Standard Chartered: De-Dollarization Overblown, Dollar Down 10% by 2026

Share:

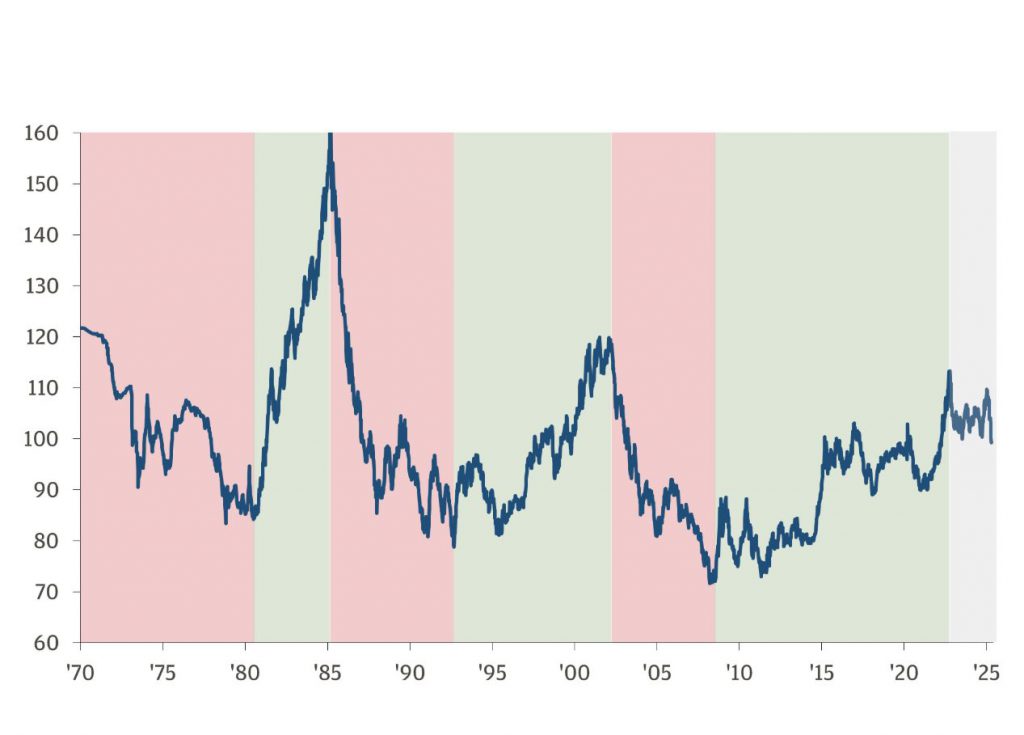

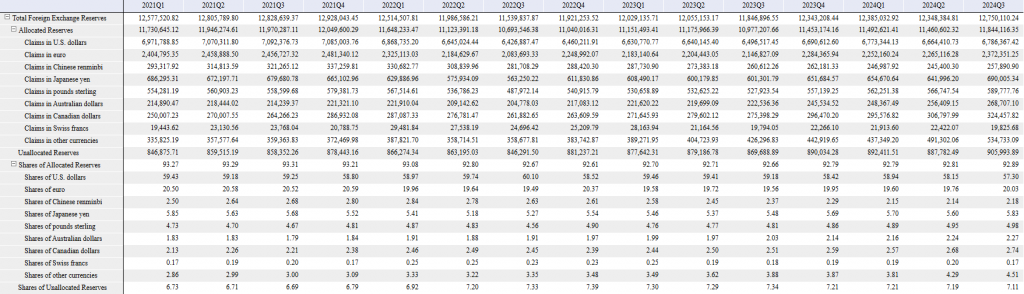

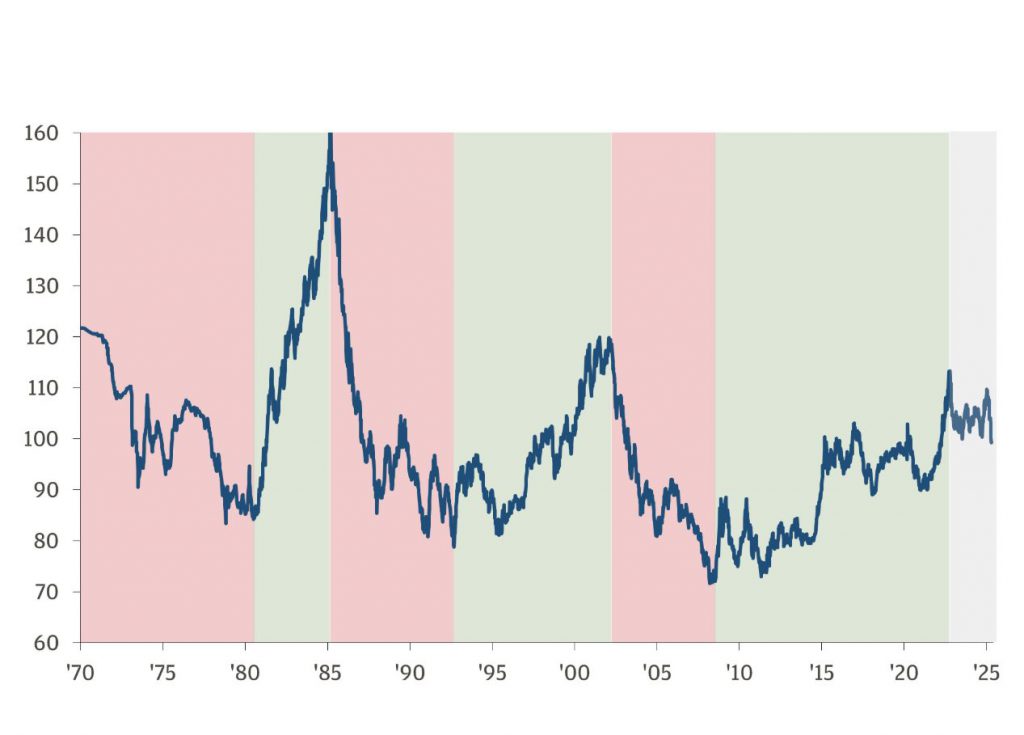

De-dollarization threats may be exaggerated, but Standard Chartered warns the United States dollar faces a 65% probability of decline over the next 12 months. The bank’s analysis suggests that de-dollarization concerns are overblown, yet predicts potential dollar weakness of 1-10% through mid-2026, with currency substitution and cryptocurrency adoption contributing to shifting global monetary dynamics right now.

Also Read: De-Dollarization: Wall Street Dumps $59B as FMAS:25 & Russia Act

How De-Dollarization, Currency Substitution, And Crypto Impact The Dollar’s Future

Standard Chartered’s De-Dollarization Assessment

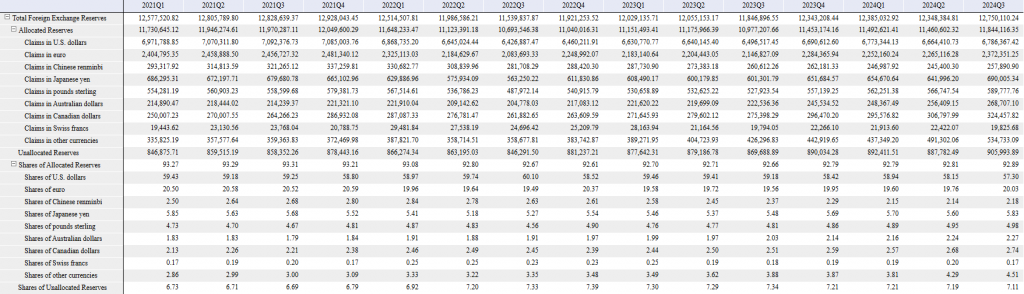

Standard Chartered’s research dismisses extreme de-dollarization scenarios while also acknowledging real pressures on dollar dominance at the time of writing. The bank stated:

It will still be an uphill challenge to replace the dollar as the global reserve currency, but there is no room for complacency given that regime shifts can occur over a relatively short time frame.

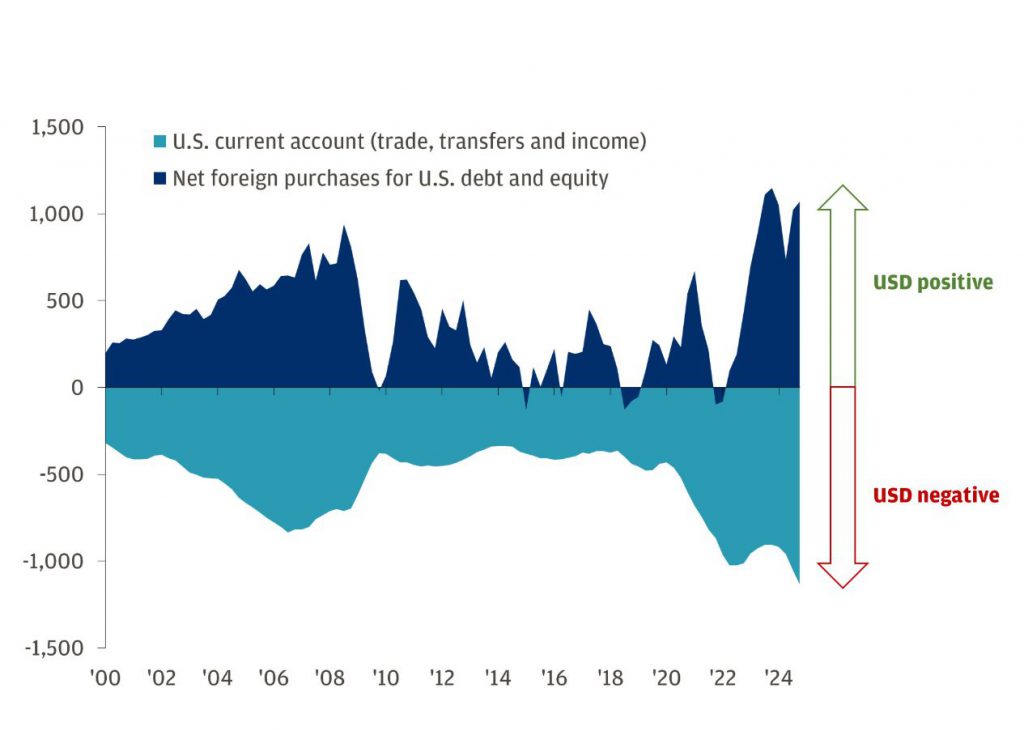

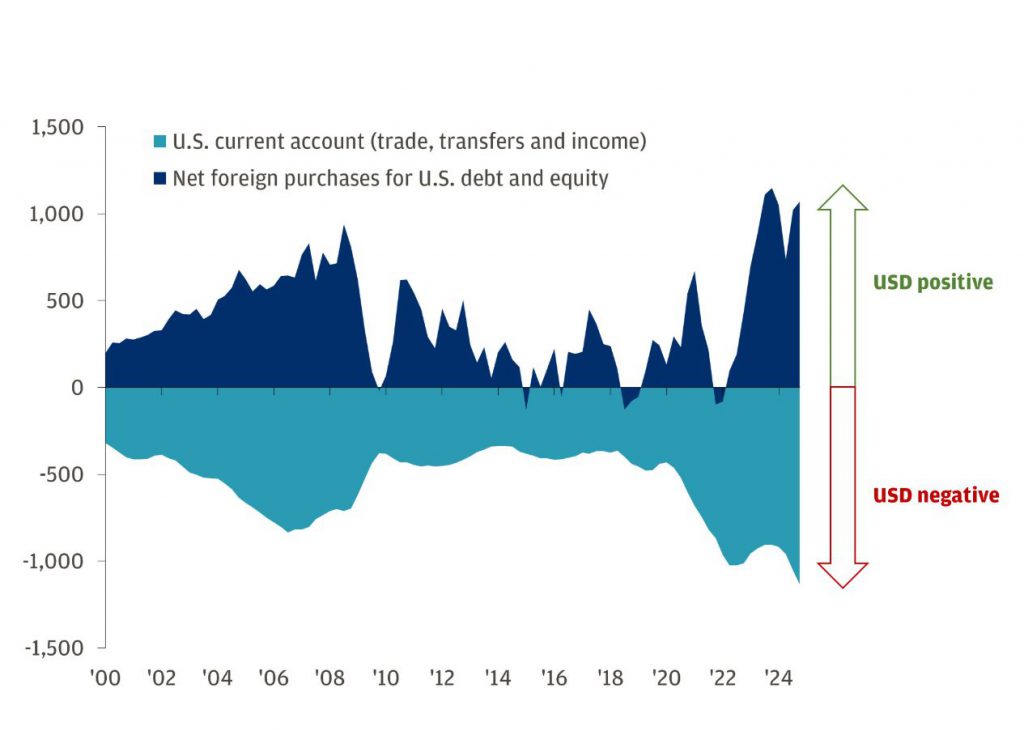

Currency Substitution and Cyclical Risks

Currency substitution efforts face obstacles, particularly regarding alternatives like the Euro and the Chinese yuan. Standard Chartered emphasized:

”A cyclical downturn is an important risk for the dollar and the probability of a US currency decline over the next 12 months are around 65%.”

The bank also notes that dedollarisation efforts remain challenging despite growing momentum.

Cryptocurrency Impact on De-Dollarization

Cryptocurrency adoption influences global currency dynamics, though technical challenges and security risks limit implementation right now. The bank noted:

”Economic and political uncertainty can undermine the perceived safety and stability of the dollar.”

Standard Chartered’s probability assessment indicates:

”The most likely outcome is a possible decline of 1-10% from the current price levels, but also with a small 5% chance of a slump of more than 10% on the horizon.”

Also Read: Russia’s New Economic Bank Fuels Global De-Dollarization Surge

The United States dollar maintains its world dominance despite any de-dollarization concerns there might exist, and currency substitution trends included, with Standard Chartered also recognizing both dollar resilience and its potential for some cyclical weakness caused gradual dedollarisation pressures.

Standard Chartered: De-Dollarization Overblown, Dollar Down 10% by 2026

Share:

De-dollarization threats may be exaggerated, but Standard Chartered warns the United States dollar faces a 65% probability of decline over the next 12 months. The bank’s analysis suggests that de-dollarization concerns are overblown, yet predicts potential dollar weakness of 1-10% through mid-2026, with currency substitution and cryptocurrency adoption contributing to shifting global monetary dynamics right now.

Also Read: De-Dollarization: Wall Street Dumps $59B as FMAS:25 & Russia Act

How De-Dollarization, Currency Substitution, And Crypto Impact The Dollar’s Future

Standard Chartered’s De-Dollarization Assessment

Standard Chartered’s research dismisses extreme de-dollarization scenarios while also acknowledging real pressures on dollar dominance at the time of writing. The bank stated:

It will still be an uphill challenge to replace the dollar as the global reserve currency, but there is no room for complacency given that regime shifts can occur over a relatively short time frame.

Currency Substitution and Cyclical Risks

Currency substitution efforts face obstacles, particularly regarding alternatives like the Euro and the Chinese yuan. Standard Chartered emphasized:

”A cyclical downturn is an important risk for the dollar and the probability of a US currency decline over the next 12 months are around 65%.”

The bank also notes that dedollarisation efforts remain challenging despite growing momentum.

Cryptocurrency Impact on De-Dollarization

Cryptocurrency adoption influences global currency dynamics, though technical challenges and security risks limit implementation right now. The bank noted:

”Economic and political uncertainty can undermine the perceived safety and stability of the dollar.”

Standard Chartered’s probability assessment indicates:

”The most likely outcome is a possible decline of 1-10% from the current price levels, but also with a small 5% chance of a slump of more than 10% on the horizon.”

Also Read: Russia’s New Economic Bank Fuels Global De-Dollarization Surge

The United States dollar maintains its world dominance despite any de-dollarization concerns there might exist, and currency substitution trends included, with Standard Chartered also recognizing both dollar resilience and its potential for some cyclical weakness caused gradual dedollarisation pressures.