BRICS: India Dumps Billions of US Dollars

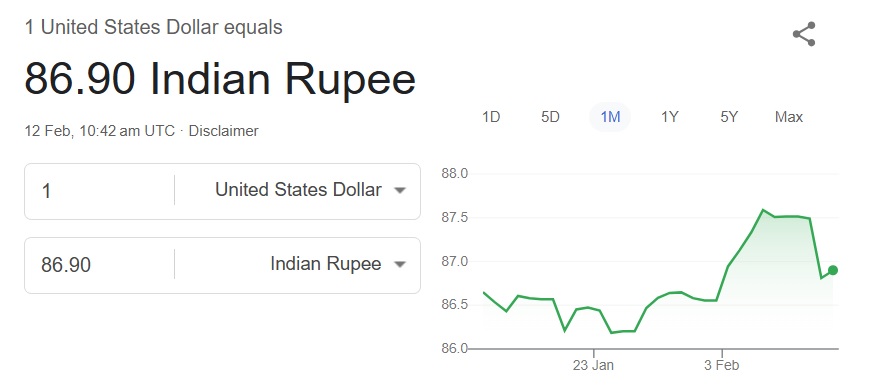

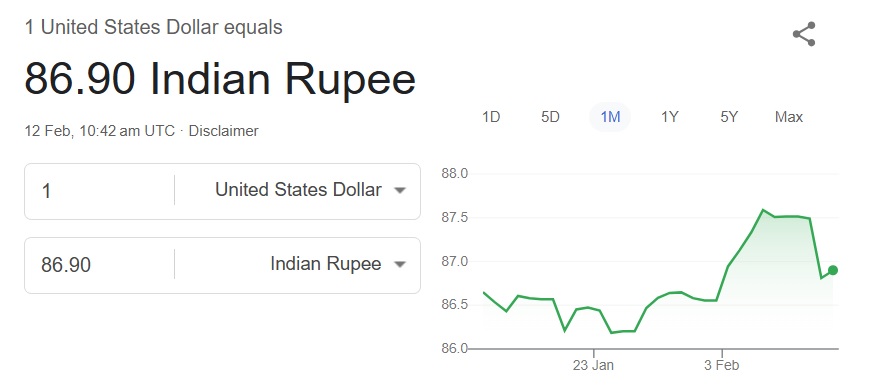

BRICS member India has once again been accused of dumping US dollars to protect its local currency, the rupee (INR). The INR had plummeted to a lifetime low of 87.60 against the USD on Monday in the forex markets. The steep fall sent jitters in the markets making the Reserve Bank of India (RBI) intervene in the forex sector. India has been accused of intervention in the currency markets to keep the rupee from falling further.

Also Read: After Pausing BRICS, Saudi Arabia Invests $600 Billion in the US

RBI directed state-run banks to sell US dollars in the forex markets to stop the rupee’s decline, reported Reuters. This is not the first time that BRICS member India has been accused of dumping US dollars. Last year alone, India was accused of market intervention more than four times to keep the rupee from falling. The trend has continued in 2025 raising questions about transparency in trade.

Also Read: India Officially Rejects BRICS Currency, Calls It ‘Impossible’

BRICS: India Accused of Market Intervention After Selling Billions of US Dollars

The latest report from Mint indicates that BRICS member India has dumped billions worth of US dollars this week. The massive sell-off made the rupee recover from a lifetime low of 87.60 on Monday and reserve course to 86.90 on Wednesday. The intervention “is surprising and has triggered a blood bath for longs (on USD/INR),” a trader at a private bank said to Reuters.

Also Read: BRICS: Iran Calls For a ‘Unified Currency’ To Challenge the US Dollar

The rupee’s rise to 86.90 is attributed to market intervention from India. Billions of US dollars were sold by the BRICS member to safeguard the rupee. State-run banks were directed to offload the currency from the RBI. “We note that the accentuated moves in USD/INR witnessed lately have brought the currency to near fair value. However, given the unrelenting global uncertainties in the near term, we expect the pressure on INR to continue,” Kotak Mahindra Bank said in a note.

BRICS: India Dumps Billions of US Dollars

BRICS member India has once again been accused of dumping US dollars to protect its local currency, the rupee (INR). The INR had plummeted to a lifetime low of 87.60 against the USD on Monday in the forex markets. The steep fall sent jitters in the markets making the Reserve Bank of India (RBI) intervene in the forex sector. India has been accused of intervention in the currency markets to keep the rupee from falling further.

Also Read: After Pausing BRICS, Saudi Arabia Invests $600 Billion in the US

RBI directed state-run banks to sell US dollars in the forex markets to stop the rupee’s decline, reported Reuters. This is not the first time that BRICS member India has been accused of dumping US dollars. Last year alone, India was accused of market intervention more than four times to keep the rupee from falling. The trend has continued in 2025 raising questions about transparency in trade.

Also Read: India Officially Rejects BRICS Currency, Calls It ‘Impossible’

BRICS: India Accused of Market Intervention After Selling Billions of US Dollars

The latest report from Mint indicates that BRICS member India has dumped billions worth of US dollars this week. The massive sell-off made the rupee recover from a lifetime low of 87.60 on Monday and reserve course to 86.90 on Wednesday. The intervention “is surprising and has triggered a blood bath for longs (on USD/INR),” a trader at a private bank said to Reuters.

Also Read: BRICS: Iran Calls For a ‘Unified Currency’ To Challenge the US Dollar

The rupee’s rise to 86.90 is attributed to market intervention from India. Billions of US dollars were sold by the BRICS member to safeguard the rupee. State-run banks were directed to offload the currency from the RBI. “We note that the accentuated moves in USD/INR witnessed lately have brought the currency to near fair value. However, given the unrelenting global uncertainties in the near term, we expect the pressure on INR to continue,” Kotak Mahindra Bank said in a note.