VanEck Warns of ETH Dilution Risk as Digital Asset Treasuries Reach $135B

Digital asset treasuries have surged to approximately $135 billion in total holdings, with investment firm VanEck cautioning that Ethereum (ETH) holders face growing dilution risks as the network’s economics shift away from fee-driven yields toward monetary asset status.

The warning comes as declining Layer 1 fee revenues coincide with rising ETH dilution for non-stakers, threatening the long-term value proposition for investors who don’t participate in staking.

VanEck Questions DAT Sustainability Amid Declining Volatility

VanEck’s September monthly report highlighted how entities like Bitmine Immersion Technologies and Strategy have driven the DAT boom, though sustainability hinges on maintaining volatility-driven funding mechanisms.

The firm noted that these “volatility reactors” require continual market turbulence to enable further cryptocurrency purchases.

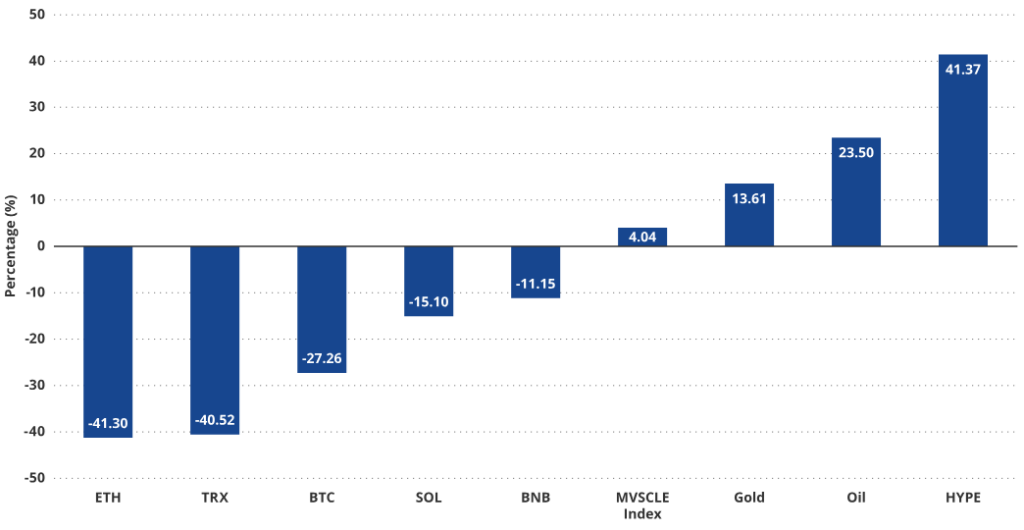

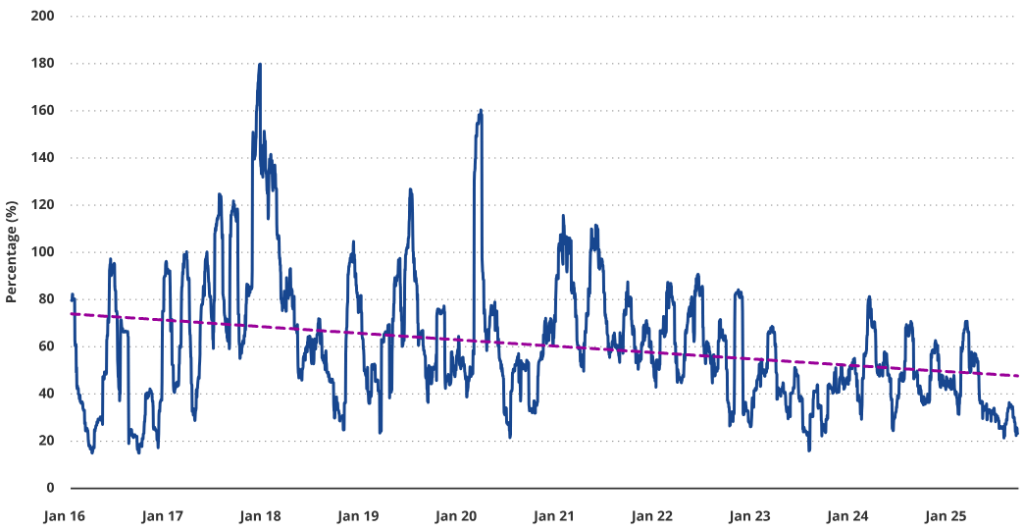

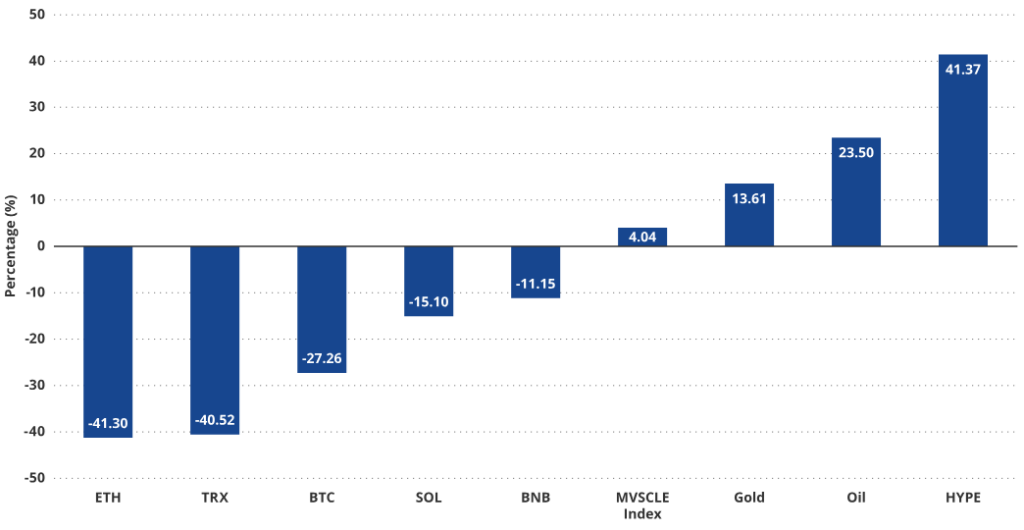

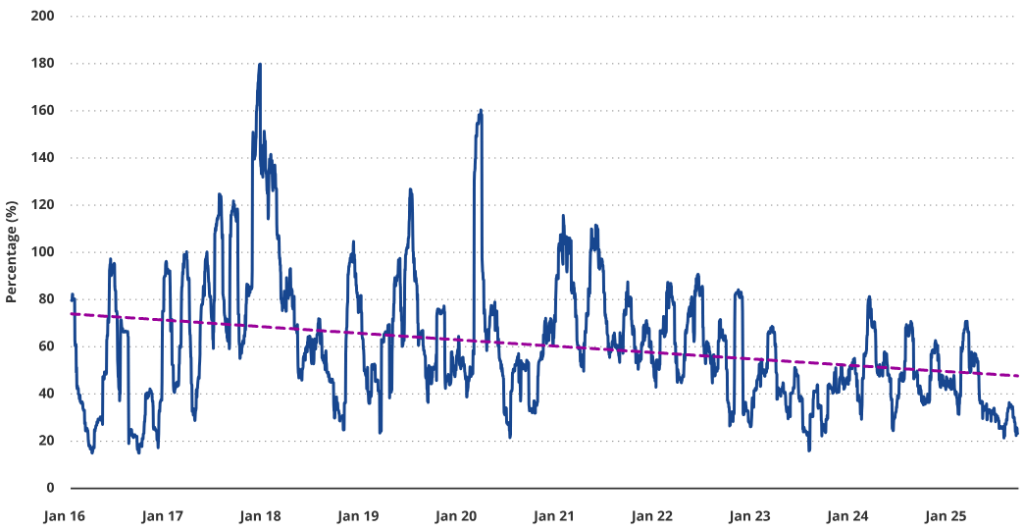

Yet, Bitcoin’s 30-day trailing volatility has trended lower over nearly a decade, largely due to its broader adoption.

The warning comes as Ethereum’s upcoming Fusaka upgrade, scheduled for December 3, threatens to accelerate dilution for non-stakers through increased Layer 2 adoption that has historically cannibalized mainnet fee revenue.

Market pressures have intensified as many DAT valuations have slipped below their net asset values, with VanEck pointing to Bitmine’s recent capital raise, where the firm sold a package effectively valued at $104.61 for $70, representing a 75% discount in volatility.

Several major DATs, including Semler Scientific, Strive, KindlyMD, and Empery Digital, now trade below their market NAVs, raising concerns about depleting the “volatility well” that enables further asset purchases.

Notably, according to a recent Cryptonews report, Standard Chartered analysts offered a contrasting view, arguing that Ethereum could emerge as the biggest winner from the DAT trend due to staking yields that should command higher market-to-net-asset-value premiums than those of its Bitcoin counterparts.

Geoffrey Kendrick, the bank’s global head of digital assets research, noted that Ethereum treasuries have accumulated approximately 3.1% of the circulating supply since June, compared to 4% for Bitcoin and just 0.8% for Solana.

Ethereum Treasuries Accelerate Accumulation Despite Market Headwinds

Corporate Ethereum accumulation has accelerated despite broader market weakness, with Bitmine purchasing another $69 million worth of ETH through Galaxy Digital’s over-the-counter desk on September 19.

The acquisition brought Bitmine’s holdings to roughly 1.95 million ETH valued at $8.66 billion, representing nearly 2% of Ethereum’s circulating supply and establishing the firm as the dominant corporate ETH treasury holder.

Blockchain records showed Galaxy Digital settled 15,427 ETH to Bitmine across four coordinated transfers within an hour, following earlier September purchases of 46,255 ETH worth $201 million and 80,325 ETH valued at $358 million.

SharpLink Gaming also expanded its position to 838,152 ETH while repurchasing nearly 1.94 million shares under a buyback program, citing undervaluation.

The company reported a net asset value of $3.86 billion with no outstanding debt and has generated 3,240 ETH in staking rewards since June.

Similarly, the Ether Machine filed a draft SEC registration statement on September 17 for its planned merger with Nasdaq-listed SPAC Dynamix Corporation.

The firm added 150,000 ETH in August alone, bringing total holdings to 495,362 ETH worth approximately $2.16 billion. The merger is expected to close in the fourth quarter pending shareholder approval.

Fusaka Upgrade Raises Stakes for Staked Versus Unstaked ETH

Ethereum co-founder Vitalik Buterin unveiled Fusaka as the network’s most ambitious scaling upgrade, introducing PeerDAS technology that allows validator nodes to verify information by checking small random pieces rather than downloading complete data blocks.

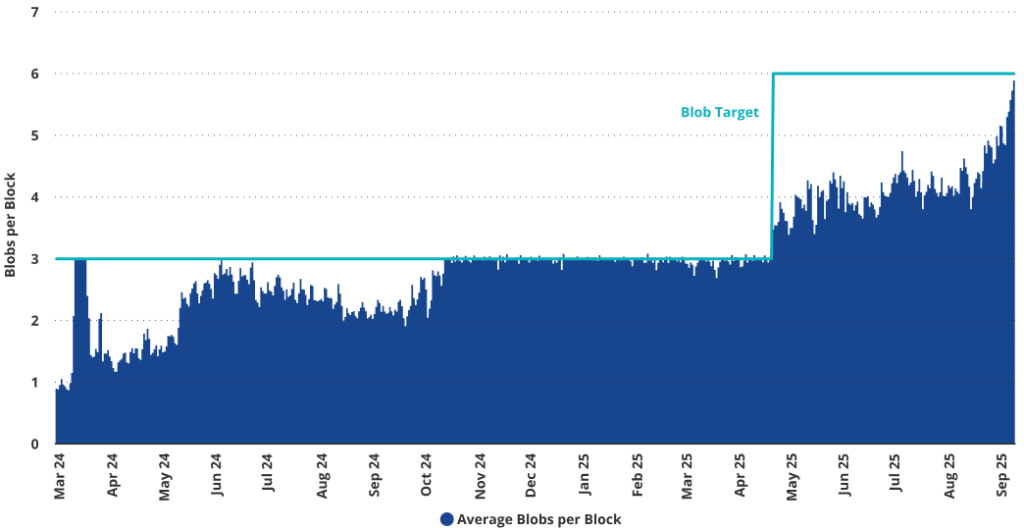

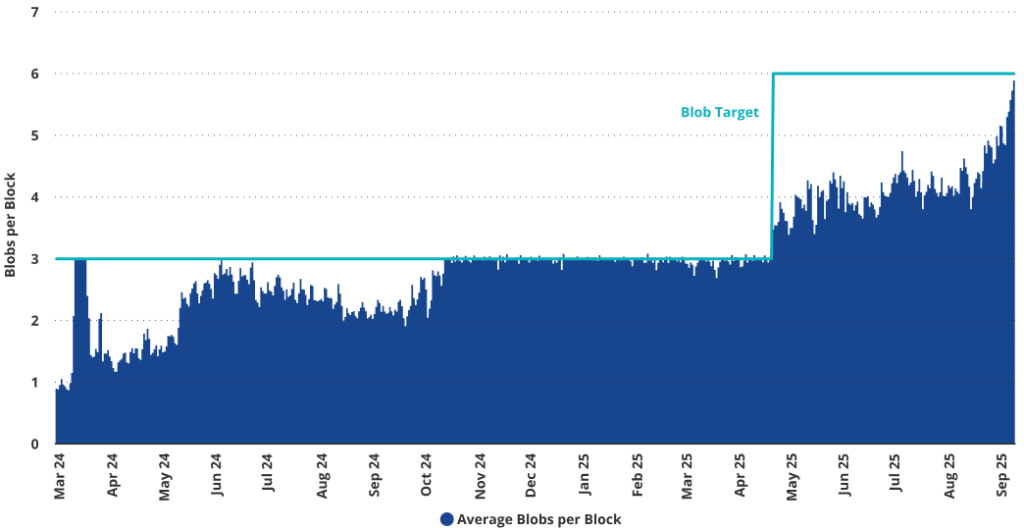

The upgrade will more than double blob capacity within two weeks through automated parameter-only forks, expanding from the current limits of 6/9 blobs to 14/21.

The revolutionary approach uses mathematical probability to ensure data availability, requiring only that more than 50% of data chunks remain accessible across the network for complete reconstruction.

Buterin described the technology as “unprecedented” for live blockchains and emphasized the cautious testing approach developers adopted despite years of preparation.

The upgrade addresses mounting economic pressures as Ethereum’s August revenue fell 44% to $14.1 million despite ETH reaching new all-time highs above $4,950.

It will also alleviate current network congestion, forcing over 2 million ETH into exit queues, which face 43-day delays, while entry processing is completed in just 7 days.

VanEck stressed that as institutional actors like DATs and ETPs accumulate long-term ETH positions to stake for in-kind yield, investors holding unstaked ETH face increasing exposure to dilution.

The firm noted Ethereum’s value proposition is trending away from fee-driven yield-bearing asset status toward a purely monetary role, with enhanced economic security for L1 settlements becoming increasingly important as more activity migrates to cheaper L2 networks.

The post VanEck Warns of ETH Dilution Risk as Digital Asset Treasuries Reach $135B appeared first on Cryptonews.

VanEck Warns of ETH Dilution Risk as Digital Asset Treasuries Reach $135B

Digital asset treasuries have surged to approximately $135 billion in total holdings, with investment firm VanEck cautioning that Ethereum (ETH) holders face growing dilution risks as the network’s economics shift away from fee-driven yields toward monetary asset status.

The warning comes as declining Layer 1 fee revenues coincide with rising ETH dilution for non-stakers, threatening the long-term value proposition for investors who don’t participate in staking.

VanEck Questions DAT Sustainability Amid Declining Volatility

VanEck’s September monthly report highlighted how entities like Bitmine Immersion Technologies and Strategy have driven the DAT boom, though sustainability hinges on maintaining volatility-driven funding mechanisms.

The firm noted that these “volatility reactors” require continual market turbulence to enable further cryptocurrency purchases.

Yet, Bitcoin’s 30-day trailing volatility has trended lower over nearly a decade, largely due to its broader adoption.

The warning comes as Ethereum’s upcoming Fusaka upgrade, scheduled for December 3, threatens to accelerate dilution for non-stakers through increased Layer 2 adoption that has historically cannibalized mainnet fee revenue.

Market pressures have intensified as many DAT valuations have slipped below their net asset values, with VanEck pointing to Bitmine’s recent capital raise, where the firm sold a package effectively valued at $104.61 for $70, representing a 75% discount in volatility.

Several major DATs, including Semler Scientific, Strive, KindlyMD, and Empery Digital, now trade below their market NAVs, raising concerns about depleting the “volatility well” that enables further asset purchases.

Notably, according to a recent Cryptonews report, Standard Chartered analysts offered a contrasting view, arguing that Ethereum could emerge as the biggest winner from the DAT trend due to staking yields that should command higher market-to-net-asset-value premiums than those of its Bitcoin counterparts.

Geoffrey Kendrick, the bank’s global head of digital assets research, noted that Ethereum treasuries have accumulated approximately 3.1% of the circulating supply since June, compared to 4% for Bitcoin and just 0.8% for Solana.

Ethereum Treasuries Accelerate Accumulation Despite Market Headwinds

Corporate Ethereum accumulation has accelerated despite broader market weakness, with Bitmine purchasing another $69 million worth of ETH through Galaxy Digital’s over-the-counter desk on September 19.

The acquisition brought Bitmine’s holdings to roughly 1.95 million ETH valued at $8.66 billion, representing nearly 2% of Ethereum’s circulating supply and establishing the firm as the dominant corporate ETH treasury holder.

Blockchain records showed Galaxy Digital settled 15,427 ETH to Bitmine across four coordinated transfers within an hour, following earlier September purchases of 46,255 ETH worth $201 million and 80,325 ETH valued at $358 million.

SharpLink Gaming also expanded its position to 838,152 ETH while repurchasing nearly 1.94 million shares under a buyback program, citing undervaluation.

The company reported a net asset value of $3.86 billion with no outstanding debt and has generated 3,240 ETH in staking rewards since June.

Similarly, the Ether Machine filed a draft SEC registration statement on September 17 for its planned merger with Nasdaq-listed SPAC Dynamix Corporation.

The firm added 150,000 ETH in August alone, bringing total holdings to 495,362 ETH worth approximately $2.16 billion. The merger is expected to close in the fourth quarter pending shareholder approval.

Fusaka Upgrade Raises Stakes for Staked Versus Unstaked ETH

Ethereum co-founder Vitalik Buterin unveiled Fusaka as the network’s most ambitious scaling upgrade, introducing PeerDAS technology that allows validator nodes to verify information by checking small random pieces rather than downloading complete data blocks.

The upgrade will more than double blob capacity within two weeks through automated parameter-only forks, expanding from the current limits of 6/9 blobs to 14/21.

The revolutionary approach uses mathematical probability to ensure data availability, requiring only that more than 50% of data chunks remain accessible across the network for complete reconstruction.

Buterin described the technology as “unprecedented” for live blockchains and emphasized the cautious testing approach developers adopted despite years of preparation.

The upgrade addresses mounting economic pressures as Ethereum’s August revenue fell 44% to $14.1 million despite ETH reaching new all-time highs above $4,950.

It will also alleviate current network congestion, forcing over 2 million ETH into exit queues, which face 43-day delays, while entry processing is completed in just 7 days.

VanEck stressed that as institutional actors like DATs and ETPs accumulate long-term ETH positions to stake for in-kind yield, investors holding unstaked ETH face increasing exposure to dilution.

The firm noted Ethereum’s value proposition is trending away from fee-driven yield-bearing asset status toward a purely monetary role, with enhanced economic security for L1 settlements becoming increasingly important as more activity migrates to cheaper L2 networks.

The post VanEck Warns of ETH Dilution Risk as Digital Asset Treasuries Reach $135B appeared first on Cryptonews.

BitMine stock ($BMNR) climbed over 6% after the company disclosed it purchased nearly $1 billion in Ethereum, increasing its total

BitMine stock ($BMNR) climbed over 6% after the company disclosed it purchased nearly $1 billion in Ethereum, increasing its total