Bitwise Files for Aptos ETF: APT Price Jumps 12% – Market Reacts

- Bitwise officially registers an Aptos ETF in Delaware.

- Aptos (APT) surged by 12% despite a broader market downturn.

- Bitwise’s move follows European ETP launches, indicating increasing institutional backing for Aptos.

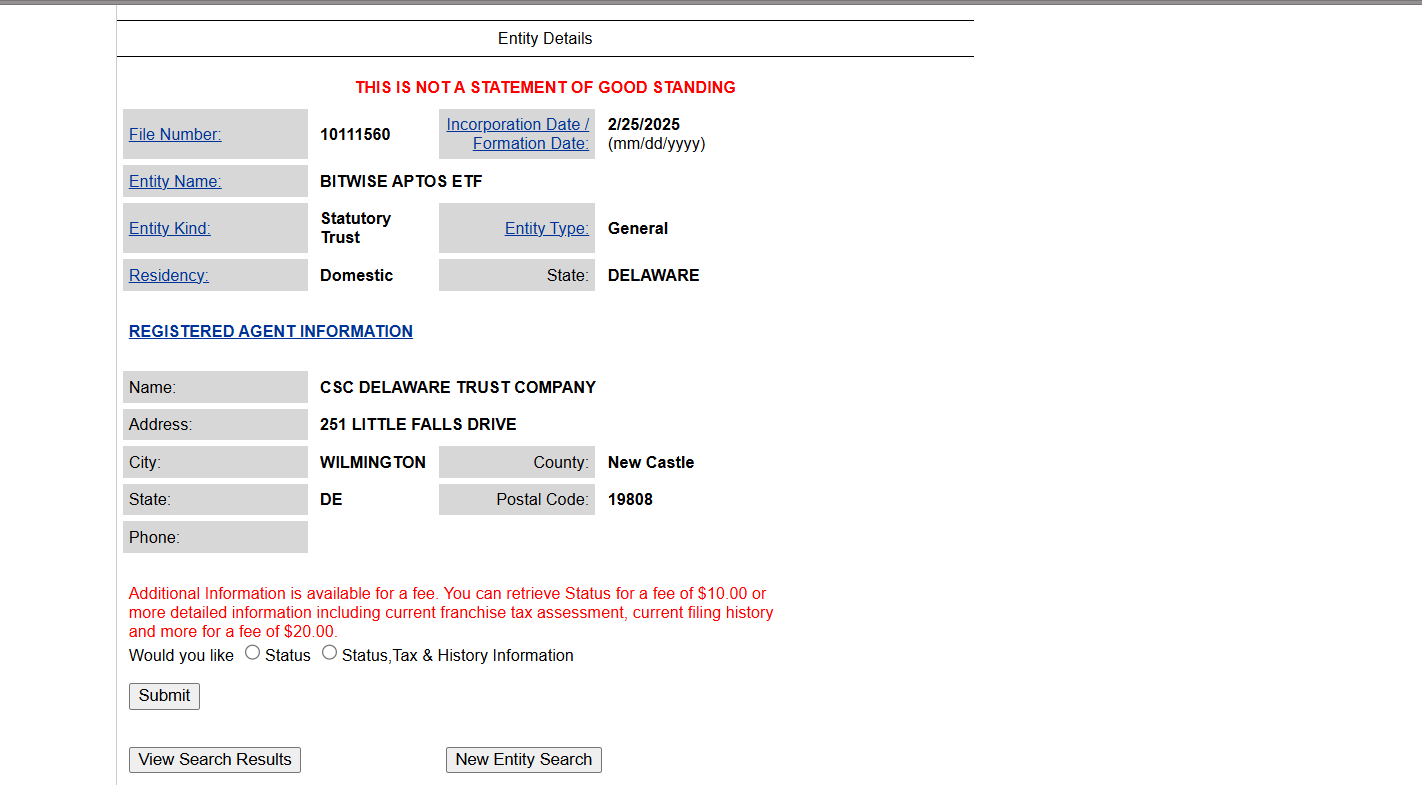

Bitwise Asset Management has taken the first step toward creating an Aptos (APT) exchange-traded fund (ETF) by officially registering an Aptos ETF entity in Delaware.

This is a big move that could allow more traditional investors to invest in Aptos through an ETF.

Bitwise Registers Aptos ETF Entity, Eyes SEC Approval

The registration, filed on February 25, shows Bitwise’s interest in bringing an Aptos-focused ETF to market. This move could then lead to Bitwise applying to the U.S. Securities and Exchange Commission (SEC) for approval to launch the ETF.

Bitwise’s application for an Aptos ETF follows similar filings for ETFs focused on other popular cryptocurrencies, like XRP, Solana (SOL), and Dogecoin (DOGE).

Aptos ETPs Already Launched in Europe

This move comes after introducing its Aptos Staking ETP on six Swiss exchanges in November 2024.

Apart from that, 21Share…

The post Bitwise Files for Aptos ETF: APT Price Jumps 12% – Market Reacts appeared first on Coin Edition.

Read More

U.S. Treasury Yield Hits Highest Since November 2023

Bitwise Files for Aptos ETF: APT Price Jumps 12% – Market Reacts

- Bitwise officially registers an Aptos ETF in Delaware.

- Aptos (APT) surged by 12% despite a broader market downturn.

- Bitwise’s move follows European ETP launches, indicating increasing institutional backing for Aptos.

Bitwise Asset Management has taken the first step toward creating an Aptos (APT) exchange-traded fund (ETF) by officially registering an Aptos ETF entity in Delaware.

This is a big move that could allow more traditional investors to invest in Aptos through an ETF.

Bitwise Registers Aptos ETF Entity, Eyes SEC Approval

The registration, filed on February 25, shows Bitwise’s interest in bringing an Aptos-focused ETF to market. This move could then lead to Bitwise applying to the U.S. Securities and Exchange Commission (SEC) for approval to launch the ETF.

Bitwise’s application for an Aptos ETF follows similar filings for ETFs focused on other popular cryptocurrencies, like XRP, Solana (SOL), and Dogecoin (DOGE).

Aptos ETPs Already Launched in Europe

This move comes after introducing its Aptos Staking ETP on six Swiss exchanges in November 2024.

Apart from that, 21Share…

The post Bitwise Files for Aptos ETF: APT Price Jumps 12% – Market Reacts appeared first on Coin Edition.

Read More