This $1K Nvidia Investment in 2014 Could’ve Changed Your Life—Here’s Why

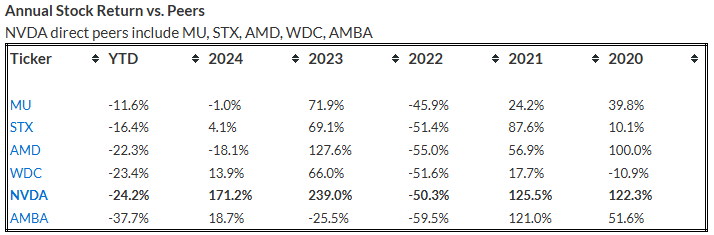

Nvidia investments have really transformed many portfolios over the past decade. And, right now, looking back at the data, we can see that a modest $1,000 placed in this tech stock around 10 years ago would actually be worth an astounding $228,490 at the time of writing, which represents a 22,749% return. This remarkable growth story, in many ways, showcases how strategic cryptocurrency investments and also patience through market volatility can lead to such high returns that, well, might seem rather unbelievable today.

Also Read: Ripple: 3 Ways To Enjoy When XRP Hits $10 In The Future

Discover Why NVIDIA’s Investment Was a Game Changer in Tech Stocks and Crypto

From Chip Designer to AI Giant

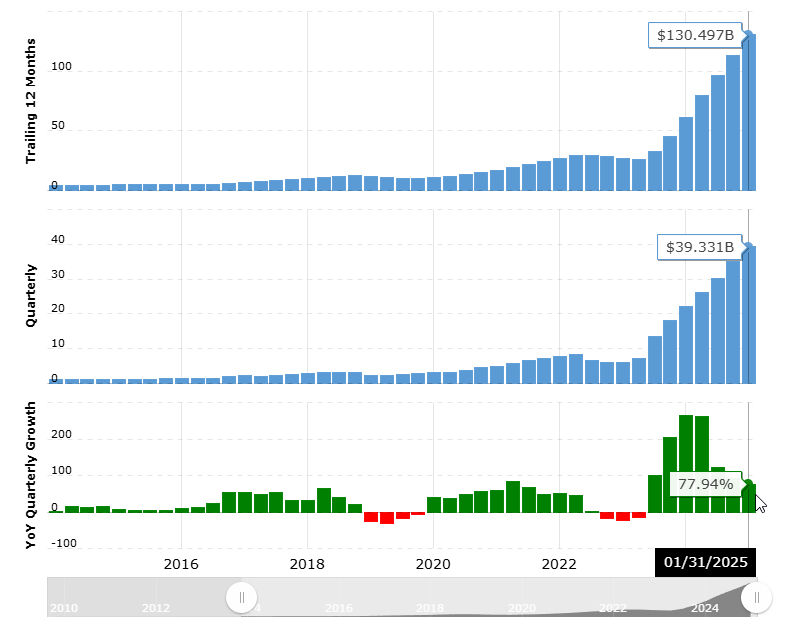

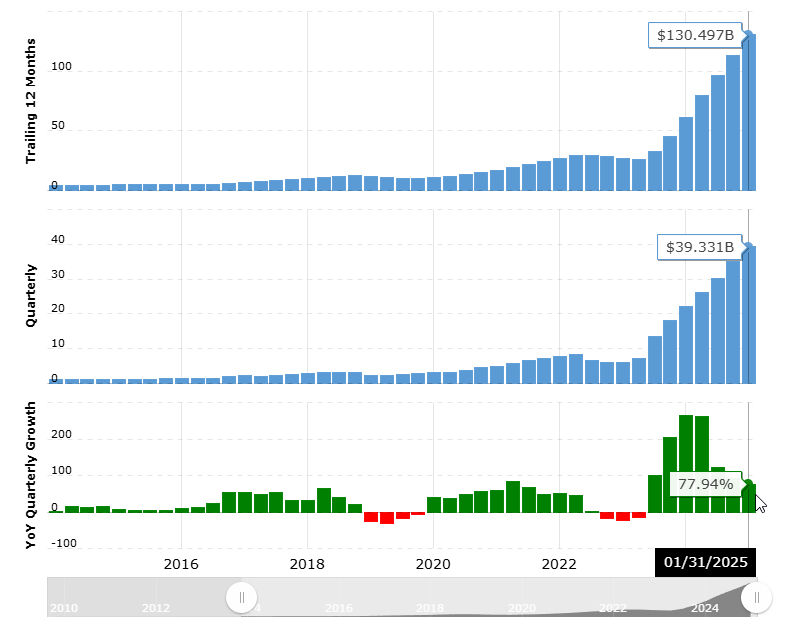

The Nvidia investment trajectory has been, to say the least, extraordinary. The company has, over time, evolved from a specialized chip designer into a $2.86 trillion tech stocks powerhouse. In its 2015 fiscal year, for instance, Nvidia has generated about $4.7 billion in revenue. That said, by 2025, this figure actually soared to over $130 billion alongside $72.9 billion in net income.

Jensen Huang, who is Nvidia’s CEO and now the 15th richest person globally, stated:

“Every single year, more people come [to GTC] because AI is able to solve more interesting problems for more industries and more companies.”

Remarkable Returns Despite Market Volatility

The numbers, in fact, tell quite a compelling story about Nvidia investment performance:

- 1 year return: 36.1% (turning $1,000 into just $1,360)

- 5 year return: 1,670% (turning $1,000 into $17,700)

- 10 year return: 22,749% (turning $1,000 into $228,490)

Also Read: New Country Begins Ditching US Dollar, Accumulates Gold in Central Bank

Cryptocurrency Investments and AI Powering Growth

Market volatility has, at various points, affected Nvidia’s stock, yet the long-term trend remains, well, impressively upward. Also, the company’s latest earnings further cement its position in the tech stocks ecosystem.

In February 2025, as an example, Nvidia announced record earnings with $39.3 billion in Q4 revenue. This represented, in fact, a 12% increase from the previous quarter and 78% growth year-over-year, highlighting the company’s dominance in AI hardware that powers many cryptocurrency investments.

Huang has called AI:

“The next industrial revolution.”

Investment Lessons and High Returns

The Nvidia investment success offers, in many ways, valuable insights for today’s investors seeking high returns. While such spectacular growth might not be replicated easily, understanding the factors behind Nvidia’s rise can help identify future opportunities in tech stocks and cryptocurrency investments.

Also Read: Analyst Explains When the US Stock Market Will Rebound

Most experts recommend diversification through index funds rather than concentrating in single stocks. Nevertheless, the Nvidia investment story demonstrates how visionary leadership and positioning in emerging technologies can sometimes overcome market volatility to deliver life-changing wealth from what were, initially, modest investments.

This $1K Nvidia Investment in 2014 Could’ve Changed Your Life—Here’s Why

Nvidia investments have really transformed many portfolios over the past decade. And, right now, looking back at the data, we can see that a modest $1,000 placed in this tech stock around 10 years ago would actually be worth an astounding $228,490 at the time of writing, which represents a 22,749% return. This remarkable growth story, in many ways, showcases how strategic cryptocurrency investments and also patience through market volatility can lead to such high returns that, well, might seem rather unbelievable today.

Also Read: Ripple: 3 Ways To Enjoy When XRP Hits $10 In The Future

Discover Why NVIDIA’s Investment Was a Game Changer in Tech Stocks and Crypto

From Chip Designer to AI Giant

The Nvidia investment trajectory has been, to say the least, extraordinary. The company has, over time, evolved from a specialized chip designer into a $2.86 trillion tech stocks powerhouse. In its 2015 fiscal year, for instance, Nvidia has generated about $4.7 billion in revenue. That said, by 2025, this figure actually soared to over $130 billion alongside $72.9 billion in net income.

Jensen Huang, who is Nvidia’s CEO and now the 15th richest person globally, stated:

“Every single year, more people come [to GTC] because AI is able to solve more interesting problems for more industries and more companies.”

Remarkable Returns Despite Market Volatility

The numbers, in fact, tell quite a compelling story about Nvidia investment performance:

- 1 year return: 36.1% (turning $1,000 into just $1,360)

- 5 year return: 1,670% (turning $1,000 into $17,700)

- 10 year return: 22,749% (turning $1,000 into $228,490)

Also Read: New Country Begins Ditching US Dollar, Accumulates Gold in Central Bank

Cryptocurrency Investments and AI Powering Growth

Market volatility has, at various points, affected Nvidia’s stock, yet the long-term trend remains, well, impressively upward. Also, the company’s latest earnings further cement its position in the tech stocks ecosystem.

In February 2025, as an example, Nvidia announced record earnings with $39.3 billion in Q4 revenue. This represented, in fact, a 12% increase from the previous quarter and 78% growth year-over-year, highlighting the company’s dominance in AI hardware that powers many cryptocurrency investments.

Huang has called AI:

“The next industrial revolution.”

Investment Lessons and High Returns

The Nvidia investment success offers, in many ways, valuable insights for today’s investors seeking high returns. While such spectacular growth might not be replicated easily, understanding the factors behind Nvidia’s rise can help identify future opportunities in tech stocks and cryptocurrency investments.

Also Read: Analyst Explains When the US Stock Market Will Rebound

Most experts recommend diversification through index funds rather than concentrating in single stocks. Nevertheless, the Nvidia investment story demonstrates how visionary leadership and positioning in emerging technologies can sometimes overcome market volatility to deliver life-changing wealth from what were, initially, modest investments.