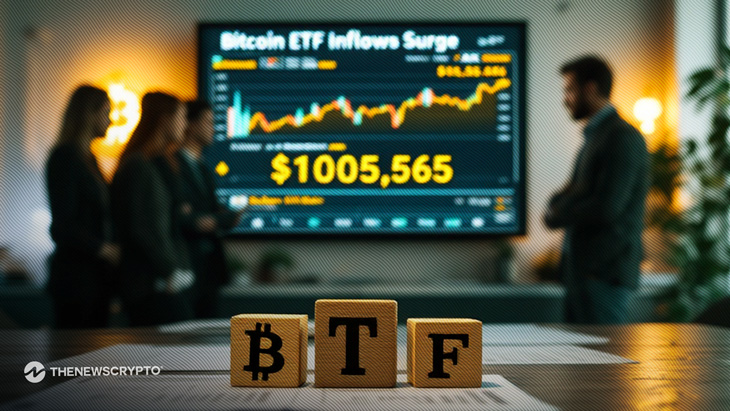

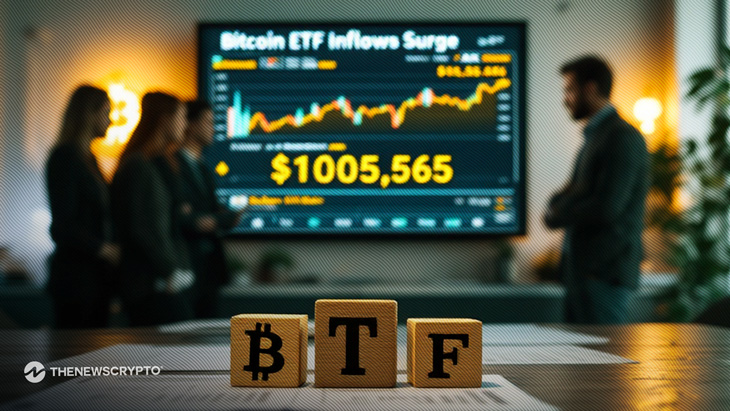

BTC Trades Above $105K, Spot Bitcoin ETF Inflows Surge, Is Bitcoin Golden Cross Ahead?

- Bitcoin ETFs had a strong start of the week with $667 million daily net inflows

- Spot Bitcoin ETFs recorded inflows for last four consecutive days

- Technical indicators are pointing towards a golden cross on BTC charts as its price is sustaining above the $100K

A major shift in global macroeconomic conditions has always influenced the crypto market. Bitcoin market price action reflects the overall health of the market as it is the largest cryptocurrency by market cap. Technical indicators hint at a “golden cross ” as Bitcoin price spreads positive market sentiment.

Spot Bitcoin ETFs recorded a daily total net inflow of $667.44 million on Monday. While the cumulative net inflow stands at $42.44 billion, the total value traded as of Monday is $3.63 billion. Bitcoin spot ETFs hold $124.97 billion in total net assets, which amounts to around 5.96% of the total Bitcoin market cap.

Market analyst platform SoSoValue confirmed these values and further estimated that BlackRock’s IBIT ETF alone bagged $306.92 million in inflows. Fidelity’s FBTC, Ark & 21 Shares, and Bitwise’s BITB follow BlackRock with considerable daily net inflows. BlackRock’s IBIT spot Bitcoin ETF maintains its dominance over the BTC ETF market.

Is a Golden Cross Ahead for the Bitcoin Market Price?

Bitcoin market price has been continuously maintaining its surge for the past couple of weeks. After breaching the $100K level earlier this month, it has managed to stay afloat till today. The surge in Bitcoin market price is spreading renewed enthusiasm among investors, leading to spot Bitcoin ETFs’ net inflows.

Coinglass data shows that the Bitcoin Open Interest (OI) rate has also surged to $71.9 billion from the lows of $45.9 billion in March 2025. The increase in Open Interest rate indicates positive market sentiment and hints at a possibility of further price surge.

Bitcoin is trading at $105,113 with a 2% surge in the last 24 hours. The Bitcoin market cap also surged to $2.08 trillion. But its 24-hour trading volume dropped 15%. Even though the trading volume dipped, the crypto community is still bullish on Bitcoin.

Renowned market analyst Benjamin Cowen estimated that a golden cross is upcoming for the Bitcoin market. A golden cross signals a bullish chart pattern for a financial asset. It is where a short-term moving average crosses above a long-term moving average. Thus, Bitcoin could experience a further price rally to its all-time high value and make Arthur Hayes’ prediction of $200K a reality soon.

BTC Trades Above $105K, Spot Bitcoin ETF Inflows Surge, Is Bitcoin Golden Cross Ahead?

- Bitcoin ETFs had a strong start of the week with $667 million daily net inflows

- Spot Bitcoin ETFs recorded inflows for last four consecutive days

- Technical indicators are pointing towards a golden cross on BTC charts as its price is sustaining above the $100K

A major shift in global macroeconomic conditions has always influenced the crypto market. Bitcoin market price action reflects the overall health of the market as it is the largest cryptocurrency by market cap. Technical indicators hint at a “golden cross ” as Bitcoin price spreads positive market sentiment.

Spot Bitcoin ETFs recorded a daily total net inflow of $667.44 million on Monday. While the cumulative net inflow stands at $42.44 billion, the total value traded as of Monday is $3.63 billion. Bitcoin spot ETFs hold $124.97 billion in total net assets, which amounts to around 5.96% of the total Bitcoin market cap.

Market analyst platform SoSoValue confirmed these values and further estimated that BlackRock’s IBIT ETF alone bagged $306.92 million in inflows. Fidelity’s FBTC, Ark & 21 Shares, and Bitwise’s BITB follow BlackRock with considerable daily net inflows. BlackRock’s IBIT spot Bitcoin ETF maintains its dominance over the BTC ETF market.

Is a Golden Cross Ahead for the Bitcoin Market Price?

Bitcoin market price has been continuously maintaining its surge for the past couple of weeks. After breaching the $100K level earlier this month, it has managed to stay afloat till today. The surge in Bitcoin market price is spreading renewed enthusiasm among investors, leading to spot Bitcoin ETFs’ net inflows.

Coinglass data shows that the Bitcoin Open Interest (OI) rate has also surged to $71.9 billion from the lows of $45.9 billion in March 2025. The increase in Open Interest rate indicates positive market sentiment and hints at a possibility of further price surge.

Bitcoin is trading at $105,113 with a 2% surge in the last 24 hours. The Bitcoin market cap also surged to $2.08 trillion. But its 24-hour trading volume dropped 15%. Even though the trading volume dipped, the crypto community is still bullish on Bitcoin.

Renowned market analyst Benjamin Cowen estimated that a golden cross is upcoming for the Bitcoin market. A golden cross signals a bullish chart pattern for a financial asset. It is where a short-term moving average crosses above a long-term moving average. Thus, Bitcoin could experience a further price rally to its all-time high value and make Arthur Hayes’ prediction of $200K a reality soon.