Bitcoin Adoption Slows Down: Bad News For Rally?

On-chain data shows the number of new Bitcoin addresses is on the decline, a sign that could be bad for the sustainability of the ongoing BTC rally.

Bitcoin Has Registered A Drop In New Addresses Joining The Network

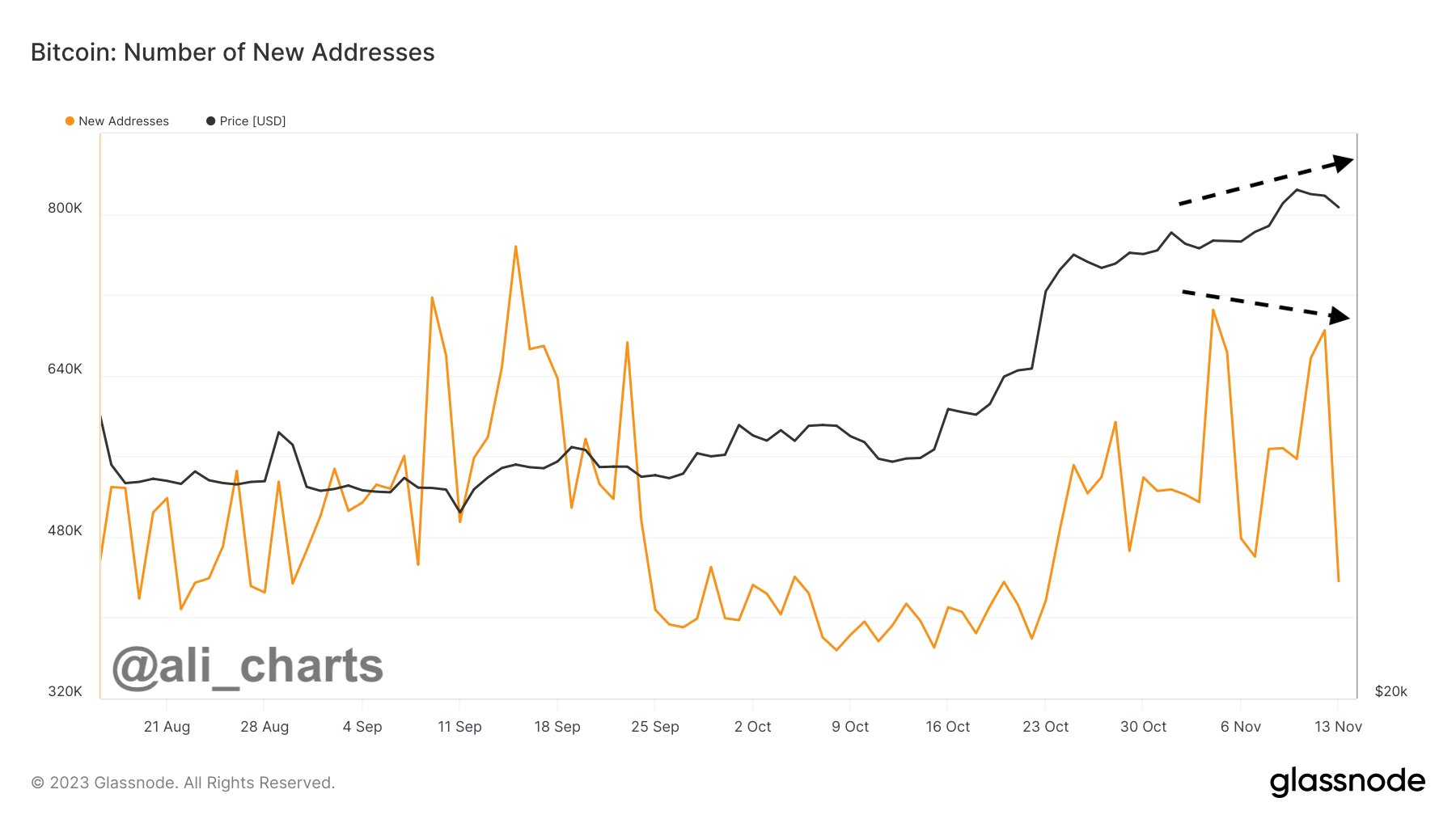

As pointed out by analyst Ali in a new post on X, the BTC price and network growth are forming a possible bearish divergence right now. The relevant metric is the daily total number of new addresses, where “new addresses” refer to those addresses that are coming online on the blockchain for the first time.

While some of the new addresses being created every day would be coming from the existing investors of the asset (who are perhaps just changing wallets for privacy reasons), a large chunk of them would naturally be because of an inflow of new holders into the market.

Thus, the total number of addresses can provide hints about how the adoption of the cryptocurrency is coming along. When the indicator’s value is high, it means that the blockchain is receiving a significant influx of new users, which suggests the asset is observing a high degree of adoption.

Now, here is a chart that shows the trend in the number of new addresses for Bitcoin over the last few months:

As displayed in the above graph, this Bitcoin metric has observed a surge in the last few weeks, suggesting that new users are being attracted to the network at a greater rate.

This surge in adoption has happened alongside the latest rally in the asset’s price. Historically, such a pattern hasn’t been an uncommon occurrence, as rallies have often appeared exciting to the public. So a large number of new users open up addresses to get in on the hype in these periods.

This rise of investor interest has actually often been a requirement for uptrends like these to be sustainable, as it’s only with sufficient new users that the asset can continue to get the fuel it needs for the price to keep up the climb.

Generally, rallies that fail to attract new attention toward the blockchain die out before long. Until recently, this rally had accompanied a fresh influx of new users into the network, with growth that was accelerating.

In the past week, though, the metric’s value has been heading down, implying that the incoming of new addresses to the Bitcoin network has been slowing down.

This pattern is certainly not a positive development for the rally’s future, as it implies the cryptocurrency could be running out of fresh momentum. If the new addresses don’t see a jump in the coming days while the price registers a rise, it could be a signal to sell, as such an uplift might only be temporary.

BTC Price

Bitcoin had plunged towards the $35,000 mark yesterday, but it appears that the asset has already recovered back above $36,000 today.

Bitcoin Adoption Slows Down: Bad News For Rally?

On-chain data shows the number of new Bitcoin addresses is on the decline, a sign that could be bad for the sustainability of the ongoing BTC rally.

Bitcoin Has Registered A Drop In New Addresses Joining The Network

As pointed out by analyst Ali in a new post on X, the BTC price and network growth are forming a possible bearish divergence right now. The relevant metric is the daily total number of new addresses, where “new addresses” refer to those addresses that are coming online on the blockchain for the first time.

While some of the new addresses being created every day would be coming from the existing investors of the asset (who are perhaps just changing wallets for privacy reasons), a large chunk of them would naturally be because of an inflow of new holders into the market.

Thus, the total number of addresses can provide hints about how the adoption of the cryptocurrency is coming along. When the indicator’s value is high, it means that the blockchain is receiving a significant influx of new users, which suggests the asset is observing a high degree of adoption.

Now, here is a chart that shows the trend in the number of new addresses for Bitcoin over the last few months:

As displayed in the above graph, this Bitcoin metric has observed a surge in the last few weeks, suggesting that new users are being attracted to the network at a greater rate.

This surge in adoption has happened alongside the latest rally in the asset’s price. Historically, such a pattern hasn’t been an uncommon occurrence, as rallies have often appeared exciting to the public. So a large number of new users open up addresses to get in on the hype in these periods.

This rise of investor interest has actually often been a requirement for uptrends like these to be sustainable, as it’s only with sufficient new users that the asset can continue to get the fuel it needs for the price to keep up the climb.

Generally, rallies that fail to attract new attention toward the blockchain die out before long. Until recently, this rally had accompanied a fresh influx of new users into the network, with growth that was accelerating.

In the past week, though, the metric’s value has been heading down, implying that the incoming of new addresses to the Bitcoin network has been slowing down.

This pattern is certainly not a positive development for the rally’s future, as it implies the cryptocurrency could be running out of fresh momentum. If the new addresses don’t see a jump in the coming days while the price registers a rise, it could be a signal to sell, as such an uplift might only be temporary.

BTC Price

Bitcoin had plunged towards the $35,000 mark yesterday, but it appears that the asset has already recovered back above $36,000 today.