TradFi ‘Dominating’ Tokenization of Real World Assets Trend, According to Kaiko Analytics

Traditional finance (TradFi) is starting to take the lead on tokenizing real-world assets (RWA), says blockchain data tracker Kaiko Analytics.

According to a new Kaiko Research post, TradFi giants like Fidelity, JPMorgan, and BlackRock are leading the new wave of RWA tokenization using crypto.

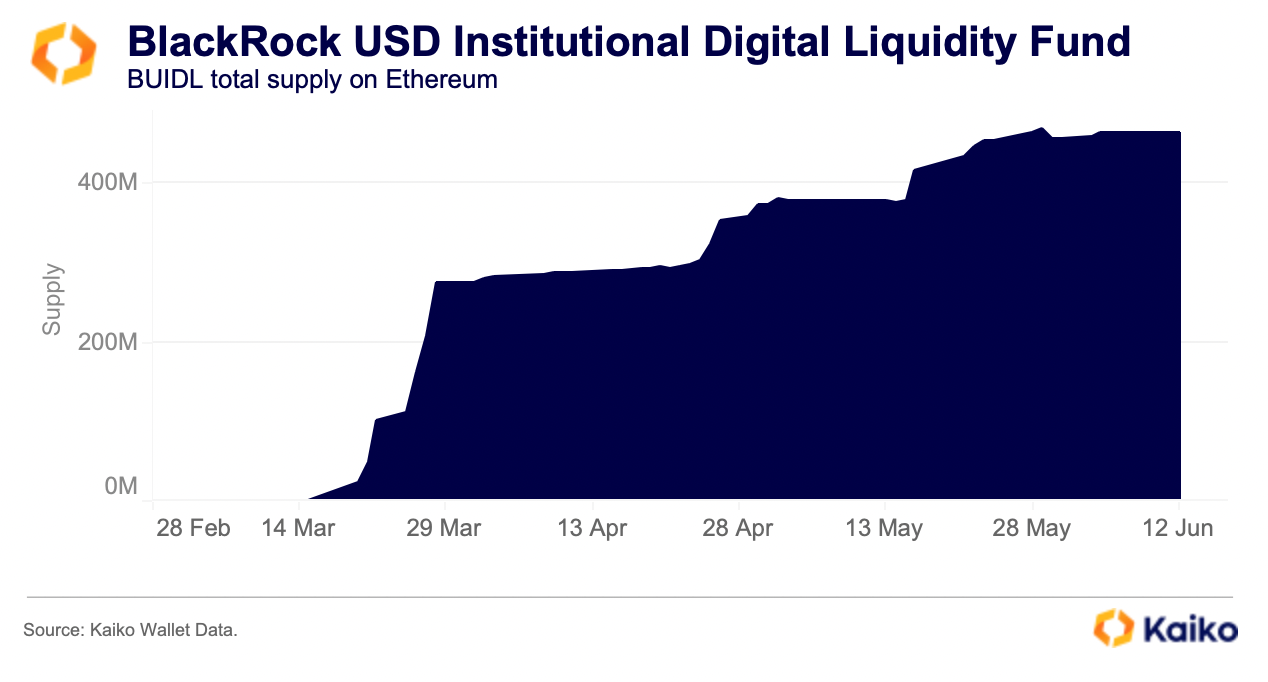

“Last week, Fidelity International announced its participation in JPMorgan’s tokenized network, becoming the latest institutional player to join the rapidly growing tokenization trend. In parallel, BlackRock’s BUIDL, its tokenized liquidity fund, continues to grow and has now accumulated over $460 million.

Since its launch in March, BlackRock’s BUIDL has outpaced several crypto-native firms, including Maple Finance’s Cash Management Fund, which focuses on short-term cash instruments. Although Maple has been active in the space for years and recovered from the 2022 crypto lending services collapse, its Cash Management Fund has only amassed around $16 million in assets, paling in comparison to BUIDL.”

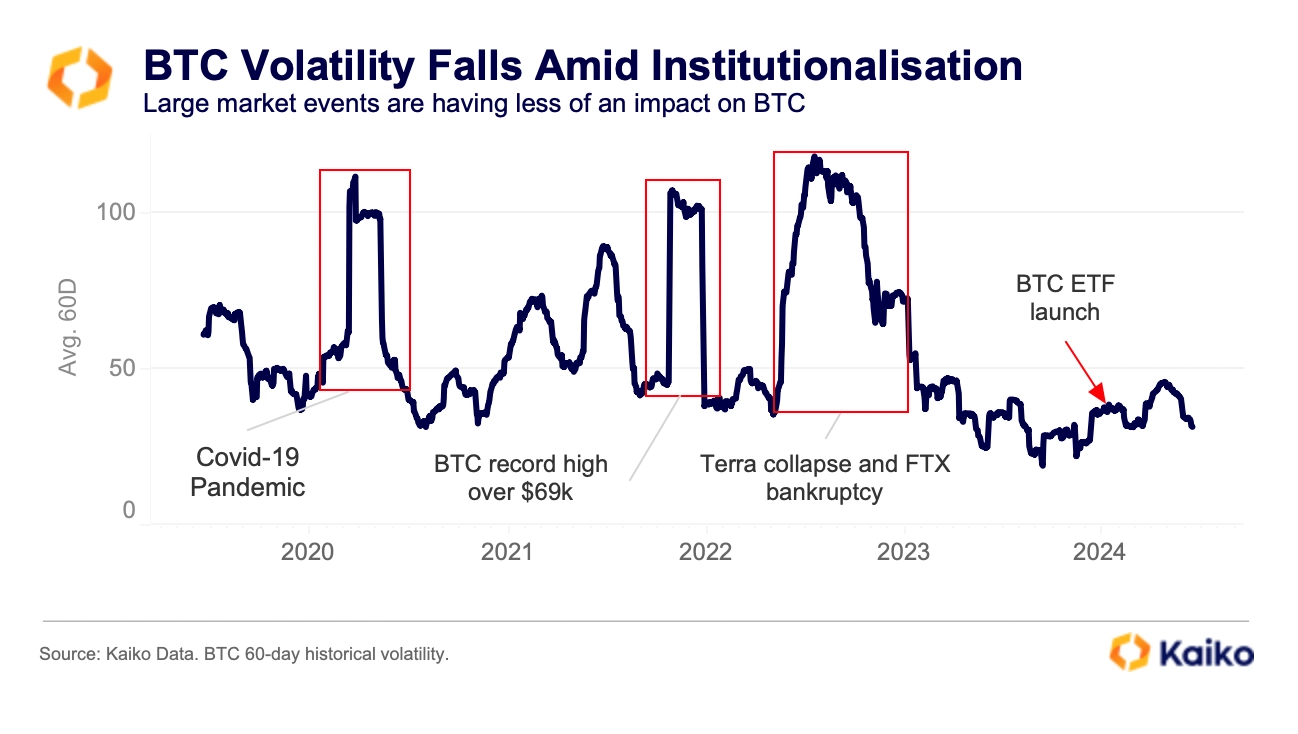

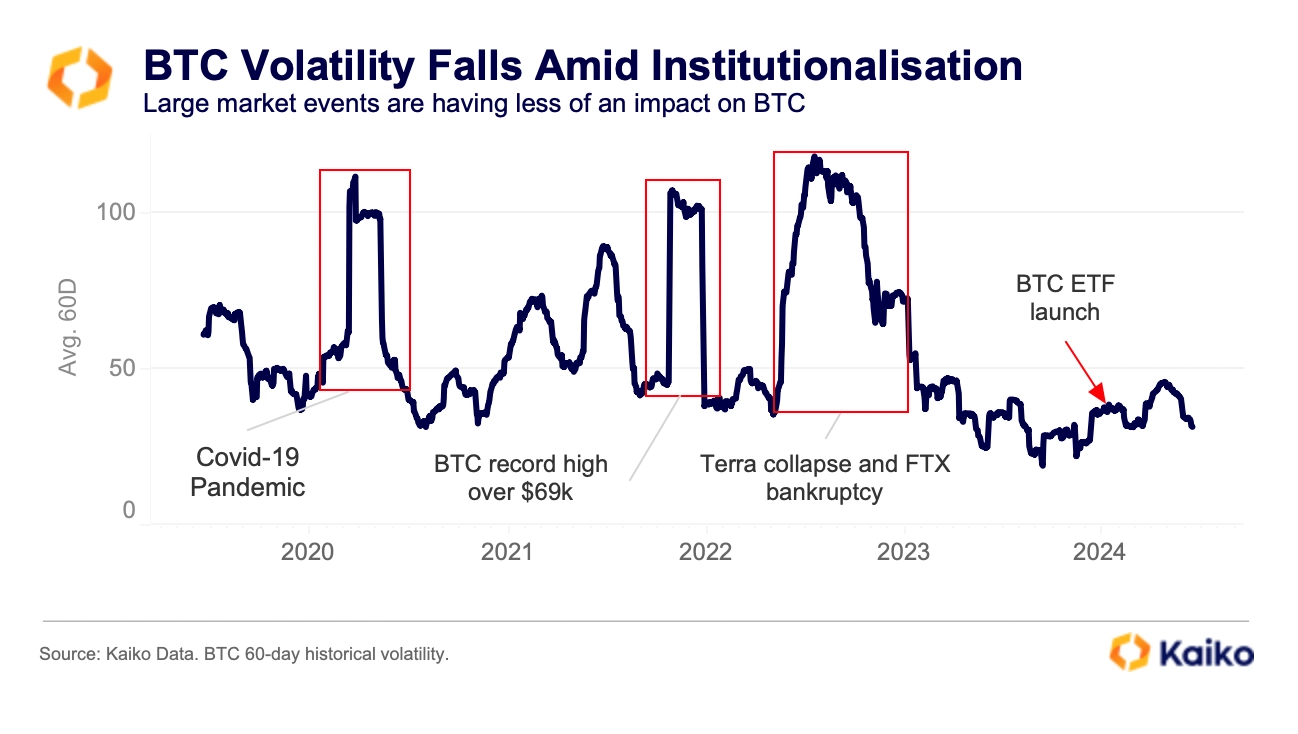

Looking at the flagship crypto Bitcoin (BTC), Kaiko suggests that BTC’s reduced volatility is a sign of the asset’s maturation.

“Although BTC might have been on a rollercoaster ride driven by macro news last week, it’s clear that the digital gold has reached a new level of maturity in 2024. This can be observed in its declining volatility, with BTC’s 60-day historical volatility remaining below 50% since the beginning of 2023. This stands in stark contrast to the significant fluctuations of 2022, when volatility exceeded 100%.”

BTC is worth $64,527 at time of writing.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post TradFi ‘Dominating’ Tokenization of Real World Assets Trend, According to Kaiko Analytics appeared first on The Daily Hodl.

TradFi ‘Dominating’ Tokenization of Real World Assets Trend, According to Kaiko Analytics

Traditional finance (TradFi) is starting to take the lead on tokenizing real-world assets (RWA), says blockchain data tracker Kaiko Analytics.

According to a new Kaiko Research post, TradFi giants like Fidelity, JPMorgan, and BlackRock are leading the new wave of RWA tokenization using crypto.

“Last week, Fidelity International announced its participation in JPMorgan’s tokenized network, becoming the latest institutional player to join the rapidly growing tokenization trend. In parallel, BlackRock’s BUIDL, its tokenized liquidity fund, continues to grow and has now accumulated over $460 million.

Since its launch in March, BlackRock’s BUIDL has outpaced several crypto-native firms, including Maple Finance’s Cash Management Fund, which focuses on short-term cash instruments. Although Maple has been active in the space for years and recovered from the 2022 crypto lending services collapse, its Cash Management Fund has only amassed around $16 million in assets, paling in comparison to BUIDL.”

Looking at the flagship crypto Bitcoin (BTC), Kaiko suggests that BTC’s reduced volatility is a sign of the asset’s maturation.

“Although BTC might have been on a rollercoaster ride driven by macro news last week, it’s clear that the digital gold has reached a new level of maturity in 2024. This can be observed in its declining volatility, with BTC’s 60-day historical volatility remaining below 50% since the beginning of 2023. This stands in stark contrast to the significant fluctuations of 2022, when volatility exceeded 100%.”

BTC is worth $64,527 at time of writing.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post TradFi ‘Dominating’ Tokenization of Real World Assets Trend, According to Kaiko Analytics appeared first on The Daily Hodl.