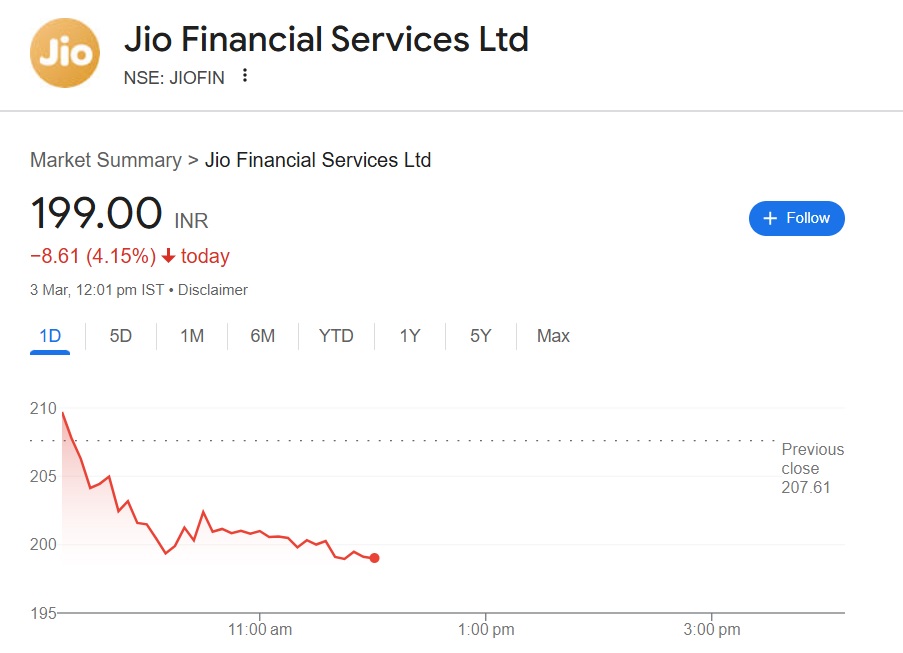

Jio Financial Shares Crash to Rs 198: Right Time to Buy?

Jio Financial Services (NSE: JIOFIN) has crashed below the Rs 200 mark on Monday’s opening bell. It is now trading at the Rs 198 mark and is attracting bearish sentiments in the indices. The stock is now well below its launch price of 214 when it first hit the markets in August 2023. Therefore, everybody who invested in JIOFIN in the last 18 months is all under massive losses.

Also Read: IRFC Shares Might Crash Another 15%, Reach 90-92 Level

Sensex and Nifty crashed 350 points and 110 points on Monday, respectively. The index is down double digits in the last six months and the downturn is likely to continue as foreign institutional investors (FII) exit the Indian markets taking entry positions in the US and Chinese stocks. Now that Jio Financial shares are below the Rs 200 mark, is this the best time to accumulate the stock?

Also Read: Sensex And Nifty Crash: Top 3 Stocks Reach 52 Week Low

When To Buy Jio Financial Shares?

Taking an entry position in Jio Financial shares is not advisable as the market’s downturn could continue. Buying JIOFIN now is as good as catching a falling knife, which is considered a dangerous move. JIOFIN is down nearly 43% in the last six months and could take many months to recover. The downturn is quick but scaling up in the chart is the hardest part.

Also Read: De-Dollarization: Global Bank Predicts Future of the US Dollar

It is advised to remain on the sidelines and watch out for market movements. The Indian rupee is dipping against the US dollar touching a low of 87.33. The FII exodus is adding to the burden making Jio Financial shares tank in the charts. In addition, a Bombay Court has ordered an FIR against SEBI chair Madhavi Puri Buch and five other top executives for alleged stock market fraud and regulatory violations.

The markets are reacting strongly to these developments and leading stocks could slip south further. It is best advised to wait and watch for further downturns before taking an entry position in Jio Financial shares.

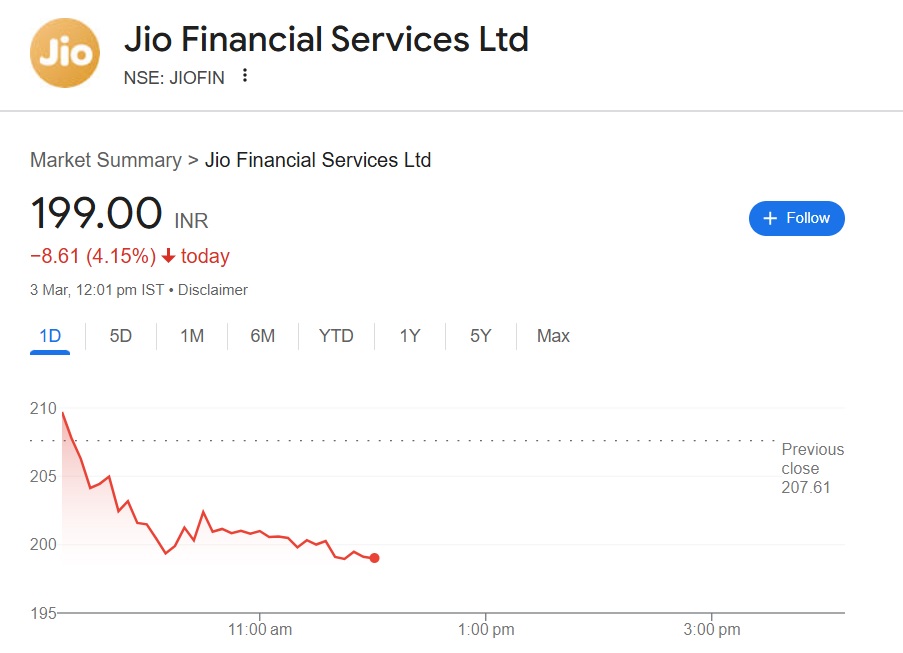

Jio Financial Shares Crash to Rs 198: Right Time to Buy?

Jio Financial Services (NSE: JIOFIN) has crashed below the Rs 200 mark on Monday’s opening bell. It is now trading at the Rs 198 mark and is attracting bearish sentiments in the indices. The stock is now well below its launch price of 214 when it first hit the markets in August 2023. Therefore, everybody who invested in JIOFIN in the last 18 months is all under massive losses.

Also Read: IRFC Shares Might Crash Another 15%, Reach 90-92 Level

Sensex and Nifty crashed 350 points and 110 points on Monday, respectively. The index is down double digits in the last six months and the downturn is likely to continue as foreign institutional investors (FII) exit the Indian markets taking entry positions in the US and Chinese stocks. Now that Jio Financial shares are below the Rs 200 mark, is this the best time to accumulate the stock?

Also Read: Sensex And Nifty Crash: Top 3 Stocks Reach 52 Week Low

When To Buy Jio Financial Shares?

Taking an entry position in Jio Financial shares is not advisable as the market’s downturn could continue. Buying JIOFIN now is as good as catching a falling knife, which is considered a dangerous move. JIOFIN is down nearly 43% in the last six months and could take many months to recover. The downturn is quick but scaling up in the chart is the hardest part.

Also Read: De-Dollarization: Global Bank Predicts Future of the US Dollar

It is advised to remain on the sidelines and watch out for market movements. The Indian rupee is dipping against the US dollar touching a low of 87.33. The FII exodus is adding to the burden making Jio Financial shares tank in the charts. In addition, a Bombay Court has ordered an FIR against SEBI chair Madhavi Puri Buch and five other top executives for alleged stock market fraud and regulatory violations.

The markets are reacting strongly to these developments and leading stocks could slip south further. It is best advised to wait and watch for further downturns before taking an entry position in Jio Financial shares.