Bitcoin faces 60% chance of correction to $70k, says Arthur Hayes

Arthur Hayes, the founder of BitMEX and legendary high–risk crypto trader, has warned that Bitcoin’s current bull market faces a 60% probability of a sharp correction to $70,000 before potentially surging to $250,000 by the end of the year.

Arthur’s projections were shared in his latest essay ‘The Ugly,’ the first part of his tryptic series. In it, he said his analysis comes from observing central bank actions in the United States, China, and of course Japan while reminding everyone that he has been in the Bitcoin market since 2012.

Central banks, liquidity, and the Bitcoin gamble

The tightening of liquidity, rising US Treasury yields, and the unpredictable behavior of global fiat markets all contribute to his short-term grim outlook. “This is a similar feeling I got in late 2021, right before the bottom fell out of the crypto markets. History doesn’t repeat itself, but it does rhyme,” he said.

He pointed to the United States as the main culprit. With the Federal Reserve raising the 10-year Treasury yield to near 5%—and likely higher—Arthur believes the US financial system is nearing its breaking point.

“Every financial crisis since 1913 was solved with printed dollars,” Arthur said, adding that: “The 10-year treasury yield will rise to between 5% to 6% and will trigger a mini-financial crisis.”

He also pointed out that: “The US Federal Reserve governors hate Trump but will do what is necessary to safeguard Pax Americana’s financial system.”

The crypto OG then pointed out that the US national debt currently sits at $36.22 trillion, up from $16.7 trillion in 2019. With the Federal Reserve scaling back its bond purchases and US commercial banks torched by recent market dynamics, traditional buyers of Treasuries have largely retreated.

Foreign surplus nations like China, Japan, and Saudi Arabia aren’t stepping in either. Instead, the market is propped up by relative value (RV) hedge funds, which Arthur described as “the last ones holding this mess together.”

RV hedge funds rely on arbitraging the spread between cash Treasuries and futures contracts, using massive leverage provided by banks. However, this system is fragile. Rising repo yields, Basel III regulations, and margin requirements are squeezing hedge funds’ ability to keep buying Treasuries.

He pointed to potential lifelines: the Federal Reserve could suspend supplemental leverage ratio (SLR) rules, allowing banks to buy Treasuries without pledging capital, or restart quantitative easing (QE). But, as Arthur puts it: “The Fed doesn’t move until it’s forced to.”

Trump, the Fed, and Bitcoin’s bull run

Arthur’s essay also zeroed in on the political dynamics at play, particularly under Trump’s presidency. He reminded us that the Fed will remain hostile to Trump, especially as Trump pushes for policies that favor Bitcoin and the broader crypto ecosystem.

“Statements by former and current Fed governors and the Fed’s actions during the Biden presidency led me to believe the Fed will do what it can to frustrate the Trump agenda,” Arthur said, recalling comments by former New York Fed president William Dudley, who openly suggested the Fed should act against Trump’s policies.

Meanwhile, Trump’s crypto-friendly decisions since inauguration like pardoning Silk Road founder Ross Ulbricht, launching his $TRUMP and $MELANIA meme coins, and signing executive orders have boosted bullish sentiment.

But Arthur sees these developments as a double-edged sword. “The bullishness is too high. A correction here would be brutal,” he explained. “All of Trump’s decisions were mostly expected, bar the memecoin launch. What is not being fully appreciated is the slowdown in filthy fiat creation in Pax Americana, China, and Japan.”

Arthur outlined a scenario where Trump’s fiscal policies, combined with debt ceiling fights, push the financial system to the brink. If the 10-year Treasury yield breaches 5%, stocks would plunge, large financial players could fail, and the Federal Reserve would be forced to act. “It’s only a matter of time,” Arthur said.

Bitcoin’s correlation with traditional markets

Arthur then proceeded to point out that Bitcoin’s short-term performance remains tied to traditional markets, especially the Nasdaq 100. He cited Bitcoin’s rising 30-day correlation with tech stocks as a key risk.

“Another belief I hold is that Bitcoin is the only truly global free market in existence. It is extremely sensitive to global fiat liquidity conditions; therefore, if a fiat liquidity crunch is forthcoming, its price will break down before that of stocks and will be the leading indicator of financial stress. If it is a leading indicator, then Bitcoin will bottom before stocks, thus predicting a re-opening of the fiat money printing spigots.”

“But in the long term, Bitcoin is uncorrelated with stock prices, but it can be very correlated in the short term. The 30-day correlation between Bitcoin and the Nasdaq 100 is high and rising. This is not good for the short-term price prognosis if stocks get smoked due to the rising 10-year yield,” he predicted.

The other players

In China, the People’s Bank of China (PBOC) had initiated money-printing measures in late 2024 to stimulate its economy. But in early 2025, the PBOC reversed course, ending its bond-buying program and focusing on strengthening the yuan.

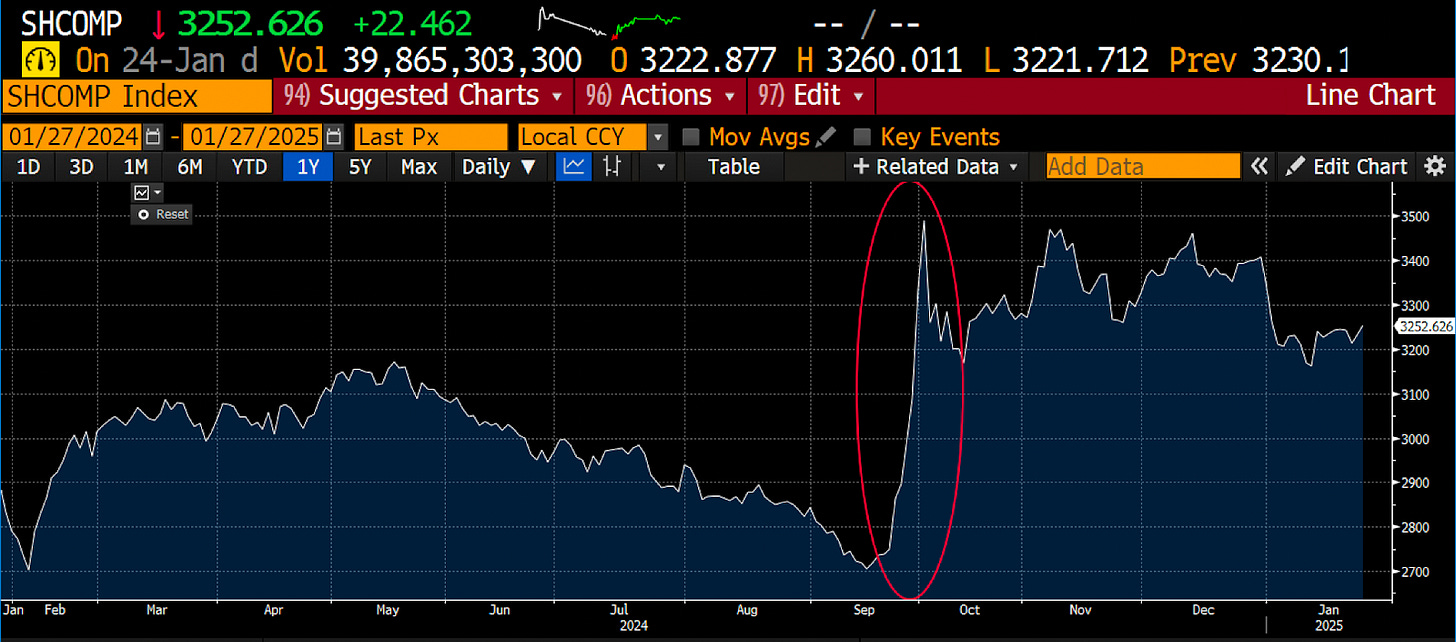

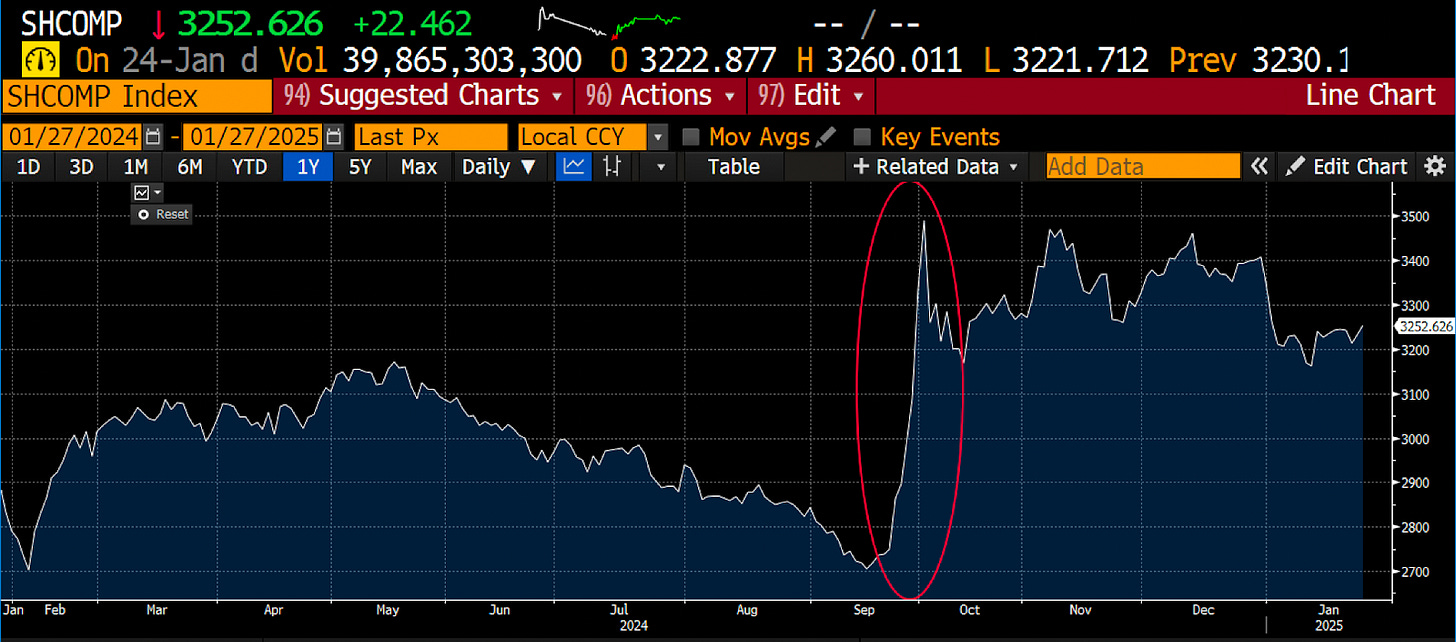

“In case your TikTok demented brain couldn’t figure out when the PBOC and central government announced their reflation policies, I circled it for you. The above is the Shanghai Composite Index. The authorities wanted comrades to front-run the red tsunami of printed yuan by purchasing stocks. The messaging worked,” Arthur said. He’s referring to the chart below.

Japan, meanwhile, has been raising interest rates and slowing its balance sheet growth. The Bank of Japan’s (BOJ) actions have driven Japanese Government Bond (JGB) yields to 15-year highs. Arthur warned that a stronger yen could force Japanese investors to repatriate capital, affecting quite literally all global financial markets.

But as always, Arthur remains extremely bullish on Bitcoin in the long-term. He described it as the only truly global free market, capable of weathering short-term volatility.

He finished off the essay saying, “If I’m wrong, my downside is that we took profit early and sold a bit of Bitcoin we purchased using profits from prior shitcoin investments. But if I’m right, then we have the cash ready to quickly double or triple our money on quality shitcoins that got the stick in a general crypto market selloff.”

Cryptopolitan Academy: How to Write a Web3 Resume That Lands Interviews - FREE Cheat Sheet

Bitcoin faces 60% chance of correction to $70k, says Arthur Hayes

Arthur Hayes, the founder of BitMEX and legendary high–risk crypto trader, has warned that Bitcoin’s current bull market faces a 60% probability of a sharp correction to $70,000 before potentially surging to $250,000 by the end of the year.

Arthur’s projections were shared in his latest essay ‘The Ugly,’ the first part of his tryptic series. In it, he said his analysis comes from observing central bank actions in the United States, China, and of course Japan while reminding everyone that he has been in the Bitcoin market since 2012.

Central banks, liquidity, and the Bitcoin gamble

The tightening of liquidity, rising US Treasury yields, and the unpredictable behavior of global fiat markets all contribute to his short-term grim outlook. “This is a similar feeling I got in late 2021, right before the bottom fell out of the crypto markets. History doesn’t repeat itself, but it does rhyme,” he said.

He pointed to the United States as the main culprit. With the Federal Reserve raising the 10-year Treasury yield to near 5%—and likely higher—Arthur believes the US financial system is nearing its breaking point.

“Every financial crisis since 1913 was solved with printed dollars,” Arthur said, adding that: “The 10-year treasury yield will rise to between 5% to 6% and will trigger a mini-financial crisis.”

He also pointed out that: “The US Federal Reserve governors hate Trump but will do what is necessary to safeguard Pax Americana’s financial system.”

The crypto OG then pointed out that the US national debt currently sits at $36.22 trillion, up from $16.7 trillion in 2019. With the Federal Reserve scaling back its bond purchases and US commercial banks torched by recent market dynamics, traditional buyers of Treasuries have largely retreated.

Foreign surplus nations like China, Japan, and Saudi Arabia aren’t stepping in either. Instead, the market is propped up by relative value (RV) hedge funds, which Arthur described as “the last ones holding this mess together.”

RV hedge funds rely on arbitraging the spread between cash Treasuries and futures contracts, using massive leverage provided by banks. However, this system is fragile. Rising repo yields, Basel III regulations, and margin requirements are squeezing hedge funds’ ability to keep buying Treasuries.

He pointed to potential lifelines: the Federal Reserve could suspend supplemental leverage ratio (SLR) rules, allowing banks to buy Treasuries without pledging capital, or restart quantitative easing (QE). But, as Arthur puts it: “The Fed doesn’t move until it’s forced to.”

Trump, the Fed, and Bitcoin’s bull run

Arthur’s essay also zeroed in on the political dynamics at play, particularly under Trump’s presidency. He reminded us that the Fed will remain hostile to Trump, especially as Trump pushes for policies that favor Bitcoin and the broader crypto ecosystem.

“Statements by former and current Fed governors and the Fed’s actions during the Biden presidency led me to believe the Fed will do what it can to frustrate the Trump agenda,” Arthur said, recalling comments by former New York Fed president William Dudley, who openly suggested the Fed should act against Trump’s policies.

Meanwhile, Trump’s crypto-friendly decisions since inauguration like pardoning Silk Road founder Ross Ulbricht, launching his $TRUMP and $MELANIA meme coins, and signing executive orders have boosted bullish sentiment.

But Arthur sees these developments as a double-edged sword. “The bullishness is too high. A correction here would be brutal,” he explained. “All of Trump’s decisions were mostly expected, bar the memecoin launch. What is not being fully appreciated is the slowdown in filthy fiat creation in Pax Americana, China, and Japan.”

Arthur outlined a scenario where Trump’s fiscal policies, combined with debt ceiling fights, push the financial system to the brink. If the 10-year Treasury yield breaches 5%, stocks would plunge, large financial players could fail, and the Federal Reserve would be forced to act. “It’s only a matter of time,” Arthur said.

Bitcoin’s correlation with traditional markets

Arthur then proceeded to point out that Bitcoin’s short-term performance remains tied to traditional markets, especially the Nasdaq 100. He cited Bitcoin’s rising 30-day correlation with tech stocks as a key risk.

“Another belief I hold is that Bitcoin is the only truly global free market in existence. It is extremely sensitive to global fiat liquidity conditions; therefore, if a fiat liquidity crunch is forthcoming, its price will break down before that of stocks and will be the leading indicator of financial stress. If it is a leading indicator, then Bitcoin will bottom before stocks, thus predicting a re-opening of the fiat money printing spigots.”

“But in the long term, Bitcoin is uncorrelated with stock prices, but it can be very correlated in the short term. The 30-day correlation between Bitcoin and the Nasdaq 100 is high and rising. This is not good for the short-term price prognosis if stocks get smoked due to the rising 10-year yield,” he predicted.

The other players

In China, the People’s Bank of China (PBOC) had initiated money-printing measures in late 2024 to stimulate its economy. But in early 2025, the PBOC reversed course, ending its bond-buying program and focusing on strengthening the yuan.

“In case your TikTok demented brain couldn’t figure out when the PBOC and central government announced their reflation policies, I circled it for you. The above is the Shanghai Composite Index. The authorities wanted comrades to front-run the red tsunami of printed yuan by purchasing stocks. The messaging worked,” Arthur said. He’s referring to the chart below.

Japan, meanwhile, has been raising interest rates and slowing its balance sheet growth. The Bank of Japan’s (BOJ) actions have driven Japanese Government Bond (JGB) yields to 15-year highs. Arthur warned that a stronger yen could force Japanese investors to repatriate capital, affecting quite literally all global financial markets.

But as always, Arthur remains extremely bullish on Bitcoin in the long-term. He described it as the only truly global free market, capable of weathering short-term volatility.

He finished off the essay saying, “If I’m wrong, my downside is that we took profit early and sold a bit of Bitcoin we purchased using profits from prior shitcoin investments. But if I’m right, then we have the cash ready to quickly double or triple our money on quality shitcoins that got the stick in a general crypto market selloff.”

Cryptopolitan Academy: How to Write a Web3 Resume That Lands Interviews - FREE Cheat Sheet