Canary Proposes First Trump Token ETF, SEC Could Slam the Door

Share:

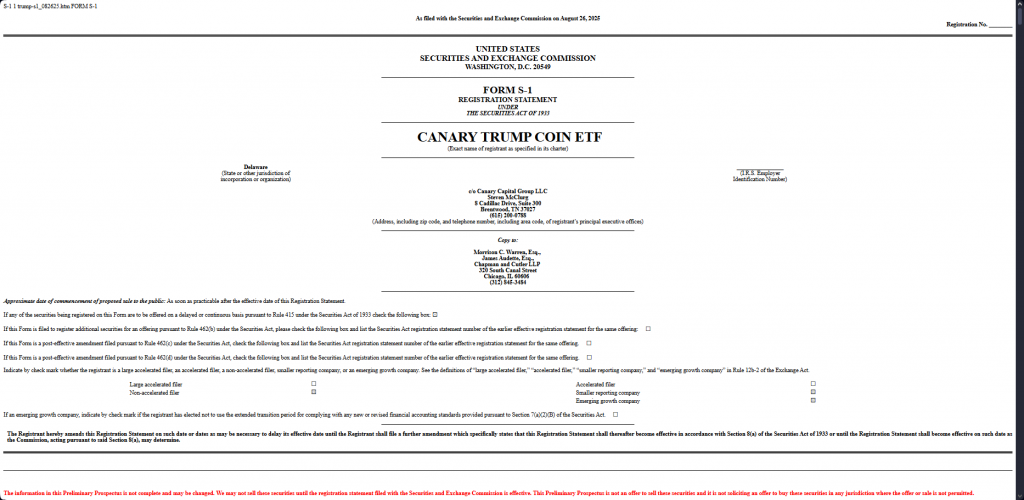

Trump token’s ETF filing marks a groundbreaking move by Canary Capital, which actually submitted an application to the Securities and Exchange Commission on August 26, 2025. The Canary Capital ETF filing seeks approval for what would be the first-ever political meme coin ETF targeting the Official Trump token. This Trump token ETF faces some significant SEC approval risks right now as regulators are scrutinizing Trump coin investment products that are entering traditional markets.

CANARY CAPITAL FILES FOR $TRUMP COIN ETF WITH SEC

— BSCN (@BSCNews) August 27, 2025

– Canary Capital filed an S-1 with the U.S. Securities and Exchange Commission to launch a Trump Coin ETF, a first-of-its-kind product tied to the politically charged memecoin.

– If approved, the fund will trade under the ticker… pic.twitter.com/3d1n2lKtCr

Canary Capital filed an S-1 with the U.S. Securities and Exchange Commission to launch Trump ETF, and the fund would trade under the ticker MRCA if Canary gets approval. The fund represents a first-of-its-kind product that ties to the politically charged memecoin.

Trump Token ETF Could Surge Amid SEC Approval Risks And Political Meme Coin Buzz

The Trump token ETF application comes just days after Canary Capital also proposed its “American-Made Crypto ETF,” which tracks coins invented, mined, or operated in the United States. This political meme coin strategy brings tokens tied to U.S. culture and politics into mainstream investment vehicles, raising even more SEC approval risks for the controversial asset class.

The token’s popularity rides on political sentiment rather than actual utility. This is, of course, fueling both demand and criticism at the same time. Sounds like Trump, right? I also thought so myself. Critics argue that the coin has some important ethical risks, with concerns that holders could anonymously buy influence with the president.

Trump Coin gained some popularity in early 2025 and is listed on trading platforms as fast as other memecoins. The market capitalization of the Trump coin investment lies at the stake of about 1.68 billion dollars but has been extremely erratic since its issue date.

Also Read: Trump Coin Has Fallen 88% Since January: Are Tariffs To Blame?

Political Meme Coin Faces Regulatory Scrutiny

Unlike other ETF filings which are about established cryptocurrencies, the Trump token ETF is based on a political meme coin which has great regulatory issues in the future. The Canary Capital ETF filing uses a traditional ETF model under the 1933 Securities Act, which distinguishes it from mutual fund structures that other firms have adopted.

REX Financial CEO Greg King believes Solana is the story of stablecoin's future over Ethereum. He speaks with @EricBalchunas on "ETF IQ" https://t.co/aVEoiSkzfo pic.twitter.com/iQx9g4oYJg

— Bloomberg TV (@BloombergTV) August 25, 2025

Also Read: Trump Coin Rallies 70% in 30 Days: $60 May Be Closer Than You Think

Canary Proposes First Trump Token ETF, SEC Could Slam the Door

Share:

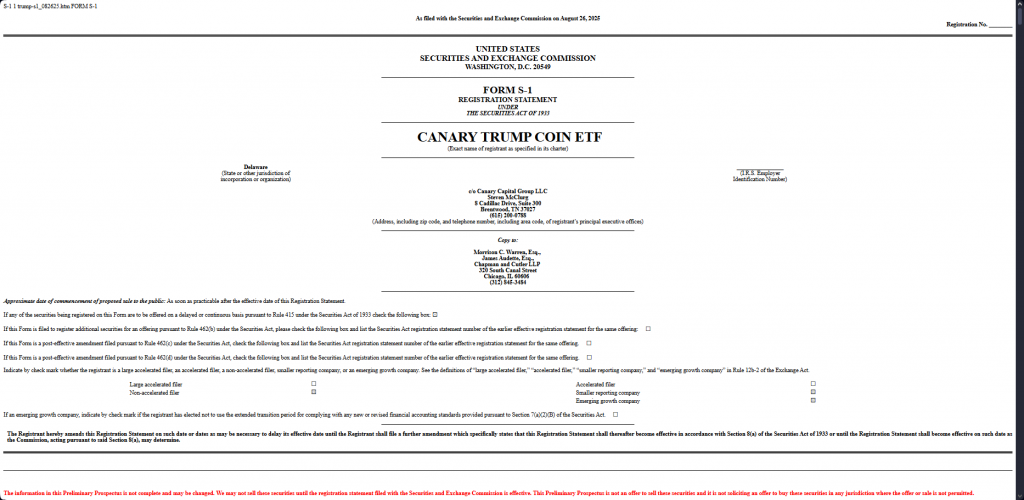

Trump token’s ETF filing marks a groundbreaking move by Canary Capital, which actually submitted an application to the Securities and Exchange Commission on August 26, 2025. The Canary Capital ETF filing seeks approval for what would be the first-ever political meme coin ETF targeting the Official Trump token. This Trump token ETF faces some significant SEC approval risks right now as regulators are scrutinizing Trump coin investment products that are entering traditional markets.

CANARY CAPITAL FILES FOR $TRUMP COIN ETF WITH SEC

— BSCN (@BSCNews) August 27, 2025

– Canary Capital filed an S-1 with the U.S. Securities and Exchange Commission to launch a Trump Coin ETF, a first-of-its-kind product tied to the politically charged memecoin.

– If approved, the fund will trade under the ticker… pic.twitter.com/3d1n2lKtCr

Canary Capital filed an S-1 with the U.S. Securities and Exchange Commission to launch Trump ETF, and the fund would trade under the ticker MRCA if Canary gets approval. The fund represents a first-of-its-kind product that ties to the politically charged memecoin.

Trump Token ETF Could Surge Amid SEC Approval Risks And Political Meme Coin Buzz

The Trump token ETF application comes just days after Canary Capital also proposed its “American-Made Crypto ETF,” which tracks coins invented, mined, or operated in the United States. This political meme coin strategy brings tokens tied to U.S. culture and politics into mainstream investment vehicles, raising even more SEC approval risks for the controversial asset class.

The token’s popularity rides on political sentiment rather than actual utility. This is, of course, fueling both demand and criticism at the same time. Sounds like Trump, right? I also thought so myself. Critics argue that the coin has some important ethical risks, with concerns that holders could anonymously buy influence with the president.

Trump Coin gained some popularity in early 2025 and is listed on trading platforms as fast as other memecoins. The market capitalization of the Trump coin investment lies at the stake of about 1.68 billion dollars but has been extremely erratic since its issue date.

Also Read: Trump Coin Has Fallen 88% Since January: Are Tariffs To Blame?

Political Meme Coin Faces Regulatory Scrutiny

Unlike other ETF filings which are about established cryptocurrencies, the Trump token ETF is based on a political meme coin which has great regulatory issues in the future. The Canary Capital ETF filing uses a traditional ETF model under the 1933 Securities Act, which distinguishes it from mutual fund structures that other firms have adopted.

REX Financial CEO Greg King believes Solana is the story of stablecoin's future over Ethereum. He speaks with @EricBalchunas on "ETF IQ" https://t.co/aVEoiSkzfo pic.twitter.com/iQx9g4oYJg

— Bloomberg TV (@BloombergTV) August 25, 2025

Also Read: Trump Coin Rallies 70% in 30 Days: $60 May Be Closer Than You Think