IRFC & Jio Financial Shares Price Prediction

Share:

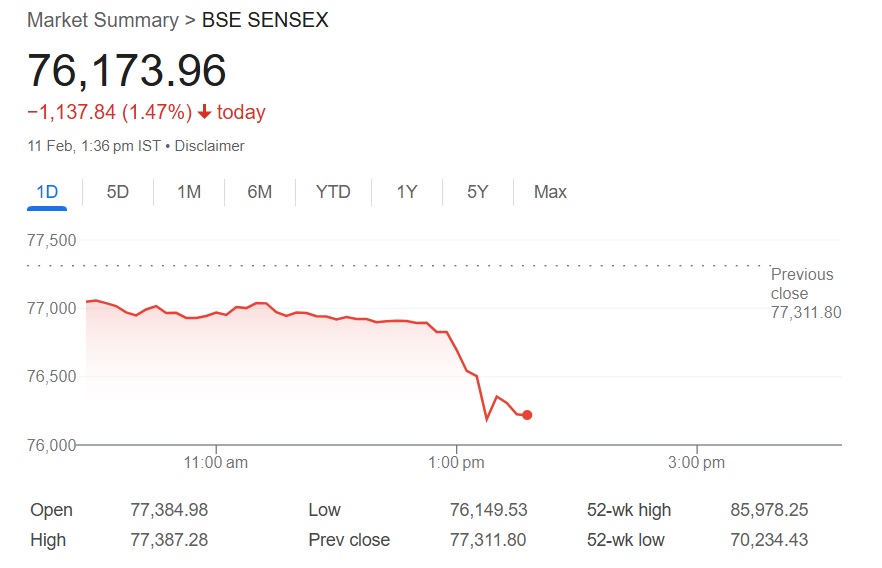

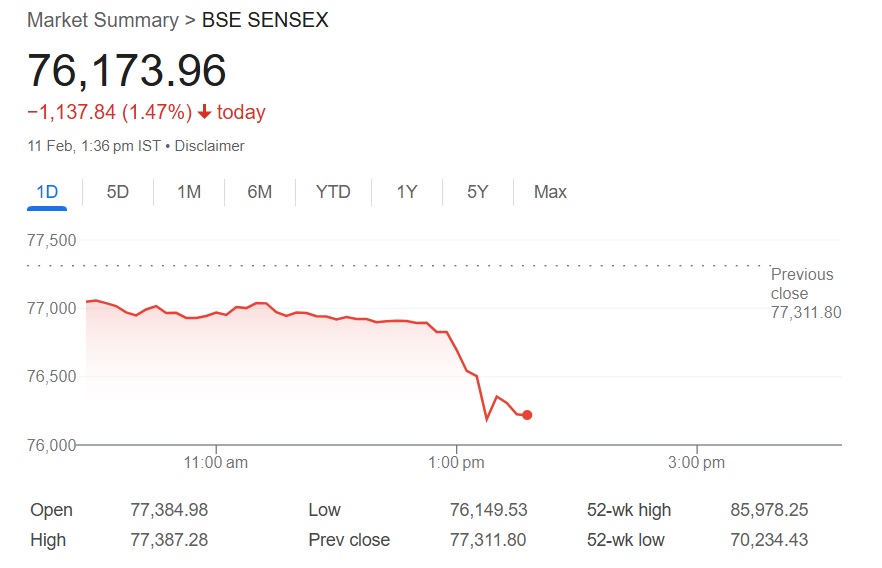

India’s stock market Sensex has plummeted a staggering 1,137 points on Tuesday while Nifty dipped nearly 350 points. The markets have been bleeding for three months with only a few price spurts that aimed at course correction. Leading shares like IRFC and Jio Financial Services have experienced massive price declines, wiping away millions worth of investors’ money. Traders who took an entry position during the Q4 of last year are all facing immense losses this month.

Also Read: De-Dollarization: 3 Countries Plan To Launch Own Currency

Will IRFC & Jio Financial Shares Dip Further?

IRFC and Jio Financial shares remain on a slippery slope as the market conditions do not favor a bull run. Anshul Jain, Head of Research at Lakshmishree, wrote that all technical indicators point towards a bearish divergence for IRFC shares. The analyst predicted that IRFC could fall below the Rs 100 level and bottom out between the 90 to 92 range. Jain called it a great buying opportunity if IRFC falls to the new lows.

Also Read: Should You Buy Warren Buffett-Backed Oil Giant Chevron (CVX) Stock?

“Given the prevailing technical indicators, the stock (IRFC shares) is expected to decline further, with potential downside targets of ₹109 and ₹92 in the next two to three months. Investors are advised to act cautiously and review their positions, as the market appears unfavorable for IRFC in the near term,” he said to Benzinga.

While the price prediction indicates that IRFC could decline in price, another analyst forecasts that Jio Financial shares could rise. Financial analysts from leading brokerage firm Anand Rathi have given Jio Financial shares a ‘buy call.’ The analysts wrote that accumulating the stock at Rs 230 to 240 level could be beneficial. The brokerage firm has predicted that Jio Financial shares could surge 25% and reach a high of Rs 305 next.

Also Read: Shiba Inu Price Prediction For 2049: Will SHIB Touch $1 Or Not?

“Jio Financial Services shares are showing signs of bottoming near a strong previous support level. Additionally, a bullish RSI divergence is visible on the chart, indicating a potential reversal. Considering these technical factors, we recommend going long in the ₹230 – 240 zone. The upside target is set at Rs 305, while the stop-loss should be placed at Rs 199 on a daily closing basis,” leading brokerage firm Anand Rathi said to Mint.

IRFC & Jio Financial Shares Price Prediction

Share:

India’s stock market Sensex has plummeted a staggering 1,137 points on Tuesday while Nifty dipped nearly 350 points. The markets have been bleeding for three months with only a few price spurts that aimed at course correction. Leading shares like IRFC and Jio Financial Services have experienced massive price declines, wiping away millions worth of investors’ money. Traders who took an entry position during the Q4 of last year are all facing immense losses this month.

Also Read: De-Dollarization: 3 Countries Plan To Launch Own Currency

Will IRFC & Jio Financial Shares Dip Further?

IRFC and Jio Financial shares remain on a slippery slope as the market conditions do not favor a bull run. Anshul Jain, Head of Research at Lakshmishree, wrote that all technical indicators point towards a bearish divergence for IRFC shares. The analyst predicted that IRFC could fall below the Rs 100 level and bottom out between the 90 to 92 range. Jain called it a great buying opportunity if IRFC falls to the new lows.

Also Read: Should You Buy Warren Buffett-Backed Oil Giant Chevron (CVX) Stock?

“Given the prevailing technical indicators, the stock (IRFC shares) is expected to decline further, with potential downside targets of ₹109 and ₹92 in the next two to three months. Investors are advised to act cautiously and review their positions, as the market appears unfavorable for IRFC in the near term,” he said to Benzinga.

While the price prediction indicates that IRFC could decline in price, another analyst forecasts that Jio Financial shares could rise. Financial analysts from leading brokerage firm Anand Rathi have given Jio Financial shares a ‘buy call.’ The analysts wrote that accumulating the stock at Rs 230 to 240 level could be beneficial. The brokerage firm has predicted that Jio Financial shares could surge 25% and reach a high of Rs 305 next.

Also Read: Shiba Inu Price Prediction For 2049: Will SHIB Touch $1 Or Not?

“Jio Financial Services shares are showing signs of bottoming near a strong previous support level. Additionally, a bullish RSI divergence is visible on the chart, indicating a potential reversal. Considering these technical factors, we recommend going long in the ₹230 – 240 zone. The upside target is set at Rs 305, while the stop-loss should be placed at Rs 199 on a daily closing basis,” leading brokerage firm Anand Rathi said to Mint.