Solana Price Forecast: Indicators Point to Downside Risk Below $200

- Open Interest has dropped sharply, showing weak conviction and drying momentum for SOL.

- Short-term holders are on edge, with NUPL at 0.03—any small dip risks triggering panic selling.

- Technicals lean bearish; if $200 breaks, it could flip into resistance and deepen the slide.

Solana’s been under the gun lately, and it shows. Price action has softened, Open Interest is bleeding out, and short-term holders are getting twitchy. When confidence wobbles like this, volatility usually follows. The key question right now—can Solana defend $200, or is another leg down just waiting to play out?

Open Interest Signals Weak Momentum

One of the clearest red flags has been the sharp drop in Open Interest (OI). Futures OI tumbled in sync with SOL’s price through September, according to CoinGlass data. Instead of loading up, traders have been unwinding positions—never a good sign when you need conviction to push higher.

With thinner OI, momentum starts to dry up, and that puts more pressure on existing support. Unless fresh interest comes flooding back, the $200 level may not have the strength to hold for long.

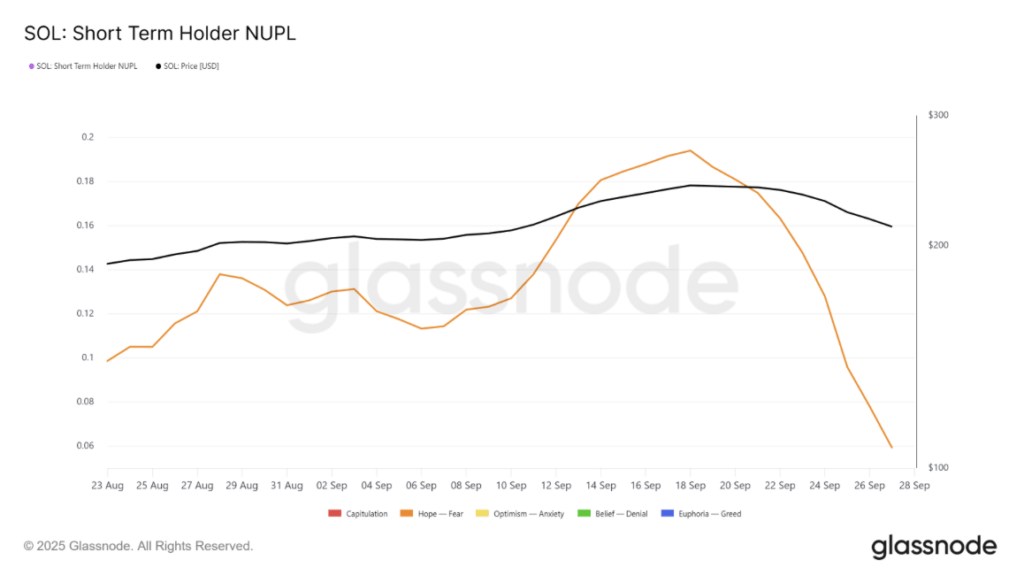

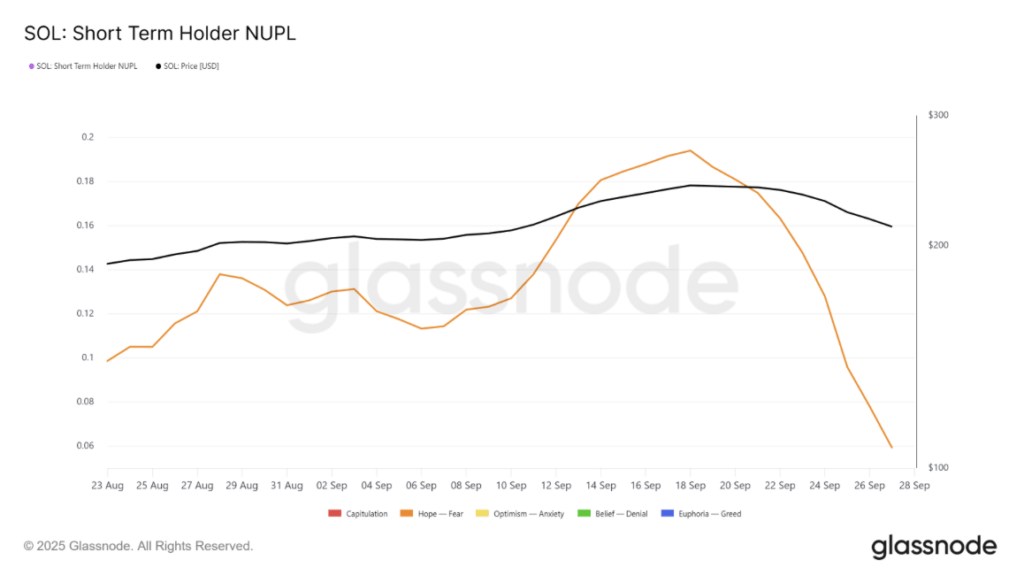

Short-Term Holders Show Signs of Fear

Glassnode data paints a nervous picture. The Short-Term Holder NUPL has slipped to just 0.03, putting SOL firmly in the “Hope–Fear” zone. In plain words: most recent buyers are either sitting at tiny profits or hovering around break-even.

That’s a dangerous setup, because even small dips could shove many into losses, sparking panic selling. When holders are on edge like this, corrections can turn sharper than expected as weak hands rush for the exit. Confidence is fragile, and the downside risk is still sitting on the table.

Technical Indicators Lean Bearish

At the time of writing, Solana was clinging to $200—but the indicators didn’t offer much comfort. RSI hovered just above oversold territory, the MACD stayed negative, and selling pressure still looked persistent.

The only bright spot, if you can call it that, was the CMF at +0.10. But even that wasn’t enough to counterbalance the broader selling trend. If bulls can’t step in quickly, there’s a real chance that $200 flips from support into resistance. For now, the threat of SOL sliding below $200 feels uncomfortably real.

The post Solana Price Forecast: Indicators Point to Downside Risk Below $200 first appeared on BlockNews.

Solana Price Forecast: Indicators Point to Downside Risk Below $200

- Open Interest has dropped sharply, showing weak conviction and drying momentum for SOL.

- Short-term holders are on edge, with NUPL at 0.03—any small dip risks triggering panic selling.

- Technicals lean bearish; if $200 breaks, it could flip into resistance and deepen the slide.

Solana’s been under the gun lately, and it shows. Price action has softened, Open Interest is bleeding out, and short-term holders are getting twitchy. When confidence wobbles like this, volatility usually follows. The key question right now—can Solana defend $200, or is another leg down just waiting to play out?

Open Interest Signals Weak Momentum

One of the clearest red flags has been the sharp drop in Open Interest (OI). Futures OI tumbled in sync with SOL’s price through September, according to CoinGlass data. Instead of loading up, traders have been unwinding positions—never a good sign when you need conviction to push higher.

With thinner OI, momentum starts to dry up, and that puts more pressure on existing support. Unless fresh interest comes flooding back, the $200 level may not have the strength to hold for long.

Short-Term Holders Show Signs of Fear

Glassnode data paints a nervous picture. The Short-Term Holder NUPL has slipped to just 0.03, putting SOL firmly in the “Hope–Fear” zone. In plain words: most recent buyers are either sitting at tiny profits or hovering around break-even.

That’s a dangerous setup, because even small dips could shove many into losses, sparking panic selling. When holders are on edge like this, corrections can turn sharper than expected as weak hands rush for the exit. Confidence is fragile, and the downside risk is still sitting on the table.

Technical Indicators Lean Bearish

At the time of writing, Solana was clinging to $200—but the indicators didn’t offer much comfort. RSI hovered just above oversold territory, the MACD stayed negative, and selling pressure still looked persistent.

The only bright spot, if you can call it that, was the CMF at +0.10. But even that wasn’t enough to counterbalance the broader selling trend. If bulls can’t step in quickly, there’s a real chance that $200 flips from support into resistance. For now, the threat of SOL sliding below $200 feels uncomfortably real.

The post Solana Price Forecast: Indicators Point to Downside Risk Below $200 first appeared on BlockNews.