BNY Mellon Invests in Bitcoin ETFs Amid Rising Institutional Interest

Share:

The Shift to Bitcoin ETFs

BNY Mellon, the oldest and largest custodian bank in the U.S., has officially entered the Bitcoin ETF market. According to recent SEC filings, the bank has invested in Bitcoin ETFs offered by BlackRock and Grayscale. This move not only marks a significant pivot in the bank’s investment strategy but also underscores a growing institutional interest in cryptocurrency as a legitimate asset class.

Milestone for U.S. Crypto Investors

This year has been groundbreaking for American cryptocurrency enthusiasts. The U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs, responding to persistent investor demand. These approvals represent a monumental step forward in integrating cryptocurrencies into the mainstream financial ecosystem and have spurred notable market activity.

Record-Breaking Market Response

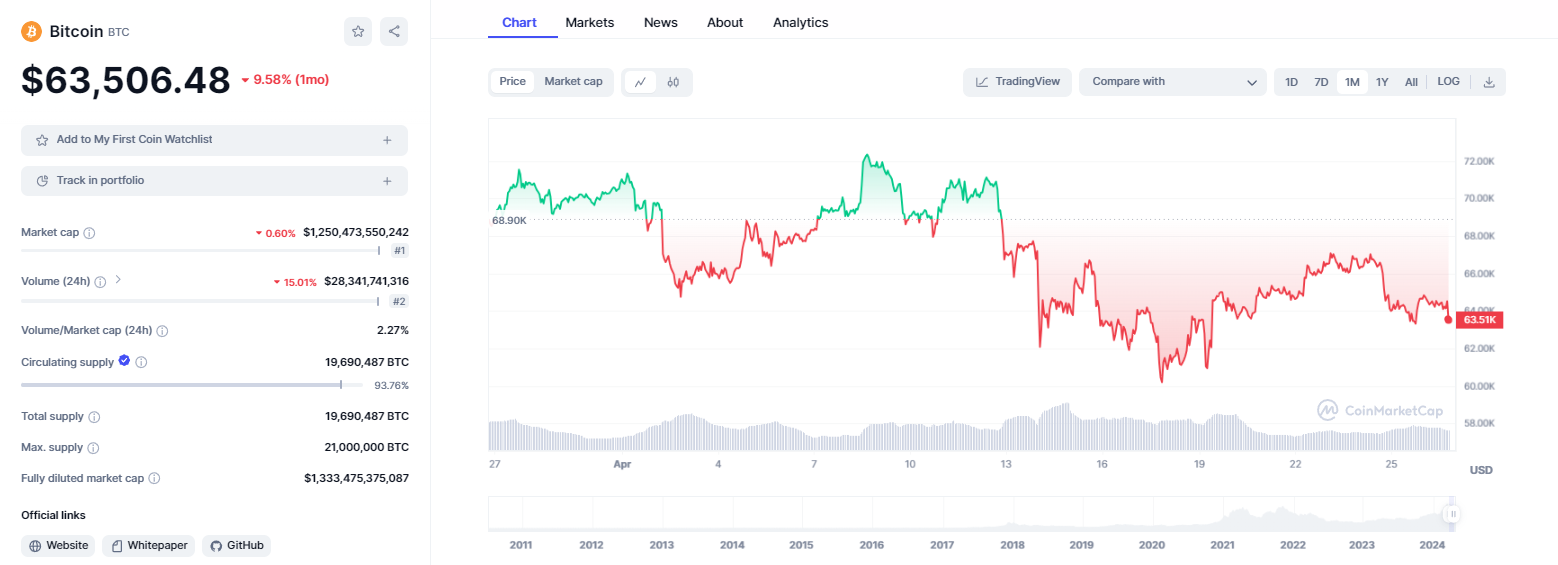

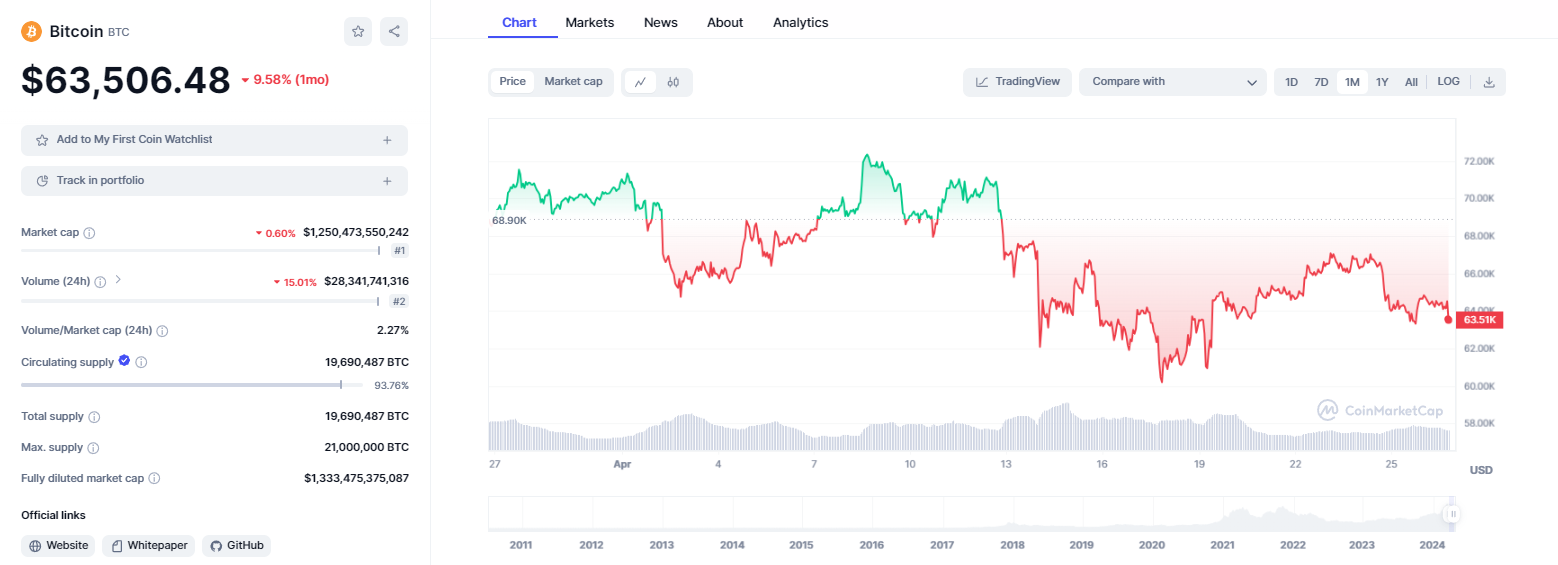

The anticipation and subsequent approval of these ETFs have dramatically influenced the cryptocurrency market. Bitcoin reached a new all-time high of $73,737 in March, driven by robust demand for institutional-grade crypto products. This trend reflects a broader acceptance among institutional investors, who are increasingly viewing cryptocurrencies as a valuable component of a diversified investment portfolio.

Global Movement Towards Crypto ETFs

On the international stage, Hong Kong’s financial authorities have also embraced cryptocurrency, having approved the trading of Bitcoin and Ethereum ETFs set to begin on April 30. This approval not only signifies the growing global integration of cryptocurrencies into the financial markets but also potentially sets the stage for similar developments in other financial hubs.

Future Predictions and Market Potential

According to CoinCodex, Bitcoin is predicted to reach a new peak of $84,412 by May 25, likely driven by the excitement surrounding the launch of Hong Kong’s Bitcoin ETFs. Furthermore, if the U.S. were to approve a spot Ethereum ETF, it could trigger another substantial rally in the crypto market, with Ethereum poised to gain significantly from increased institutional involvement.

Ethereum’s Outlook Amidst Institutional Adoption

Despite trading at a significant discount from its November 2021 peak, Ethereum could see substantial gains from continued institutional interest. The adoption of cryptocurrencies by major institutions like BNY Mellon could serve as a catalyst for further price increases and broader acceptance of these digital assets within traditional investment portfolios.

The investment landscape is rapidly changing, with cryptocurrencies at the forefront of this evolution. BNY Mellon’s strategic move into Bitcoin ETFs highlights the increasing confidence major institutions have in the crypto market, promising exciting developments for the future of finance.

Read More

BNY Mellon Invests in Bitcoin ETFs Amid Rising Institutional Interest

Share:

The Shift to Bitcoin ETFs

BNY Mellon, the oldest and largest custodian bank in the U.S., has officially entered the Bitcoin ETF market. According to recent SEC filings, the bank has invested in Bitcoin ETFs offered by BlackRock and Grayscale. This move not only marks a significant pivot in the bank’s investment strategy but also underscores a growing institutional interest in cryptocurrency as a legitimate asset class.

Milestone for U.S. Crypto Investors

This year has been groundbreaking for American cryptocurrency enthusiasts. The U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs, responding to persistent investor demand. These approvals represent a monumental step forward in integrating cryptocurrencies into the mainstream financial ecosystem and have spurred notable market activity.

Record-Breaking Market Response

The anticipation and subsequent approval of these ETFs have dramatically influenced the cryptocurrency market. Bitcoin reached a new all-time high of $73,737 in March, driven by robust demand for institutional-grade crypto products. This trend reflects a broader acceptance among institutional investors, who are increasingly viewing cryptocurrencies as a valuable component of a diversified investment portfolio.

Global Movement Towards Crypto ETFs

On the international stage, Hong Kong’s financial authorities have also embraced cryptocurrency, having approved the trading of Bitcoin and Ethereum ETFs set to begin on April 30. This approval not only signifies the growing global integration of cryptocurrencies into the financial markets but also potentially sets the stage for similar developments in other financial hubs.

Future Predictions and Market Potential

According to CoinCodex, Bitcoin is predicted to reach a new peak of $84,412 by May 25, likely driven by the excitement surrounding the launch of Hong Kong’s Bitcoin ETFs. Furthermore, if the U.S. were to approve a spot Ethereum ETF, it could trigger another substantial rally in the crypto market, with Ethereum poised to gain significantly from increased institutional involvement.

Ethereum’s Outlook Amidst Institutional Adoption

Despite trading at a significant discount from its November 2021 peak, Ethereum could see substantial gains from continued institutional interest. The adoption of cryptocurrencies by major institutions like BNY Mellon could serve as a catalyst for further price increases and broader acceptance of these digital assets within traditional investment portfolios.

The investment landscape is rapidly changing, with cryptocurrencies at the forefront of this evolution. BNY Mellon’s strategic move into Bitcoin ETFs highlights the increasing confidence major institutions have in the crypto market, promising exciting developments for the future of finance.

Read More