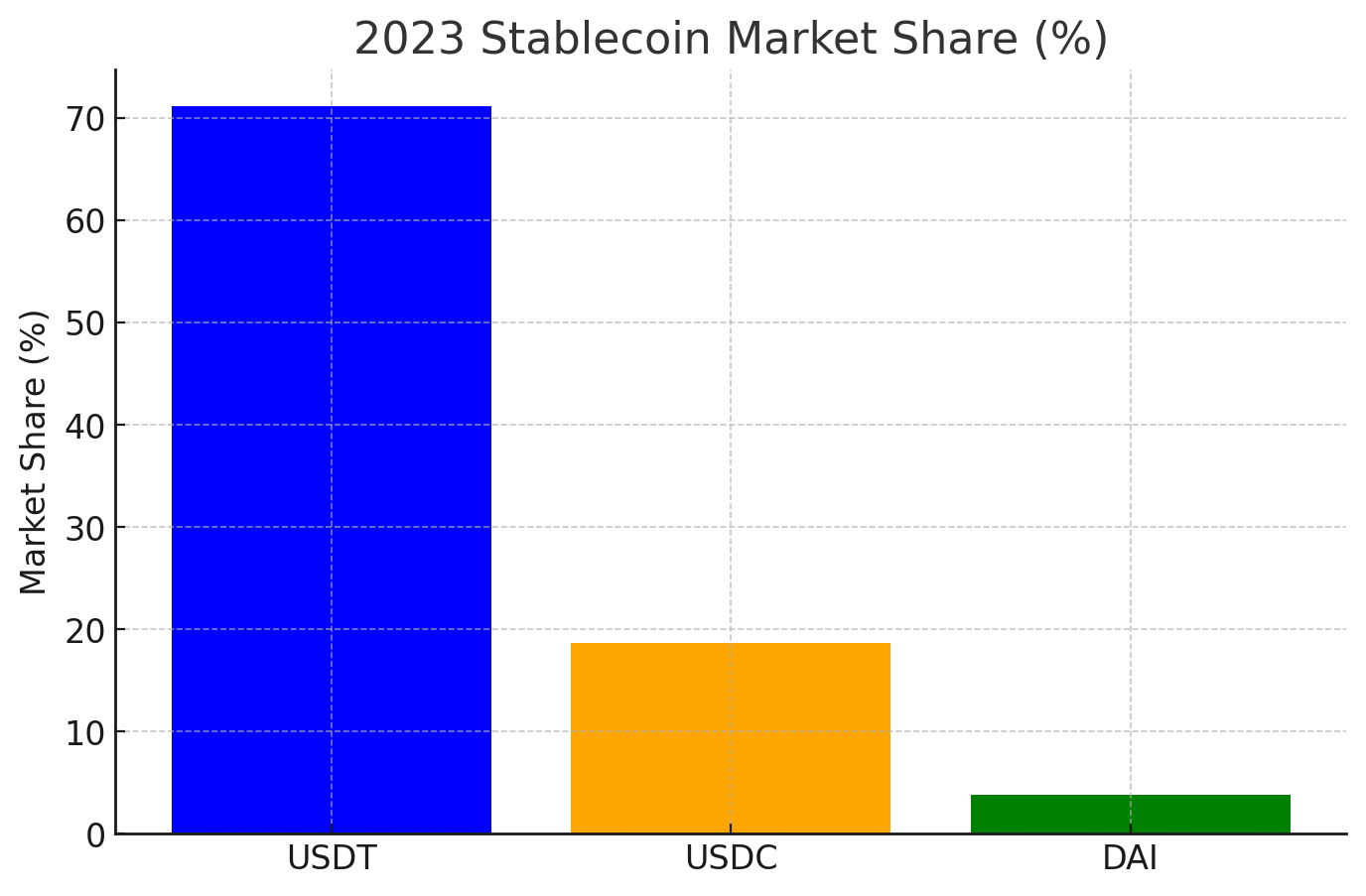

Stablecoins

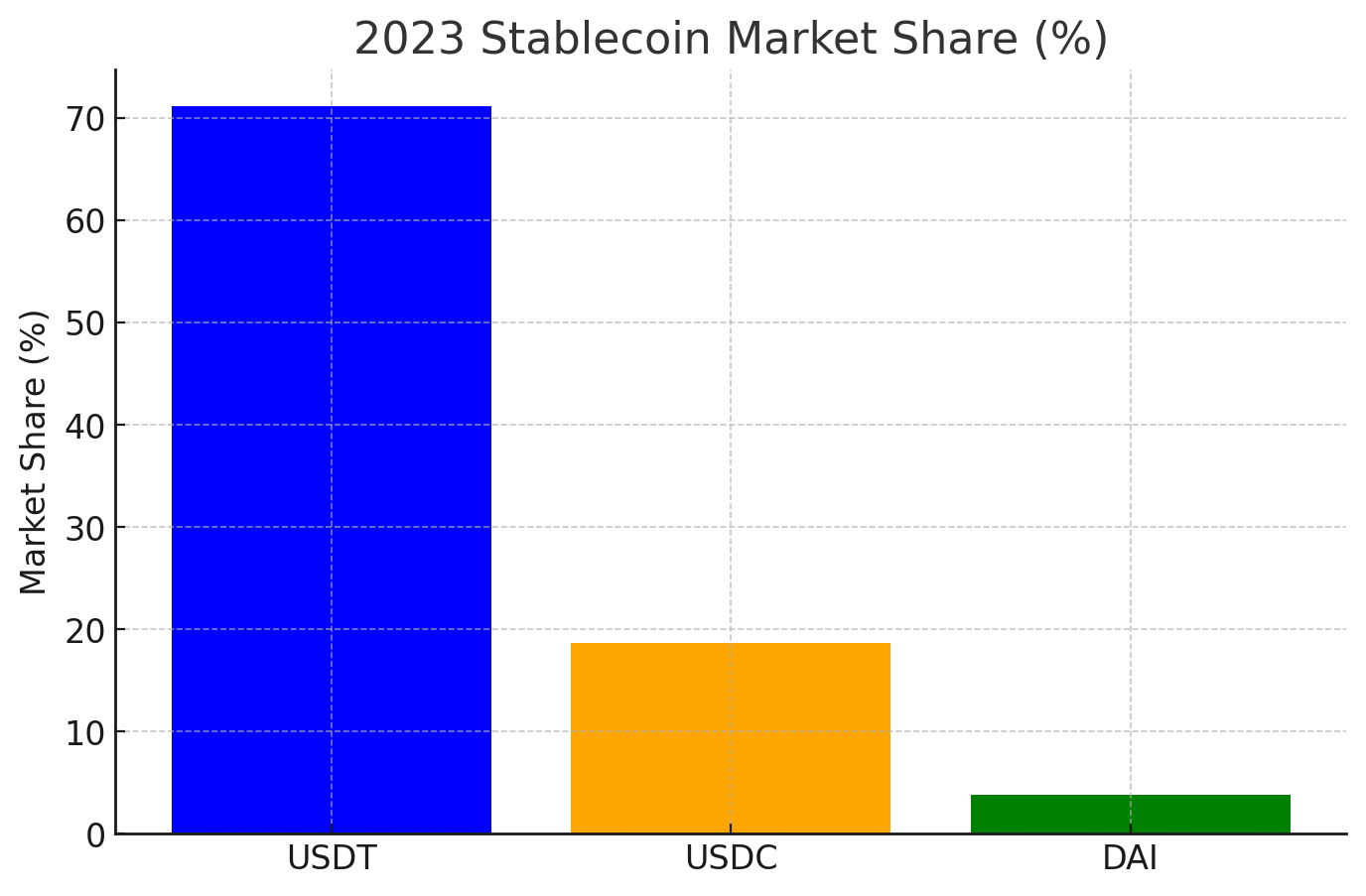

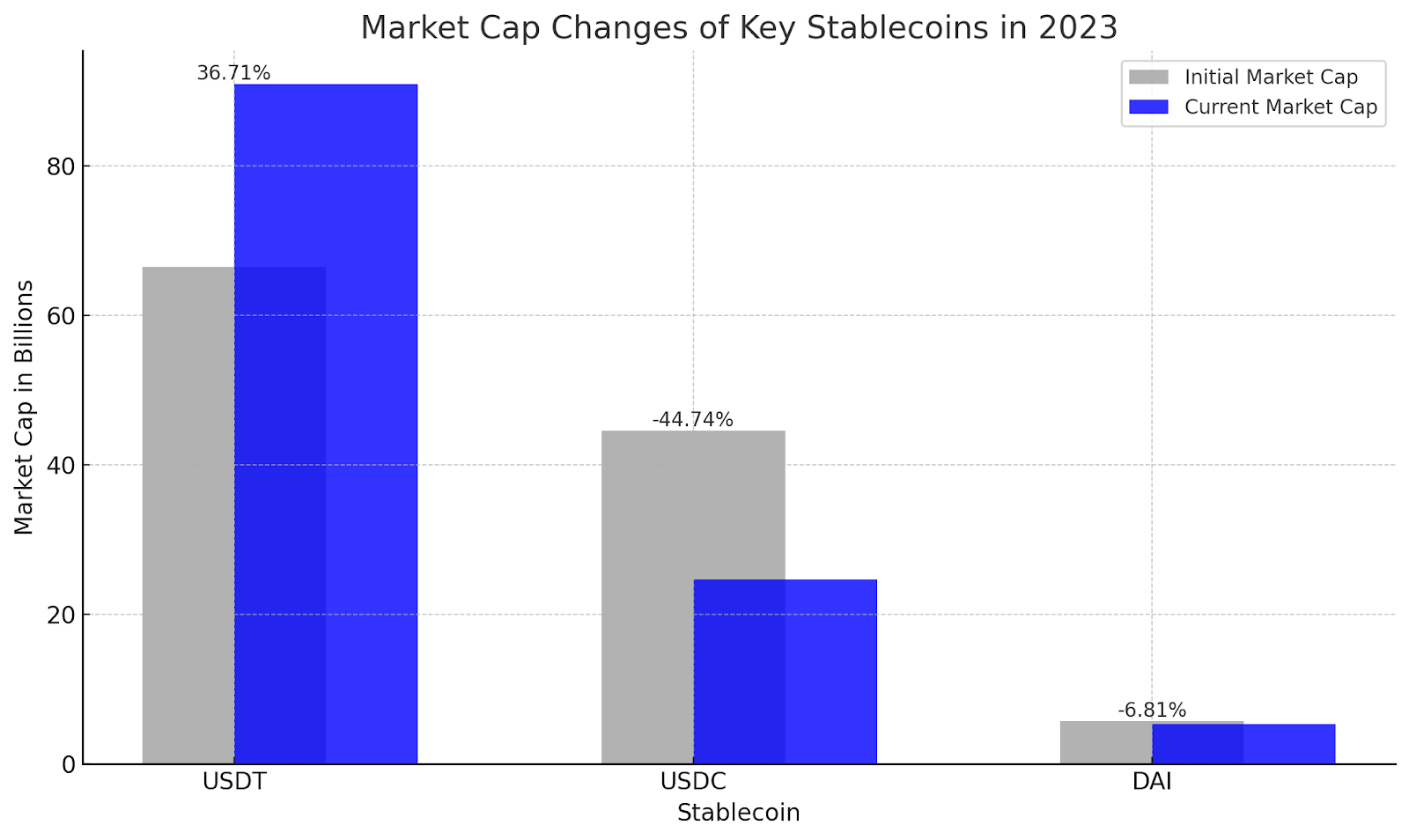

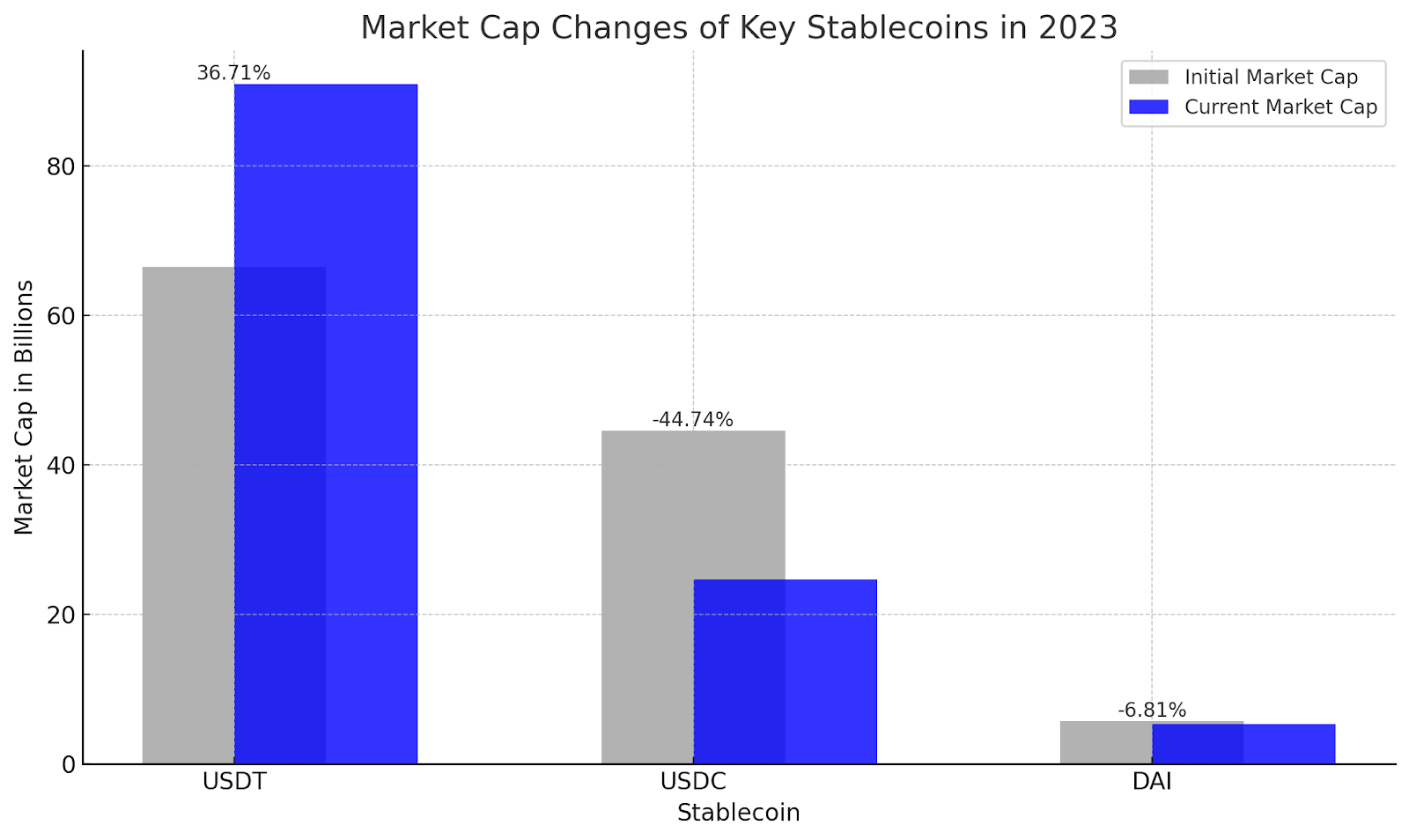

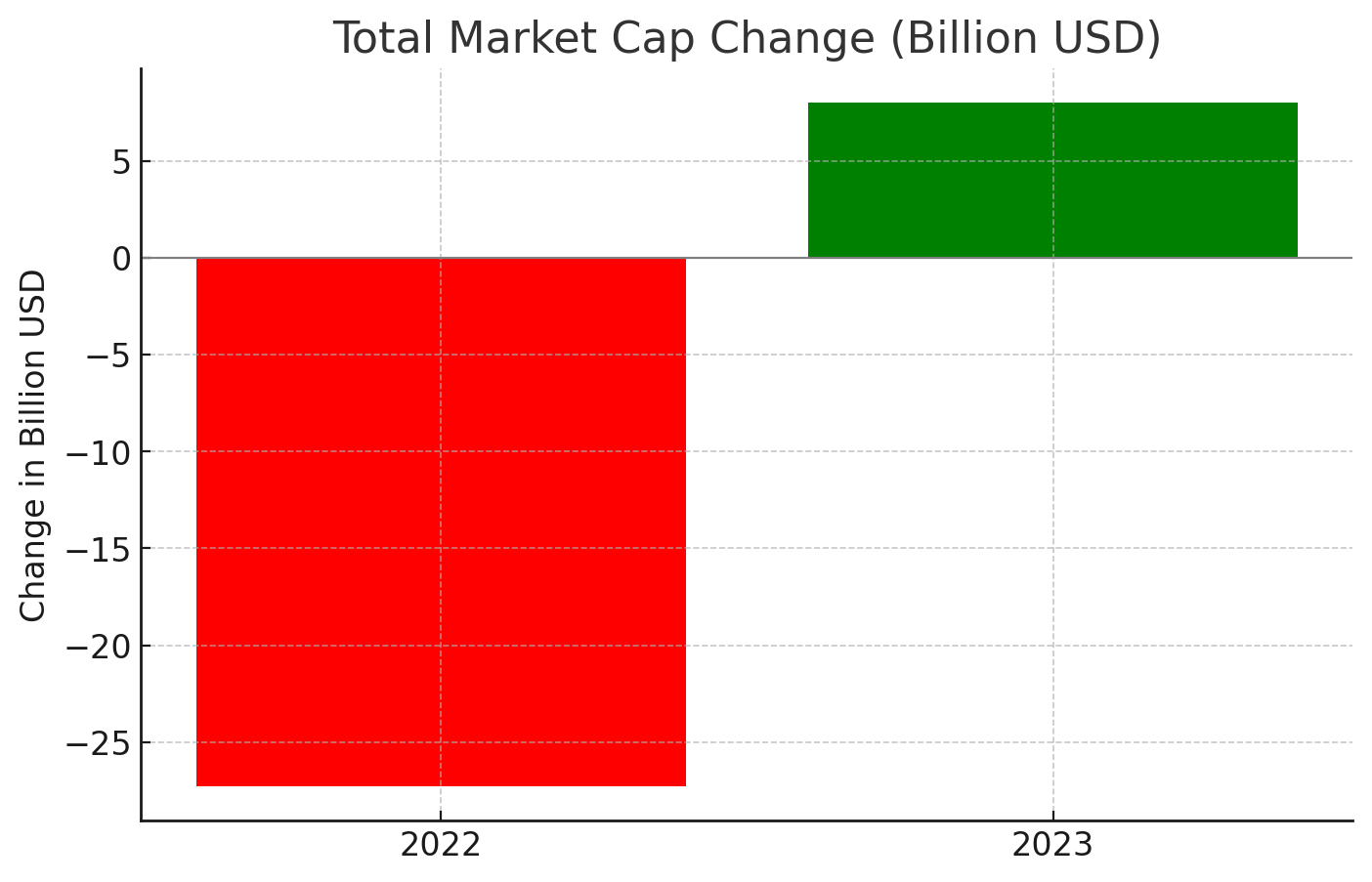

USDT regained and expanded its dominance, commanding 71.17% of the market with a market cap of $97.5 billion. USDC held 18.69%, and DAI captured 3.86%. This shows a more substantial market consolidation around these top players, particularly USDT.

Let’s take a closer look at the market cap of these stablecoins.

- USDT (Tether): Starting the year at $66.47 billion, USDT saw an increase to $90.87 billion, marking a significant growth of 36.71%. This upsurge underscores its expanding influence in the stablecoin market.

- USDC: In contrast, USDC experienced a decrease, falling from $44.55 billion at the beginning of the year to $24.62 billion. This represents a considerable decline of 44.74%, reflecting a significant shift in its market position.

- DAI: DAI showed relatively minor changes, starting at $5.73 billion and slightly decreasing to $5.34 billion, amounting to a 6.81% decrease.

NFT

A Volatile Year For NFTs Marks A Bittersweet End

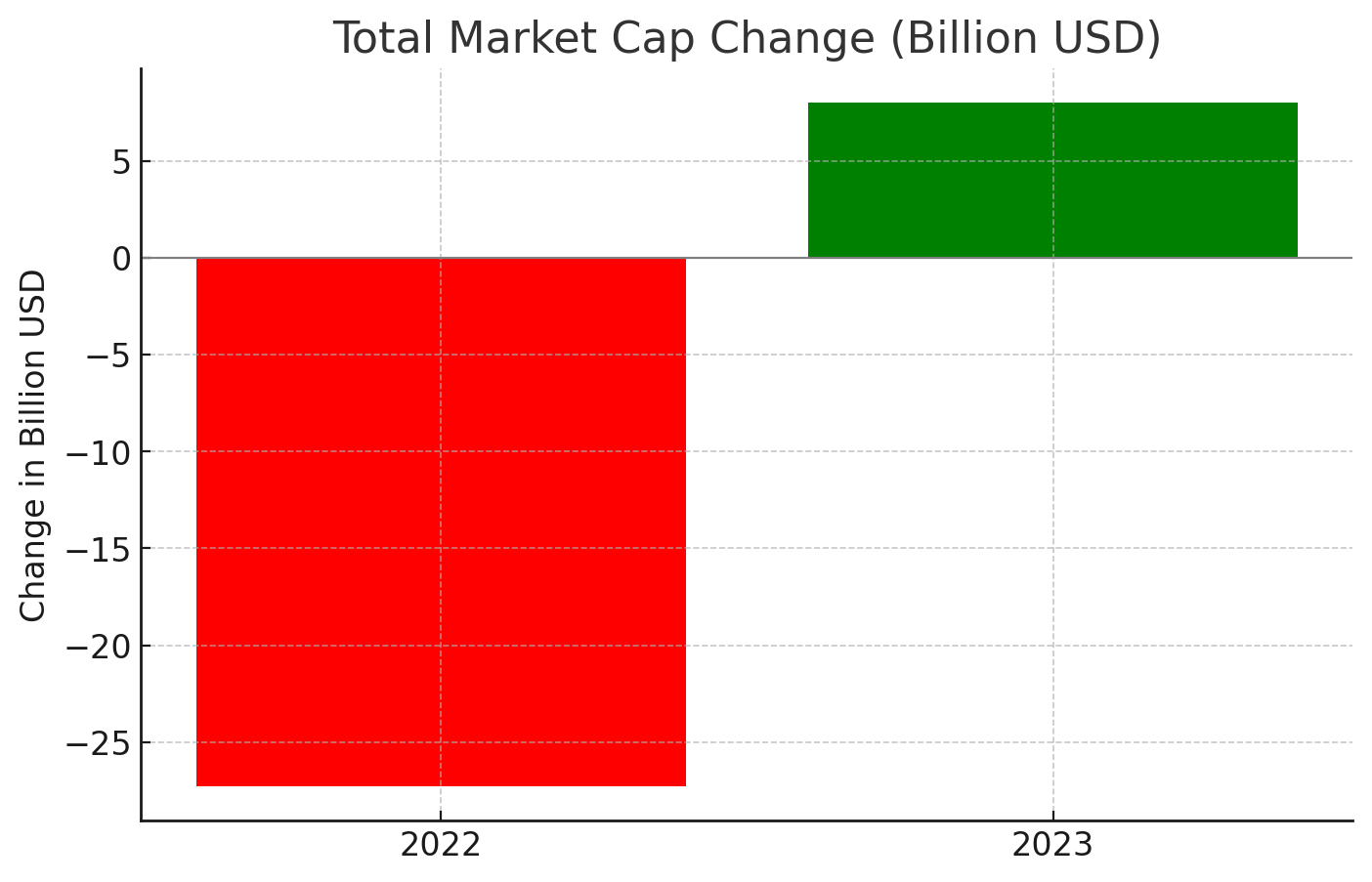

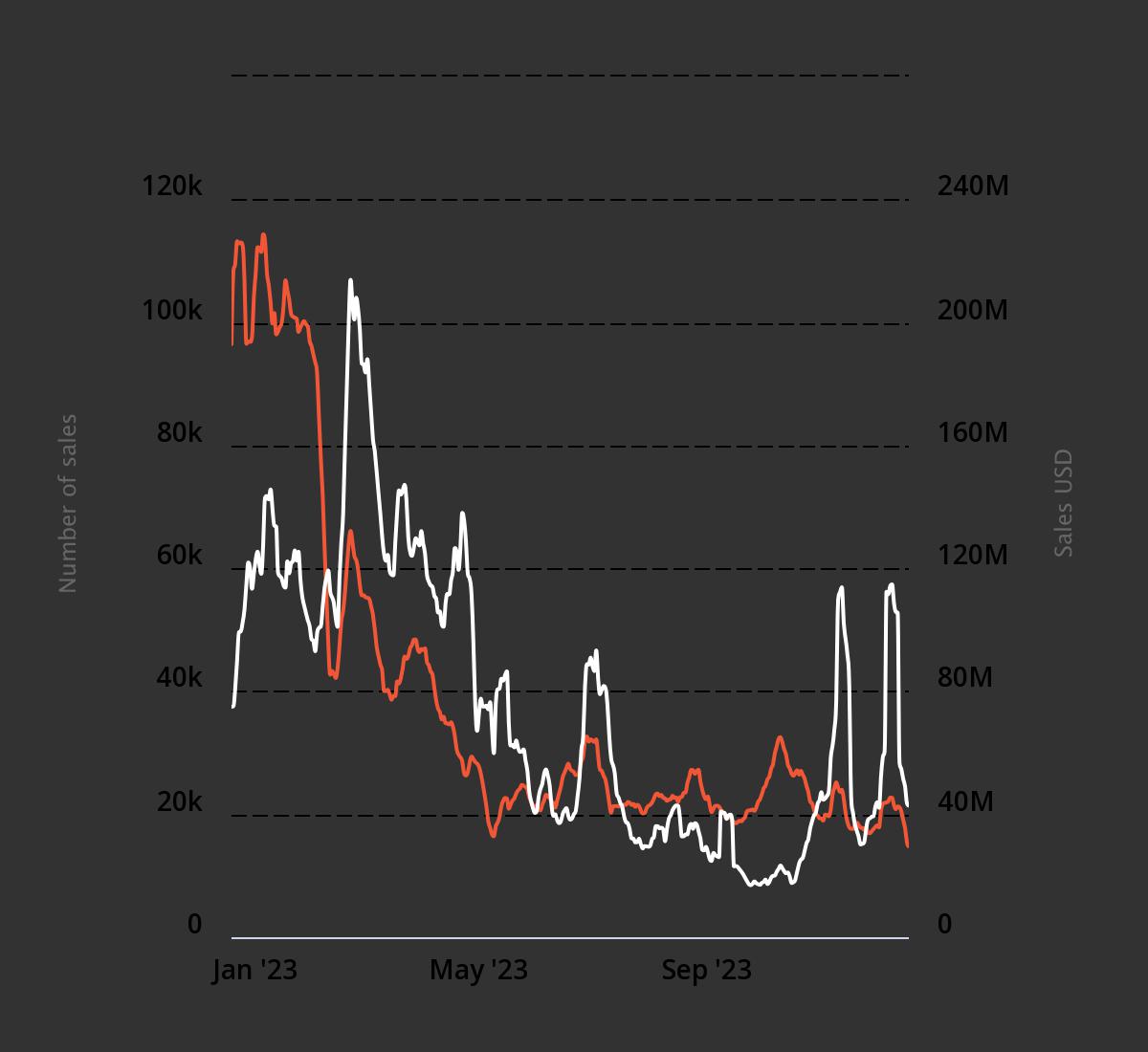

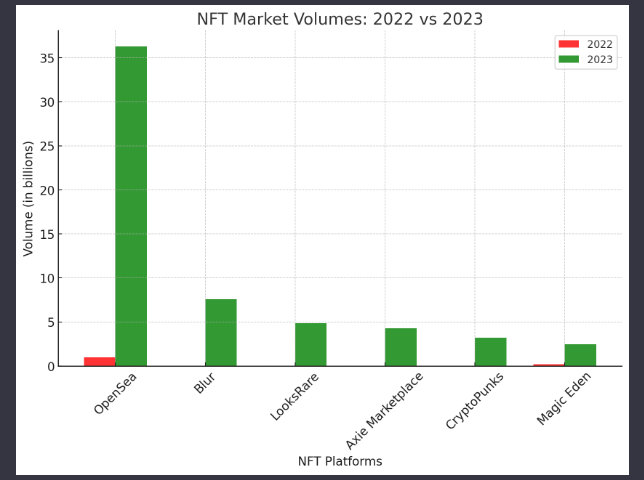

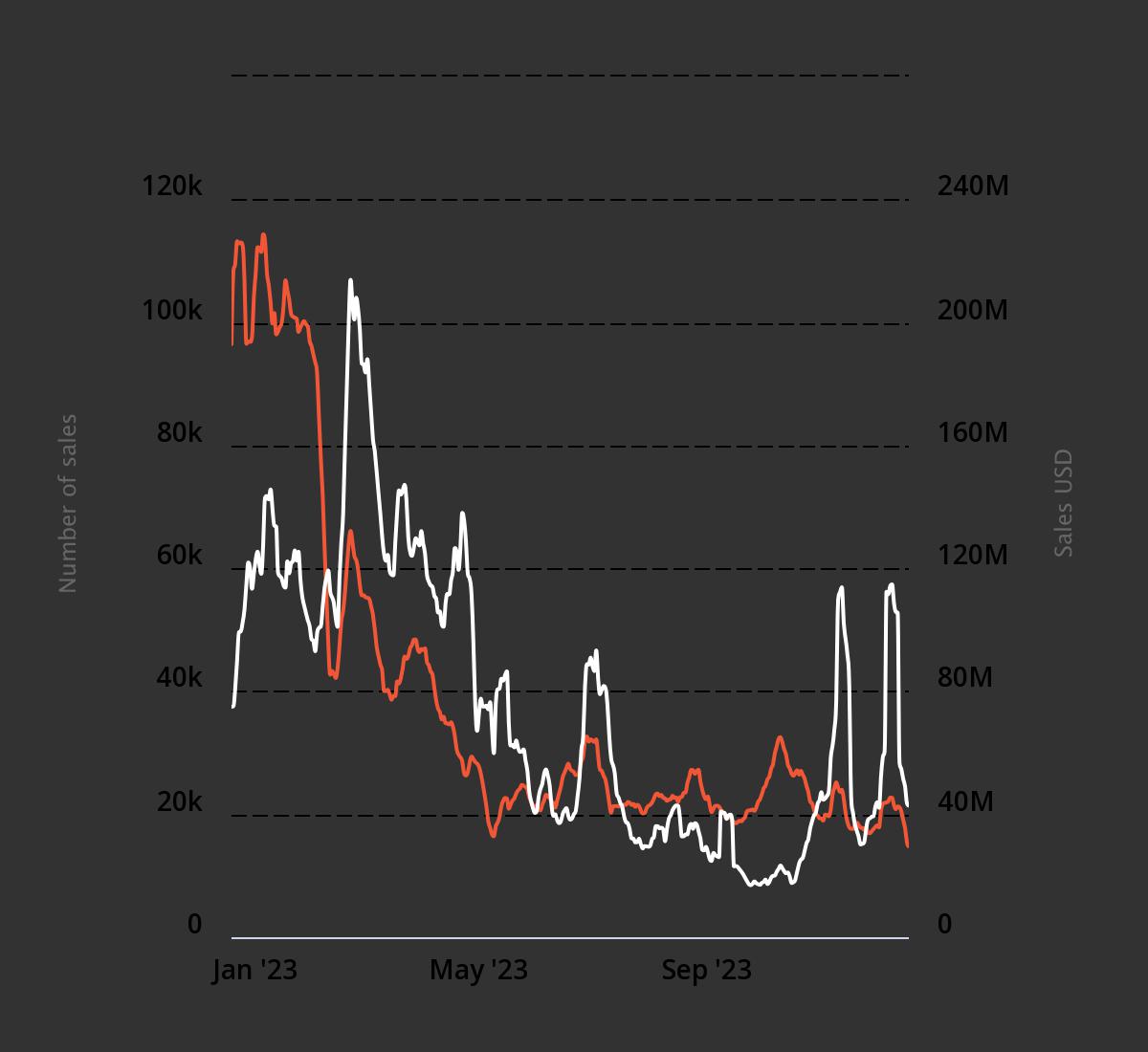

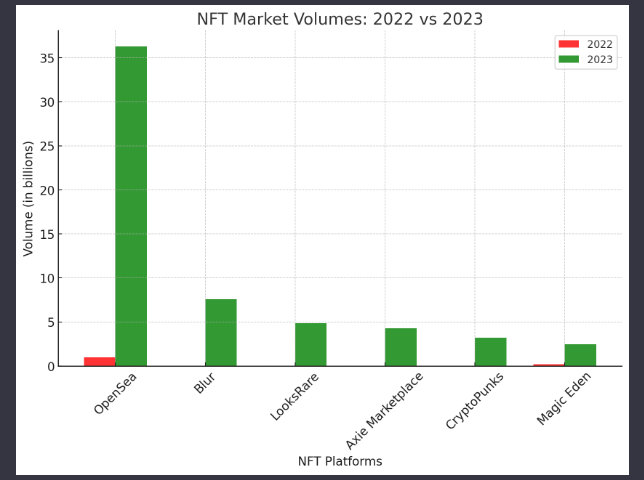

The NFT market in 2023, valued at a staggering $22 billion, has experienced significant fluctuations. Initially, the industry saw a 220-fold growth since 2021, despite a 90% sales drop from its September 2021 peak, showcasing resilience. Monthly sales average $1.8 billion, with half of these transactions under $200, indicating a market of broad reach and accessibility.

Mid-year, the market declined, with sales dipping to under 4,000 and volumes around $1.5 million. However, there was a notable resurgence on December 6th, with sales hitting 2,364 and volumes reaching $56 million.

This peak was brief, as sales dipped to around 2,000 again, with volumes falling to approximately $4.42 million. Despite these ups and downs, the NFT market is expected to rebound, with predictions of reaching $80 billion by 2025. This optimism is underscored by record-breaking sales, such as a collection selling for $91.8 million.

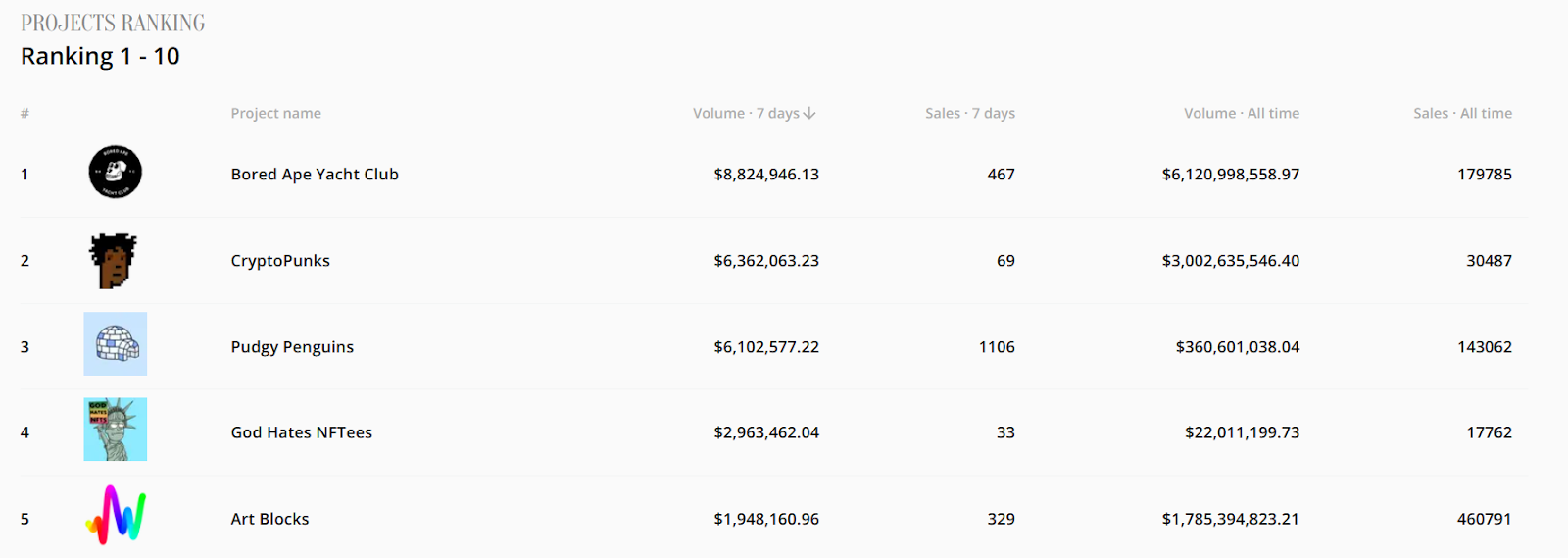

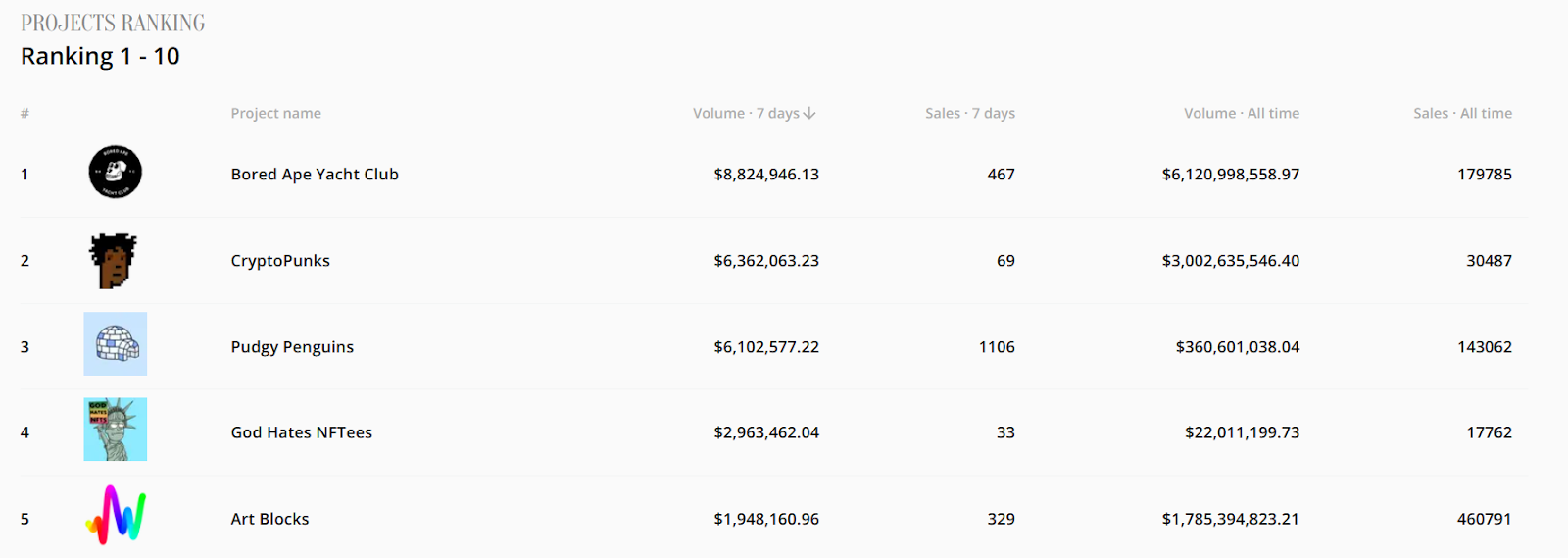

In the dynamic NFT market of 2023, Bored Ape Yacht Club tops the leaderboard with $8.8 million in volume, closely followed by CryptoPunks at $6.36 million and Pudgy Penguins at $6.10 million. God Hates NFTees and ART Blocks complete the top five, each reflecting their distinct positions in the market through their respective volumes and sales.

TOP ROI Tokens

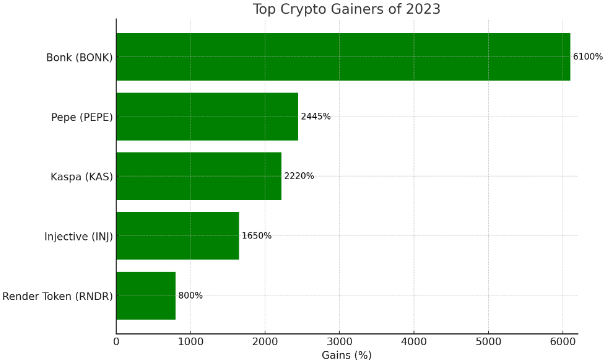

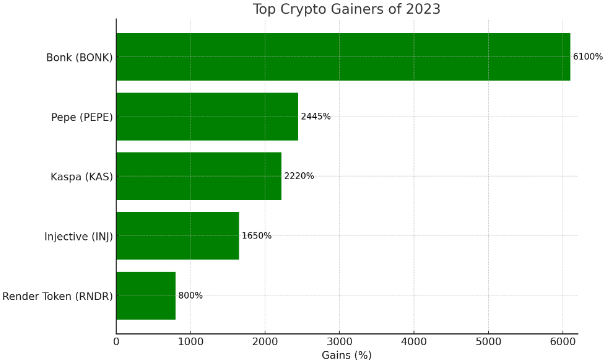

The year 2023 has been dynamic for cryptocurrencies, with significant movements at both ends of the spectrum. The top gainer’s chart showcases an impressive lineup led by Bonk (BONK) with a staggering 6100% increase, highlighting its dominance as the year’s top performer.

Pepe (PEPE) and Kaspa (KAS) followed suit with substantial gains of 2445% and 2220%, respectively. Injective (INJ) and Render Token (RNDR) rounded out the top five with impressive gains of 1650% and 800%.

Crypto vs Other Assets

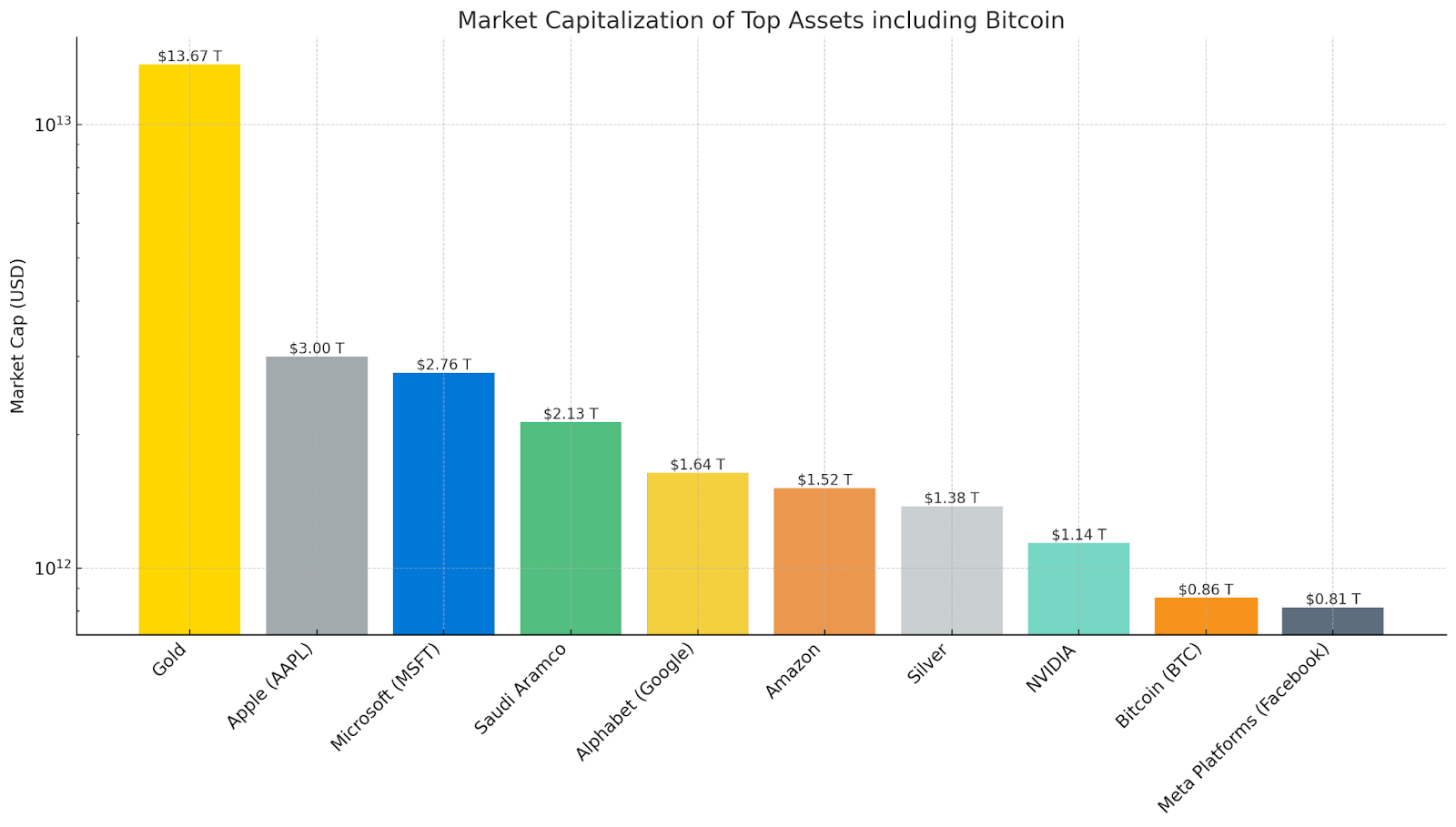

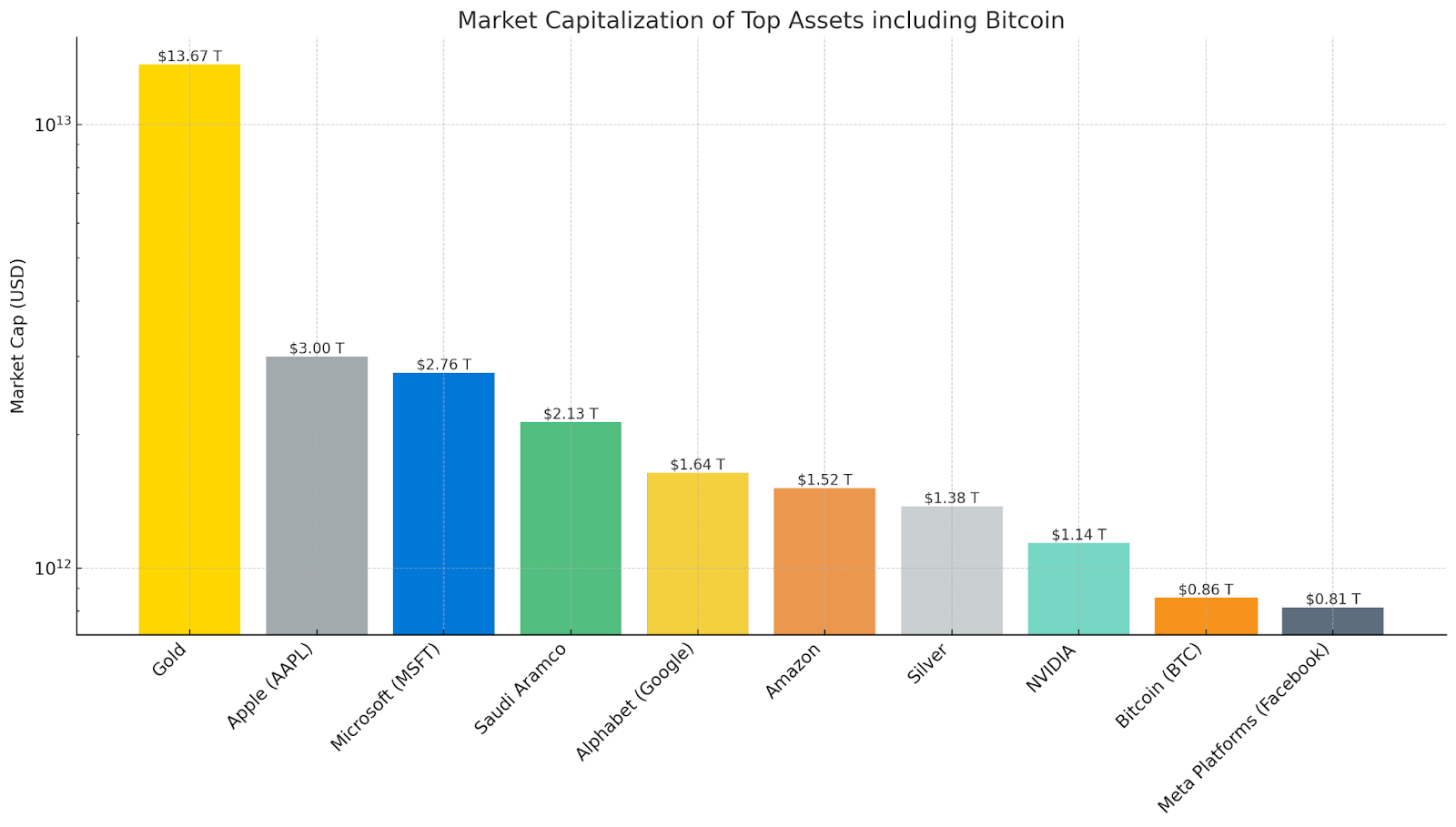

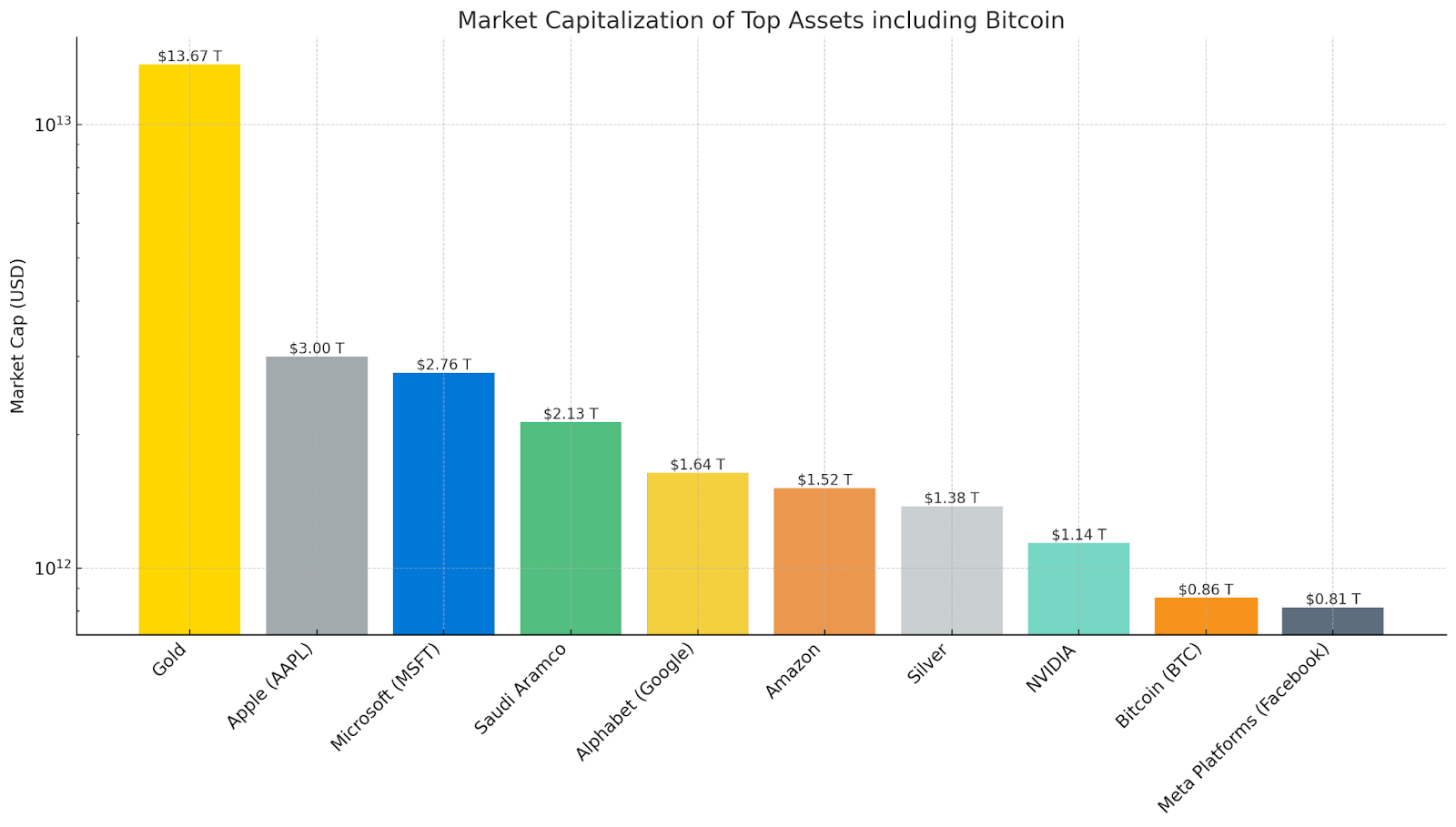

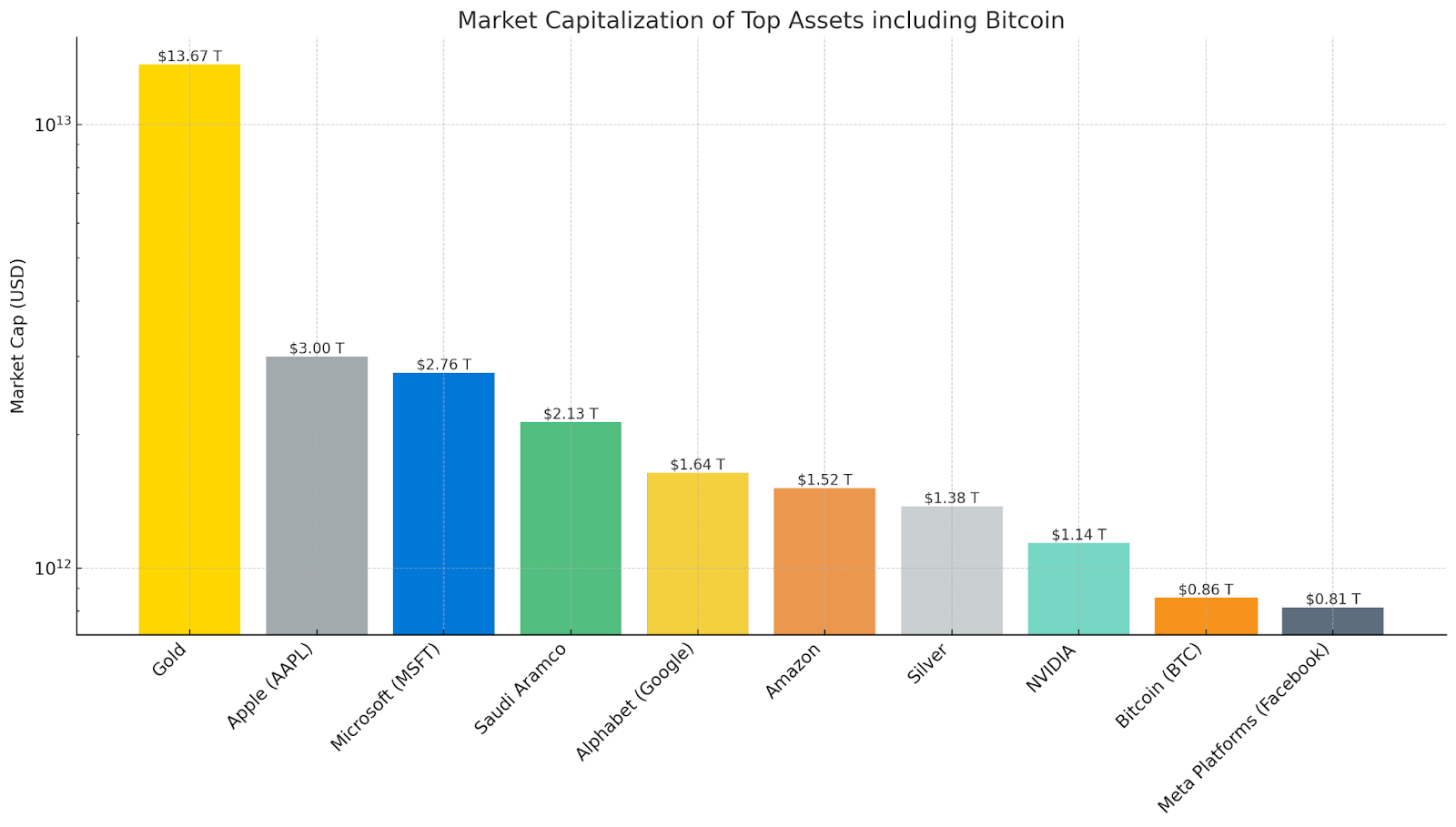

The bar chart above illustrates the market capitalizations of various top assets, highlighting Bitcoin’s (BTC) significant standing. With a market cap of approximately $855.97 billion, BTC overtakes giants like Meta Platforms (formerly Facebook) and positions itself prominently among the world’s most valuable assets.

The chart underscores Bitcoin’s impressive market growth and potential as a digital store of value, often compared to gold, which retains the top spot with a market cap of $13.67 trillion.

The crypto market’s performance in 2023 outshined traditional assets, with the total market cap experiencing an exceptional increase of 104.42%. In stark contrast, the S&P 500 saw a modest rise of 13.82%, while precious metals like gold remained stable, and silver declined by 9.83%. Despite its volatility, this disparity illustrates the crypto market’s high growth potential and positions it as a significant player among global asset classes.

Bitcoin Spot ETF Applications: A Glimmer of Regulatory Hope

The U.S. Securities and Exchange Commission (SEC) has pushed the timeline for its decision on multiple high-profile Bitcoin spot ETF applications into 2024. Notable applicants like BlackRock, WisdomTree, and Valkyrie Digital Assets are now set to await the SEC’s rulings until mid-January 2024.

The ongoing applications for Bitcoin Spot ETFs have been a significant area of interest in 2023. These ETFs, if approved, could significantly boost the market by offering investors a regulated way to gain exposure to Bitcoin.

The SEC’s deferral of Bitcoin Spot ETF decisions to 2024 has kept the crypto community on edge. Amid this waiting period, the historic impact of Gold ETFs on gold prices in the early 2000s offers a glimpse into Bitcoin’s future.

Introducing Gold ETFs led to a 350% surge in gold’s market price, underscoring the profound influence ETFs can have. A similar upswing could be in store for Bitcoin with the approval of its ETFs, potentially unlocking a new wave of mainstream investment.

Bitcoin’s Next Rally To $100K in 2024

As we draw the curtains on the exhilarating journey of the crypto market in 2023, we stand on the cusp of a new potential breakout rally. The market has weathered its fair share of storms, from banking collapses to regulatory headwinds, yet it has demonstrated remarkable resilience and an upward trajectory.

There’s a palpable sense of bullish anticipation among investors, traders, and market enthusiasts. Several factors fan these bullish flames:

- Bitcoin Spot ETF Hopes: The approval of a Bitcoin Spot ETF could be the domino that sets off a cascading effect of bullish momentum, replicating the historical impact of Gold ETFs.

- Potential Rate Cuts: The anticipation of rate cuts in 2024 could shift the financial landscape, potentially increasing the attractiveness of non-traditional assets like Bitcoin.

- Bitcoin Halving 2024: The upcoming halving event has historically been a precursor to significant price increases, and the next one could set the stage for another major rally.

- Santa Rally: The end-of-year surge in market activity, often referred to as the Santa Rally, could extend its goodwill into the crypto space, stirring a surge in Bitcoin’s value.

- New Year Rally Anticipation: The new year often comes with renewed optimism and investment fervor, which could further cement the foundation for Bitcoin’s ascent.

Therefore, the winds of change suggest that Bitcoin might not just test new highs but could soar to the coveted $100,000 mark in 2024.

Crypto Market Yearly Report 2023: An In-Depth Analysis and Insights

The post Crypto Market Yearly Report 2023: An In-Depth Analysis and Insights appeared first on Coinpedia Fintech News

2023 has been a highly volatile year for Bitcoin and the entire crypto market. Starting the year on a bullish rally like a tracer bullet to being on a collision course, pulling back for the entire Summer, and finally recovering and forming a new 52W high in 2023.

Catalyzing the significant price movements in the crypto markets, the recent developments in the world market have led to a domino effect in Bitcoin. Fortunately, it ends on a bullish note in 2023.

The volatility in the Global markets due to ongoing conflicts around the world, the failing banking systems, the U.S. economy on high alert driving sharp changes in interest rates, and the rising interest of big shot Investment Institutions into Bitcoin and hoping for a Bitcoin Spot ETF were the driving force behind this year’s price movement.

Now that we know the driving factors for this year’s Crypto market let’s look at it in detail to understand the upcoming price movement. Cracking the code with previous price movements, let’s find out if Bitcoin can hit the $100,000 mark in 2024. And what you should expect in the crypto market in the coming months.

Bitcoin Price Movement In 2023

At the end of 2023, the crypto market has shown signs of stabilization and growth. Bitcoin, in particular, has experienced significant price movements throughout the year.

Starting the year at around $16,000 lowest price point since November 2020, Bitcoin’s price surged to nearly $24,000 in January, dropped to around $20,000 in mid-year, and experienced fluctuations in response to various market stimuli, including regulatory news and global economic trends.

However, the growing anticipations of Bitcoin spot ETF approval and the hopes of a bull run in 2024 due to the Bitcoin Halving event keep the buyers eager and ready to pay the extra premium. Fueled by some extra bullish sentiments like the upcoming Bitcoin halving event, the potential rate cuts in 2024, and more, the bull run is gaining momentum.

By the end of the year, Bitcoin’s price movement reflected a more mature and resilient market, with the Uptober rally prolonging the uptrend to reach cross $40,000, to form the 52W high at $44,729, a significant recovery within a year.

But before coming to the present bull run in Bitcoin, let us look at the entire year.

A Bullish Year For Crypto

Commencing 2023 on a bullish note, Bitcoin, the leading cryptocurrency, saw a remarkable rise in the first quarter. Starting the year at $16,508, the BTC price trend kept an overall positive monthly growth, leading to 4-consecutive bullish candles in the monthly chart. The bullish growth over the 4-month phase accounts for an increase of 78%.

Ethereum, the second-largest cryptocurrency by market capitalization, also witnessed substantial growth. Making six consecutive bullish candles, the ETH price jumped from $1,195 to $1,945, a 62% increase in the first half of 2023.

This positive trend was primarily attributed to easing macroeconomic pressures and shifting investor sentiment. Analysts pointed to the Federal Reserve’s potential slowdown in rate hikes as a key driver of this optimism, fostering a bullish sentiment among investors and contributing to the market’s upward trajectory.

Bitcoin’s grip on the crypto market has tightened in 2023. We kicked off the year with Bitcoin holding a substantial 40% of the market, with Ethereum trailing at 18.43% and USDT securing a solid 8.30%. Flash forward, and Bitcoin has bulldozed past the 50% threshold at 51.68%. Ethereum’s slice has shrunk to 16.77%, and USDT has dipped to 5.71%, while the combined might of the altcoins has dwindled from 32% to 26%.

On the emotional barometer of the market—the Crypto Fear and Greed Index—we’ve ridden a wave from a neutral 59% to the depths of fear at 31.83% in September. But now, we’re surfing in the greed zone at a bullish 69.79%, a sign that optimism is back with a vengeance.

In the derivatives arena, open interest has been a rollercoaster. The futures market has soared from $1.28 billion to $2.30 billion, while perpetuals have seen a steep climb from $109 billion to $139 billion despite severe ups and downs.

BRC – 20 Tokens

In 2023, the BRC-20 token standard, built on the Bitcoin blockchain leveraging the Ordinals protocol, marked a pivotal shift in utilizing Bitcoin. This new class of fungible tokens allowed for functionalities akin to the ERC-20 standard on Ethereum but with the security and widespread adoption of Bitcoin.

The rise of BRC-20 tokens on the Bitcoin blockchain has sparked diverse social sentiments reminiscent of last year’s DeFi token frenzy. Investors are showing speculative interest, eyeing BRC-20 tokens for potential gains, yet wary of their volatility and unproven long-term value. Hence, the high enthusiasm among investors is drawn to the potential applications of these tokens.

The crypto community remains divided: some view BRC-20 as a valuable innovation for Bitcoin, enhancing its utility beyond mere transactions. Meanwhile, others see it as a deviation from Bitcoin’s original intent, potentially leading to increased transaction fees and network congestion.

Key developments and their implications for BRC-20 in 2023 included:

- High Returns: BRC-20 tokens experienced substantial growth, with some tokens like Bonk (BONK) seeing a meteoric rise of over 6,100% within a year. This surge reflected the market’s appetite for innovative uses of the Bitcoin blockchain.

- Innovative Protocol Use: The use of the Ordinals protocol by BRC-20 showcased a novel application of Bitcoin’s infrastructure, going beyond NFTs and tapping into the demand for fungible assets on this primary blockchain.

- Future Aspects: BRC-20’s potential extends into DeFi, governance, and crowdfunding on the Bitcoin blockchain. The focus on leveraging Bitcoin’s robust security and user base could redefine the blockchain’s role in the broader cryptocurrency ecosystem.

Top Blockchain Performance in 2023

2023 has been a wild ride in the blockchain universe! The total value locked (TVL) in the market skyrocketed from $56.99 Billion at the year’s start to an impressive $93.2 Billion. That’s a massive jump! What does this mean? It indicates growing trust and investment in blockchain technologies—a sign that the crypto world is expanding its influence!

Comparison of Ecosystems

- Ethereum: Dominating the scene with a staggering 69.75% dominance and a TVL of $61.18 billion. Its market cap stands at an impressive 613.03% of the total.

- Tron: With 8.75% dominance and a TVL of $8.17 billion, Tron takes a significant spot. Its market cap is 81.86% of the total.

- BSC (Binance Smart Chain): Holding its ground with 4.14% dominance and a TVL of $3.83 billion. BSC’s market cap contributes to 38.38% of the total.

- Solana: A key player with 2.70% dominance and a TVL of $2.41 billion. Solana’s market cap is 24.15% of the total.

- Arbitrum: Marking its presence with 2.96% dominance and a TVL of $2.28 billion. Arbitrum’s market cap accounts for 22.85% of the total.

DeFi Market

Liquid Staking Tops The Sectoral Growth

The DeFi sector 2023 has showcased significant growth, with a 32% year-over-year increase, pushing the market cap beyond $50 billion. DeFi’s diverse ecosystem saw varied performances across its sub-sectors:

- Collateralized Debt Positions (CDPs) increased by 15.73%, indicating a steady trust in blockchain-based collateral management.

- Lending, an essential DeFi function, jumped by 91%, reflecting a surge in decentralized borrowing and lending activities.

- However, decentralized Exchanges (DEXs) experienced an 11% decline, suggesting a shift in the liquidity provision landscape.

- Liquid Staking dominated, capturing 28% of the total value locked (TVL) with a striking 255% growth, spearheaded by Lido DAO.

- Yield farming also saw a stable rise of 20%, with Convex Finance contributing significantly to this sector’s value.

Top DeFi platforms like Rocket Pool and Lido DAO stood out with TVL growths of 366% and 255%, respectively. Despite some fluctuations, the overall momentum of DeFi is positive, with platforms like AAVE and Maker DAO showing solid growth and resilience in 2023.

Performance Of Top DeFi Tokens by Market Cap

- Avalanche (AVAX): 274.28% return

- Chainlink (LINK/USD): 12.63% return

- Injective Protocol (INJ/USD): 453.36% return

- Internet Computer (ICP/USD): 16.77% return

- Uniswap (UNI/USD): -4.68% return

The Injective Protocol token (INJ/USD) has the highest return among the group, exceeding 450%, which could indicate a significant development in the project or a substantial increase in adoption and demand. Avalanche (AVAX) also shows strong performance, with more than a 270% return, suggesting robust growth and key ecosystem advancements. In contrast, Uniswap (UNI/USD) experienced a slight decline in 2023.

Metaverse

In the captivating realm of the metaverse, 2023 has been a year of dynamic growth and expansion. The total market capitalization is a remarkable $12.29 billion, with an active 24-hour trading volume of $1.25 billion. The trailblazing tokens are at the forefront of this vibrant sector: SAND from Sandbox, MANA from Decentraland, and AXS from Axie Infinity.

SAND has made a solid mark with a year-to-date growth of 21.44%, showcasing its growing influence in the metaverse landscape. MANA, not to be outdone, has soared even higher, registering an impressive 51.49% growth, reflecting its robust position in the market. Meanwhile, AXS from Axie Infinity has charted a more modest course, with a growth of 3.19%.

These tokens are more than just digital assets; they represent the burgeoning potential of the metaverse – a digital universe where creativity, economy, and technology converge. The growth figures of these tokens are a clear indicator of the sector’s momentum and the increasing interest of investors and users alike.

Stablecoins

USDT regained and expanded its dominance, commanding 71.17% of the market with a market cap of $97.5 billion. USDC held 18.69%, and DAI captured 3.86%. This shows a more substantial market consolidation around these top players, particularly USDT.

Let’s take a closer look at the market cap of these stablecoins.

- USDT (Tether): Starting the year at $66.47 billion, USDT saw an increase to $90.87 billion, marking a significant growth of 36.71%. This upsurge underscores its expanding influence in the stablecoin market.

- USDC: In contrast, USDC experienced a decrease, falling from $44.55 billion at the beginning of the year to $24.62 billion. This represents a considerable decline of 44.74%, reflecting a significant shift in its market position.

- DAI: DAI showed relatively minor changes, starting at $5.73 billion and slightly decreasing to $5.34 billion, amounting to a 6.81% decrease.

NFT

A Volatile Year For NFTs Marks A Bittersweet End

The NFT market in 2023, valued at a staggering $22 billion, has experienced significant fluctuations. Initially, the industry saw a 220-fold growth since 2021, despite a 90% sales drop from its September 2021 peak, showcasing resilience. Monthly sales average $1.8 billion, with half of these transactions under $200, indicating a market of broad reach and accessibility.

Mid-year, the market declined, with sales dipping to under 4,000 and volumes around $1.5 million. However, there was a notable resurgence on December 6th, with sales hitting 2,364 and volumes reaching $56 million.

This peak was brief, as sales dipped to around 2,000 again, with volumes falling to approximately $4.42 million. Despite these ups and downs, the NFT market is expected to rebound, with predictions of reaching $80 billion by 2025. This optimism is underscored by record-breaking sales, such as a collection selling for $91.8 million.

In the dynamic NFT market of 2023, Bored Ape Yacht Club tops the leaderboard with $8.8 million in volume, closely followed by CryptoPunks at $6.36 million and Pudgy Penguins at $6.10 million. God Hates NFTees and ART Blocks complete the top five, each reflecting their distinct positions in the market through their respective volumes and sales.

TOP ROI Tokens

The year 2023 has been dynamic for cryptocurrencies, with significant movements at both ends of the spectrum. The top gainer’s chart showcases an impressive lineup led by Bonk (BONK) with a staggering 6100% increase, highlighting its dominance as the year’s top performer.

Pepe (PEPE) and Kaspa (KAS) followed suit with substantial gains of 2445% and 2220%, respectively. Injective (INJ) and Render Token (RNDR) rounded out the top five with impressive gains of 1650% and 800%.

Crypto vs Other Assets

The bar chart above illustrates the market capitalizations of various top assets, highlighting Bitcoin’s (BTC) significant standing. With a market cap of approximately $855.97 billion, BTC overtakes giants like Meta Platforms (formerly Facebook) and positions itself prominently among the world’s most valuable assets.

The chart underscores Bitcoin’s impressive market growth and potential as a digital store of value, often compared to gold, which retains the top spot with a market cap of $13.67 trillion.

The crypto market’s performance in 2023 outshined traditional assets, with the total market cap experiencing an exceptional increase of 104.42%. In stark contrast, the S&P 500 saw a modest rise of 13.82%, while precious metals like gold remained stable, and silver declined by 9.83%. Despite its volatility, this disparity illustrates the crypto market’s high growth potential and positions it as a significant player among global asset classes.

Bitcoin Spot ETF Applications: A Glimmer of Regulatory Hope

The U.S. Securities and Exchange Commission (SEC) has pushed the timeline for its decision on multiple high-profile Bitcoin spot ETF applications into 2024. Notable applicants like BlackRock, WisdomTree, and Valkyrie Digital Assets are now set to await the SEC’s rulings until mid-January 2024.

The ongoing applications for Bitcoin Spot ETFs have been a significant area of interest in 2023. These ETFs, if approved, could significantly boost the market by offering investors a regulated way to gain exposure to Bitcoin.

The SEC’s deferral of Bitcoin Spot ETF decisions to 2024 has kept the crypto community on edge. Amid this waiting period, the historic impact of Gold ETFs on gold prices in the early 2000s offers a glimpse into Bitcoin’s future.

Introducing Gold ETFs led to a 350% surge in gold’s market price, underscoring the profound influence ETFs can have. A similar upswing could be in store for Bitcoin with the approval of its ETFs, potentially unlocking a new wave of mainstream investment.

Bitcoin’s Next Rally To $100K in 2024

As we draw the curtains on the exhilarating journey of the crypto market in 2023, we stand on the cusp of a new potential breakout rally. The market has weathered its fair share of storms, from banking collapses to regulatory headwinds, yet it has demonstrated remarkable resilience and an upward trajectory.

There’s a palpable sense of bullish anticipation among investors, traders, and market enthusiasts. Several factors fan these bullish flames:

- Bitcoin Spot ETF Hopes: The approval of a Bitcoin Spot ETF could be the domino that sets off a cascading effect of bullish momentum, replicating the historical impact of Gold ETFs.

- Potential Rate Cuts: The anticipation of rate cuts in 2024 could shift the financial landscape, potentially increasing the attractiveness of non-traditional assets like Bitcoin.

- Bitcoin Halving 2024: The upcoming halving event has historically been a precursor to significant price increases, and the next one could set the stage for another major rally.

- Santa Rally: The end-of-year surge in market activity, often referred to as the Santa Rally, could extend its goodwill into the crypto space, stirring a surge in Bitcoin’s value.

- New Year Rally Anticipation: The new year often comes with renewed optimism and investment fervor, which could further cement the foundation for Bitcoin’s ascent.

Therefore, the winds of change suggest that Bitcoin might not just test new highs but could soar to the coveted $100,000 mark in 2024.