Dogecoin Is Observing Bullish Signals On These Indicators

An analyst has pointed out how Dogecoin has recently observed patterns in two indicators that could prove to be bullish for its price.

Dogecoin Has Seen Positive Signals On TD Sequential & Whale Supply

In a new post on X, analyst Ali Martinez has talked about a Tom Demark (TD) Sequential signal that Dogecoin has just witnessed on its 4-hour price chart. The “TD Sequential” refers to a technical analysis indicator that’s used for locating points of probable reversal for any asset’s price.

The indicator includes two phases, called the setup and countdown. During the first of these, the setup, candles in the price of the same color are counted up to nine. These candles aren’t necessary to be consecutive.

When the nine candles are in, the setup is said to be finished, and the TD Sequential gives a reversal signal for the asset. Naturally, if the candles involved in the setup’s completion were green, the indicator would suggest a top, and if they were red, the signal would be for a bottom.

As soon as the setup is over, the countdown phase begins. This phase of the TD Sequential works exactly the same as the setup, except for the fact that it involves thirteen candles, not nine. Once these candles have also been printed, the indicator gives another buy or sell signal for the price.

Recently, Dogecoin has finished the first of these TD Sequential phases. Here is the chart shared by the analyst that shows this signal in DOGE’s 4-hour price:

As is visible in the above graph, the Dogecoin 4-hour price has completed the TD Sequential setup with nine green candles, which implies the coin may now be set for a turnaround to the upside.

This isn’t the only positive signal that DOGE has observed recently, as Martinez has pointed out in another X post that the whales have been busy purchasing during the last couple of days.

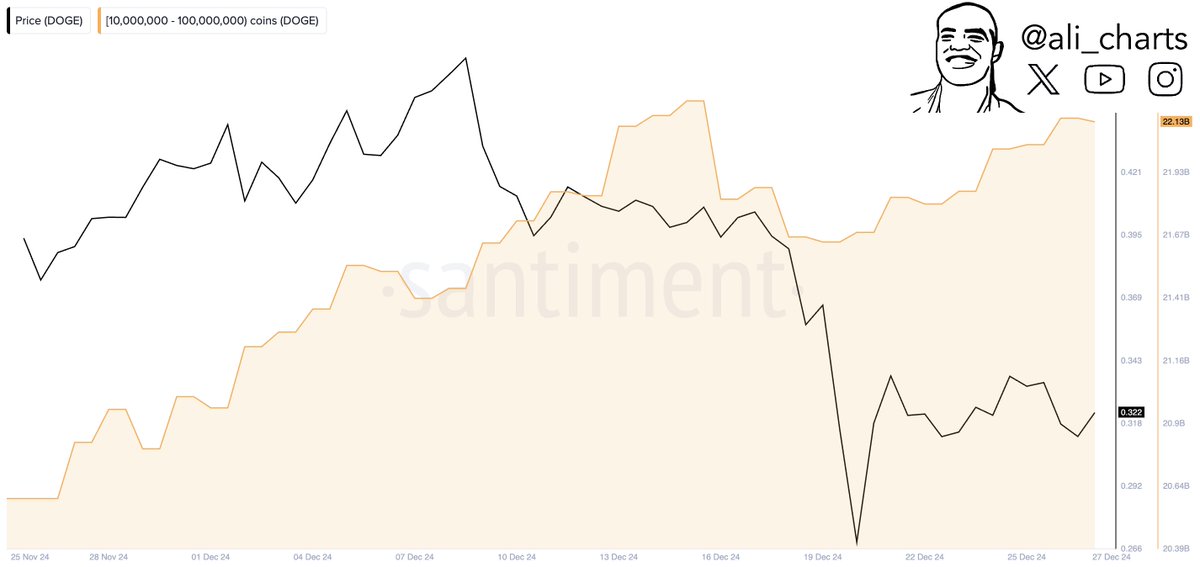

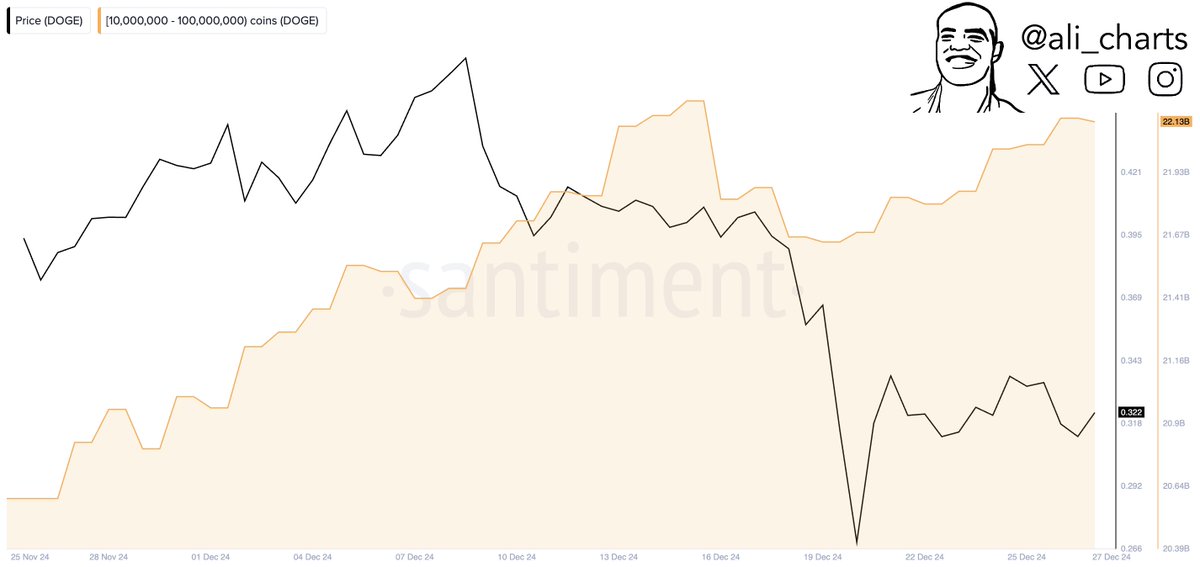

The on-chain indicator cited by the analyst is the Supply Distribution from the analytics firm Santiment, which tells us about the amount of supply that any particular wallet group is holding right now.

Below is the chart for the metric that specifically shows the data for the whale cohort, massive investors carrying between 10 million and 100 million tokens:

From the graph, it’s apparent that the Dogecoin supply held by the whales has registered an increase recently. More specifically, the whales have added a net amount of 90 million DOGE (worth around $28.7 million) to their holdings in the last two days.

This accumulation would imply that these key investors believe the cryptocurrency to be worth buying at the current price level.

DOGE Price

At the time of writing, Dogecoin is floating around $0.319, up more than 10% over the last week.

Dogecoin Is Observing Bullish Signals On These Indicators

An analyst has pointed out how Dogecoin has recently observed patterns in two indicators that could prove to be bullish for its price.

Dogecoin Has Seen Positive Signals On TD Sequential & Whale Supply

In a new post on X, analyst Ali Martinez has talked about a Tom Demark (TD) Sequential signal that Dogecoin has just witnessed on its 4-hour price chart. The “TD Sequential” refers to a technical analysis indicator that’s used for locating points of probable reversal for any asset’s price.

The indicator includes two phases, called the setup and countdown. During the first of these, the setup, candles in the price of the same color are counted up to nine. These candles aren’t necessary to be consecutive.

When the nine candles are in, the setup is said to be finished, and the TD Sequential gives a reversal signal for the asset. Naturally, if the candles involved in the setup’s completion were green, the indicator would suggest a top, and if they were red, the signal would be for a bottom.

As soon as the setup is over, the countdown phase begins. This phase of the TD Sequential works exactly the same as the setup, except for the fact that it involves thirteen candles, not nine. Once these candles have also been printed, the indicator gives another buy or sell signal for the price.

Recently, Dogecoin has finished the first of these TD Sequential phases. Here is the chart shared by the analyst that shows this signal in DOGE’s 4-hour price:

As is visible in the above graph, the Dogecoin 4-hour price has completed the TD Sequential setup with nine green candles, which implies the coin may now be set for a turnaround to the upside.

This isn’t the only positive signal that DOGE has observed recently, as Martinez has pointed out in another X post that the whales have been busy purchasing during the last couple of days.

The on-chain indicator cited by the analyst is the Supply Distribution from the analytics firm Santiment, which tells us about the amount of supply that any particular wallet group is holding right now.

Below is the chart for the metric that specifically shows the data for the whale cohort, massive investors carrying between 10 million and 100 million tokens:

From the graph, it’s apparent that the Dogecoin supply held by the whales has registered an increase recently. More specifically, the whales have added a net amount of 90 million DOGE (worth around $28.7 million) to their holdings in the last two days.

This accumulation would imply that these key investors believe the cryptocurrency to be worth buying at the current price level.

DOGE Price

At the time of writing, Dogecoin is floating around $0.319, up more than 10% over the last week.