The Best Crypto Cards For 2024

The post The Best Crypto Cards For 2024 appeared first on Coinpedia Fintech News

In the ever-evolving world of cryptocurrency, one thing is essential – how to use digital assets in the real world of finance? This is why Crypto Cards are becoming quite important, bridging the gap between the crypto sphere and traditional finance.

With recent developments in the crypto world, such as Binance discontinuing its crypto card services in the EEA region, creating a void in the European market. Many new and existing card providers have stepped in to seize the opportunity.

As we begin the year 2024, let’s explore some of the top crypto card providers, including the new contenders. Moreover, If you were a Binance Card user, this guide may also help you find the perfect replacement.

In this guide, we will thoroughly explore some of the most popular and eagerly anticipated crypto cards. We would compare various aspects of these cards including cashback rewards, supported assets, fee structures, and their pros and cons. So, let’s dive in!

What is a Crypto Card?

Crypto cards, also known as crypto debit cards or Bitcoin cards, are designed to allow users to make everyday purchases using their cryptocurrency holdings.

Every time a user pays using a Crypto card, their cryptocurrency holdings (such as BTC, ETH, USDT) are converted into fiat currency (like USD to EUR) at the time of a transaction.

With these crypto cards, you can make online or in-person purchases and access cash from ATMs, all using your cryptocurrency. No longer do you need to find merchants or ATMs that accept digital assets; you can simply pay with your crypto card with the crypto of your choice, which will be converted seamlessly at the time of your purchase.

These crypto cards aren’t just for crypto enthusiasts, they’re also perfectly suitable for everyday shoppers. Most of these crypto cards function as rewards cards (just like traditional credit cards), enabling you to earn cashback rewards on your purchases.

How to Choose the Best Crypto Card?

When deciding on the most suitable crypto card, there are numerous factors to take into account.

The initial aspect to examine is the range of supported cryptocurrencies, which affords users greater flexibility in spending their preferred digital assets without the necessity of converting them into more widely accepted currencies.

The second most important to look at is the cashback rewards. Most of the crypto cards offer cashback rewards on purchases, providing users with incentives to use the card for their crypto spending. Typically, these rewards are distributed in the form of cryptocurrencies.

You should also pay extra attention to the fee structure. Different cards have varying fees, including issuance fees, transaction fees, crypto conversion fees, and ATM withdrawal fees. Users should carefully review these fees before selecting a card.

Best Crypto Cards – Quick Comparison

| Crypto Card | Cashback | Crypto | Transaction Fees |

Nexo Card | Up to 2% (on credit card mode) | 62 | 0.5% foreign transaction fee |

Hi Debit Card | Up to 12% | 3 | 1% to 2% foreign transaction fee 1.5% withdrawal fees (above limits) |

ByBit Card | Up to 10% (Requires a 30-day trade volume of 10 million USD) | 5 | 0.5% + Mastercard FX rate 2% Crypto conversion fee 2% ATM fee (above limits) |

Choise.com Card | Nill | 30 | 2.5% conversion fee 2.%% Crypto conversion fees €2.99 Monthly fees |

Crypto.com | Up to 5% (requires staking of €350k in CRO tokens) | 22 | 2% (non EUR) 1% top-up fee 2% ATM fee (above limits) |

CryptoWallet Card | Up to 3% | 800+ | 0.8% transaction fee No conversion fee No monthly card fees |

Top Crypto Card of 2023

Nexo Card

The Nexo Card is a cryptocurrency card offered by Nexo, a blockchain-based financial services platform. This card functions a bit differently than most other crypto cards. The Nexo crypto card is a “dual card” that can be switched between a credit card and a debit card.

When you switch it to crypto credit card mode, you can spend fiat money using your cryptocurrency as collateral, without actually selling your cryptocurrencies. At the end of the billing period, you can settle your Nexo card balance, much like you would with a traditional credit card.

You earn crypto cashback when you use the Nexo card in credit card mode. You can choose between the NEXO token and Bitcoin to earn 2% or 0.5% cashback, respectively.

When you switch it to crypto debit card mode, you spend your cryptocurrencies directly from your Nexo account. You don’t earn any cashback in debit card mode; instead, you earn interest on your crypto balance. This interest can be either 9% in NEXO tokens or 7% in fiat currency.

Transaction fee: No transaction fee

Other fee: 0.5% foreign transaction fee

Cashback: Up to 2%

Supported cryptos: 62

Monthly/annual fee: Nil

Pros  | Cons  |

| Switch between credit card and debit card mode Earn interest on debit card mode | Only 0.5% cashback if you choose BTC No cash back on debit card mode |

Choise.com Card

The Choise.com card is linked to your wallet in the Choise.com App, allowing you to store and spend 30 cryptocurrencies, including BTC, ETH, and more. The card does not offer any cashback on card purchases. The card offers zero transaction fee but crypto conversion fees may apply.

TheChoise.com card operates as a pre-paid card, available in both plastic and virtual formats. Users can top up their card with cryptocurrency directly from their wallet, and the card’s balance will be replenished with funds in EUR, making it ready for spending.

Users have the choice of loading their card with €299 every month, which exempts them from monthly maintenance fees. Alternatively, if they choose not to load this specific amount, they can opt for a monthly maintenance fee of €2.99.

Transaction fee: Nil

Cashback: Nill

Supported cryptos: 30

Monthly/annual fee: €2.99

Pros  | Cons  |

| Zero transaction fee | No cashback on card purchases €2.99 Monthly fees |

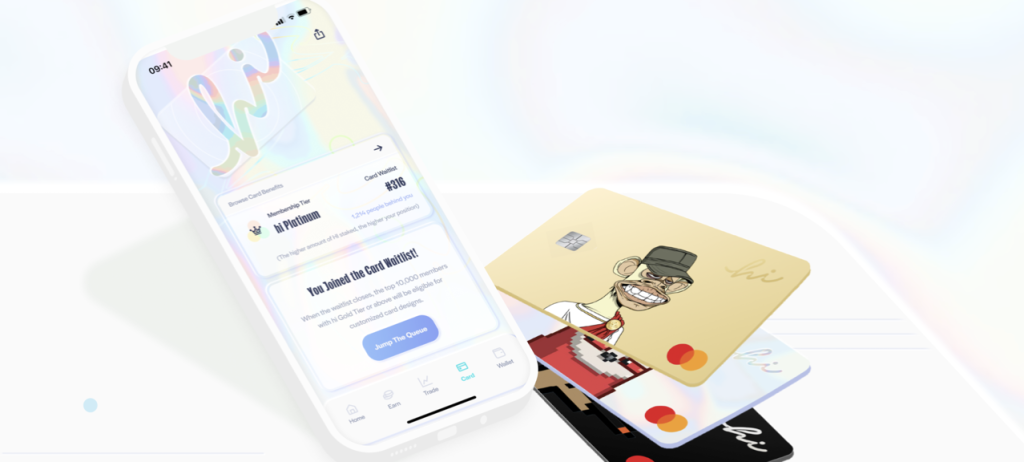

Hi Debit Card

The Hi Debit card is an innovative upcoming cryptocurrency card that combines the functionality of a regular Debit Mastercard with support for both cryptocurrencies and traditional fiat currencies.

Hi Debit Card allows users to spend Bitcoin (BTC), Ethereum (ETH) and Tether (USDT). This means you can use this card to make payments with both crypto and fiat at over 90 million merchants worldwide that accept Chip and PIN or Contactless payments, whether in physical stores or online.

In partnership with Mastercard, the Hi.com card offers a unique feature – the world’s first Debit Card with NFT (Non-Fungible Token) avatar customization. Users can personalise their crypto card with NFT avatars, including popular characters like Punks, Apes, and Goblins.

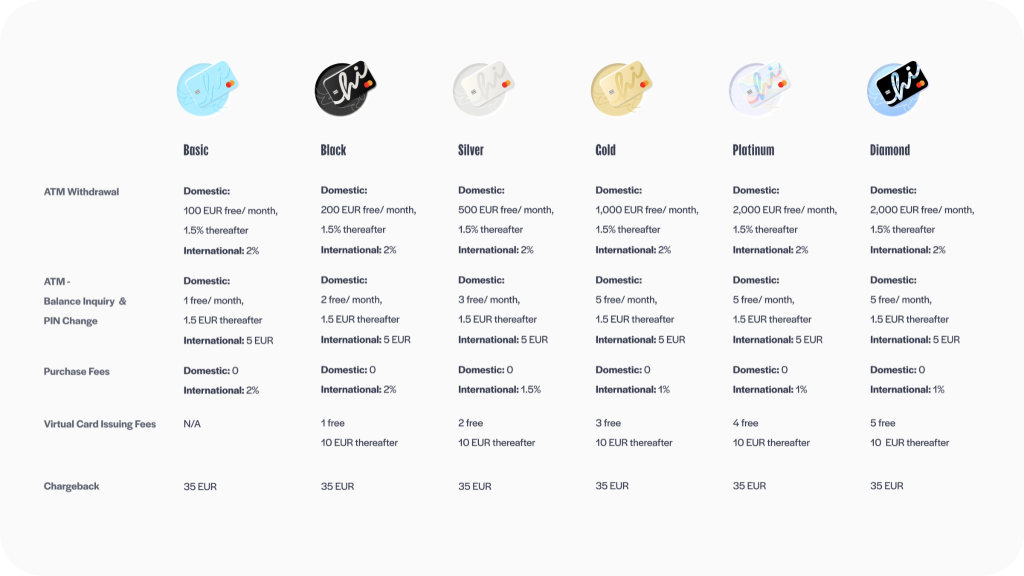

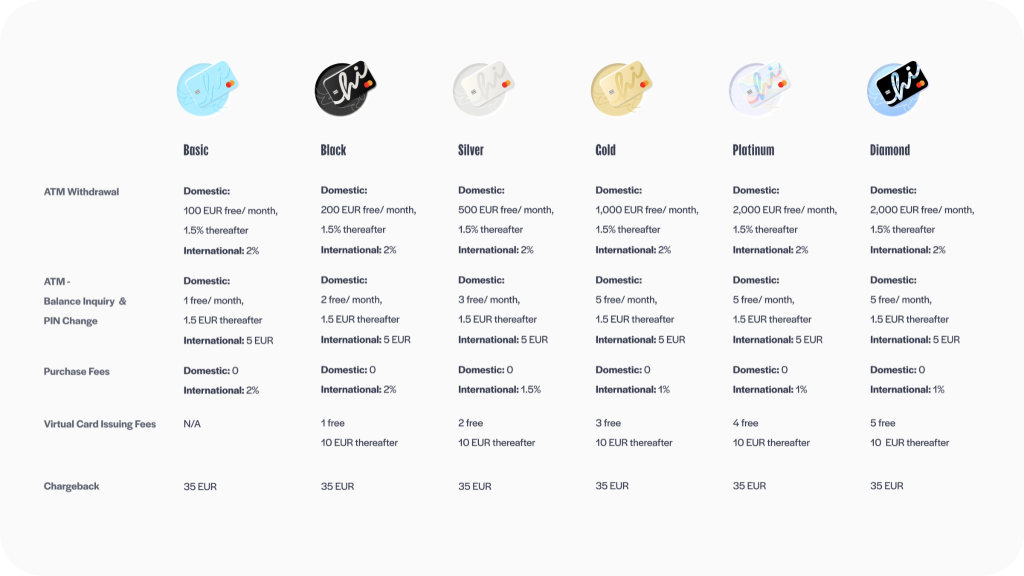

Hi Debit Card does not charge any transaction fee on domestic purchases (in EUR and GBP). However, please note that there are daily, monthly, and annual spending limits associated with the crypto card. For international purchases, a fee of up to 2% is charged on the total spent amount.

The card does not offer high withdrawal limits – the basic card only allows 100 EUR per month, while the top-tier card allows only 2000 EUR per month. There is a fee of 1.5% if you exceed the monthly withdrawal limits. Moreover, A fee of 2% is charged on international withdrawals (regardless of the monthly limits).

Depending on your card tier, users can receive between 1% to 5% in cashback rewards when making payments with either fiat currency or other cryptocurrencies. Please note that certain transactions will be illegible for the cashback regards. More info here.

Transaction fee: Up to 2% on international transactions

Other fees: 1.5% withdrawal fee (above limits)

Cashback: Up to 12%

Supported cryptos: 3

Monthly/annual fee: No

Pros  | Cons  |

| Card customisation options available Up to 12% cashback | Only 3 cryptocurrencies supported Low withdrawal limits 2% international transaction fee |

ByBit Card

The ByBit Card is a crypto debit card offered by ByBit crypto exchange. The Bybit Card does not have its own dedicated wallet balance. instead, it uses the balance (fiat and crypto) available in your Funding account on the Bybit exchange.

To enjoy the maximum 10% cashback, you would need a “VIP supreme” account that requires a 30-day trade volume of 10 million USD on the ByBit platform.

Even to access 1% cashback, you would need “VIP 1” status that requires 50,000 USD in asset balance.

It’s worth noting that the ByBit Card offers support to only 5 crypto BTC, ETH, XRP, USDT and USDC and 2 fiat currency USD and EUR. The card also does

Transaction fee: 0.5% non-EUR transactions(plus Mastercard FX rate)

Other fee: 2% Crypto conversion fee, 2% ATM fee (above limits)

Cashback: Up to 10%

Supported cryptos: 5

Card issue: 5 EUR physical card

Monthly/annual fee: Nil

Pros  | Cons  |

| Support both crypto and fiat currency | Only 5 cryptos supported One free ATM withdrawal per month (of max 200 EUR) thereafter 2% ATM fee Huge asset balance requirements to enjoy cashback |

Crypto.com Card

The Crypto.com Card is a cryptocurrency debit card issued by Crypto.com, a well-known cryptocurrency platform. The Crypto.com Card allows users to load and spend on various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and the native Crypto.com Coin (CRO), among others.

The Crypto.com Card is available in different tiers, each offering various benefits and rewards. The higher the card tier, the more significant the benefits, including higher cashback rates and additional perks such as free Spotify, Netflix, or Amazon Prime subscriptions etc.

With the Crypto.com Visa Card, you can earn cashback in the form of the Crypto.com Coin (CRO) which can range from 1% to 5%, depending on the card tier. However, to enjoy the maximum 5% cashback, it’s necessary to lock the equivalent of €350,000 in CRO tokens for a period of six months.

Transaction fee: 2% non-EUR transaction

Other fees: 1% top-up fee, 2% ATM Withdrawal fee (above ATM limits)

Cashback: Up to 5%

Supported cryptos: 22

Monthly/annual fee: Nil

Pros  | Cons  |

| Get additional perks (Spotify, Netflix, Amazon Prime, etc) | 1% card top-up fee Only 22 cryptocurrencies To enjoy 5% cashback you need to lock CRO worth €350,000 for 6 months |

CryptoWallet.com

CryptoWallet.com Card allows you to spend over 800 cryptocurrencies directly from your wallet. Each time you make a payment using the CW card, your cryptocurrencies are seamlessly converted to fiat currency at the moment of the transaction. Within the app, you have the freedom to select your preferred cryptocurrency for your payments.

The CryptoWallet.com card offers several advantages, including the lowest transaction fees in Europe and the largest selection of supported crypto compared to all the other crypto cards currently offered.

Furthermore, users have the opportunity to receive cashback rewards of up to 3%, distributed in the form of the native $SPEND token. This crypto card offers a convenient and cost-efficient solution for users to access and utilize their cryptocurrency holdings.

Transaction fee: 0.8%

Crypto conversions fee: Nil

Cashback: Up to 3%

Supported cryptos: 800+

Monthly/annual fee: Nil

Pros  | Cons  |

| 0.8% transaction fee (lowest) 800+ supported cryptos (highest) Up to 3% cashback Zero monthly fee | Launching in Q1 2024 |

Bottom Line

After evaluating several popular and upcoming crypto cards, each with its distinct features and benefits, the CryptoWallet.com Card emerges as the top pick for crypto enthusiasts and everyday shoppers.

The CryptoWallet.com Card offers the lowest transaction fee in Europe, a mere 0.8%, and it does not impose any hidden or crypto conversion fees. While certain crypto cards like the Bybit card or the Crypto.com card may advertise zero transaction fees (within Europe), it’s important to be aware that they may actually involve concealed fees, markups on crypto conversion, or top-up fees, which could potentially reach as high as 3%.

Furthermore, The CryptoWallet.com Card takes the lead with support for over 800 cryptocurrencies, providing users with unmatched flexibility in managing and spending their digital assets. It offers a broader range of supported assets than any other crypto card on the market.

Additionally, the CryptoWallet.com Card provides cashback rewards of up to 3%, distributed in the form of the native $SPEND token.

It’s worth noting that many other crypto cards, like the Crypto.com card, may offer high cashback rates but come with substantial requirements. For instance, to access up to 5% cashback with Crypto.com, users are required to lock the equivalent of €350,000 in CRO tokens for a period of six months. Similarly, the Bybit card offers a lucrative cashback of up to 10%, but it mandates significant asset balances, such as a 30-day trade volume of 10 million USD to access the 10% cashback.

In a competitive crypto landscape, the CryptoWallet.com Card excels in terms of convenience, cost-efficiency, and broad cryptocurrency support, making it a standout choice for those seeking an ideal crypto card in 2024.

The Best Crypto Cards For 2024

The post The Best Crypto Cards For 2024 appeared first on Coinpedia Fintech News

In the ever-evolving world of cryptocurrency, one thing is essential – how to use digital assets in the real world of finance? This is why Crypto Cards are becoming quite important, bridging the gap between the crypto sphere and traditional finance.

With recent developments in the crypto world, such as Binance discontinuing its crypto card services in the EEA region, creating a void in the European market. Many new and existing card providers have stepped in to seize the opportunity.

As we begin the year 2024, let’s explore some of the top crypto card providers, including the new contenders. Moreover, If you were a Binance Card user, this guide may also help you find the perfect replacement.

In this guide, we will thoroughly explore some of the most popular and eagerly anticipated crypto cards. We would compare various aspects of these cards including cashback rewards, supported assets, fee structures, and their pros and cons. So, let’s dive in!

What is a Crypto Card?

Crypto cards, also known as crypto debit cards or Bitcoin cards, are designed to allow users to make everyday purchases using their cryptocurrency holdings.

Every time a user pays using a Crypto card, their cryptocurrency holdings (such as BTC, ETH, USDT) are converted into fiat currency (like USD to EUR) at the time of a transaction.

With these crypto cards, you can make online or in-person purchases and access cash from ATMs, all using your cryptocurrency. No longer do you need to find merchants or ATMs that accept digital assets; you can simply pay with your crypto card with the crypto of your choice, which will be converted seamlessly at the time of your purchase.

These crypto cards aren’t just for crypto enthusiasts, they’re also perfectly suitable for everyday shoppers. Most of these crypto cards function as rewards cards (just like traditional credit cards), enabling you to earn cashback rewards on your purchases.

How to Choose the Best Crypto Card?

When deciding on the most suitable crypto card, there are numerous factors to take into account.

The initial aspect to examine is the range of supported cryptocurrencies, which affords users greater flexibility in spending their preferred digital assets without the necessity of converting them into more widely accepted currencies.

The second most important to look at is the cashback rewards. Most of the crypto cards offer cashback rewards on purchases, providing users with incentives to use the card for their crypto spending. Typically, these rewards are distributed in the form of cryptocurrencies.

You should also pay extra attention to the fee structure. Different cards have varying fees, including issuance fees, transaction fees, crypto conversion fees, and ATM withdrawal fees. Users should carefully review these fees before selecting a card.

Best Crypto Cards – Quick Comparison

| Crypto Card | Cashback | Crypto | Transaction Fees |

Nexo Card | Up to 2% (on credit card mode) | 62 | 0.5% foreign transaction fee |

Hi Debit Card | Up to 12% | 3 | 1% to 2% foreign transaction fee 1.5% withdrawal fees (above limits) |

ByBit Card | Up to 10% (Requires a 30-day trade volume of 10 million USD) | 5 | 0.5% + Mastercard FX rate 2% Crypto conversion fee 2% ATM fee (above limits) |

Choise.com Card | Nill | 30 | 2.5% conversion fee 2.%% Crypto conversion fees €2.99 Monthly fees |

Crypto.com | Up to 5% (requires staking of €350k in CRO tokens) | 22 | 2% (non EUR) 1% top-up fee 2% ATM fee (above limits) |

CryptoWallet Card | Up to 3% | 800+ | 0.8% transaction fee No conversion fee No monthly card fees |

Top Crypto Card of 2023

Nexo Card

The Nexo Card is a cryptocurrency card offered by Nexo, a blockchain-based financial services platform. This card functions a bit differently than most other crypto cards. The Nexo crypto card is a “dual card” that can be switched between a credit card and a debit card.

When you switch it to crypto credit card mode, you can spend fiat money using your cryptocurrency as collateral, without actually selling your cryptocurrencies. At the end of the billing period, you can settle your Nexo card balance, much like you would with a traditional credit card.

You earn crypto cashback when you use the Nexo card in credit card mode. You can choose between the NEXO token and Bitcoin to earn 2% or 0.5% cashback, respectively.

When you switch it to crypto debit card mode, you spend your cryptocurrencies directly from your Nexo account. You don’t earn any cashback in debit card mode; instead, you earn interest on your crypto balance. This interest can be either 9% in NEXO tokens or 7% in fiat currency.

Transaction fee: No transaction fee

Other fee: 0.5% foreign transaction fee

Cashback: Up to 2%

Supported cryptos: 62

Monthly/annual fee: Nil

Pros  | Cons  |

| Switch between credit card and debit card mode Earn interest on debit card mode | Only 0.5% cashback if you choose BTC No cash back on debit card mode |

Choise.com Card

The Choise.com card is linked to your wallet in the Choise.com App, allowing you to store and spend 30 cryptocurrencies, including BTC, ETH, and more. The card does not offer any cashback on card purchases. The card offers zero transaction fee but crypto conversion fees may apply.

TheChoise.com card operates as a pre-paid card, available in both plastic and virtual formats. Users can top up their card with cryptocurrency directly from their wallet, and the card’s balance will be replenished with funds in EUR, making it ready for spending.

Users have the choice of loading their card with €299 every month, which exempts them from monthly maintenance fees. Alternatively, if they choose not to load this specific amount, they can opt for a monthly maintenance fee of €2.99.

Transaction fee: Nil

Cashback: Nill

Supported cryptos: 30

Monthly/annual fee: €2.99

Pros  | Cons  |

| Zero transaction fee | No cashback on card purchases €2.99 Monthly fees |

Hi Debit Card

The Hi Debit card is an innovative upcoming cryptocurrency card that combines the functionality of a regular Debit Mastercard with support for both cryptocurrencies and traditional fiat currencies.

Hi Debit Card allows users to spend Bitcoin (BTC), Ethereum (ETH) and Tether (USDT). This means you can use this card to make payments with both crypto and fiat at over 90 million merchants worldwide that accept Chip and PIN or Contactless payments, whether in physical stores or online.

In partnership with Mastercard, the Hi.com card offers a unique feature – the world’s first Debit Card with NFT (Non-Fungible Token) avatar customization. Users can personalise their crypto card with NFT avatars, including popular characters like Punks, Apes, and Goblins.

Hi Debit Card does not charge any transaction fee on domestic purchases (in EUR and GBP). However, please note that there are daily, monthly, and annual spending limits associated with the crypto card. For international purchases, a fee of up to 2% is charged on the total spent amount.

The card does not offer high withdrawal limits – the basic card only allows 100 EUR per month, while the top-tier card allows only 2000 EUR per month. There is a fee of 1.5% if you exceed the monthly withdrawal limits. Moreover, A fee of 2% is charged on international withdrawals (regardless of the monthly limits).

Depending on your card tier, users can receive between 1% to 5% in cashback rewards when making payments with either fiat currency or other cryptocurrencies. Please note that certain transactions will be illegible for the cashback regards. More info here.

Transaction fee: Up to 2% on international transactions

Other fees: 1.5% withdrawal fee (above limits)

Cashback: Up to 12%

Supported cryptos: 3

Monthly/annual fee: No

Pros  | Cons  |

| Card customisation options available Up to 12% cashback | Only 3 cryptocurrencies supported Low withdrawal limits 2% international transaction fee |

ByBit Card

The ByBit Card is a crypto debit card offered by ByBit crypto exchange. The Bybit Card does not have its own dedicated wallet balance. instead, it uses the balance (fiat and crypto) available in your Funding account on the Bybit exchange.

To enjoy the maximum 10% cashback, you would need a “VIP supreme” account that requires a 30-day trade volume of 10 million USD on the ByBit platform.

Even to access 1% cashback, you would need “VIP 1” status that requires 50,000 USD in asset balance.

It’s worth noting that the ByBit Card offers support to only 5 crypto BTC, ETH, XRP, USDT and USDC and 2 fiat currency USD and EUR. The card also does

Transaction fee: 0.5% non-EUR transactions(plus Mastercard FX rate)

Other fee: 2% Crypto conversion fee, 2% ATM fee (above limits)

Cashback: Up to 10%

Supported cryptos: 5

Card issue: 5 EUR physical card

Monthly/annual fee: Nil

Pros  | Cons  |

| Support both crypto and fiat currency | Only 5 cryptos supported One free ATM withdrawal per month (of max 200 EUR) thereafter 2% ATM fee Huge asset balance requirements to enjoy cashback |

Crypto.com Card

The Crypto.com Card is a cryptocurrency debit card issued by Crypto.com, a well-known cryptocurrency platform. The Crypto.com Card allows users to load and spend on various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and the native Crypto.com Coin (CRO), among others.

The Crypto.com Card is available in different tiers, each offering various benefits and rewards. The higher the card tier, the more significant the benefits, including higher cashback rates and additional perks such as free Spotify, Netflix, or Amazon Prime subscriptions etc.

With the Crypto.com Visa Card, you can earn cashback in the form of the Crypto.com Coin (CRO) which can range from 1% to 5%, depending on the card tier. However, to enjoy the maximum 5% cashback, it’s necessary to lock the equivalent of €350,000 in CRO tokens for a period of six months.

Transaction fee: 2% non-EUR transaction

Other fees: 1% top-up fee, 2% ATM Withdrawal fee (above ATM limits)

Cashback: Up to 5%

Supported cryptos: 22

Monthly/annual fee: Nil

Pros  | Cons  |

| Get additional perks (Spotify, Netflix, Amazon Prime, etc) | 1% card top-up fee Only 22 cryptocurrencies To enjoy 5% cashback you need to lock CRO worth €350,000 for 6 months |

CryptoWallet.com

CryptoWallet.com Card allows you to spend over 800 cryptocurrencies directly from your wallet. Each time you make a payment using the CW card, your cryptocurrencies are seamlessly converted to fiat currency at the moment of the transaction. Within the app, you have the freedom to select your preferred cryptocurrency for your payments.

The CryptoWallet.com card offers several advantages, including the lowest transaction fees in Europe and the largest selection of supported crypto compared to all the other crypto cards currently offered.

Furthermore, users have the opportunity to receive cashback rewards of up to 3%, distributed in the form of the native $SPEND token. This crypto card offers a convenient and cost-efficient solution for users to access and utilize their cryptocurrency holdings.

Transaction fee: 0.8%

Crypto conversions fee: Nil

Cashback: Up to 3%

Supported cryptos: 800+

Monthly/annual fee: Nil

Pros  | Cons  |

| 0.8% transaction fee (lowest) 800+ supported cryptos (highest) Up to 3% cashback Zero monthly fee | Launching in Q1 2024 |

Bottom Line

After evaluating several popular and upcoming crypto cards, each with its distinct features and benefits, the CryptoWallet.com Card emerges as the top pick for crypto enthusiasts and everyday shoppers.

The CryptoWallet.com Card offers the lowest transaction fee in Europe, a mere 0.8%, and it does not impose any hidden or crypto conversion fees. While certain crypto cards like the Bybit card or the Crypto.com card may advertise zero transaction fees (within Europe), it’s important to be aware that they may actually involve concealed fees, markups on crypto conversion, or top-up fees, which could potentially reach as high as 3%.

Furthermore, The CryptoWallet.com Card takes the lead with support for over 800 cryptocurrencies, providing users with unmatched flexibility in managing and spending their digital assets. It offers a broader range of supported assets than any other crypto card on the market.

Additionally, the CryptoWallet.com Card provides cashback rewards of up to 3%, distributed in the form of the native $SPEND token.

It’s worth noting that many other crypto cards, like the Crypto.com card, may offer high cashback rates but come with substantial requirements. For instance, to access up to 5% cashback with Crypto.com, users are required to lock the equivalent of €350,000 in CRO tokens for a period of six months. Similarly, the Bybit card offers a lucrative cashback of up to 10%, but it mandates significant asset balances, such as a 30-day trade volume of 10 million USD to access the 10% cashback.

In a competitive crypto landscape, the CryptoWallet.com Card excels in terms of convenience, cost-efficiency, and broad cryptocurrency support, making it a standout choice for those seeking an ideal crypto card in 2024.