South African Official: Common Currency Requires Central Bank, Threatens Monetary Policy Independence

South Africa’s minister of finance has explained why he believes that no country is ready for a common currency, including a unified BRICS currency. “Setting up a common currency presupposes setting up a central bank, and that presupposes losing independence on monetary policies, and I don’t think any country is ready for that,” he emphasized.

‘I Don’t Think Any Country Is Ready for That’

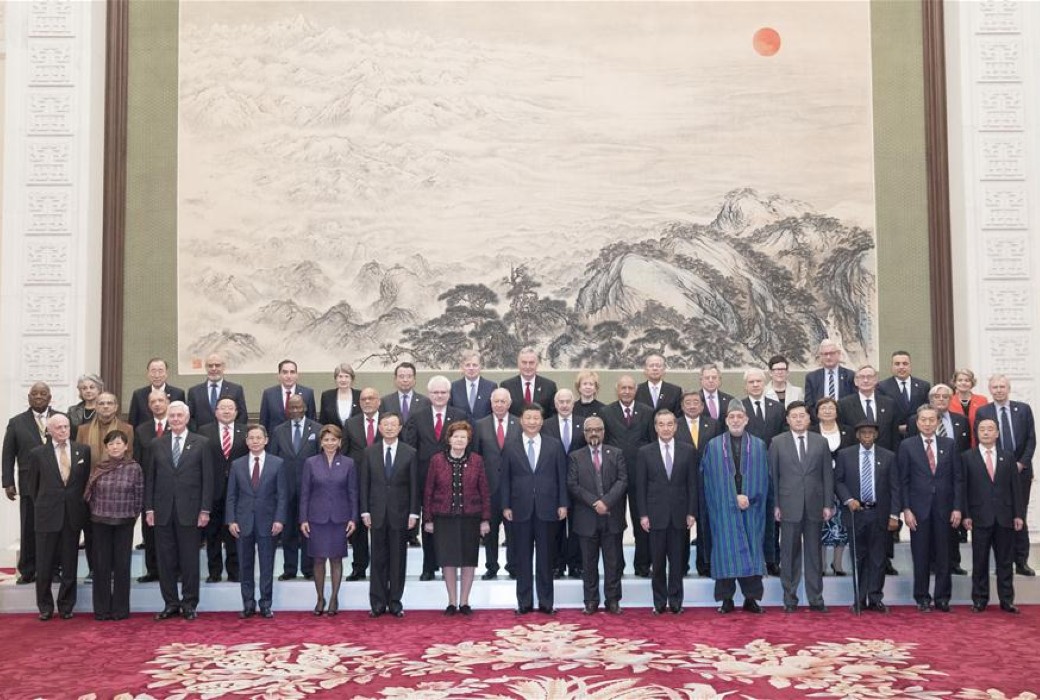

South Africa’s Minister of Finance Enoch Godongwana talked about the prospect of creating a common currency in an interview on the sidelines of the BRICS economic bloc’s annual summit in Johannesburg on Thursday. South Africa was the host of this year’s BRICS summit.

Despite widespread expectations of the BRICS countries announcing the creation of a common currency, potentially backed by gold, he stressed that “No one has tabled the issue of a BRICS currency, not even in informal meetings.” The official continued:

Setting up a common currency presupposes setting up a central bank, and that presupposes losing independence on monetary policies, and I don’t think any country is ready for that.

The BRICS nations (Brazil, Russia, India, China, and South Africa) announced at the conclusion of the summit that six countries have been invited to join as new members, with their inclusion set to commence on Jan. 1, 2024. The six nations are Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates (UAE).

One of the key topics extensively deliberated on at the BRICS summit was the use of local currencies in international trade and financial transactions, rather than relying on the U.S. dollar.

Godongwana stated that when South Africa trades with Botswana, for example, “we know the rate of exchange between the two currencies,” emphasizing that “There is no reason why we can’t pay them in pula and they pay us in rands.”

In their declaration, released at the conclusion of the summit, the BRICS leaders pushed for the use of local currencies. “We stress the importance of encouraging the use of local currencies in international trade and financial transactions between BRICS as well as their trading partners,” their declaration states.

What do you think about the statements by South Africa’s Minister of Finance Enoch Godongwana about the creation of a common currency? Let us know in the comments section below.

Read More

J.P. Morgan: BRICS De-Dollarization Will Trigger US Borrowing Spike

South African Official: Common Currency Requires Central Bank, Threatens Monetary Policy Independence

South Africa’s minister of finance has explained why he believes that no country is ready for a common currency, including a unified BRICS currency. “Setting up a common currency presupposes setting up a central bank, and that presupposes losing independence on monetary policies, and I don’t think any country is ready for that,” he emphasized.

‘I Don’t Think Any Country Is Ready for That’

South Africa’s Minister of Finance Enoch Godongwana talked about the prospect of creating a common currency in an interview on the sidelines of the BRICS economic bloc’s annual summit in Johannesburg on Thursday. South Africa was the host of this year’s BRICS summit.

Despite widespread expectations of the BRICS countries announcing the creation of a common currency, potentially backed by gold, he stressed that “No one has tabled the issue of a BRICS currency, not even in informal meetings.” The official continued:

Setting up a common currency presupposes setting up a central bank, and that presupposes losing independence on monetary policies, and I don’t think any country is ready for that.

The BRICS nations (Brazil, Russia, India, China, and South Africa) announced at the conclusion of the summit that six countries have been invited to join as new members, with their inclusion set to commence on Jan. 1, 2024. The six nations are Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates (UAE).

One of the key topics extensively deliberated on at the BRICS summit was the use of local currencies in international trade and financial transactions, rather than relying on the U.S. dollar.

Godongwana stated that when South Africa trades with Botswana, for example, “we know the rate of exchange between the two currencies,” emphasizing that “There is no reason why we can’t pay them in pula and they pay us in rands.”

In their declaration, released at the conclusion of the summit, the BRICS leaders pushed for the use of local currencies. “We stress the importance of encouraging the use of local currencies in international trade and financial transactions between BRICS as well as their trading partners,” their declaration states.

What do you think about the statements by South Africa’s Minister of Finance Enoch Godongwana about the creation of a common currency? Let us know in the comments section below.

Read More