XRP’s Potential Breakout Fueled by VivoPower’s $100M Ripple Bet

- VivoPower invests $100M in Ripple equity, indirectly holding ~211M XRP worth $696M.

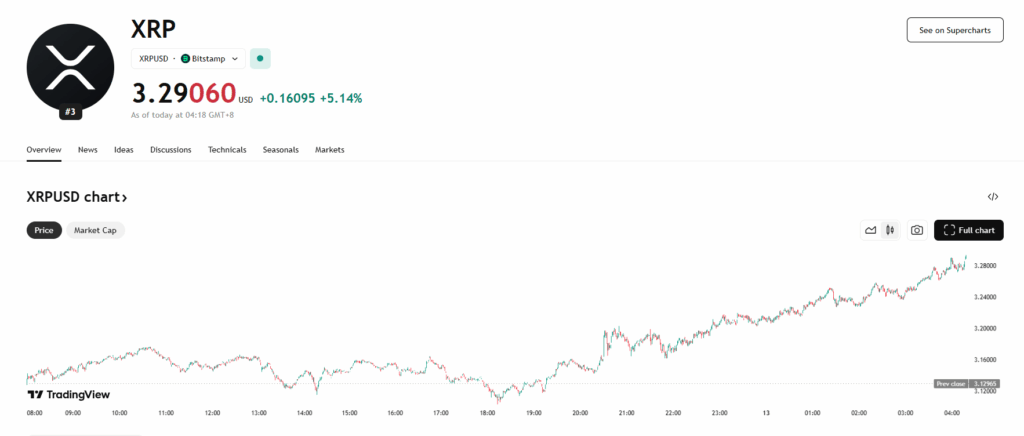

- Analysts spot bullish flag breakouts on XRP charts, with targets of $11–$15 if resistance breaks.

- Move positions VivoPower ahead of potential Ripple ETF growth, signaling deeper institutional adoption.

The buzz around XRP’s price surge has picked up serious momentum after VivoPower International revealed a landmark $100 million investment in Ripple shares. This is a historic move, marking the first time a U.S.-listed company has purchased Ripple equity—giving institutional investors a unique, indirect way to gain XRP exposure. VivoPower’s stake currently represents roughly 211 million XRP, valued near $696 million, positioning it as a significant whale player in the ecosystem.

Technical Signals Pointing to a Major XRP Move

Multiple high-profile analysts are calling attention to strong breakout signals forming across XRP’s weekly charts. Technical setups, including bullish flag formations, are pointing to potential price targets in the $11–$15 range if consolidation resistance is finally broken. Chart expert Ali Charts has emphasized that XRP’s breakout on the weekly timeframe could trigger an explosive rally, while social media influencer Bark predicted this week could “melt faces” if momentum holds.

Strategic Timing Ahead of ETF Developments

VivoPower’s move isn’t just about equity—it’s a calculated positioning ahead of any potential Ripple ETF developments. The structure of the investment allows traditional equity investors to tap into XRP’s growth without direct crypto ownership, signaling a strategic bridge between traditional finance and the digital asset space. This kind of institutional validation boosts market confidence, with many seeing it as a step toward mainstream adoption.

Institutional Endorsement and Market Sentiment

This investment is being read as more than just capital—it’s an endorsement of XRP’s long-term value proposition. As STEPH IS CRYPTO noted in their announcement, VivoPower’s entry makes it the first U.S.-listed firm to commit this scale of funding to Ripple equity and XRP. Combined with bullish chart patterns, the timing has supercharged investor optimism, creating conditions where a sharp, multi-dollar breakout looks increasingly possible.

The post XRP’s Potential Breakout Fueled by VivoPower’s $100M Ripple Bet first appeared on BlockNews.

Read More

How Many XRP Tokens Do You Need to Build Wealth in 2025?

XRP’s Potential Breakout Fueled by VivoPower’s $100M Ripple Bet

- VivoPower invests $100M in Ripple equity, indirectly holding ~211M XRP worth $696M.

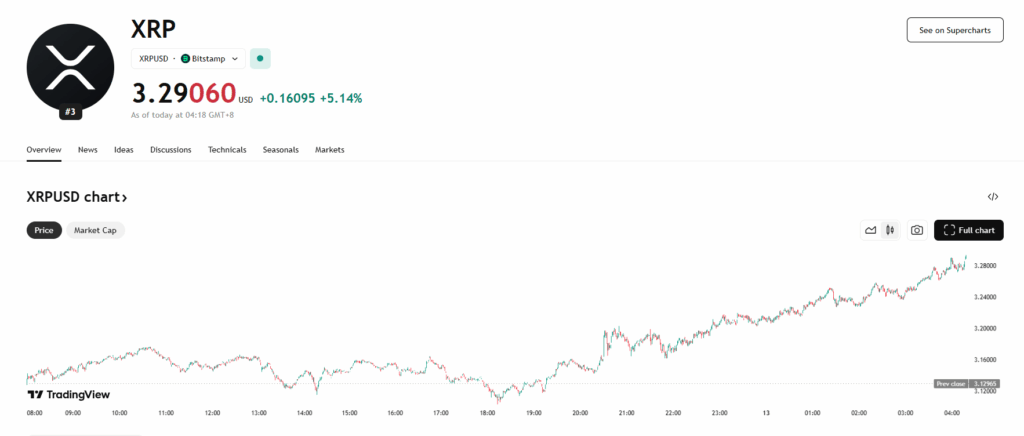

- Analysts spot bullish flag breakouts on XRP charts, with targets of $11–$15 if resistance breaks.

- Move positions VivoPower ahead of potential Ripple ETF growth, signaling deeper institutional adoption.

The buzz around XRP’s price surge has picked up serious momentum after VivoPower International revealed a landmark $100 million investment in Ripple shares. This is a historic move, marking the first time a U.S.-listed company has purchased Ripple equity—giving institutional investors a unique, indirect way to gain XRP exposure. VivoPower’s stake currently represents roughly 211 million XRP, valued near $696 million, positioning it as a significant whale player in the ecosystem.

Technical Signals Pointing to a Major XRP Move

Multiple high-profile analysts are calling attention to strong breakout signals forming across XRP’s weekly charts. Technical setups, including bullish flag formations, are pointing to potential price targets in the $11–$15 range if consolidation resistance is finally broken. Chart expert Ali Charts has emphasized that XRP’s breakout on the weekly timeframe could trigger an explosive rally, while social media influencer Bark predicted this week could “melt faces” if momentum holds.

Strategic Timing Ahead of ETF Developments

VivoPower’s move isn’t just about equity—it’s a calculated positioning ahead of any potential Ripple ETF developments. The structure of the investment allows traditional equity investors to tap into XRP’s growth without direct crypto ownership, signaling a strategic bridge between traditional finance and the digital asset space. This kind of institutional validation boosts market confidence, with many seeing it as a step toward mainstream adoption.

Institutional Endorsement and Market Sentiment

This investment is being read as more than just capital—it’s an endorsement of XRP’s long-term value proposition. As STEPH IS CRYPTO noted in their announcement, VivoPower’s entry makes it the first U.S.-listed firm to commit this scale of funding to Ripple equity and XRP. Combined with bullish chart patterns, the timing has supercharged investor optimism, creating conditions where a sharp, multi-dollar breakout looks increasingly possible.

The post XRP’s Potential Breakout Fueled by VivoPower’s $100M Ripple Bet first appeared on BlockNews.

Read More

BREAKING:

BREAKING: