US Stocks: Dow Drops 1,400 Points as Markets Nosedive on Trump Tariffs

Although the US stock market had been struggling for most of the year, things took a turn with the Dow (DJI) dropping a remarkable 1,400 points as the market’s nosedive followed US President Donald Trump’s ‘Liberation Day’ tariff announcement Tuesday.

The president announced that the country would be adopting a bevy of import taxes to balance international trade. Moreover, the move was always poised to have a massive impact on Wall Street and the economy. Indeed, the former is proving that correct, with a host of mega-cap stocks plummeting Wednesday.

Also Read: Amazon (AMZN) Expands AI Push as Stock Eyes End to 8-Week Losing Streak

US Stock Market Falls: Dow Plummets and S&P 500 Loses 4%

Throughout the first three months of the year, the United States had seen many of its larger companies struggle. Some of the most prominent tech firms were unable to find their footing, with companies like Tesla (TSLA) and Amazon (AMZN) boasting eight- and nine-week losing streaks.

Those losses went into overdrive Wednesday. Indeed, the US stock market plummeted, with the Dow dropping 1,400 points on the heels of US President Trump’s Liberation Day tariffs. The sweeping economic policy was at least a 10% import tax for all trade partners, with some even higher. Global trade war risks skyrocketed, with Wall Street facing a massive sell-off.

Also Read: 3 Best Dividend Stocks of Q1 2025. How Will They Perform in Q2?

The board market index fell 4%, aligning with its worst day since September 2022. Moreover, the Dow Jones Industrial Average and Nasdaq Composite both plummeted 3.3% and 5%, respectively, according to CNBC. Moreover, the move saw the Magnificent Seven drop significantly.

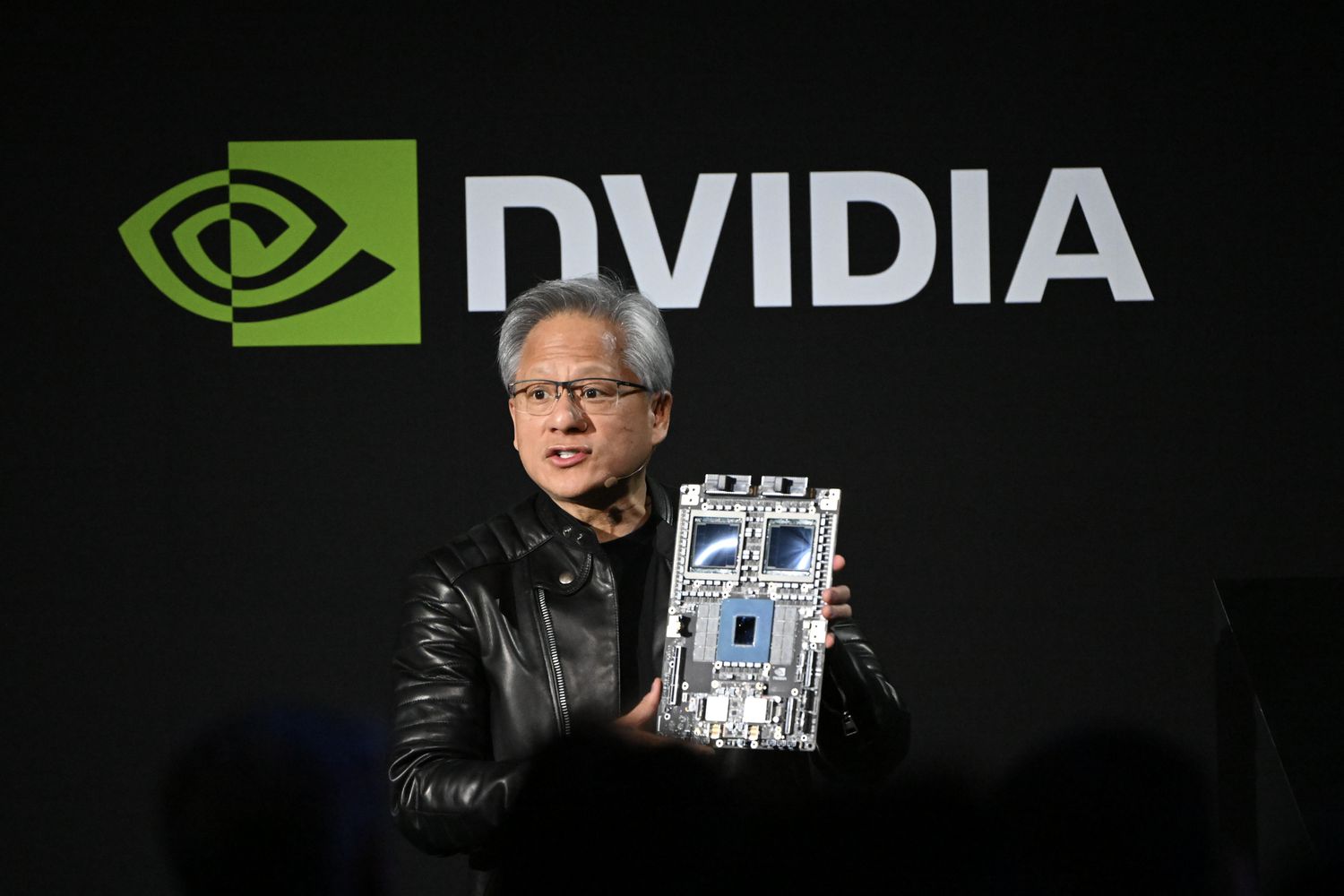

Apple (AAPL) shares led the way, falling more than 9%. Additionally, tech titan Nvidia (NVDA) and the aforementioned Tesla dropped 6%. However, things may get even worse. Although Trump announced a baseline tariff, they are expected to announce “even bigger duties against countries that levy higher rates on the US” in the coming days.

US Stocks: Dow Drops 1,400 Points as Markets Nosedive on Trump Tariffs

Although the US stock market had been struggling for most of the year, things took a turn with the Dow (DJI) dropping a remarkable 1,400 points as the market’s nosedive followed US President Donald Trump’s ‘Liberation Day’ tariff announcement Tuesday.

The president announced that the country would be adopting a bevy of import taxes to balance international trade. Moreover, the move was always poised to have a massive impact on Wall Street and the economy. Indeed, the former is proving that correct, with a host of mega-cap stocks plummeting Wednesday.

Also Read: Amazon (AMZN) Expands AI Push as Stock Eyes End to 8-Week Losing Streak

US Stock Market Falls: Dow Plummets and S&P 500 Loses 4%

Throughout the first three months of the year, the United States had seen many of its larger companies struggle. Some of the most prominent tech firms were unable to find their footing, with companies like Tesla (TSLA) and Amazon (AMZN) boasting eight- and nine-week losing streaks.

Those losses went into overdrive Wednesday. Indeed, the US stock market plummeted, with the Dow dropping 1,400 points on the heels of US President Trump’s Liberation Day tariffs. The sweeping economic policy was at least a 10% import tax for all trade partners, with some even higher. Global trade war risks skyrocketed, with Wall Street facing a massive sell-off.

Also Read: 3 Best Dividend Stocks of Q1 2025. How Will They Perform in Q2?

The board market index fell 4%, aligning with its worst day since September 2022. Moreover, the Dow Jones Industrial Average and Nasdaq Composite both plummeted 3.3% and 5%, respectively, according to CNBC. Moreover, the move saw the Magnificent Seven drop significantly.

Apple (AAPL) shares led the way, falling more than 9%. Additionally, tech titan Nvidia (NVDA) and the aforementioned Tesla dropped 6%. However, things may get even worse. Although Trump announced a baseline tariff, they are expected to announce “even bigger duties against countries that levy higher rates on the US” in the coming days.