BTC Price Commences Potential Recovery; Will Bitcoin Tokens Sustain Gains?

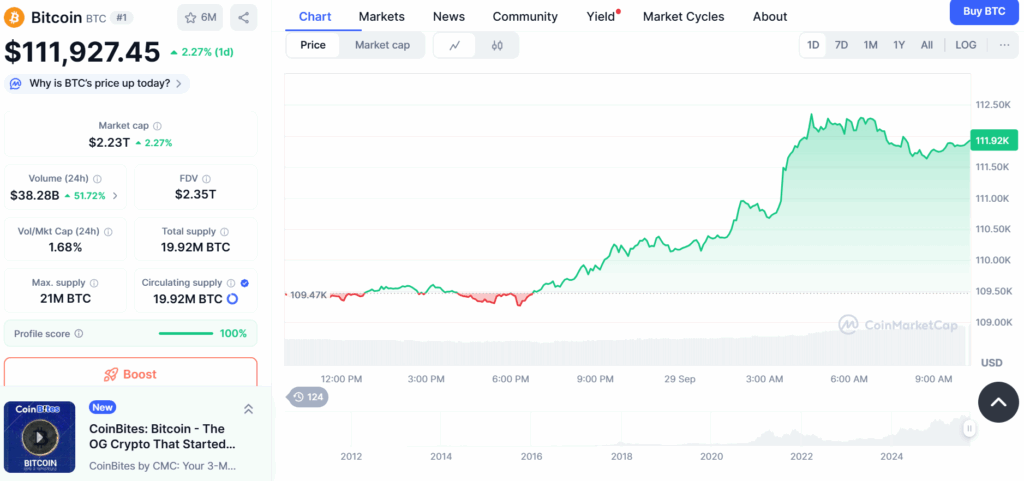

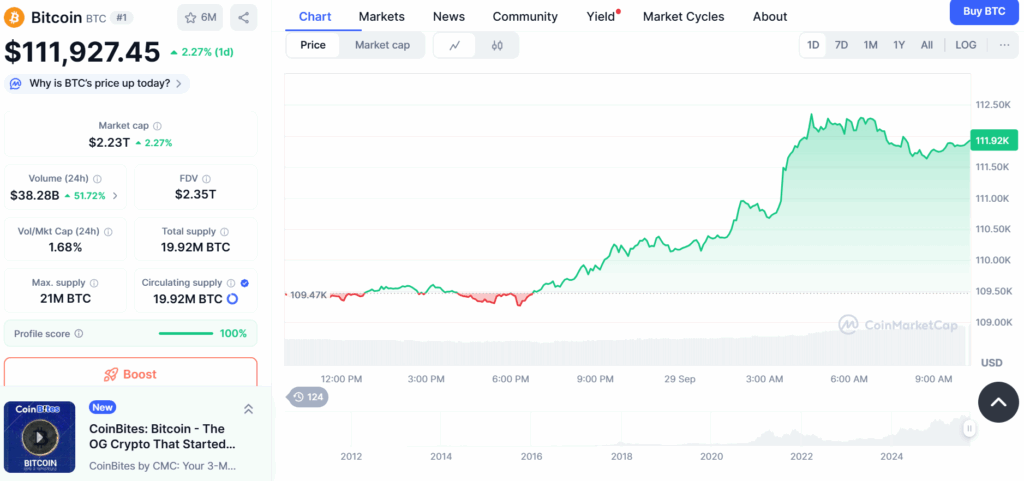

- BTC price is listed at $111,927.45 after an increase of 2.27% over the past 24 hours.

- Bitcoin tokens are testing a resistance level of $113,223.

- Rate cut and ETF flows are likely to affect BTC price in the days to come.

Many cryptocurrencies are seeing an increase in their value. Bitcoin tokens are one of them, with BTC price noting a significant surge in the last 24 hours. However, it remains to be seen if the price of Bitcoin tokens sustains ongoing gains or sees downtrends in the days to come. Two factors are expected to affect the rise and fall of BTC price irrespective of predicted estimates.

Gains in BTC Price

BTC price was hovering below $109,000 a couple of hours ago, but the flagship cryptocurrency has commenced a potential recovery. Bitcoin tokens are now exchanging hands at $111,927.45. This is after an increase of 2.27% over the past 24 hours, and 3.1% in the last 30 days. It is considerably down by 2.4% over a week, but the recent increase has vastly washed out the weekly decline.

The 24-hour trading volume has soared by 51.72%. Interestingly, Bitcoin tokens are down by 10.08% from their ATH of $124,457.12, which was noted on August 14, 2025. It is estimated that reclaiming the margin of $112k could fuel its rise closer to the all-time high milestone.

Possible Price Movements for Bitcoin Tokens

BTC price would either tank or jump in the days to come. Predictions estimate Bitcoin tokens to surge by 4.70% in the next 30 days. This would take the value to around $116,858 amid the volatility of 2.36%. Overall sentiments towards the crypto following the short-term BTC price prediction have shifted to neutral. The same is evident from the FGI rating of 50 points.

The closest resistance level rests at $113,223, provided BTC moves to $112k. The closest support level is at $110,109. A decline beneath that margin may invite more downtrends. The 14-Day RSI is at 46.29 points, signalling an option to buy the token.

That said, it is important to note that thorough research and risk assessment are imperative before trading any crypto. The contents of this article are neither recommendations nor advice.

Factors That Could Affect BTC Price

A total of two factors are teased to affect BTC price. The 25 bps Fed rate cut and Spot Bitcoin ETF flows. The Fed rate cut happened earlier this month, but its effects are buffering in triggering upticks for the token. Slashing lending rates is often associated with boosting confidence to invest in risky markets. Thereby, enhancing liquidity and fueling price rises.

Next, Spot Bitcoin ETF faced pressure last week as it recorded outflows for four out of five days. The highest outward movement of funds was on September 26, 2025, for $418.3 million. The type of flows in the upcoming week could set a new sentiment of confidence for the community.

Highlighted Crypto News Today:

BTC Price Commences Potential Recovery; Will Bitcoin Tokens Sustain Gains?

- BTC price is listed at $111,927.45 after an increase of 2.27% over the past 24 hours.

- Bitcoin tokens are testing a resistance level of $113,223.

- Rate cut and ETF flows are likely to affect BTC price in the days to come.

Many cryptocurrencies are seeing an increase in their value. Bitcoin tokens are one of them, with BTC price noting a significant surge in the last 24 hours. However, it remains to be seen if the price of Bitcoin tokens sustains ongoing gains or sees downtrends in the days to come. Two factors are expected to affect the rise and fall of BTC price irrespective of predicted estimates.

Gains in BTC Price

BTC price was hovering below $109,000 a couple of hours ago, but the flagship cryptocurrency has commenced a potential recovery. Bitcoin tokens are now exchanging hands at $111,927.45. This is after an increase of 2.27% over the past 24 hours, and 3.1% in the last 30 days. It is considerably down by 2.4% over a week, but the recent increase has vastly washed out the weekly decline.

The 24-hour trading volume has soared by 51.72%. Interestingly, Bitcoin tokens are down by 10.08% from their ATH of $124,457.12, which was noted on August 14, 2025. It is estimated that reclaiming the margin of $112k could fuel its rise closer to the all-time high milestone.

Possible Price Movements for Bitcoin Tokens

BTC price would either tank or jump in the days to come. Predictions estimate Bitcoin tokens to surge by 4.70% in the next 30 days. This would take the value to around $116,858 amid the volatility of 2.36%. Overall sentiments towards the crypto following the short-term BTC price prediction have shifted to neutral. The same is evident from the FGI rating of 50 points.

The closest resistance level rests at $113,223, provided BTC moves to $112k. The closest support level is at $110,109. A decline beneath that margin may invite more downtrends. The 14-Day RSI is at 46.29 points, signalling an option to buy the token.

That said, it is important to note that thorough research and risk assessment are imperative before trading any crypto. The contents of this article are neither recommendations nor advice.

Factors That Could Affect BTC Price

A total of two factors are teased to affect BTC price. The 25 bps Fed rate cut and Spot Bitcoin ETF flows. The Fed rate cut happened earlier this month, but its effects are buffering in triggering upticks for the token. Slashing lending rates is often associated with boosting confidence to invest in risky markets. Thereby, enhancing liquidity and fueling price rises.

Next, Spot Bitcoin ETF faced pressure last week as it recorded outflows for four out of five days. The highest outward movement of funds was on September 26, 2025, for $418.3 million. The type of flows in the upcoming week could set a new sentiment of confidence for the community.

Highlighted Crypto News Today: