Veteran Trader Tone Vays Issues Urgent Bitcoin Warning, Says Bigger Correction Looming – Here Are His Targets

Veteran trader Tone Vays is issuing a warning that Bitcoin (BTC) could soon undergo a much bigger market correction.

In a new video update, the seasoned analyst tells his 123,000 YouTube subscribers that Bitcoin could dip into the mid-$30,000 range if it fails to reclaim a key level.

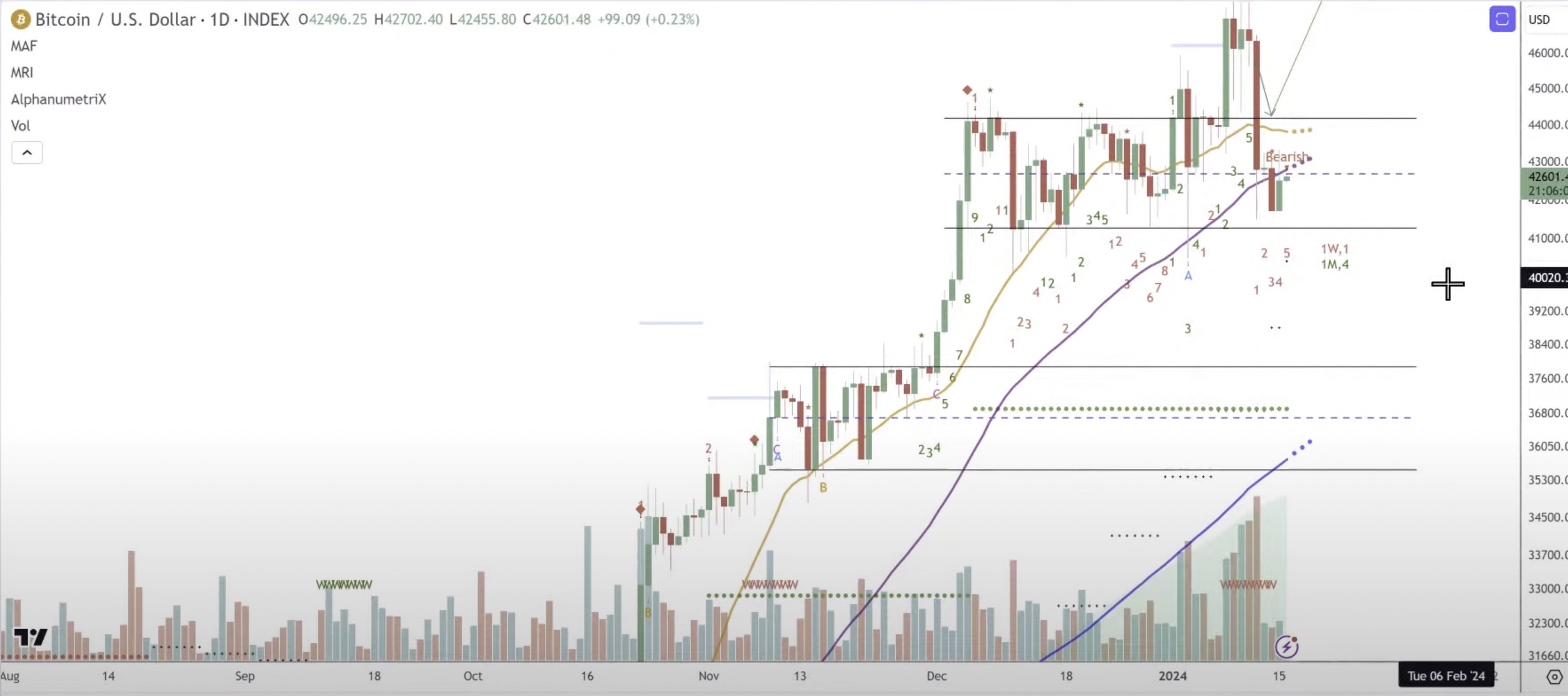

“All signs are pointing to a much, much bigger correction. I hope this doesn’t happen. I really hope we go up from here. I don’t want to see us correct. We’ve already dealt with a huge bear market. However, I am going to remain on the sidelines with cash until Bitcoin breaks out above these moving averages. I need to break even the second moving average. I need $44,000. I need a daily close at $44,000 or a move to $36,000. I really need that to go long Bitcoin.

There could be something in between. It depends how fast or how slow we go down. It’s possible I may find a good buying opportunity down here at $39,000. But realistically, I am looking for either a move above the moving average of $44,000 or a move all the way down to $36,000 where we have a beautiful combination of the MRI (Momentum Reversal Indicator) support line on the daily chart, the 128-day moving average and the top of the channel.”

The trader also says that if Bitcoin soon dips below $40,000 that would not be comparable to the historic dips before pre-halving events, when miners’ rewards are cut in half. The next halving event is expected in April.

“Do I think the pre-halving dump has started? No, I wasn’t actually anticipating the pre-halving dump. The pre-halving dump usually happens a few weeks before the halving. It doesn’t happen four months before the halving.”

The trader predicts Bitcoin will not revisit the $20,000 range and would only retest the $30,000 level if there was some black swan event.

“I don’t see us going into the $20,000s. $30,000 is my absolute bottom low. And in order for us to even get to $30,000 something catastrophic happens.”

Bitcoin is trading for $43,222 at time of writing, up nearly 2% in the last 24 hours.

I

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Veteran Trader Tone Vays Issues Urgent Bitcoin Warning, Says Bigger Correction Looming – Here Are His Targets appeared first on The Daily Hodl.

Veteran Trader Tone Vays Issues Urgent Bitcoin Warning, Says Bigger Correction Looming – Here Are His Targets

Veteran trader Tone Vays is issuing a warning that Bitcoin (BTC) could soon undergo a much bigger market correction.

In a new video update, the seasoned analyst tells his 123,000 YouTube subscribers that Bitcoin could dip into the mid-$30,000 range if it fails to reclaim a key level.

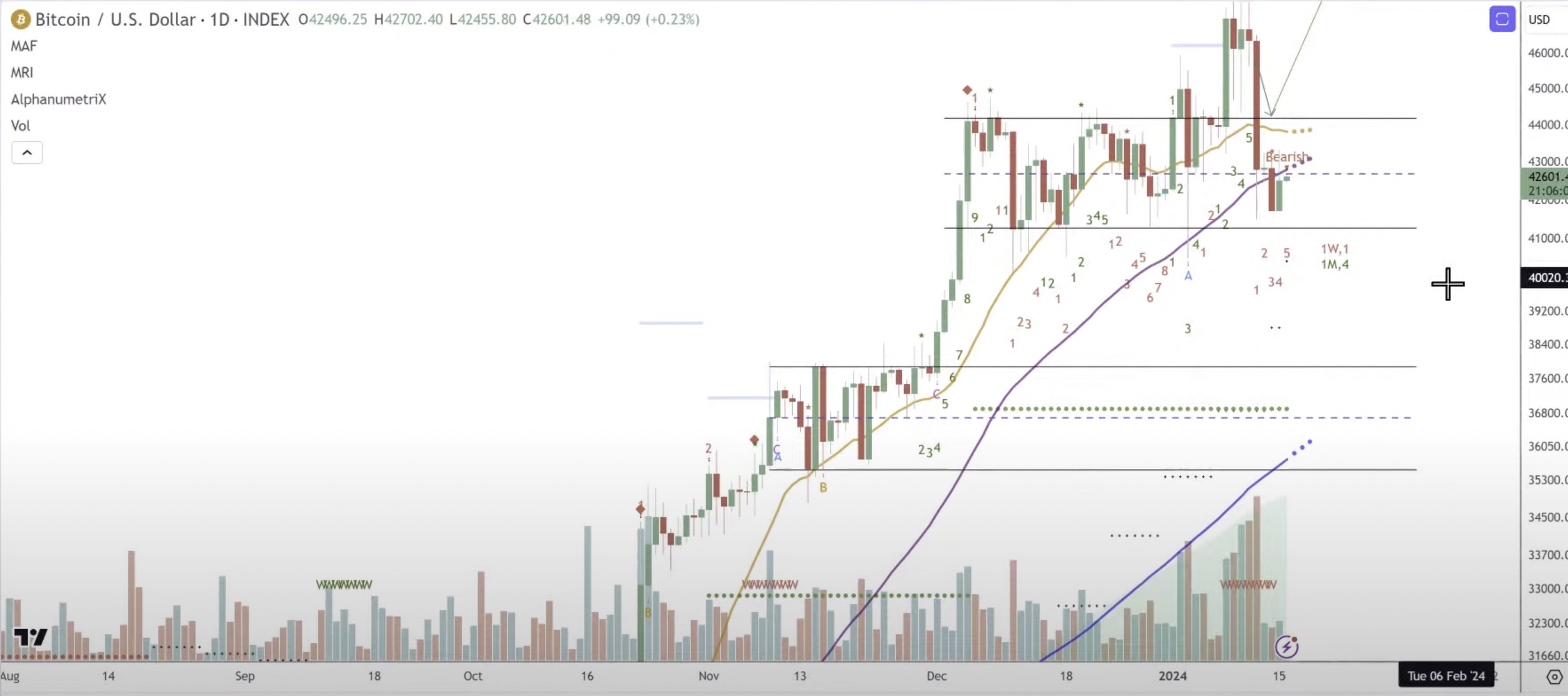

“All signs are pointing to a much, much bigger correction. I hope this doesn’t happen. I really hope we go up from here. I don’t want to see us correct. We’ve already dealt with a huge bear market. However, I am going to remain on the sidelines with cash until Bitcoin breaks out above these moving averages. I need to break even the second moving average. I need $44,000. I need a daily close at $44,000 or a move to $36,000. I really need that to go long Bitcoin.

There could be something in between. It depends how fast or how slow we go down. It’s possible I may find a good buying opportunity down here at $39,000. But realistically, I am looking for either a move above the moving average of $44,000 or a move all the way down to $36,000 where we have a beautiful combination of the MRI (Momentum Reversal Indicator) support line on the daily chart, the 128-day moving average and the top of the channel.”

The trader also says that if Bitcoin soon dips below $40,000 that would not be comparable to the historic dips before pre-halving events, when miners’ rewards are cut in half. The next halving event is expected in April.

“Do I think the pre-halving dump has started? No, I wasn’t actually anticipating the pre-halving dump. The pre-halving dump usually happens a few weeks before the halving. It doesn’t happen four months before the halving.”

The trader predicts Bitcoin will not revisit the $20,000 range and would only retest the $30,000 level if there was some black swan event.

“I don’t see us going into the $20,000s. $30,000 is my absolute bottom low. And in order for us to even get to $30,000 something catastrophic happens.”

Bitcoin is trading for $43,222 at time of writing, up nearly 2% in the last 24 hours.

I

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Veteran Trader Tone Vays Issues Urgent Bitcoin Warning, Says Bigger Correction Looming – Here Are His Targets appeared first on The Daily Hodl.