Native Markets has staked and locked 200k HYPE for 3 years, making USDH the first permissionless spot quote asset to be added on @HyperliquidX HYPE / USDH is now live for trading.

Hyperliquid Hypurr NFT giveaway sparks $45M frenzy amid security concerns

Share:

Hyperliquid’s much-hyped NFT giveaway to early adopters has become both a windfall and a controversy.

The launch of the Hypurr NFT collection created instant wealth for thousands of users, but a security breach and looming risks have raised sharp questions about the stability of the ecosystem.

Instant wealth, instant drama

On September 28, the Hyper Foundation distributed 4,600 Hypurr NFTs to early supporters of Hyperliquid, a perpetuals-focused Layer-1 blockchain.

The airdrop required no action from recipients, with the tokens landing directly on the HyperEVM mainnet.

Most of the NFTs went to participants in the Genesis event from November 2024, while a small allocation was set aside for the foundation, developers, and artists.

Trading began immediately, and demand exploded. Within 24 hours, OpenSea recorded roughly 952,000 HYPE tokens in sales, worth around $45 million.

The collection’s floor price quickly climbed above $68,000, with rare pieces selling for far more.

One standout, Hypurr #21 featuring “Knight Ghost Armor” and “Knight Helm Ghost” traits, fetched 9,999 HYPE tokens— about $467,000.

But even before the official drop, some NFTs had changed hands through over-the-counter desks for as much as $88,000.

But the celebrations were short-lived. Blockchain investigator ZachXBT revealed that eight Hypurr NFTs tied to compromised wallets had been stolen shortly after the launch, netting the attacker about $400,000.

The theft sent jitters through the community, shifting attention from record sales to security concerns.

Mixed reactions across the community

The sharp rise in valuations triggered mixed emotions online. Some recipients expressed joy at receiving assets worth more than an annual salary at no cost, while others voiced discomfort at the stark inequality.

Social media commentator MoonOverlord noted the irony of people struggling with living costs while others flaunted digital cats worth $50,000.

Others took a cautious stance. One user, DidiTrading, said they preferred to wait for the market to stabilise before deciding whether to sell their NFT.

For its part, the Hyper Foundation emphasised that the collection was designed as a cultural memento rather than a utility-driven asset. Each NFT, the team said, captured the moods, tastes, and quirks of the early Hyperliquid community.

The lack of guaranteed benefits, however, did not dampen trading enthusiasm. Volume stayed high even after the initial frenzy, showing strong demand from both collectors and speculators.

Hyperliquid ecosystem and HYPE price reaction

The NFT launch coincided with Hyperliquid’s rollout of new infrastructure features. The network activated permissionless spot quote assets, allowing stablecoin issuers to deploy trading pairs without requiring approval.

Native Markets seized the opportunity, releasing USDH, a stablecoin backed by cash and US Treasuries, as the first permissionless quote asset. This move enabled immediate HYPE/USDH trading and broadened the platform’s reach.

The Hypurr collection was also minted on the HyperEVM, a programmability layer introduced earlier this year that links smart contracts with Hyperliquid’s Layer-1 via HyperBFT consensus.

Hypurr NFTs have been deployed on the HyperEVM. Participants had the opportunity to opt in to receive a Hypurr NFT after the HyperEVM went live as part of the Genesis Event in November 2024. The HyperEVM launched in February 2025 as the general programmability interface to the

The upgrade opens the door for developers to build lending markets, tokenisation protocols, and staking products tied to Hyperliquid’s liquidity.

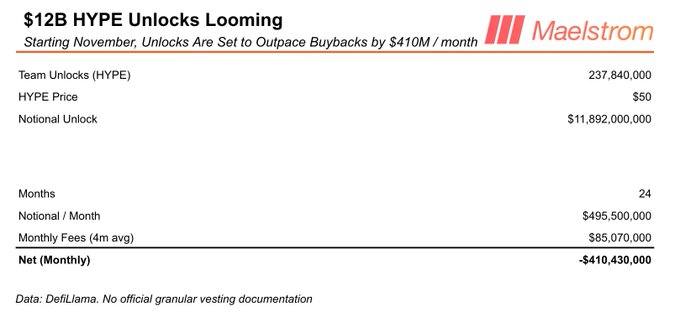

Despite the innovation, risks continue to shadow the project. Analysts point to a looming $12 billion HYPE unlock set to begin in late November, which could place heavy selling pressure on the token.

At current prices, the vesting schedule will release nearly $500 million worth of HYPE monthly over two years.

Starting November 29, 237.8M HYPE will begin vesting linearly over 24 months. At $50 per token, that’s $11.9B in team unlocks — nearly $500M notional hitting the market every month. That leaves a $410M/month supply overhang post buybacks. Has the market priced in the sheer scale

Adding to the unease, blockchain security firm PeckShield recently flagged that kHYPE, the staked version of Hyperliquid’s governance token, briefly lost its peg, dipping to 0.88 before recovering. The episode underscored fragility in derivative markets tied to the project’s token economy.

#PeckShieldAlert Between Sept. 24–27, $kHYPE (@kinetiq_xyz Staked HYPE) briefly deviated from its peg, bottoming at 0.8802 against $WHYPE. The peg has since been restored.

Notably, the HYPE token has responded modestly to the developments, climbing 5.8% in the past day to trade near $47.

Analysts warn that the upcoming unlock poses a significant risk to the price of HYPE, although optimism persists if new infrastructure features succeed and institutional interest grows.

The post Hyperliquid Hypurr NFT giveaway sparks $45M frenzy amid security concerns appeared first on Invezz

Hyperliquid Hypurr NFT giveaway sparks $45M frenzy amid security concerns

Share:

Hyperliquid’s much-hyped NFT giveaway to early adopters has become both a windfall and a controversy.

The launch of the Hypurr NFT collection created instant wealth for thousands of users, but a security breach and looming risks have raised sharp questions about the stability of the ecosystem.

Instant wealth, instant drama

On September 28, the Hyper Foundation distributed 4,600 Hypurr NFTs to early supporters of Hyperliquid, a perpetuals-focused Layer-1 blockchain.

The airdrop required no action from recipients, with the tokens landing directly on the HyperEVM mainnet.

Most of the NFTs went to participants in the Genesis event from November 2024, while a small allocation was set aside for the foundation, developers, and artists.

Trading began immediately, and demand exploded. Within 24 hours, OpenSea recorded roughly 952,000 HYPE tokens in sales, worth around $45 million.

The collection’s floor price quickly climbed above $68,000, with rare pieces selling for far more.

One standout, Hypurr #21 featuring “Knight Ghost Armor” and “Knight Helm Ghost” traits, fetched 9,999 HYPE tokens— about $467,000.

But even before the official drop, some NFTs had changed hands through over-the-counter desks for as much as $88,000.

But the celebrations were short-lived. Blockchain investigator ZachXBT revealed that eight Hypurr NFTs tied to compromised wallets had been stolen shortly after the launch, netting the attacker about $400,000.

The theft sent jitters through the community, shifting attention from record sales to security concerns.

Mixed reactions across the community

The sharp rise in valuations triggered mixed emotions online. Some recipients expressed joy at receiving assets worth more than an annual salary at no cost, while others voiced discomfort at the stark inequality.

Social media commentator MoonOverlord noted the irony of people struggling with living costs while others flaunted digital cats worth $50,000.

Others took a cautious stance. One user, DidiTrading, said they preferred to wait for the market to stabilise before deciding whether to sell their NFT.

For its part, the Hyper Foundation emphasised that the collection was designed as a cultural memento rather than a utility-driven asset. Each NFT, the team said, captured the moods, tastes, and quirks of the early Hyperliquid community.

The lack of guaranteed benefits, however, did not dampen trading enthusiasm. Volume stayed high even after the initial frenzy, showing strong demand from both collectors and speculators.

Hyperliquid ecosystem and HYPE price reaction

The NFT launch coincided with Hyperliquid’s rollout of new infrastructure features. The network activated permissionless spot quote assets, allowing stablecoin issuers to deploy trading pairs without requiring approval.

Native Markets seized the opportunity, releasing USDH, a stablecoin backed by cash and US Treasuries, as the first permissionless quote asset. This move enabled immediate HYPE/USDH trading and broadened the platform’s reach.

Native Markets has staked and locked 200k HYPE for 3 years, making USDH the first permissionless spot quote asset to be added on @HyperliquidX HYPE / USDH is now live for trading.

The Hypurr collection was also minted on the HyperEVM, a programmability layer introduced earlier this year that links smart contracts with Hyperliquid’s Layer-1 via HyperBFT consensus.

Hypurr NFTs have been deployed on the HyperEVM. Participants had the opportunity to opt in to receive a Hypurr NFT after the HyperEVM went live as part of the Genesis Event in November 2024. The HyperEVM launched in February 2025 as the general programmability interface to the

The upgrade opens the door for developers to build lending markets, tokenisation protocols, and staking products tied to Hyperliquid’s liquidity.

Despite the innovation, risks continue to shadow the project. Analysts point to a looming $12 billion HYPE unlock set to begin in late November, which could place heavy selling pressure on the token.

At current prices, the vesting schedule will release nearly $500 million worth of HYPE monthly over two years.

Starting November 29, 237.8M HYPE will begin vesting linearly over 24 months. At $50 per token, that’s $11.9B in team unlocks — nearly $500M notional hitting the market every month. That leaves a $410M/month supply overhang post buybacks. Has the market priced in the sheer scale

Adding to the unease, blockchain security firm PeckShield recently flagged that kHYPE, the staked version of Hyperliquid’s governance token, briefly lost its peg, dipping to 0.88 before recovering. The episode underscored fragility in derivative markets tied to the project’s token economy.

#PeckShieldAlert Between Sept. 24–27, $kHYPE (@kinetiq_xyz Staked HYPE) briefly deviated from its peg, bottoming at 0.8802 against $WHYPE. The peg has since been restored.

Notably, the HYPE token has responded modestly to the developments, climbing 5.8% in the past day to trade near $47.

Analysts warn that the upcoming unlock poses a significant risk to the price of HYPE, although optimism persists if new infrastructure features succeed and institutional interest grows.

The post Hyperliquid Hypurr NFT giveaway sparks $45M frenzy amid security concerns appeared first on Invezz