India’s Rupee Becomes Worst-Performing Currency of the Year in Asia

Share:

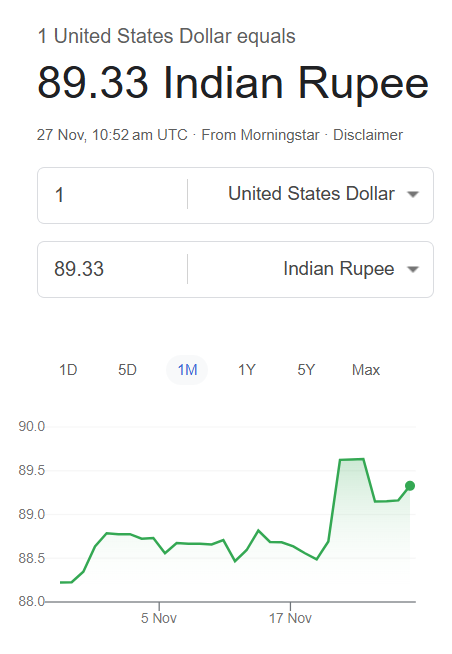

India’s local currency, the rupee, is now the worst-performing tender in the Asian markets against the US dollar. The INR had fallen to a low of 88 last week, which sent alarm bells in the forex markets. If the 88 level wasn’t worse enough, the local currency plunged further and is now at 89.33 on Thursday’s trading session.

The US dollar is dominating the rupee in the currency markets, pushing it to new lows every month. The trade wars and tariffs have dimmed the lights on the local currency, giving the USD an edge. In addition, the trade deals are yet to be finalized by Trump, and the waiting period is squeezing the INR’s prospects.

Several businesses in the imports and exports sector have already contacted the Modi administration to find a solution to tariffs, which are at a higher rate. Also, the exodus of foreign investors from the Indian stock market is also dimming the INR. Billions worth of foreign funds exited the stock market in 2025, giving a boost in the arm for the US dollar and not the rupee.

Also Read: As 2025 Ends, Here’s the World’s 10 Richest Super Billionaires List

US Dollar Triumphs As India’s Rupee Heads Deep South

India’s central bank, the Reserve Bank of India (RBI), has sold over $30 billion in US dollars to safeguard the rupee in July, reported Bloomberg. It managed to stabilize the currency at around the 86 level, but the USD penetrated through. The INR is now at a crucial juncture where only positive developments from the US-India trade could safeguard its prospects.

Also Read: S&P Correction Looms: Raymond James Says Market Could Fall 10%

The RBI has not intervened in the currency market this time, which pushed the rupee to a lifetime low against the US dollar. The USD has soared over 20% in five years against the INR, according to TradingView. In a year alone, the de facto global currency is already up close to 6%. India’s local currency also dipped nearly 4.35% year-to-date and remains extremely bearish.

India’s Rupee Becomes Worst-Performing Currency of the Year in Asia

Share:

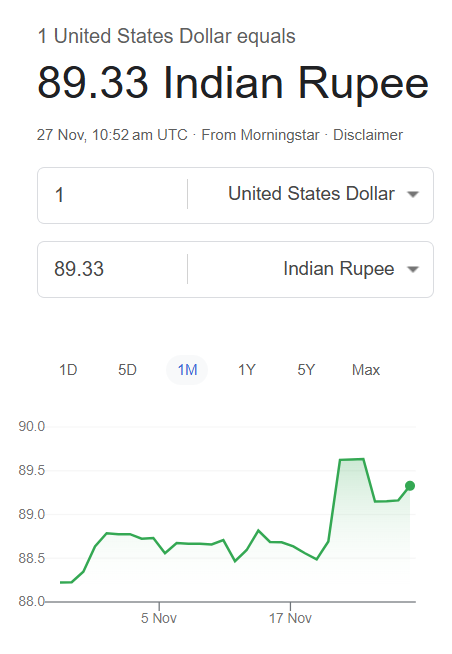

India’s local currency, the rupee, is now the worst-performing tender in the Asian markets against the US dollar. The INR had fallen to a low of 88 last week, which sent alarm bells in the forex markets. If the 88 level wasn’t worse enough, the local currency plunged further and is now at 89.33 on Thursday’s trading session.

The US dollar is dominating the rupee in the currency markets, pushing it to new lows every month. The trade wars and tariffs have dimmed the lights on the local currency, giving the USD an edge. In addition, the trade deals are yet to be finalized by Trump, and the waiting period is squeezing the INR’s prospects.

Several businesses in the imports and exports sector have already contacted the Modi administration to find a solution to tariffs, which are at a higher rate. Also, the exodus of foreign investors from the Indian stock market is also dimming the INR. Billions worth of foreign funds exited the stock market in 2025, giving a boost in the arm for the US dollar and not the rupee.

Also Read: As 2025 Ends, Here’s the World’s 10 Richest Super Billionaires List

US Dollar Triumphs As India’s Rupee Heads Deep South

India’s central bank, the Reserve Bank of India (RBI), has sold over $30 billion in US dollars to safeguard the rupee in July, reported Bloomberg. It managed to stabilize the currency at around the 86 level, but the USD penetrated through. The INR is now at a crucial juncture where only positive developments from the US-India trade could safeguard its prospects.

Also Read: S&P Correction Looms: Raymond James Says Market Could Fall 10%

The RBI has not intervened in the currency market this time, which pushed the rupee to a lifetime low against the US dollar. The USD has soared over 20% in five years against the INR, according to TradingView. In a year alone, the de facto global currency is already up close to 6%. India’s local currency also dipped nearly 4.35% year-to-date and remains extremely bearish.