Cardi B’s X Account Promotes Meme Coin: Be Careful, Warning Signs Appear

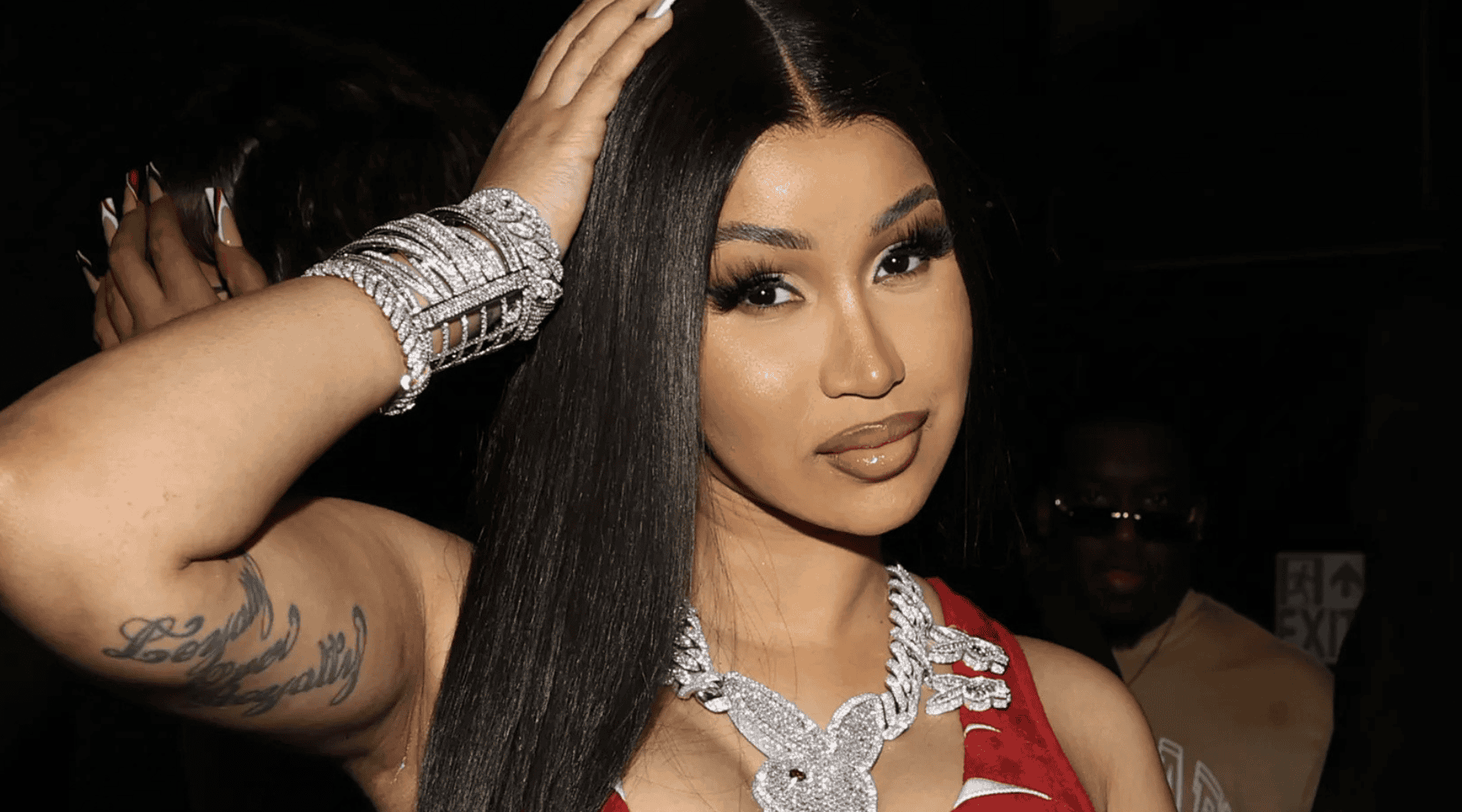

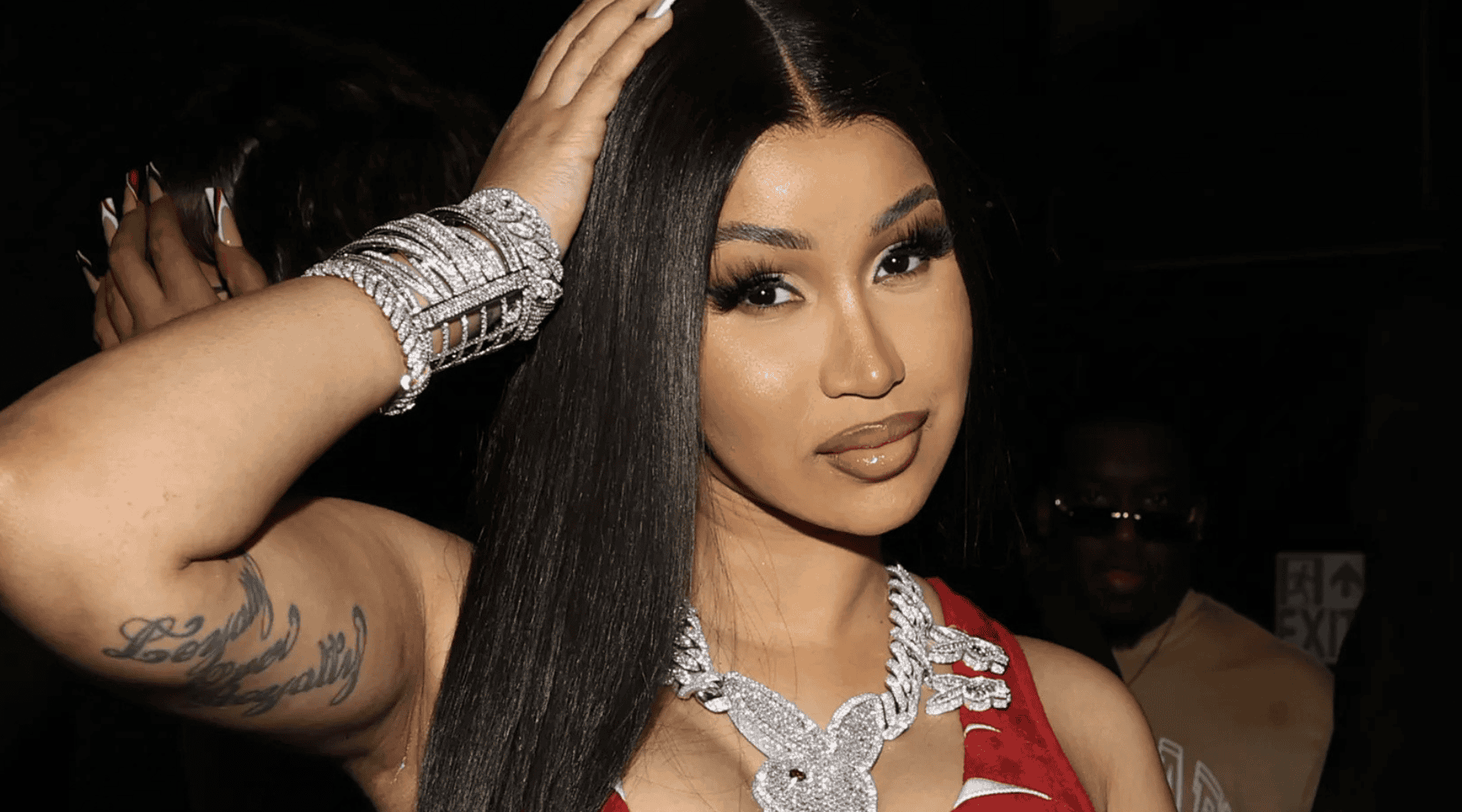

Cardi B, took to her X account to promote a new meme coin named after her iconic track.

However, there have been concerns surrounding the promotion, with security experts suggesting the account may have been compromised.

Cardi B Shares $WAP Video

The rapper, who has been in the news lately after claims emerged that she had undergone surgery, set off events with an October 7 post on X with a picture of her holding a cat.

In the post, Cardi B, whose real name is Belcalis Marlenis Almanzar, referred to the cat as a “new family member.” She further asked her followers to guess its name.

Hours later, she made another post stating, “Her name is $WAP.” The tweet also contained a wallet address as well as a brief animated video seemingly promoting a meme coin.

The promotion quickly caught the attention of the crypto community, with many voicing concerns about its legitimacy.

Blockchain security firm Peckshield was among the first to react, informing users that the rapper’s account may have been compromised to promote a possible scam.

It also urged her followers to exercise caution when interacting with her posts. However, some X users dismissed the warning, claiming the promotion was planned and deliberate.

Possible Rug Pull?

Adding to the unease around the launch of $WAP, crypto sleuth CryptoRugMunch highlighted a troubling trend: the top 200 wallets holding the coin’s supply were newly created, with most funded by larger wallets within the project.

The setup sparked fears of a potential rug pull, a scam in which developers drain liquidity and leave investors with worthless tokens.

At the time of writing, $WAP had amassed a total liquidity of $548,000 and a fully diluted valuation (FDV) of $17.6 million.

Additionally, the coin’s price stood at $0.01766, showing a spike in activity with over 20,000 transactions in just a few hours, according to data from Dexscreener. Despite this, questions around its legitimacy still persist, with some wondering whether it will end up like other celebrity-backed meme coins that turned out to be scams.

The apparent involvement of prominent crypto influencer Ansem also added fuel to the debate after he reacted to Cardi B’s initial X post asking followers to guess her new cat’s name. Ansem, who boasts more than half a million followers on X, responded by calling it “CAT SZN,” in a post that has been viewed more than 141,000 times.

The influencer is no stranger to controversy. Recently, he found himself at the center of a heated debate with blockchain investigator ZachXBT, who accused him of promoting low-cap meme coins to his followers. The detective claimed the coins often leave retail investors holding the bag when their value plummets.

The post Cardi B’s X Account Promotes Meme Coin: Be Careful, Warning Signs Appear appeared first on CryptoPotato.

Cardi B’s X Account Promotes Meme Coin: Be Careful, Warning Signs Appear

Cardi B, took to her X account to promote a new meme coin named after her iconic track.

However, there have been concerns surrounding the promotion, with security experts suggesting the account may have been compromised.

Cardi B Shares $WAP Video

The rapper, who has been in the news lately after claims emerged that she had undergone surgery, set off events with an October 7 post on X with a picture of her holding a cat.

In the post, Cardi B, whose real name is Belcalis Marlenis Almanzar, referred to the cat as a “new family member.” She further asked her followers to guess its name.

Hours later, she made another post stating, “Her name is $WAP.” The tweet also contained a wallet address as well as a brief animated video seemingly promoting a meme coin.

The promotion quickly caught the attention of the crypto community, with many voicing concerns about its legitimacy.

Blockchain security firm Peckshield was among the first to react, informing users that the rapper’s account may have been compromised to promote a possible scam.

It also urged her followers to exercise caution when interacting with her posts. However, some X users dismissed the warning, claiming the promotion was planned and deliberate.

Possible Rug Pull?

Adding to the unease around the launch of $WAP, crypto sleuth CryptoRugMunch highlighted a troubling trend: the top 200 wallets holding the coin’s supply were newly created, with most funded by larger wallets within the project.

The setup sparked fears of a potential rug pull, a scam in which developers drain liquidity and leave investors with worthless tokens.

At the time of writing, $WAP had amassed a total liquidity of $548,000 and a fully diluted valuation (FDV) of $17.6 million.

Additionally, the coin’s price stood at $0.01766, showing a spike in activity with over 20,000 transactions in just a few hours, according to data from Dexscreener. Despite this, questions around its legitimacy still persist, with some wondering whether it will end up like other celebrity-backed meme coins that turned out to be scams.

The apparent involvement of prominent crypto influencer Ansem also added fuel to the debate after he reacted to Cardi B’s initial X post asking followers to guess her new cat’s name. Ansem, who boasts more than half a million followers on X, responded by calling it “CAT SZN,” in a post that has been viewed more than 141,000 times.

The influencer is no stranger to controversy. Recently, he found himself at the center of a heated debate with blockchain investigator ZachXBT, who accused him of promoting low-cap meme coins to his followers. The detective claimed the coins often leave retail investors holding the bag when their value plummets.

The post Cardi B’s X Account Promotes Meme Coin: Be Careful, Warning Signs Appear appeared first on CryptoPotato.