Why Is Crypto Up Today? – October 2, 2025

The crypto market is up today, with the cryptocurrency market capitalization jumping by 4.2%, now standing at $4.17 trillion. 98 of the top 100 coins have appreciated over the past 24 hours. At the same time, the total crypto trading volume is at $215 billion, higher than what we’ve been seeing lately.

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have increased over the past 24 hours.

Bitcoin (BTC) appreciated 3.7%, currently trading at $118,682.

Ethereum (ETH) is up by 6.3%, now changing hands at $4,399. It is again among the best performers.

Dogecoin (DOGE) is the best performer on this list, having increased by 9.7% to the price of $0.2563.

Solana (SOL) is next, with an increase of 6.6%. now trading at $223.

When it comes to the top 100 coins, seven coins saw double-digit rises. Zcash (ZEC) is at the top, having seen a 74.2% jump to $147.

Provenance Blockchain (HASH) follows: it’s up 14.4% to $0.03926 .

Only two coins are down: MemeCore (M) and Figure Heloc (FIGR_HELOC) are down 10.7% and 2.5% to $2.16 and $1.01.

Meanwhile, Japanese loan provider MBK says it has bought over $2 million worth of BTC and struck a partnership deal with FINX JCrypto, which owns the Coin Estate exchange.

‘Market Awaits Conviction for Next Decisive Move’

According to Glassnode, Bitcoin “repeatedly defended the short-term holder cost basis, underscoring its role as a key pivot between bullish continuation and bearish risk.”

Moreover, long-term holder distribution has cooled after months of steady selling. ETF inflows have resumed. This has provided a stabilizing influence on market structure. “Together, these dynamics point to healthier demand-side conditions.”

Options market, volatility, and flow signals together “suggest a market resetting into a more neutral, constructive backdrop, awaiting conviction for the next decisive move,” Glassnode writes.

Per Bitunix analysts, the government shutdown in the US represents a short-term political risk and does not alter the medium-term easing trend. However, it amplifies market volatility. “The current environment is caught in a tug-of-war between ‘rate cut expectations’ and ‘growth concerns’, keeping investor sentiment cautious.”

For BTC, they recommend that investors watch supports at 110,000–112,000 and 106,000–108,000, and resistance at 116,000 and 122,000–125,000. “Flexibility is key, and traders should closely monitor liquidation hotspots.”

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC trades at $118,682. This is an increase from the intraday low of $114,525. The intraday high currently stands at $119,400.

Notably, BTC recorded a breakout above $118,000, opening doors for it to test $120,200 and $122,335, and possibly even $124,525 down the line. On the other hand, pullbacks are possible toward $117,000–$117,500.

Ethereum is currently trading at $4,399. It’s seen a notable increase from the daily low of $4,143 to the high of $4,414, before slightly retreating to the current price. The day’s high is also its intraweek high.

The coin could potentially move further towards $4,500 and then $4,750. Pullbacks could lead to a drop below $4,100 and $4,000.

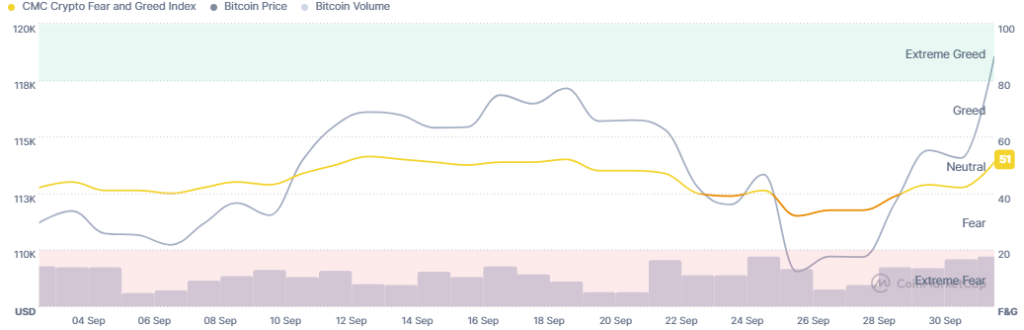

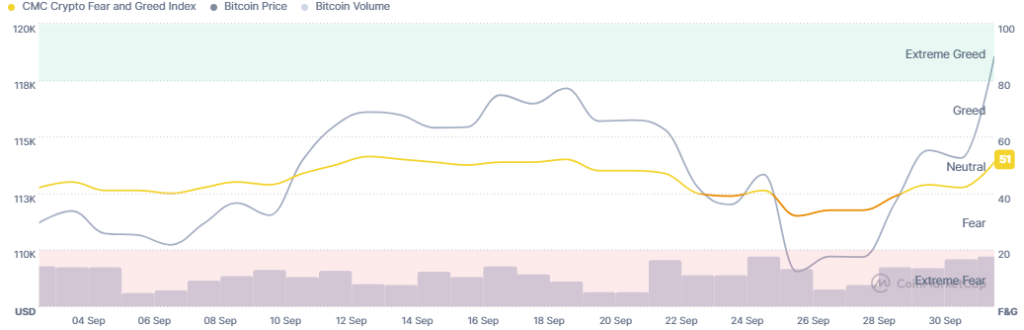

Meanwhile, the crypto market sentiment is increasing within the neutral zone. After dipping into the fear zone, then moving on the verge of it, the crypto fear and greed index climbed to 51, compared to yesterday’s 42.

Market participants are growing more optimistic as October begins, but the sentiment in general has shifted to the cooling phase.

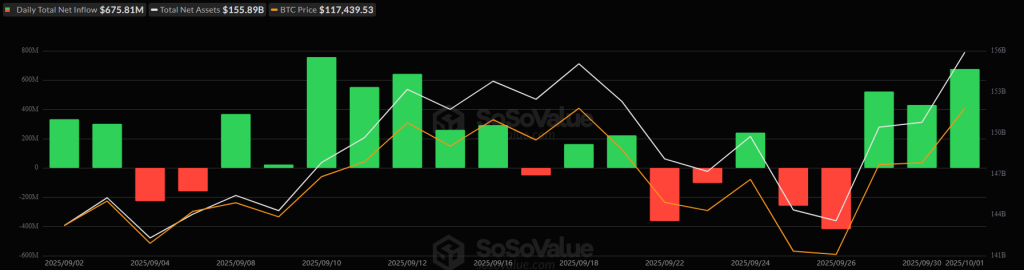

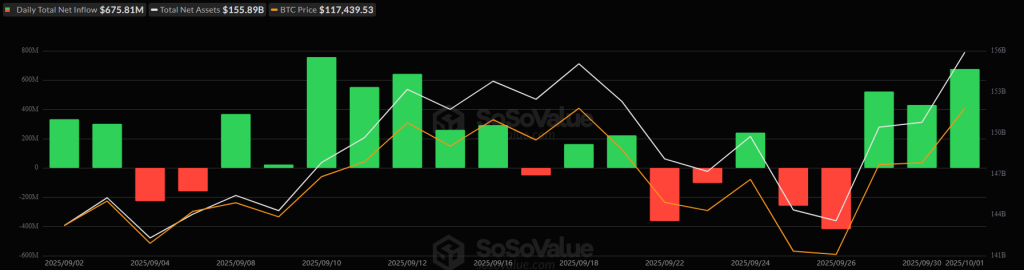

Moreover, the US BTC spot exchange-traded funds (ETFs) saw another day of significant positive flows, recording $675.81 million in inflows on Wednesday. The cumulative net inflow now stands at $58.44 billion.

Of the 12 ETFs, seven saw inflows, and there were no outflows. BlackRock is at the top of this list with $405.48 million, followed by Fidelity’s $179.32 million.

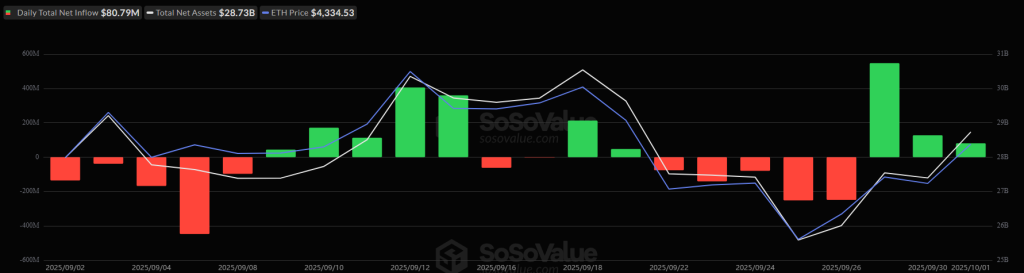

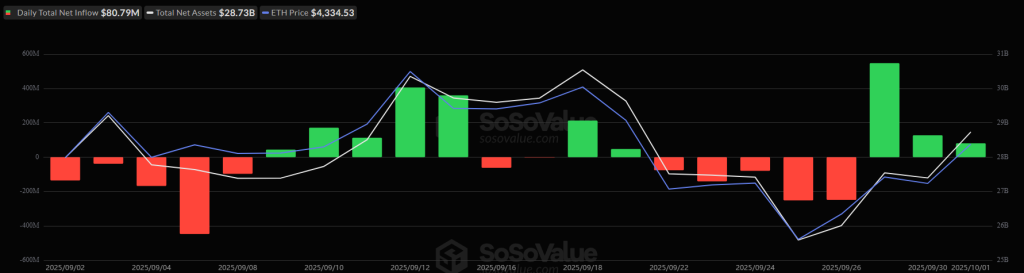

The US ETH ETFs also recorded inflows of $80.79 million on 1 October. Four of the nine finds saw positive flows, and none noted negative flows.

Fidelity took in $36.76 million, followed by BlackRock’s $26.17 million. The cumulative total net inflow now stands at $13.88 billion.

Meanwhile, institutional interest in Bitcoin keeps rising. Japanese investment firm Metaplanet, for example, has become the fourth-largest BTC holder.

Moreover, Thailand is readying to expand its crypto ETF offerings beyond Bitcoin, aiming to include a basket of digital tokens. The Thai SEC is drafting new rules in coordination with other key agencies, aiming for a rollout early next year.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market has increased over the past day, and major stock indexes closed higher for a fourth straight session on Wednesday. By the closing time on 1 October, the S&P 500 was up by 0.34%, the Nasdaq-100 increased by 0.49%, and the Dow Jones Industrial Average rose 0.0093%. Historically, the fourth quarter has been strong for US stocks.

- Is this rally sustainable?

Uptober has started strong, and prices may still rise before a natural pullback. A consolidation period is healthy for the market.

The post Why Is Crypto Up Today? – October 2, 2025 appeared first on Cryptonews.

Why Is Crypto Up Today? – October 2, 2025

The crypto market is up today, with the cryptocurrency market capitalization jumping by 4.2%, now standing at $4.17 trillion. 98 of the top 100 coins have appreciated over the past 24 hours. At the same time, the total crypto trading volume is at $215 billion, higher than what we’ve been seeing lately.

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have increased over the past 24 hours.

Bitcoin (BTC) appreciated 3.7%, currently trading at $118,682.

Ethereum (ETH) is up by 6.3%, now changing hands at $4,399. It is again among the best performers.

Dogecoin (DOGE) is the best performer on this list, having increased by 9.7% to the price of $0.2563.

Solana (SOL) is next, with an increase of 6.6%. now trading at $223.

When it comes to the top 100 coins, seven coins saw double-digit rises. Zcash (ZEC) is at the top, having seen a 74.2% jump to $147.

Provenance Blockchain (HASH) follows: it’s up 14.4% to $0.03926 .

Only two coins are down: MemeCore (M) and Figure Heloc (FIGR_HELOC) are down 10.7% and 2.5% to $2.16 and $1.01.

Meanwhile, Japanese loan provider MBK says it has bought over $2 million worth of BTC and struck a partnership deal with FINX JCrypto, which owns the Coin Estate exchange.

‘Market Awaits Conviction for Next Decisive Move’

According to Glassnode, Bitcoin “repeatedly defended the short-term holder cost basis, underscoring its role as a key pivot between bullish continuation and bearish risk.”

Moreover, long-term holder distribution has cooled after months of steady selling. ETF inflows have resumed. This has provided a stabilizing influence on market structure. “Together, these dynamics point to healthier demand-side conditions.”

Options market, volatility, and flow signals together “suggest a market resetting into a more neutral, constructive backdrop, awaiting conviction for the next decisive move,” Glassnode writes.

Per Bitunix analysts, the government shutdown in the US represents a short-term political risk and does not alter the medium-term easing trend. However, it amplifies market volatility. “The current environment is caught in a tug-of-war between ‘rate cut expectations’ and ‘growth concerns’, keeping investor sentiment cautious.”

For BTC, they recommend that investors watch supports at 110,000–112,000 and 106,000–108,000, and resistance at 116,000 and 122,000–125,000. “Flexibility is key, and traders should closely monitor liquidation hotspots.”

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC trades at $118,682. This is an increase from the intraday low of $114,525. The intraday high currently stands at $119,400.

Notably, BTC recorded a breakout above $118,000, opening doors for it to test $120,200 and $122,335, and possibly even $124,525 down the line. On the other hand, pullbacks are possible toward $117,000–$117,500.

Ethereum is currently trading at $4,399. It’s seen a notable increase from the daily low of $4,143 to the high of $4,414, before slightly retreating to the current price. The day’s high is also its intraweek high.

The coin could potentially move further towards $4,500 and then $4,750. Pullbacks could lead to a drop below $4,100 and $4,000.

Meanwhile, the crypto market sentiment is increasing within the neutral zone. After dipping into the fear zone, then moving on the verge of it, the crypto fear and greed index climbed to 51, compared to yesterday’s 42.

Market participants are growing more optimistic as October begins, but the sentiment in general has shifted to the cooling phase.

Moreover, the US BTC spot exchange-traded funds (ETFs) saw another day of significant positive flows, recording $675.81 million in inflows on Wednesday. The cumulative net inflow now stands at $58.44 billion.

Of the 12 ETFs, seven saw inflows, and there were no outflows. BlackRock is at the top of this list with $405.48 million, followed by Fidelity’s $179.32 million.

The US ETH ETFs also recorded inflows of $80.79 million on 1 October. Four of the nine finds saw positive flows, and none noted negative flows.

Fidelity took in $36.76 million, followed by BlackRock’s $26.17 million. The cumulative total net inflow now stands at $13.88 billion.

Meanwhile, institutional interest in Bitcoin keeps rising. Japanese investment firm Metaplanet, for example, has become the fourth-largest BTC holder.

Moreover, Thailand is readying to expand its crypto ETF offerings beyond Bitcoin, aiming to include a basket of digital tokens. The Thai SEC is drafting new rules in coordination with other key agencies, aiming for a rollout early next year.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market has increased over the past day, and major stock indexes closed higher for a fourth straight session on Wednesday. By the closing time on 1 October, the S&P 500 was up by 0.34%, the Nasdaq-100 increased by 0.49%, and the Dow Jones Industrial Average rose 0.0093%. Historically, the fourth quarter has been strong for US stocks.

- Is this rally sustainable?

Uptober has started strong, and prices may still rise before a natural pullback. A consolidation period is healthy for the market.

The post Why Is Crypto Up Today? – October 2, 2025 appeared first on Cryptonews.

Metaplanet buys another 5,268 Bitcoin worth $615.6 MILLION.

Metaplanet buys another 5,268 Bitcoin worth $615.6 MILLION.

![[LIVE] Market Watch: CZ Expected to Return to Binance After Trump Pardon; Bitcoin Reclaims $110K, BNB Rallies 5%](https://cimg.co/p/assets/empty-cryptonews.jpg)