How Bitcoin correlates with traditional assets in the ETF age

The integration of Bitcoin into mainstream markets took a significant leap forward with the SEC’s approval to the first spot Bitcoin ETF in the U.S. This benchmark event shows the necessity of understanding its interaction with conventional assets, especially for the traditional investor looking to diversify their portfolios.

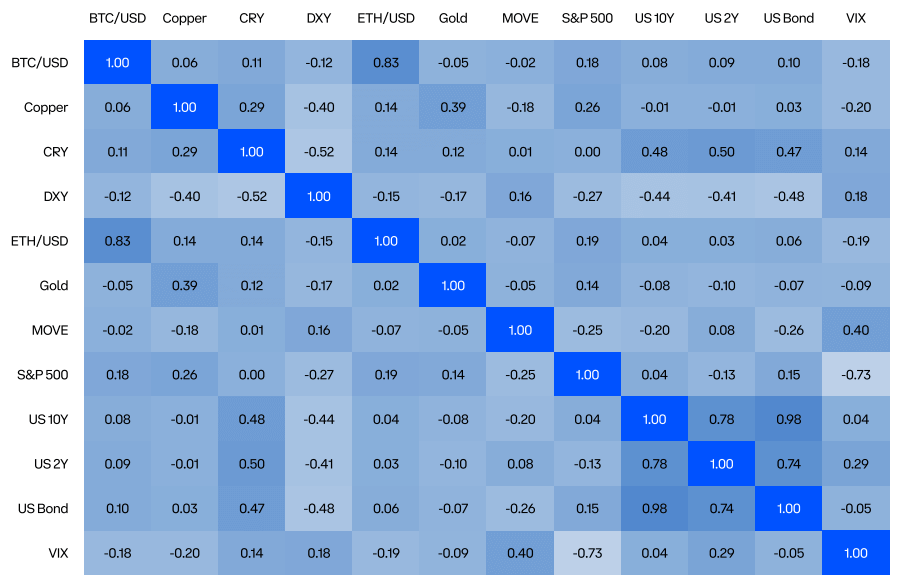

Correlation coefficients, the statistical measures reflecting the extent to which two securities move in relation to each other, lie at the heart of this understanding. Glassnode’s latest report, a collaboration with Coinbase Institutional, provides a robust introduction to crypto market fundamentals for institutional investors, including the correlation between Bitcoin and a spectrum of traditional assets throughout 2023, such as the S&P 500, copper, and the VIX.

Bitcoin’s relationship with Ethereum is central to the crypto market. The two assets showed a strong positive correlation of 0.83 throughout 2023, indicating a parallel response to market movement. This confirms the long-known sentiment that when BTC thrives or falters, Ethereum is likely to follow suit.

In contrast, Bitcoin’s correlation with commodities like copper remains relatively muted, signaling an independence that suggests a potential hedge against movements in the commodities market. However, these modest correlation coefficients, hovering around 0.06 to 0.10, also imply that BTC does not serve as a direct proxy for commodities within investment portfolios.

Equity markets show only a marginally higher correlation to Bitcoin. With coefficients of 0.18, BTC price movements are only slightly in step with the broader stock market, suggesting that Bitcoin may offer diversification benefits for investors holding traditional stock portfolios.

The inverse relationship between BTC and the DXY, at -0.12, reveals a nuanced narrative. As the dollar’s value climbs, Bitcoin’s value in USD terms tends to decline, and vice versa. Furthermore, the VIX, known as the market’s “fear gauge,” inversely correlates with BTC at -0.18. This negative correlation with market volatility indicates that Bitcoin does not necessarily follow the panic or greed that grips traditional markets.

Turning to the bond market, Bitcoin’s correlations with long-term Treasury bonds (U.S. 10Y and U.S. 2Y) are positive but weak and slightly more pronounced, with the U.S. Bond index at 0.10. While not indicative of a strong relationship, these correlations highlight Bitcoin’s complex interplay with interest rates and investor sentiment in the fixed-income market.

The overwhelmingly inverse correlation BTC displays with traditional assets becomes particularly compelling in a market with a growing spot ETF trading volume. It can potentially lure more institutional investors towards Bitcoin, offering them a regulated and familiar avenue to engage with a non-traditional asset.

The post How Bitcoin correlates with traditional assets in the ETF age appeared first on CryptoSlate.

How Bitcoin correlates with traditional assets in the ETF age

The integration of Bitcoin into mainstream markets took a significant leap forward with the SEC’s approval to the first spot Bitcoin ETF in the U.S. This benchmark event shows the necessity of understanding its interaction with conventional assets, especially for the traditional investor looking to diversify their portfolios.

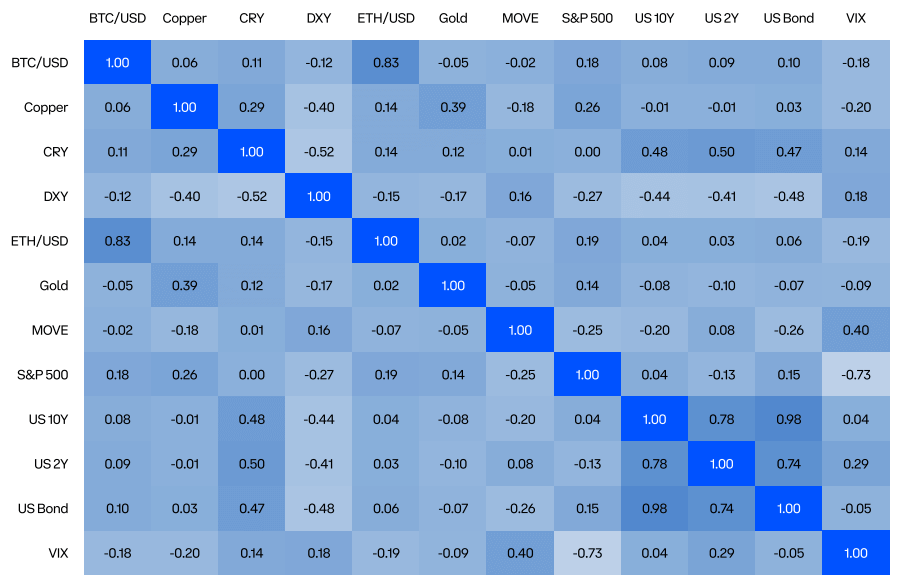

Correlation coefficients, the statistical measures reflecting the extent to which two securities move in relation to each other, lie at the heart of this understanding. Glassnode’s latest report, a collaboration with Coinbase Institutional, provides a robust introduction to crypto market fundamentals for institutional investors, including the correlation between Bitcoin and a spectrum of traditional assets throughout 2023, such as the S&P 500, copper, and the VIX.

Bitcoin’s relationship with Ethereum is central to the crypto market. The two assets showed a strong positive correlation of 0.83 throughout 2023, indicating a parallel response to market movement. This confirms the long-known sentiment that when BTC thrives or falters, Ethereum is likely to follow suit.

In contrast, Bitcoin’s correlation with commodities like copper remains relatively muted, signaling an independence that suggests a potential hedge against movements in the commodities market. However, these modest correlation coefficients, hovering around 0.06 to 0.10, also imply that BTC does not serve as a direct proxy for commodities within investment portfolios.

Equity markets show only a marginally higher correlation to Bitcoin. With coefficients of 0.18, BTC price movements are only slightly in step with the broader stock market, suggesting that Bitcoin may offer diversification benefits for investors holding traditional stock portfolios.

The inverse relationship between BTC and the DXY, at -0.12, reveals a nuanced narrative. As the dollar’s value climbs, Bitcoin’s value in USD terms tends to decline, and vice versa. Furthermore, the VIX, known as the market’s “fear gauge,” inversely correlates with BTC at -0.18. This negative correlation with market volatility indicates that Bitcoin does not necessarily follow the panic or greed that grips traditional markets.

Turning to the bond market, Bitcoin’s correlations with long-term Treasury bonds (U.S. 10Y and U.S. 2Y) are positive but weak and slightly more pronounced, with the U.S. Bond index at 0.10. While not indicative of a strong relationship, these correlations highlight Bitcoin’s complex interplay with interest rates and investor sentiment in the fixed-income market.

The overwhelmingly inverse correlation BTC displays with traditional assets becomes particularly compelling in a market with a growing spot ETF trading volume. It can potentially lure more institutional investors towards Bitcoin, offering them a regulated and familiar avenue to engage with a non-traditional asset.

The post How Bitcoin correlates with traditional assets in the ETF age appeared first on CryptoSlate.