Ripple (XRP) Price Prediction: Head and Shoulders Pattern Flashes 30% Breakdown Signal

Ripple XRP $2.08 24h volatility: 5.7% Market cap: $122.65 B Vol. 24h: $3.70 B price broke below the critical $2 level on Monday, June 23, marking its lowest point in 75 days. Now hovering near $1.92, XRP appears technically vulnerable.

XRP Touches 75-Day Low as Ripple vs. SEC Case and Geopolitical Crisis Form Dual Catalyst

XRP’s recent price slide has been fueled by a rare convergence of legal and macroeconomic catalysts. The token lost its grip on the $2 level for the first time since April 9, following a sharp rise in global risk aversion and fresh legal ambiguity in the ongoing SEC vs. Ripple litigation.

On June 20, rumors of a delay in the long-awaited summary judgment added uncertainty to Ripple’s legal trajectory. At the same time, deteriorating diplomatic ties between major economies sent tremors across global markets, prompting institutional outflows from top altcoins. XRP, Solana SOL $140.9 24h volatility: 8.8% Market cap: $74.90 B Vol. 24h: $6.17 B , Ethereum ETH $2 349 24h volatility: 7.3% Market cap: $283.47 B Vol. 24h: $22.61 B and Cardano ADA $0.56 24h volatility: 6.0% Market cap: $20.24 B Vol. 24h: $830.97 M all posted losses on Monday, June 23.

The price decline appears to have triggered a cascade of technical breakdowns. XRP broke below its 50-day exponential moving average on June 21, followed by a breach of the $2 psychological support two days later. The daily RSI has dropped below 40, indicating increasing bearish momentum with little sign of reversal.

Unless the Ripple legal team provides a concrete update or macro sentiment stabilizes, XRP may continue to bleed toward the $1.50 technical floor identified from the neckline of the emerging Head and Shoulders pattern. A daily close above $2.10 remains the minimum requirement to invalidate the bearish thesis.

Bears Establish Dominance with $37.9M Leverage at $2.10 Resistance

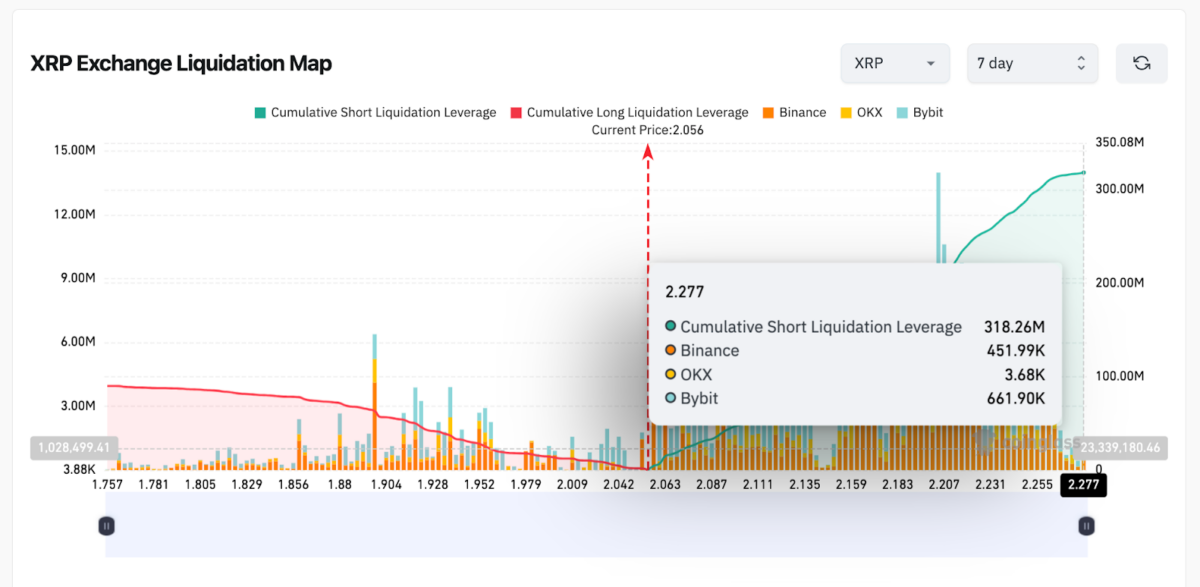

Data from Coinglass shows that bearish traders are firmly in control of XRP’s short-term price action. In the past seven days, $318 million in short positions have been opened on XRP, outpacing the $89 million in long contracts recorded over the same period.

Ripple (XRP) Liquidation Map | Coinglass

Of the leveraged shorts, roughly $15 million are concentrated around the $2.10 resistance zone, suggesting that bears are defending this level as a key psychological and technical threshold. This cluster of leverage is acting as a supply wall, capping any bullish reversal attempts.

If XRP fails to decisively close above the $2.10 level to trigger short liquidations, the current imbalance may continue to push the token downward.

Ripple (XRP) Price Forecast: Is XRP at Risk of Another 30% Breakdown?

XRP’s daily chart presents a clearly defined Head and Shoulders pattern, often considered a reliable indicator of bearish reversals. With the neckline now broken at the $2.00 level, technical projections suggest XRP may be on the verge of a 30% correction toward the $1.45, $1.50 range.

As depicted above, the left shoulder formed in early May, the head peaked near $2.80 in mid-May, and the right shoulder failed to breach the previous high, topping out near $2.45. The breakdown below the neckline has been accompanied by rising volume, a confirmation signal that lends further weight to the bearish thesis.

The Relative Strength Index (RSI) has declined to 38.95, hovering just above oversold territory, with no immediate signs of bullish divergence. This momentum trend supports the notion that XRP may not yet have found a local bottom.

XRP Price Forecast | Source: TradingView

Unless bulls can force a daily close back above $2.10, the path of least resistance remains to the downside. Short-term recovery may face stiff resistance at $2.20 and $2.45, while continuation of the pattern’s trajectory places XRP’s mid-term support at the $1.50 mark.

In the absence of a fundamental reversal catalyst, such as a favorable court ruling or de-escalation in geopolitical tensions, bearish pressure is likely to persist.

XRP Steadies as Solaxy ($SOLX) Launches Solana’s First Layer-2

While XRP consolidates near $0.49, early-stage investors are turning to Solaxy ($SOLX)—the first Layer-2 solution on Solana.

With its testnet live and exchange listings on the horizon, Solaxy offers unmatched scalability, 0% staking fees, and multi-chain support. The $SOLX presale is now live, positioning itself as a high-upside play in Solana’s growing ecosystem.

The post Ripple (XRP) Price Prediction: Head and Shoulders Pattern Flashes 30% Breakdown Signal appeared first on Coinspeaker.

Read More

XRP To $30 Beyond 2026? Analyst Reveals Key BTC Ratio To Watch

Ripple (XRP) Price Prediction: Head and Shoulders Pattern Flashes 30% Breakdown Signal

Ripple XRP $2.08 24h volatility: 5.7% Market cap: $122.65 B Vol. 24h: $3.70 B price broke below the critical $2 level on Monday, June 23, marking its lowest point in 75 days. Now hovering near $1.92, XRP appears technically vulnerable.

XRP Touches 75-Day Low as Ripple vs. SEC Case and Geopolitical Crisis Form Dual Catalyst

XRP’s recent price slide has been fueled by a rare convergence of legal and macroeconomic catalysts. The token lost its grip on the $2 level for the first time since April 9, following a sharp rise in global risk aversion and fresh legal ambiguity in the ongoing SEC vs. Ripple litigation.

On June 20, rumors of a delay in the long-awaited summary judgment added uncertainty to Ripple’s legal trajectory. At the same time, deteriorating diplomatic ties between major economies sent tremors across global markets, prompting institutional outflows from top altcoins. XRP, Solana SOL $140.9 24h volatility: 8.8% Market cap: $74.90 B Vol. 24h: $6.17 B , Ethereum ETH $2 349 24h volatility: 7.3% Market cap: $283.47 B Vol. 24h: $22.61 B and Cardano ADA $0.56 24h volatility: 6.0% Market cap: $20.24 B Vol. 24h: $830.97 M all posted losses on Monday, June 23.

The price decline appears to have triggered a cascade of technical breakdowns. XRP broke below its 50-day exponential moving average on June 21, followed by a breach of the $2 psychological support two days later. The daily RSI has dropped below 40, indicating increasing bearish momentum with little sign of reversal.

Unless the Ripple legal team provides a concrete update or macro sentiment stabilizes, XRP may continue to bleed toward the $1.50 technical floor identified from the neckline of the emerging Head and Shoulders pattern. A daily close above $2.10 remains the minimum requirement to invalidate the bearish thesis.

Bears Establish Dominance with $37.9M Leverage at $2.10 Resistance

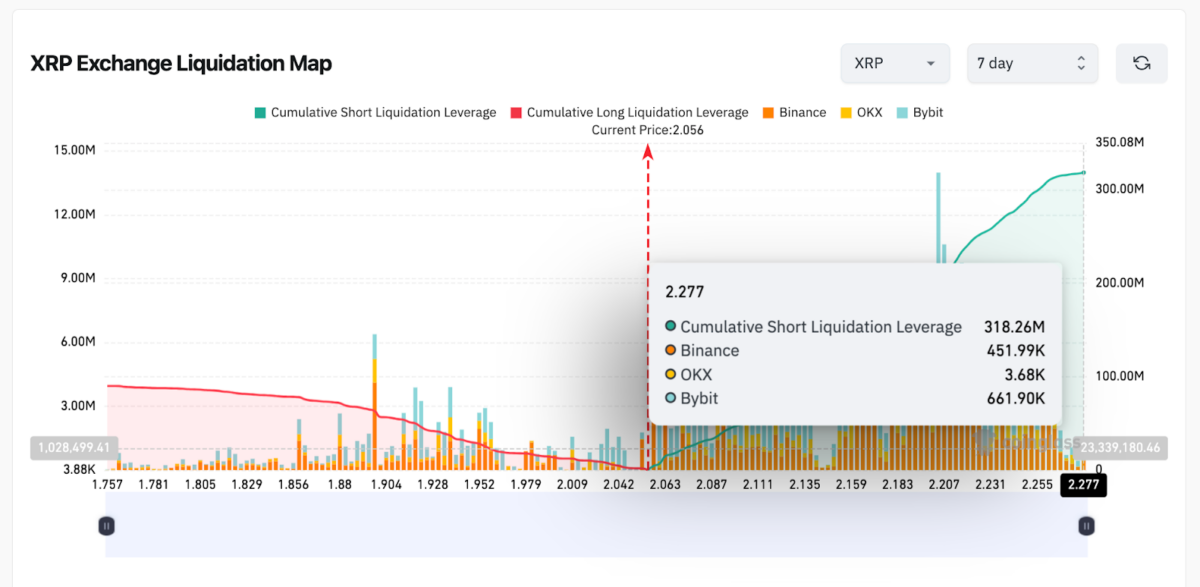

Data from Coinglass shows that bearish traders are firmly in control of XRP’s short-term price action. In the past seven days, $318 million in short positions have been opened on XRP, outpacing the $89 million in long contracts recorded over the same period.

Ripple (XRP) Liquidation Map | Coinglass

Of the leveraged shorts, roughly $15 million are concentrated around the $2.10 resistance zone, suggesting that bears are defending this level as a key psychological and technical threshold. This cluster of leverage is acting as a supply wall, capping any bullish reversal attempts.

If XRP fails to decisively close above the $2.10 level to trigger short liquidations, the current imbalance may continue to push the token downward.

Ripple (XRP) Price Forecast: Is XRP at Risk of Another 30% Breakdown?

XRP’s daily chart presents a clearly defined Head and Shoulders pattern, often considered a reliable indicator of bearish reversals. With the neckline now broken at the $2.00 level, technical projections suggest XRP may be on the verge of a 30% correction toward the $1.45, $1.50 range.

As depicted above, the left shoulder formed in early May, the head peaked near $2.80 in mid-May, and the right shoulder failed to breach the previous high, topping out near $2.45. The breakdown below the neckline has been accompanied by rising volume, a confirmation signal that lends further weight to the bearish thesis.

The Relative Strength Index (RSI) has declined to 38.95, hovering just above oversold territory, with no immediate signs of bullish divergence. This momentum trend supports the notion that XRP may not yet have found a local bottom.

XRP Price Forecast | Source: TradingView

Unless bulls can force a daily close back above $2.10, the path of least resistance remains to the downside. Short-term recovery may face stiff resistance at $2.20 and $2.45, while continuation of the pattern’s trajectory places XRP’s mid-term support at the $1.50 mark.

In the absence of a fundamental reversal catalyst, such as a favorable court ruling or de-escalation in geopolitical tensions, bearish pressure is likely to persist.

XRP Steadies as Solaxy ($SOLX) Launches Solana’s First Layer-2

While XRP consolidates near $0.49, early-stage investors are turning to Solaxy ($SOLX)—the first Layer-2 solution on Solana.

With its testnet live and exchange listings on the horizon, Solaxy offers unmatched scalability, 0% staking fees, and multi-chain support. The $SOLX presale is now live, positioning itself as a high-upside play in Solana’s growing ecosystem.

The post Ripple (XRP) Price Prediction: Head and Shoulders Pattern Flashes 30% Breakdown Signal appeared first on Coinspeaker.

Read More