DeFi Protocol Thala Will Launch Thala V2 In Stages In August

Share:

Key Points:

- Thala Protocol announces Thala V2 with a phased rollout and significant updates, including Peg Stability Module, incentives for borrowing, and revamped tokenomics.

- VeTHL was introduced for improved vote-escrow governance, integration of Parliament for DAO governance, and batch auctions for token launches.

- The protocol focuses on community involvement and user feedback as it prepares to launch enhanced RWA products and introduces UI/UX upgrades and gas optimizations.

Thala, the largest native protocol on Aptos, has announced the upcoming release of Thala V2, introducing significant changes and enhancements to the protocol.

With a thriving community and substantial achievements since its April launch, the protocol has garnered a peak TVL of $30 million and $50 million in trading volume. Building on this momentum, Thala V2 aims to revolutionize the protocol through a phased rollout strategy.

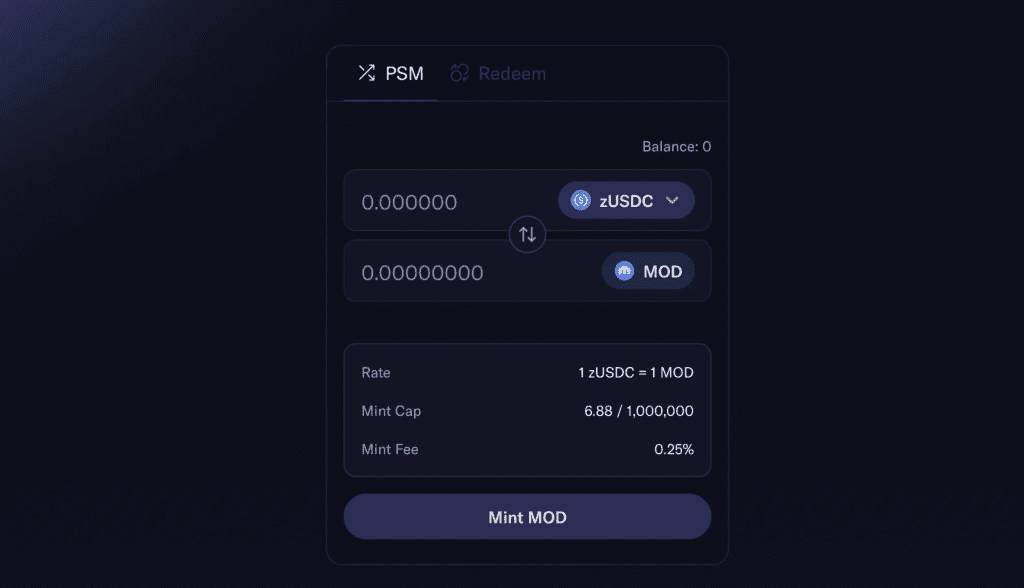

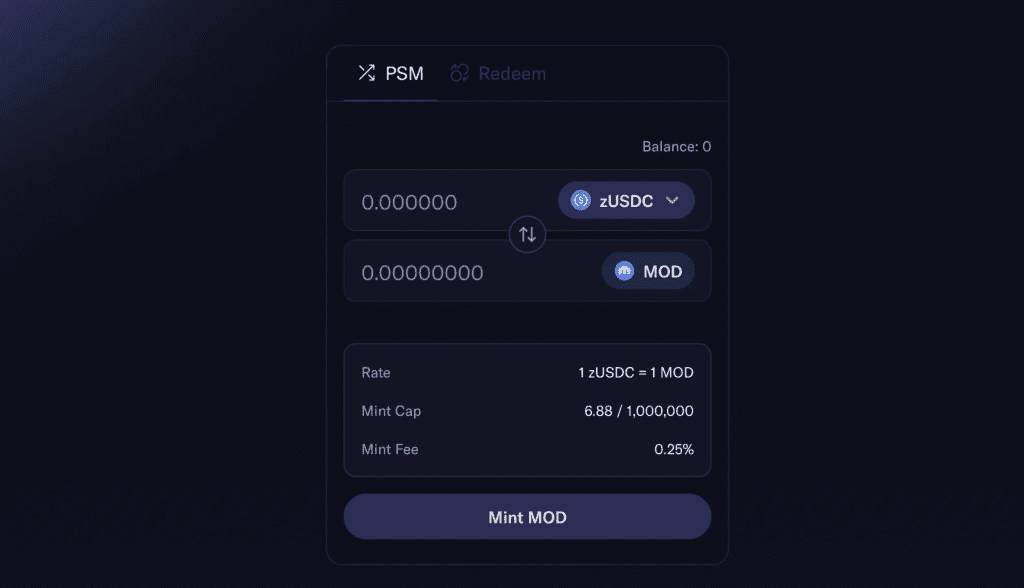

Phase 1 of the rollout brings key updates, including the introduction of the Peg Stability Module (PSM) to strengthen the Move Dollar’s peg. This interest-free vault system enables users to swap 1-to-1 between MOD and whitelisted stablecoins. Additionally, Thala offers incentives for borrowing against exotic collateral types, distinguishing itself from other CDP protocols.

Furthermore, Flashloans will be integrated into Thala’s design, providing users with streamlined access to leverage and facilitating collateral swaps and liquidations. These improvements enhance the overall user experience on the platform.

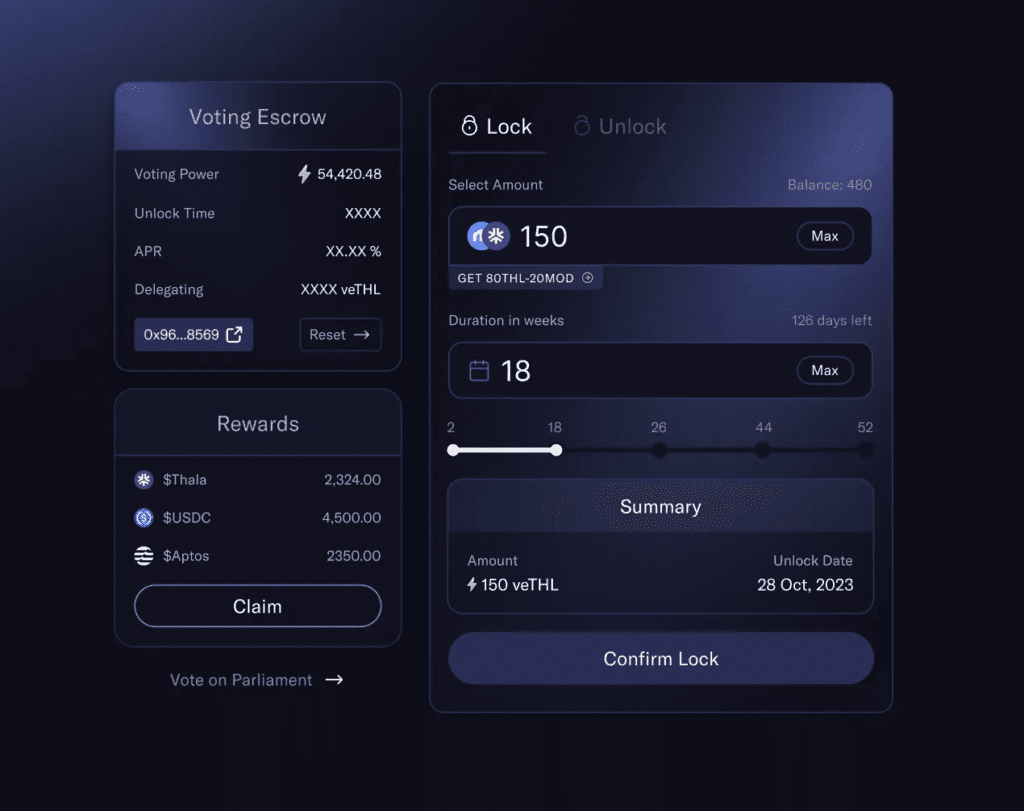

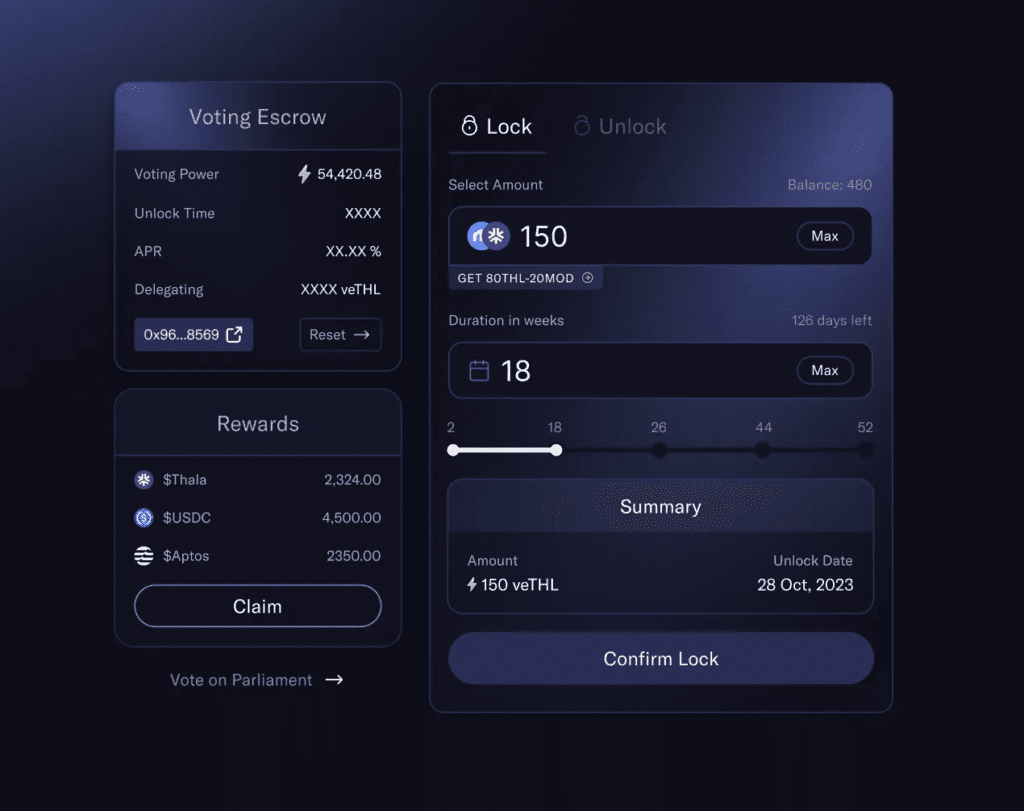

Phase 2 focuses on the implementation of veTHL, Thala’s vote-escrow model. The updated tokenomics allow for more flexible participation in governance, supporting both single-sided THL and THL-MOD liquidity pool tokens. VeTHL holders can contribute their voting weight to Thala’s decision-making process by locking either of these tokens.

To ensure long-term sustainability, the protocol has revamped its tokenomics, introducing escrowed THL (esTHL) as a reward for liquidity and stability pool providers. Users can convert esTHL to liquid THL through a vesting period, which can be exited early with a dynamic penalty. Part of the penalty will reward veTHL holders, fostering their long-term commitment, while the rest returns to the treasury.

In Phase 3, Thala integrates Parliament for its DAO governance, enabling veTHL holders to vote on crucial protocol matters. This groundbreaking move positions the protocol as the first protocol to leverage Parliament for DAO governance, setting a precedent for other Aptos-native protocols to follow.

Thala V2 will also introduce batch auctions to provide more flexibility for token distribution during token launches. Additionally, an enhanced RWA product is set to launch by the end of July, aiming to improve the user experience for DeFi applications related to real-world assets.

These significant updates come alongside quality-of-life improvements, including UI/UX upgrades and gas optimizations. the protocol encourages community feedback and discourse in the lead-up to the launch, ensuring that the platform aligns with user preferences and requirements.

As Thala’s vision evolves, the team remains committed to community-driven growth and innovation, solidifying its position as a leading protocol in the vibrant Aptos ecosystem.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Read more...

Coincu News

DeFi Protocol Thala Will Launch Thala V2 In Stages In August

Share:

Key Points:

- Thala Protocol announces Thala V2 with a phased rollout and significant updates, including Peg Stability Module, incentives for borrowing, and revamped tokenomics.

- VeTHL was introduced for improved vote-escrow governance, integration of Parliament for DAO governance, and batch auctions for token launches.

- The protocol focuses on community involvement and user feedback as it prepares to launch enhanced RWA products and introduces UI/UX upgrades and gas optimizations.

Thala, the largest native protocol on Aptos, has announced the upcoming release of Thala V2, introducing significant changes and enhancements to the protocol.

With a thriving community and substantial achievements since its April launch, the protocol has garnered a peak TVL of $30 million and $50 million in trading volume. Building on this momentum, Thala V2 aims to revolutionize the protocol through a phased rollout strategy.

Phase 1 of the rollout brings key updates, including the introduction of the Peg Stability Module (PSM) to strengthen the Move Dollar’s peg. This interest-free vault system enables users to swap 1-to-1 between MOD and whitelisted stablecoins. Additionally, Thala offers incentives for borrowing against exotic collateral types, distinguishing itself from other CDP protocols.

Furthermore, Flashloans will be integrated into Thala’s design, providing users with streamlined access to leverage and facilitating collateral swaps and liquidations. These improvements enhance the overall user experience on the platform.

Phase 2 focuses on the implementation of veTHL, Thala’s vote-escrow model. The updated tokenomics allow for more flexible participation in governance, supporting both single-sided THL and THL-MOD liquidity pool tokens. VeTHL holders can contribute their voting weight to Thala’s decision-making process by locking either of these tokens.

To ensure long-term sustainability, the protocol has revamped its tokenomics, introducing escrowed THL (esTHL) as a reward for liquidity and stability pool providers. Users can convert esTHL to liquid THL through a vesting period, which can be exited early with a dynamic penalty. Part of the penalty will reward veTHL holders, fostering their long-term commitment, while the rest returns to the treasury.

In Phase 3, Thala integrates Parliament for its DAO governance, enabling veTHL holders to vote on crucial protocol matters. This groundbreaking move positions the protocol as the first protocol to leverage Parliament for DAO governance, setting a precedent for other Aptos-native protocols to follow.

Thala V2 will also introduce batch auctions to provide more flexibility for token distribution during token launches. Additionally, an enhanced RWA product is set to launch by the end of July, aiming to improve the user experience for DeFi applications related to real-world assets.

These significant updates come alongside quality-of-life improvements, including UI/UX upgrades and gas optimizations. the protocol encourages community feedback and discourse in the lead-up to the launch, ensuring that the platform aligns with user preferences and requirements.

As Thala’s vision evolves, the team remains committed to community-driven growth and innovation, solidifying its position as a leading protocol in the vibrant Aptos ecosystem.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Read more...

Coincu News