Bitcoin Price Analysis: BTC Gains Momentum but Is Rejection at $90K Imminent?

Bitcoin’s bullish retracement continues as it approaches the critical $90K resistance.

However, low trading activity suggests a higher probability of rejection at this level, leading to potential consolidation in the short term.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin’s bullish retracement has continued after finding support at the crucial $80K threshold, leading to a steady climb toward its prior swing high. Recently, the asset experienced increased buying pressure at the 200-day moving average ($85K), pushing it toward the critical $90K resistance zone, where substantial supply may be present.

However, the market currently lacks strong bullish momentum and trading activity, increasing the likelihood of rejection at $90K, followed by further consolidation. That said, if unexpected buying pressure emerges, a breakout above this level could trigger a liquidation cascade, propelling Bitcoin to new highs.

The 4-Hour Chart

On the lower timeframe, BTC has been trading within a descending price channel, forming lower lows and lower highs, indicating a bearish market structure with sellers in control. Recently, Bitcoin initiated a bullish retracement from the channel’s lower boundary and is now testing the upper trendline at $88K.

If buyers manage to reclaim this critical boundary, a rally toward the $90K resistance will likely follow. Conversely, failure to break above this level could result in rejection and continued consolidation in the short term.

Sentiment Analysis

By Shayan

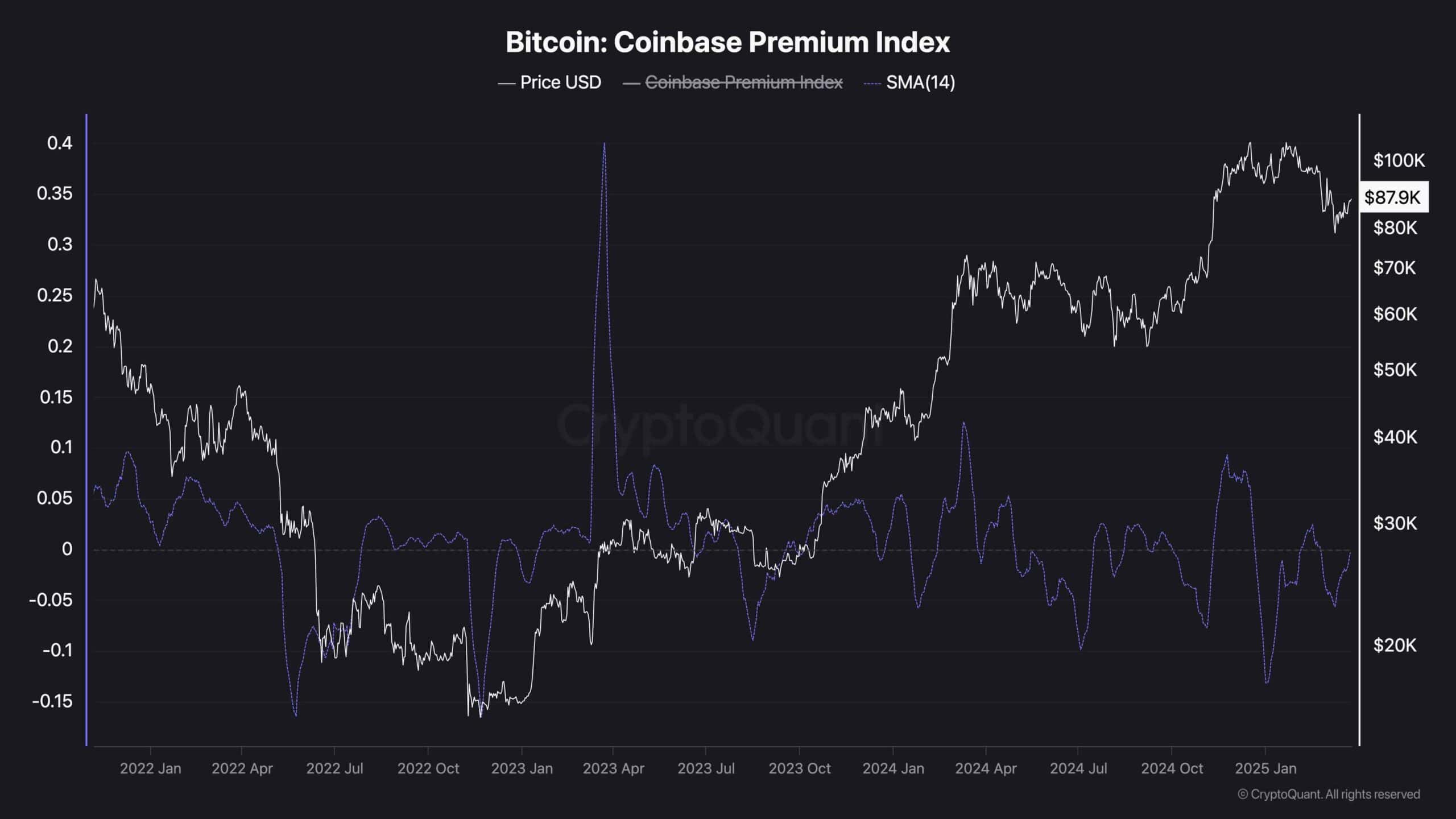

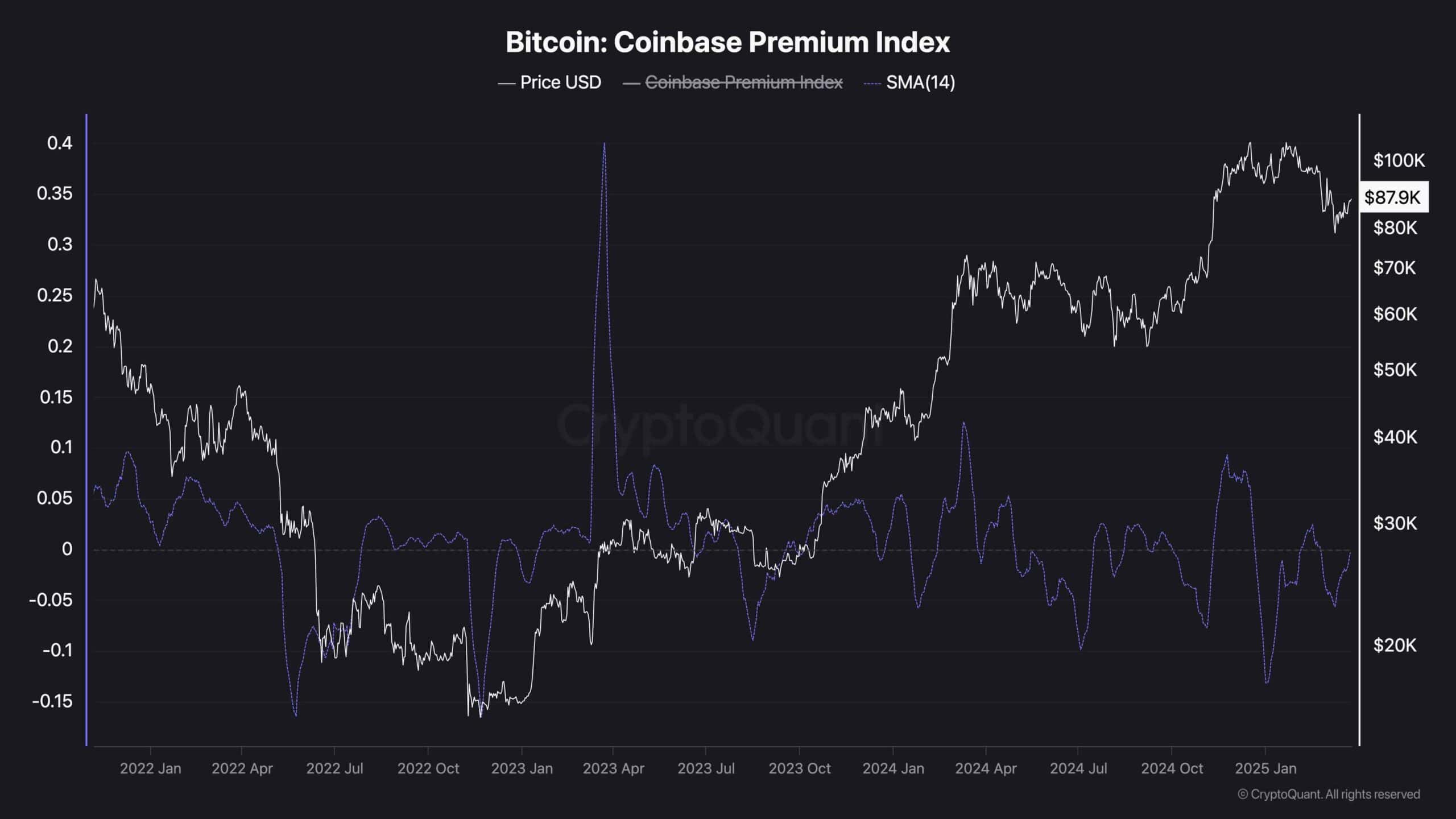

As Bitcoin adoption expands in the U.S., local investors have played a key role in shaping market trends. The Coinbase Premium Index is a useful indicator of their sentiment and trading activity.

Recently, the metric has been fluctuating around zero, reflecting uncertainty among U.S. traders. However, it now appears to be turning positive, suggesting a potential resurgence of interest in BTC on the largest US-based exchange.

Historically, a consistently positive Coinbase Premium has often coincided with upward price momentum, as rising demand from U.S. investors bolsters confidence in the broader market. While this could be a bullish sign, traders should remain cautious and consider other market forces that could swiftly impact sentiment.

The post Bitcoin Price Analysis: BTC Gains Momentum but Is Rejection at $90K Imminent? appeared first on CryptoPotato.

Bitcoin Price Analysis: BTC Gains Momentum but Is Rejection at $90K Imminent?

Bitcoin’s bullish retracement continues as it approaches the critical $90K resistance.

However, low trading activity suggests a higher probability of rejection at this level, leading to potential consolidation in the short term.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin’s bullish retracement has continued after finding support at the crucial $80K threshold, leading to a steady climb toward its prior swing high. Recently, the asset experienced increased buying pressure at the 200-day moving average ($85K), pushing it toward the critical $90K resistance zone, where substantial supply may be present.

However, the market currently lacks strong bullish momentum and trading activity, increasing the likelihood of rejection at $90K, followed by further consolidation. That said, if unexpected buying pressure emerges, a breakout above this level could trigger a liquidation cascade, propelling Bitcoin to new highs.

The 4-Hour Chart

On the lower timeframe, BTC has been trading within a descending price channel, forming lower lows and lower highs, indicating a bearish market structure with sellers in control. Recently, Bitcoin initiated a bullish retracement from the channel’s lower boundary and is now testing the upper trendline at $88K.

If buyers manage to reclaim this critical boundary, a rally toward the $90K resistance will likely follow. Conversely, failure to break above this level could result in rejection and continued consolidation in the short term.

Sentiment Analysis

By Shayan

As Bitcoin adoption expands in the U.S., local investors have played a key role in shaping market trends. The Coinbase Premium Index is a useful indicator of their sentiment and trading activity.

Recently, the metric has been fluctuating around zero, reflecting uncertainty among U.S. traders. However, it now appears to be turning positive, suggesting a potential resurgence of interest in BTC on the largest US-based exchange.

Historically, a consistently positive Coinbase Premium has often coincided with upward price momentum, as rising demand from U.S. investors bolsters confidence in the broader market. While this could be a bullish sign, traders should remain cautious and consider other market forces that could swiftly impact sentiment.

The post Bitcoin Price Analysis: BTC Gains Momentum but Is Rejection at $90K Imminent? appeared first on CryptoPotato.