Bullish completes oversubscribed $1.1 billion IPO to list on NYSE

Bullish, the crypto exchange backed by Peter Thiel, raised $1.1 billion in its IPO on Tuesday after pushing its share price higher than expected.

The company confirmed through a statement on its website that it sold 30 million shares at $37 each, even though the original price range was between $32 and $33. At this price, Bullish now carries a $5.4 billion valuation, based on what it reported to the U.S. Securities and Exchange Commission.

The company had already adjusted its plans the day before. On Monday, Bullish increased the share count from earlier estimates and moved the price target higher. Investors didn’t flinch. The IPO ended up being more than 20 times oversubscribed, showing the insane demand.

Bullish IPO rides momentum from Trump’s new stablecoin law

Two heavyweight firms, BlackRock and ARK Investment Management, stepped in with interest to buy up to $200 million worth of shares between them. That figure came straight from the company’s latest SEC filings. It’s still unclear how much either firm actually bought, but the interest was official.

This public debut wasn’t the original game plan. Bullish first tried to go public in 2021 through a SPAC merger that would’ve given it a $9 billion valuation. That attempt fell through in 2022, and the deal never progressed.

Now, Tom Farley, who used to be the president of the New York Stock Exchange, is the firm’s CEO.

The company doesn’t just deal in crypto exchange services. It also owns CoinDesk, the crypto news platform. In its official filings, Bullish said it provides spot, margin, and derivatives trading, and targets institutional investors specifically.

Ownership is still concentrated. Brendan Blumer, the CEO of Block.one and a Bullish co-founder, will hold on to 30.1% of the company after the IPO. Kokuei Yuan, a board member, is expected to own 26.7%. That means two people together control more than half the company.

JPMorgan, Jefferies, and Citigroup led the offering. Bullish is scheduled to start trading on Wednesday on the New York Stock Exchange under the symbol BLSH.

In July, President Donald Trump signed a federal law to regulate stablecoins, finally giving legal structure to dollar-pegged crypto. This move followed years of lobbying from crypto firms. That win gave companies like Bullish more confidence going into public markets.

KEY Difference Wire helps crypto brands break through and dominate headlines fast

Read More

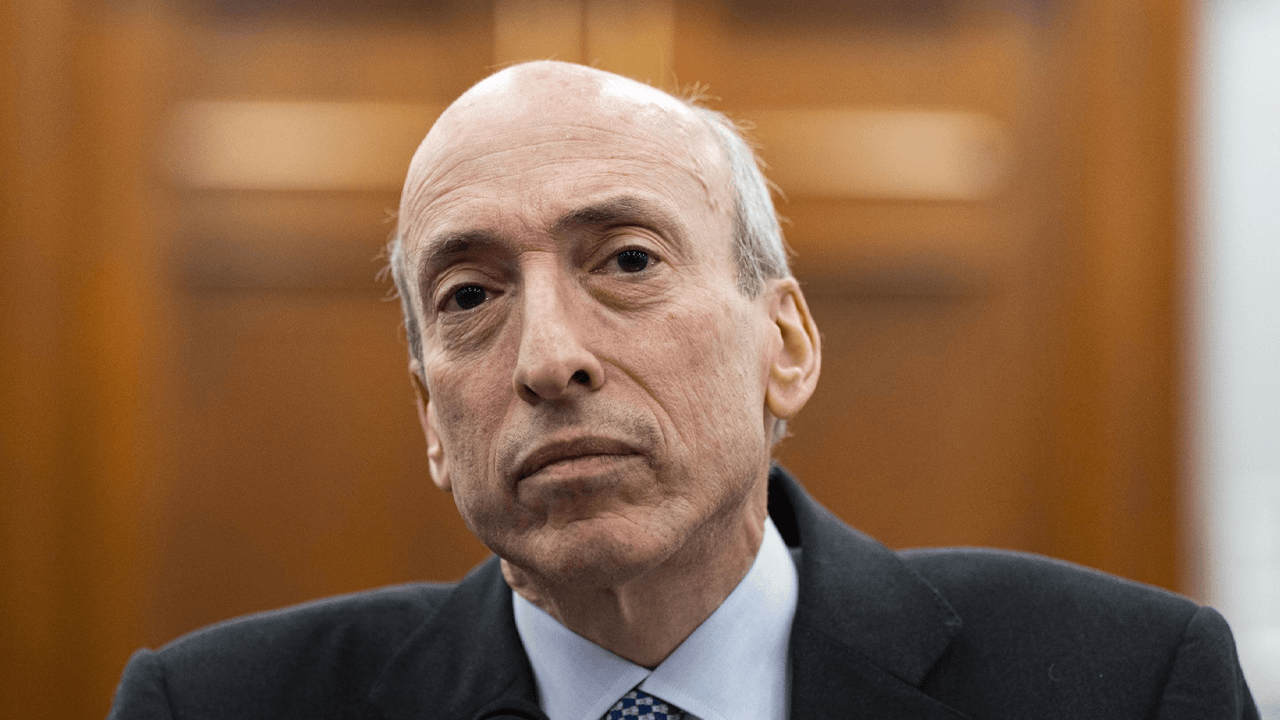

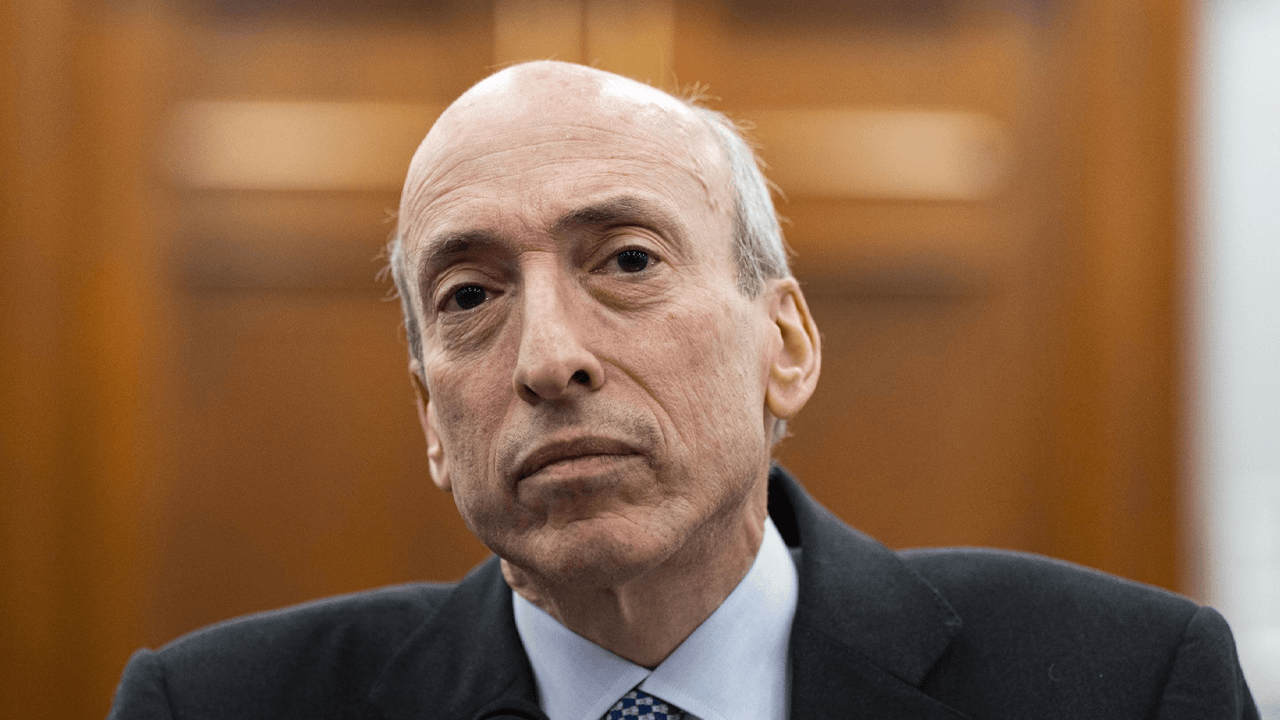

Erased Gensler Texts Ignite Crypto Backlash as SEC Watchdog Faults ‘Avoidable Errors’

Bullish completes oversubscribed $1.1 billion IPO to list on NYSE

Bullish, the crypto exchange backed by Peter Thiel, raised $1.1 billion in its IPO on Tuesday after pushing its share price higher than expected.

The company confirmed through a statement on its website that it sold 30 million shares at $37 each, even though the original price range was between $32 and $33. At this price, Bullish now carries a $5.4 billion valuation, based on what it reported to the U.S. Securities and Exchange Commission.

The company had already adjusted its plans the day before. On Monday, Bullish increased the share count from earlier estimates and moved the price target higher. Investors didn’t flinch. The IPO ended up being more than 20 times oversubscribed, showing the insane demand.

Bullish IPO rides momentum from Trump’s new stablecoin law

Two heavyweight firms, BlackRock and ARK Investment Management, stepped in with interest to buy up to $200 million worth of shares between them. That figure came straight from the company’s latest SEC filings. It’s still unclear how much either firm actually bought, but the interest was official.

This public debut wasn’t the original game plan. Bullish first tried to go public in 2021 through a SPAC merger that would’ve given it a $9 billion valuation. That attempt fell through in 2022, and the deal never progressed.

Now, Tom Farley, who used to be the president of the New York Stock Exchange, is the firm’s CEO.

The company doesn’t just deal in crypto exchange services. It also owns CoinDesk, the crypto news platform. In its official filings, Bullish said it provides spot, margin, and derivatives trading, and targets institutional investors specifically.

Ownership is still concentrated. Brendan Blumer, the CEO of Block.one and a Bullish co-founder, will hold on to 30.1% of the company after the IPO. Kokuei Yuan, a board member, is expected to own 26.7%. That means two people together control more than half the company.

JPMorgan, Jefferies, and Citigroup led the offering. Bullish is scheduled to start trading on Wednesday on the New York Stock Exchange under the symbol BLSH.

In July, President Donald Trump signed a federal law to regulate stablecoins, finally giving legal structure to dollar-pegged crypto. This move followed years of lobbying from crypto firms. That win gave companies like Bullish more confidence going into public markets.

KEY Difference Wire helps crypto brands break through and dominate headlines fast

Read More