BRICS: Has Chinese Yuan Made Inroads Into the World’s Reserves?

China has aggressively pushed the Chinese yuan as a major payment option for trade settlements between BRICS members since 2022. After the White House pressed sanctions on Russia for invading Ukraine, the Xi Jinping administration made use of the turmoil by placing its local currency ahead for cross-border transactions.

Also Read: BRICS: 2 Countries Settle Oil Trade in New Currency, Discard US Dollar

Its BRICS counterpart Russia was the top user of the Chinese yuan as it settled major trade deals in the currency. Even countries such as Iran, India, the UAE, Nigeria, and Belarus settled several trade payments in the Chinese yuan. So has the Communist country’s currency grown by leaps and bounds in the world’s reserves? The answer is no.

Also Read: BRICS: When Barack Obama Predicted the US Dollar’s Future

BRICS: Chinese Yuan Made Inroads In International Reserves?

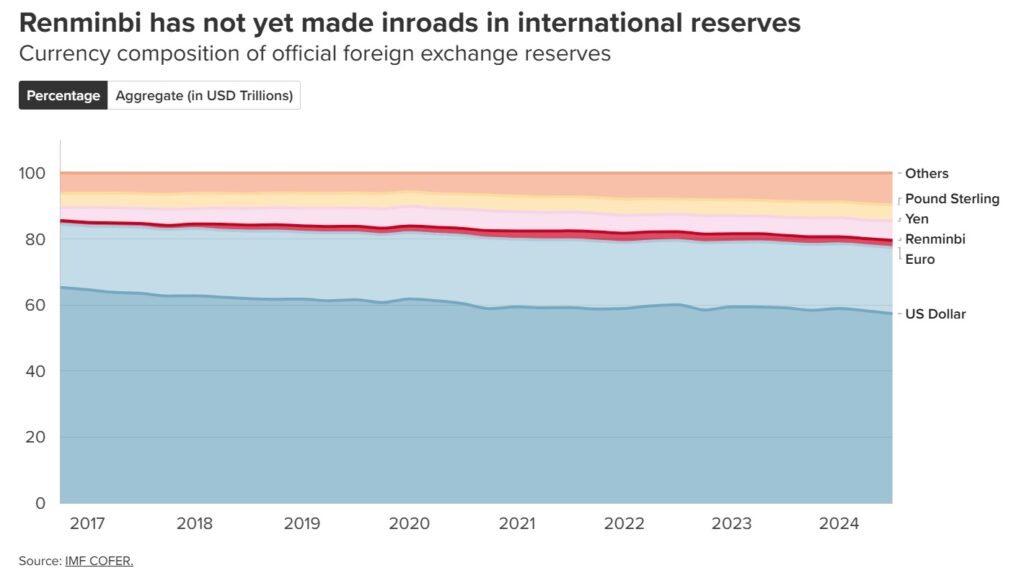

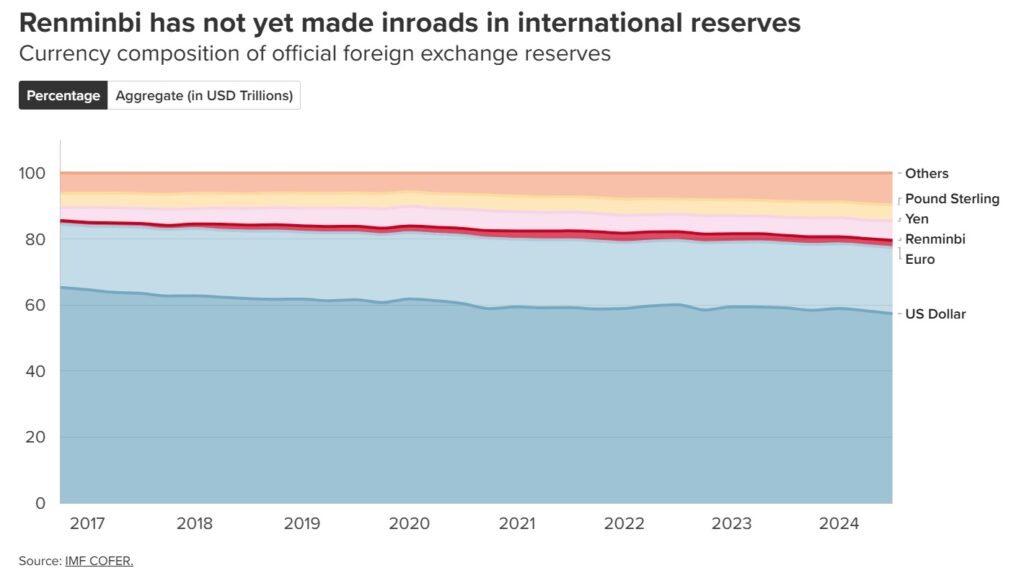

The latest data from The Atlantic Council shows that the Chinese yuan has not made any major inroads in international reserves. Though its usage has slightly increased, it does not create any impact or threaten the dominance of the US dollar. Even BRICS countries are now hesitant to use the Chinese yuan for trade as they believe the Communist nation is using the alliance as a stepping stone for world domination.

Also Read: What Are the Advantages of a BRICS Currency?

BRICS member India stepped back from using the Chinese yuan after settling many trade deals in the currency. The Modi government does not want to promote or use the currency as it can make China much stronger. India and China have been at loggerheads for several decades due to border and trade disputes. Therefore, using their local currency will only empower the opposition and make India look weaker.

The Chinese yuan has a long way to go to even challenge the dominance of the US dollar. Other leading currencies like the euro and pound are yet to dent the USD’s prospects despite being second and third in line. BRICS has little to no chance of making the Chinese yuan reign supreme in the coming decades.

BRICS: Has Chinese Yuan Made Inroads Into the World’s Reserves?

China has aggressively pushed the Chinese yuan as a major payment option for trade settlements between BRICS members since 2022. After the White House pressed sanctions on Russia for invading Ukraine, the Xi Jinping administration made use of the turmoil by placing its local currency ahead for cross-border transactions.

Also Read: BRICS: 2 Countries Settle Oil Trade in New Currency, Discard US Dollar

Its BRICS counterpart Russia was the top user of the Chinese yuan as it settled major trade deals in the currency. Even countries such as Iran, India, the UAE, Nigeria, and Belarus settled several trade payments in the Chinese yuan. So has the Communist country’s currency grown by leaps and bounds in the world’s reserves? The answer is no.

Also Read: BRICS: When Barack Obama Predicted the US Dollar’s Future

BRICS: Chinese Yuan Made Inroads In International Reserves?

The latest data from The Atlantic Council shows that the Chinese yuan has not made any major inroads in international reserves. Though its usage has slightly increased, it does not create any impact or threaten the dominance of the US dollar. Even BRICS countries are now hesitant to use the Chinese yuan for trade as they believe the Communist nation is using the alliance as a stepping stone for world domination.

Also Read: What Are the Advantages of a BRICS Currency?

BRICS member India stepped back from using the Chinese yuan after settling many trade deals in the currency. The Modi government does not want to promote or use the currency as it can make China much stronger. India and China have been at loggerheads for several decades due to border and trade disputes. Therefore, using their local currency will only empower the opposition and make India look weaker.

The Chinese yuan has a long way to go to even challenge the dominance of the US dollar. Other leading currencies like the euro and pound are yet to dent the USD’s prospects despite being second and third in line. BRICS has little to no chance of making the Chinese yuan reign supreme in the coming decades.