Bitcoin ETFs on Fire: 5-Day Inflow Wave Signals New Accumulation Phase

Bitcoin is closing up on its all-time high of $124K as spot ETFs recorded five consecutive days of inflows, with over $985 million entering Bitcoin funds on October 3 alone.

Ethereum ETFs also joined the surge with $234 million in inflows, extending their own five-day streak. Meanwhile, ETH price broke above the $4,500 price level, up 12% in the past week.

On October 3, Bitcoin spot ETFs recorded total net inflows of $985 million, marking five consecutive days of net inflows. Ethereum spot ETFs saw total net inflows of $234 million, also extending their streak to five consecutive days.https://t.co/Hj2Gs49bWa pic.twitter.com/X0vbUoOL9w

— Wu Blockchain (@WuBlockchain) October 4, 2025

Bitcoin ETFs Fuel Institutional Accumulation

The surge in ETF inflows represents an increase in institutional demand following a brief cooling-off period in September. The consistent net inflows suggest large-scale investors are re-entering the market, taking advantage of the recent dip from $117K to $108.6K.

Swissblock analysts described this retracement as a “constructive reset, not capitulation,” noting that the move reflected system stress without structural weakness.

The move that took BTC from $117K down to $108.6K was a constructive reset, not capitulation.

It showed stress in the system, but not fragility.

Resets like these create opportunity. 🧵 pic.twitter.com/nWAv8WppRO

— Swissblock (@swissblock__) October 3, 2025

Analysts emphasized that the absorption of late-August selling clusters between $114K and $118K unlocked the path toward an all-time high (ATH) retest.

At press time, Bitcoin trades at $122K, just 1.6% shy of its record high of $124K, underscoring the intensity of the recent rebound.

According to Swissblock, long-term holders have reduced their selling intensity, a signal of easing supply pressure and early signs of accumulation. Historically, such patterns mark the beginning of new market rallies.

On-Chain Metrics Reflect Maturing Market

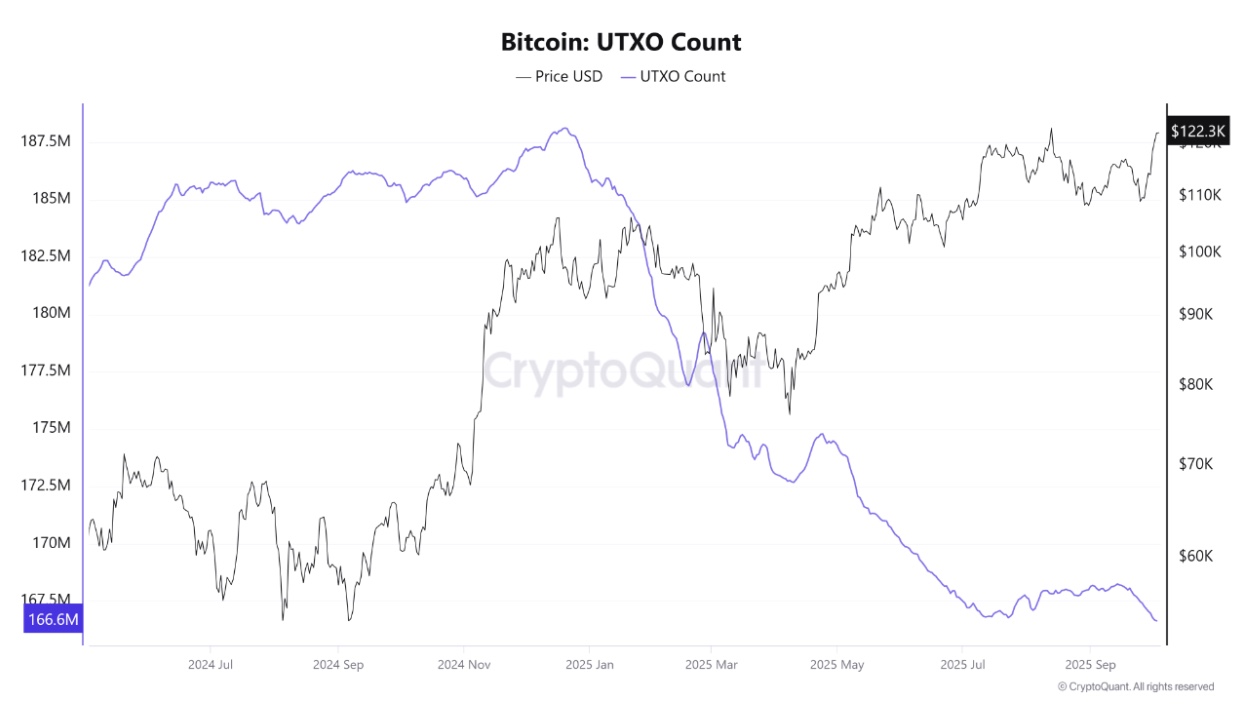

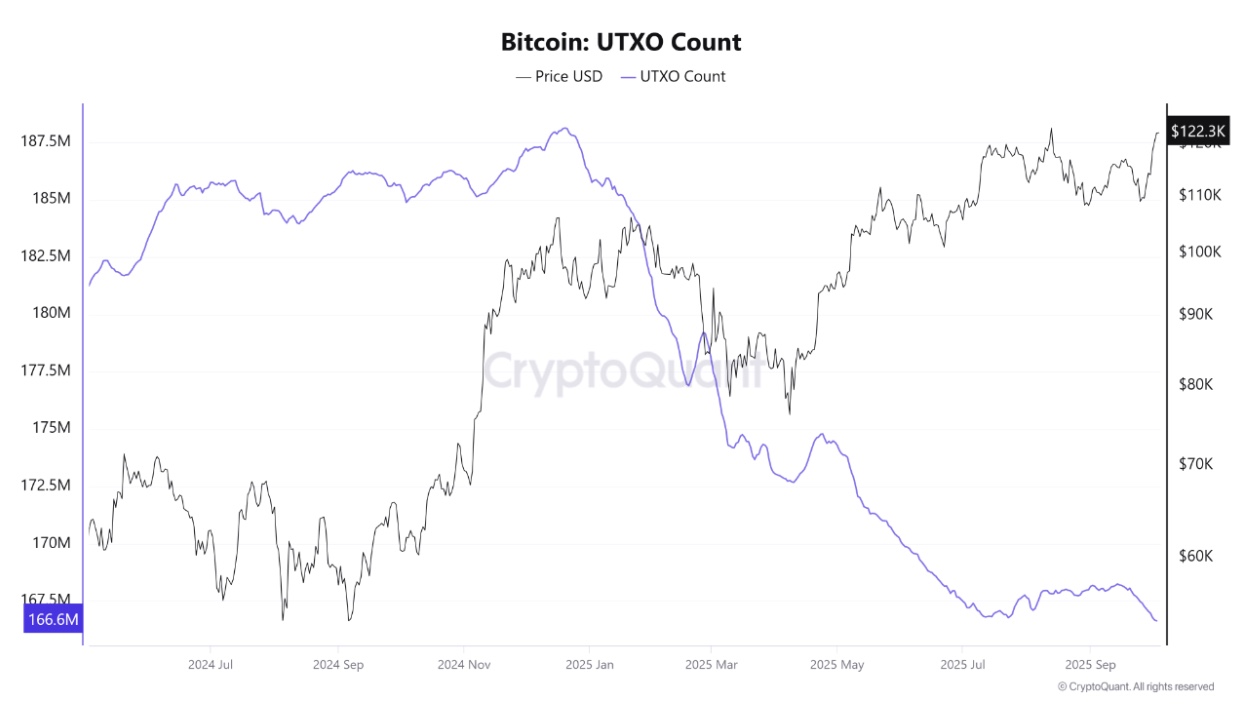

On-chain data from CryptoQuant shows that Bitcoin’s UTXO count has dropped to 166.6 million, its lowest since April 2024, marking an 11% decline since its early-2025 peak.

While the metric’s decline may seem negative at first glance, it actually points to network consolidation, whale accumulation, and reduced retail activity.

The drop in UTXO count coincides with a rise in Bitcoin’s price from $99K to $122K, indicating that long-term holders are increasingly storing coins rather than spending them.

Bitcoin UTXO count | Source: CryptoQuant

Fewer UTXOs typically signal reduced selling pressure, improved network efficiency, and a mature phase of market development.

Derivatives Data Highlights Speculative Confidence

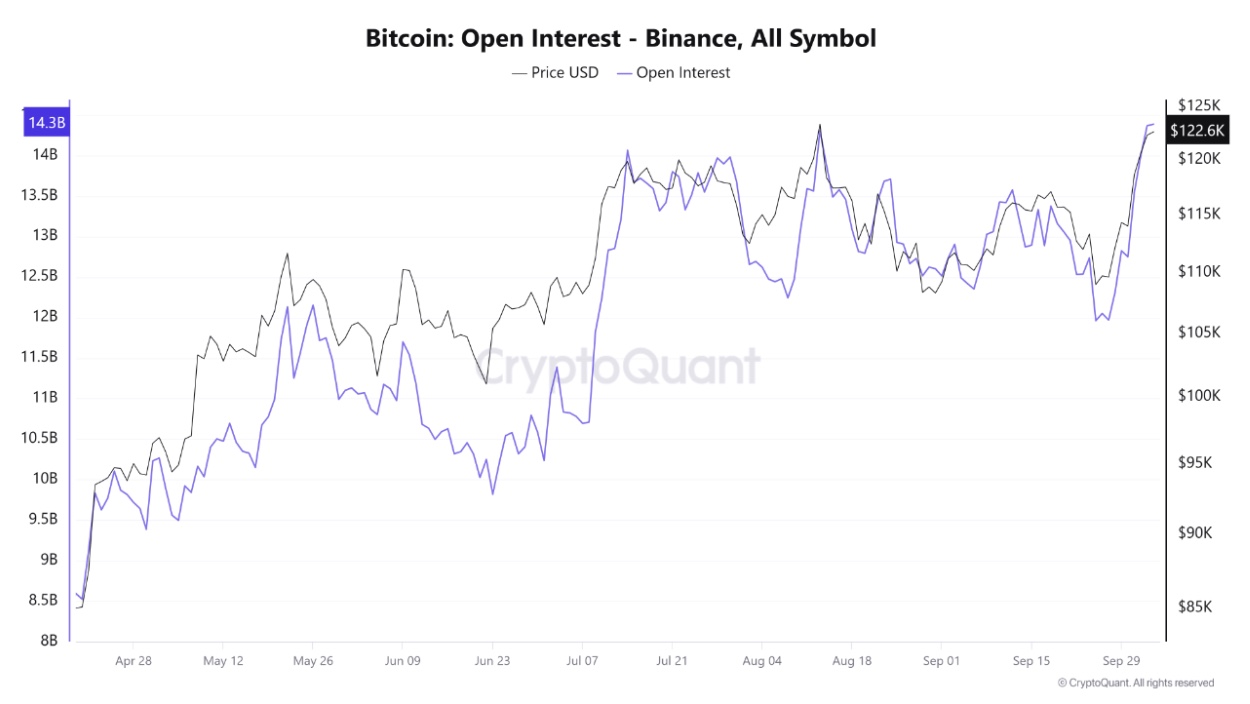

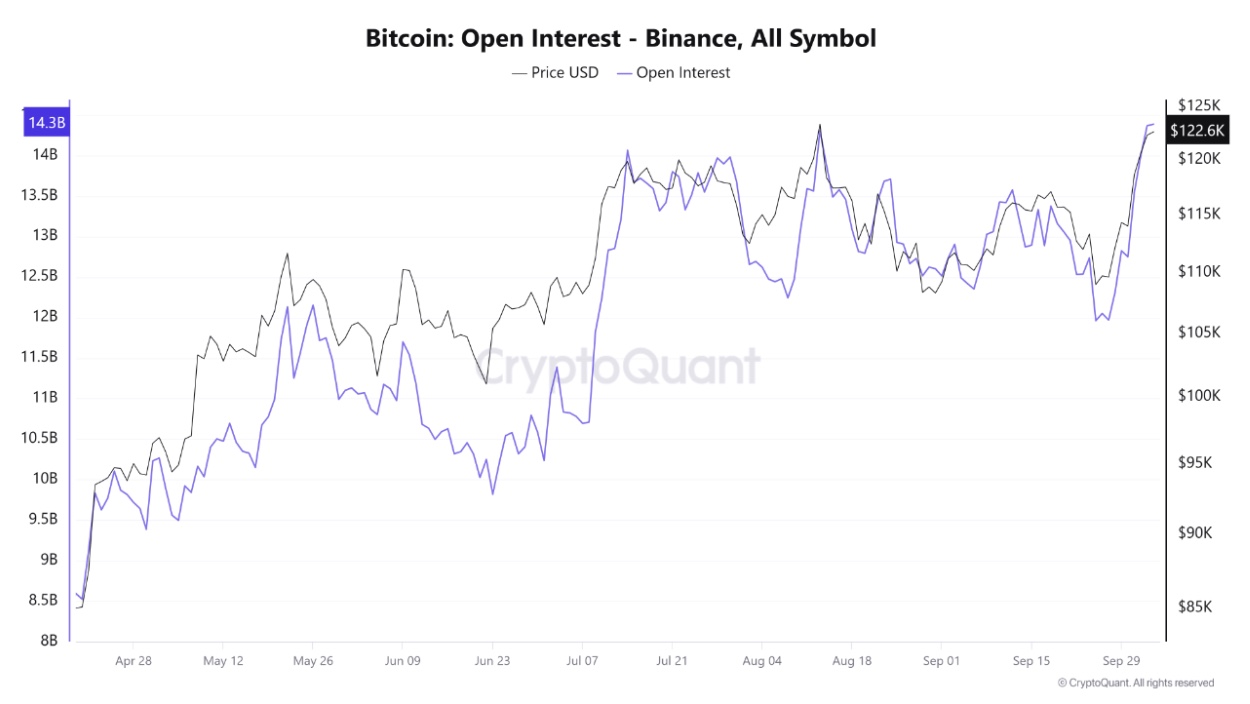

Bitcoin derivatives open interest has reached a record high of $14.37 billion on Binance, surpassing the previous peak of $14.31 billion set in August.

As per CryptoQuant, the rise in open interest, alongside price surge from $108K to $122K since late September, confirms that the rally is being driven by fresh inflows and new long positions, rather than simple short covering.

Bitcoin OI on Binance | Source: TradingView

However, analysts cautioned that if open interest remains high while prices drop, it could trigger a cascade of liquidations. For now, the structure remains healthy, with inflows and volume supporting the rally.

The post Bitcoin ETFs on Fire: 5-Day Inflow Wave Signals New Accumulation Phase appeared first on Coinspeaker.

Bitcoin ETFs on Fire: 5-Day Inflow Wave Signals New Accumulation Phase

Bitcoin is closing up on its all-time high of $124K as spot ETFs recorded five consecutive days of inflows, with over $985 million entering Bitcoin funds on October 3 alone.

Ethereum ETFs also joined the surge with $234 million in inflows, extending their own five-day streak. Meanwhile, ETH price broke above the $4,500 price level, up 12% in the past week.

On October 3, Bitcoin spot ETFs recorded total net inflows of $985 million, marking five consecutive days of net inflows. Ethereum spot ETFs saw total net inflows of $234 million, also extending their streak to five consecutive days.https://t.co/Hj2Gs49bWa pic.twitter.com/X0vbUoOL9w

— Wu Blockchain (@WuBlockchain) October 4, 2025

Bitcoin ETFs Fuel Institutional Accumulation

The surge in ETF inflows represents an increase in institutional demand following a brief cooling-off period in September. The consistent net inflows suggest large-scale investors are re-entering the market, taking advantage of the recent dip from $117K to $108.6K.

Swissblock analysts described this retracement as a “constructive reset, not capitulation,” noting that the move reflected system stress without structural weakness.

The move that took BTC from $117K down to $108.6K was a constructive reset, not capitulation.

It showed stress in the system, but not fragility.

Resets like these create opportunity. 🧵 pic.twitter.com/nWAv8WppRO

— Swissblock (@swissblock__) October 3, 2025

Analysts emphasized that the absorption of late-August selling clusters between $114K and $118K unlocked the path toward an all-time high (ATH) retest.

At press time, Bitcoin trades at $122K, just 1.6% shy of its record high of $124K, underscoring the intensity of the recent rebound.

According to Swissblock, long-term holders have reduced their selling intensity, a signal of easing supply pressure and early signs of accumulation. Historically, such patterns mark the beginning of new market rallies.

On-Chain Metrics Reflect Maturing Market

On-chain data from CryptoQuant shows that Bitcoin’s UTXO count has dropped to 166.6 million, its lowest since April 2024, marking an 11% decline since its early-2025 peak.

While the metric’s decline may seem negative at first glance, it actually points to network consolidation, whale accumulation, and reduced retail activity.

The drop in UTXO count coincides with a rise in Bitcoin’s price from $99K to $122K, indicating that long-term holders are increasingly storing coins rather than spending them.

Bitcoin UTXO count | Source: CryptoQuant

Fewer UTXOs typically signal reduced selling pressure, improved network efficiency, and a mature phase of market development.

Derivatives Data Highlights Speculative Confidence

Bitcoin derivatives open interest has reached a record high of $14.37 billion on Binance, surpassing the previous peak of $14.31 billion set in August.

As per CryptoQuant, the rise in open interest, alongside price surge from $108K to $122K since late September, confirms that the rally is being driven by fresh inflows and new long positions, rather than simple short covering.

Bitcoin OI on Binance | Source: TradingView

However, analysts cautioned that if open interest remains high while prices drop, it could trigger a cascade of liquidations. For now, the structure remains healthy, with inflows and volume supporting the rally.

The post Bitcoin ETFs on Fire: 5-Day Inflow Wave Signals New Accumulation Phase appeared first on Coinspeaker.