XRP Set to Lead Altcoin Boom With Explosive $9.69 Target, Says Analyst

In the latest “The Weekly Insight,” analyst @CryptoinsightUK places XRP at the center of the next market advance—mapping a five-wave structure that targets Wave 3 ≈ $6.50, Wave 4 holding > $5, and Wave 5 ≈ $9.69. The call is anchored in XRP’s relative strength and a broader macro setup that he describes bluntly: “I’m bullish. I’m bullish. I’m bullish.”

Near term, he concedes Bitcoin can still “dip in the short term and reclaim some of the liquidity sitting below us,” but he argues that any shakeout precedes an aggressive upswing that should favor leaders like XRP.

The author’s relative-strength case is explicit: “XRP has been leading the way this cycle,” adding it “is about to begin its next major leg higher.” He contrasts structures: “If you overlay the Ethereum chart on top of XRP’s, the difference is striking… XRP… held strong around all-time highs… has pushed above both its previous all-time high and the $2.70 swing high, and is now consolidating above them.

Meanwhile, Ethereum is still struggling to reclaim and hold its all-time high.” He continues: “This relative strength is important… it could continue to outperform the largest altcoin in the market,” with spot ETF speculation for XRP “possibly coming in September or October” and potential policy tailwinds adding fuel.

What Needs To Happen For XRP To Hit $9.69?

Zooming out, the newsletter situates XRP within a risk-on macro backdrop that could lift Bitcoin and TOTAL/Total2 and, by extension, turbo-charge altcoin leadership. Equities breadth is the opening bid: the S&P 500, Nasdaq, Dow Jones, and Russell 2000 are, he writes, “on the edge of or already in expansion,” with monthly RSI in overbought historically preceding “at least a few months, and often a prolonged period, of strong bull market activity.” He calls it a “clear signal, a green light for risk on.”

On cross-asset signals, @CryptoinsightUK underscores the directional tie between Bitcoin and gold, despite gold’s “risk-off” label. Chinese gold demand and Western currency debasement, in his view, strengthen Bitcoin’s long-term case. Historically, gold bottoms have led Bitcoin bottoms by an average ~126 days across four instances; applied to the latest sequence, he sketches a probabilistic Bitcoin bottom window around September 15, 2025.

The liquidity map remains pivotal. On higher timeframes, he sees “extremely dense” liquidity above Bitcoin, arguing that once the current range resolves, “the move will likely be sharp and aggressive,” with a roadmap that “quickly” carries BTC toward $144,000 and beyond.

For alt breadth, he points to Total2. By his analog, today’s structure rhymes with an “orange circle” precursor from last cycle; from that point to the peak, alts rallied about 350% (technically ~366%). A repeat implies ~$7.73 trillion for Total2—an environment in which “XRP will be one of the clear leaders in the next leg of this market cycle,” provided Bitcoin prints new highs and Total2 breaks out.

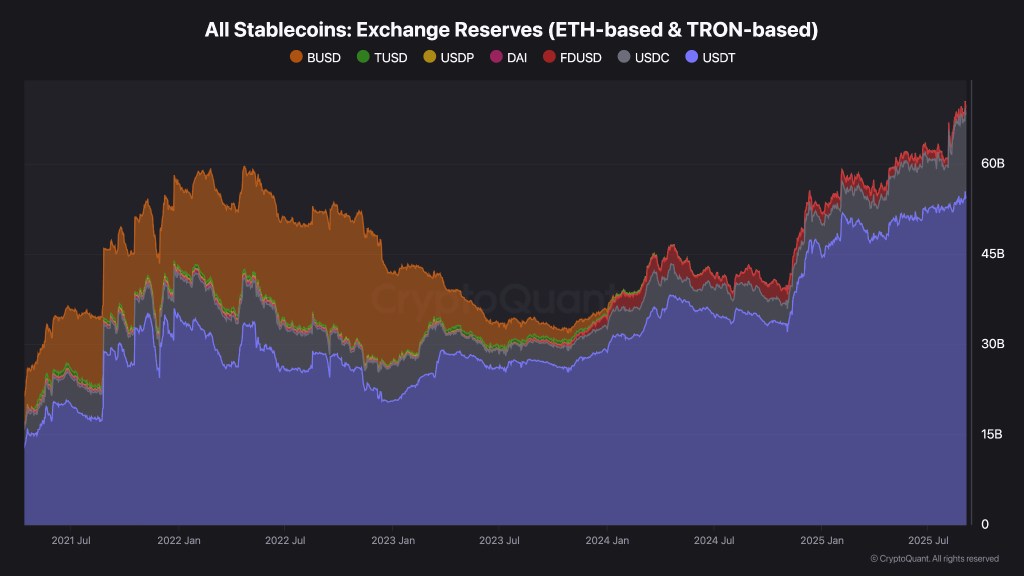

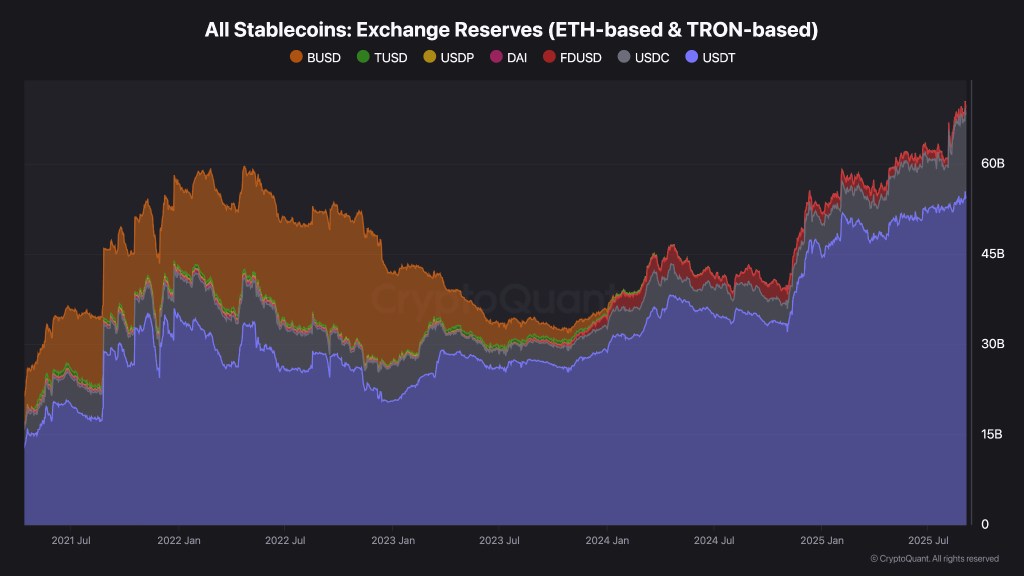

The companion “Charts of the Week” (by @thecryptomann1) sharpen the market’s near-term complexion and how it may channel into XRP. Stablecoin exchange reserves (ETH- and Tron-based) sit at all-time highs—~$66 billion (≈ $53B USDT, $13B USDC), a cache of “dry powder” that could chase upside on a breakout or cushion a final dip toward ~$105,000 on BTC before reversing.

A caution flag: the 30-day change in aggregate whale holdings has “dropped off a cliff” recently—“alarming,” he notes, and not to be ignored even if it doesn’t spell disaster. Meanwhile, NUPL (Net Unrealized Profit/Loss) has been sliding as the market “takes back” profits from the past ten months; a revisit of the “yellow zone” (<~0.5) could catalyze the next parabolic phase. Structurally, the realized price bands are yet to tag their upper bound, supporting a cycle view that BTC surpasses $200,000 before the run is done.

Within that mosaic, XRP’s wave count and leadership profile are the through-line. The projected path—Wave 3 to ~$6.5, Wave 4 holding above $5, Wave 5 extending to ~$9.69—is presented as the high-conviction roadmap if Bitcoin’s final shakeout resolves higher, Total2 breaks to new cycle highs, and ETF/policy catalysts keep skewing flows toward XRP. To the author, those pieces add up to a market where “any pullback is a buying opportunity,” and where the path of least resistance—once the range resolves—is higher, with XRP positioned to lead.

At press time XRP traded at $2.975.

Read More

Everyone’s Wrong About XRP: Here’s Why, Says Top Analyst

XRP Set to Lead Altcoin Boom With Explosive $9.69 Target, Says Analyst

In the latest “The Weekly Insight,” analyst @CryptoinsightUK places XRP at the center of the next market advance—mapping a five-wave structure that targets Wave 3 ≈ $6.50, Wave 4 holding > $5, and Wave 5 ≈ $9.69. The call is anchored in XRP’s relative strength and a broader macro setup that he describes bluntly: “I’m bullish. I’m bullish. I’m bullish.”

Near term, he concedes Bitcoin can still “dip in the short term and reclaim some of the liquidity sitting below us,” but he argues that any shakeout precedes an aggressive upswing that should favor leaders like XRP.

The author’s relative-strength case is explicit: “XRP has been leading the way this cycle,” adding it “is about to begin its next major leg higher.” He contrasts structures: “If you overlay the Ethereum chart on top of XRP’s, the difference is striking… XRP… held strong around all-time highs… has pushed above both its previous all-time high and the $2.70 swing high, and is now consolidating above them.

Meanwhile, Ethereum is still struggling to reclaim and hold its all-time high.” He continues: “This relative strength is important… it could continue to outperform the largest altcoin in the market,” with spot ETF speculation for XRP “possibly coming in September or October” and potential policy tailwinds adding fuel.

What Needs To Happen For XRP To Hit $9.69?

Zooming out, the newsletter situates XRP within a risk-on macro backdrop that could lift Bitcoin and TOTAL/Total2 and, by extension, turbo-charge altcoin leadership. Equities breadth is the opening bid: the S&P 500, Nasdaq, Dow Jones, and Russell 2000 are, he writes, “on the edge of or already in expansion,” with monthly RSI in overbought historically preceding “at least a few months, and often a prolonged period, of strong bull market activity.” He calls it a “clear signal, a green light for risk on.”

On cross-asset signals, @CryptoinsightUK underscores the directional tie between Bitcoin and gold, despite gold’s “risk-off” label. Chinese gold demand and Western currency debasement, in his view, strengthen Bitcoin’s long-term case. Historically, gold bottoms have led Bitcoin bottoms by an average ~126 days across four instances; applied to the latest sequence, he sketches a probabilistic Bitcoin bottom window around September 15, 2025.

The liquidity map remains pivotal. On higher timeframes, he sees “extremely dense” liquidity above Bitcoin, arguing that once the current range resolves, “the move will likely be sharp and aggressive,” with a roadmap that “quickly” carries BTC toward $144,000 and beyond.

For alt breadth, he points to Total2. By his analog, today’s structure rhymes with an “orange circle” precursor from last cycle; from that point to the peak, alts rallied about 350% (technically ~366%). A repeat implies ~$7.73 trillion for Total2—an environment in which “XRP will be one of the clear leaders in the next leg of this market cycle,” provided Bitcoin prints new highs and Total2 breaks out.

The companion “Charts of the Week” (by @thecryptomann1) sharpen the market’s near-term complexion and how it may channel into XRP. Stablecoin exchange reserves (ETH- and Tron-based) sit at all-time highs—~$66 billion (≈ $53B USDT, $13B USDC), a cache of “dry powder” that could chase upside on a breakout or cushion a final dip toward ~$105,000 on BTC before reversing.

A caution flag: the 30-day change in aggregate whale holdings has “dropped off a cliff” recently—“alarming,” he notes, and not to be ignored even if it doesn’t spell disaster. Meanwhile, NUPL (Net Unrealized Profit/Loss) has been sliding as the market “takes back” profits from the past ten months; a revisit of the “yellow zone” (<~0.5) could catalyze the next parabolic phase. Structurally, the realized price bands are yet to tag their upper bound, supporting a cycle view that BTC surpasses $200,000 before the run is done.

Within that mosaic, XRP’s wave count and leadership profile are the through-line. The projected path—Wave 3 to ~$6.5, Wave 4 holding above $5, Wave 5 extending to ~$9.69—is presented as the high-conviction roadmap if Bitcoin’s final shakeout resolves higher, Total2 breaks to new cycle highs, and ETF/policy catalysts keep skewing flows toward XRP. To the author, those pieces add up to a market where “any pullback is a buying opportunity,” and where the path of least resistance—once the range resolves—is higher, with XRP positioned to lead.

At press time XRP traded at $2.975.

Read More