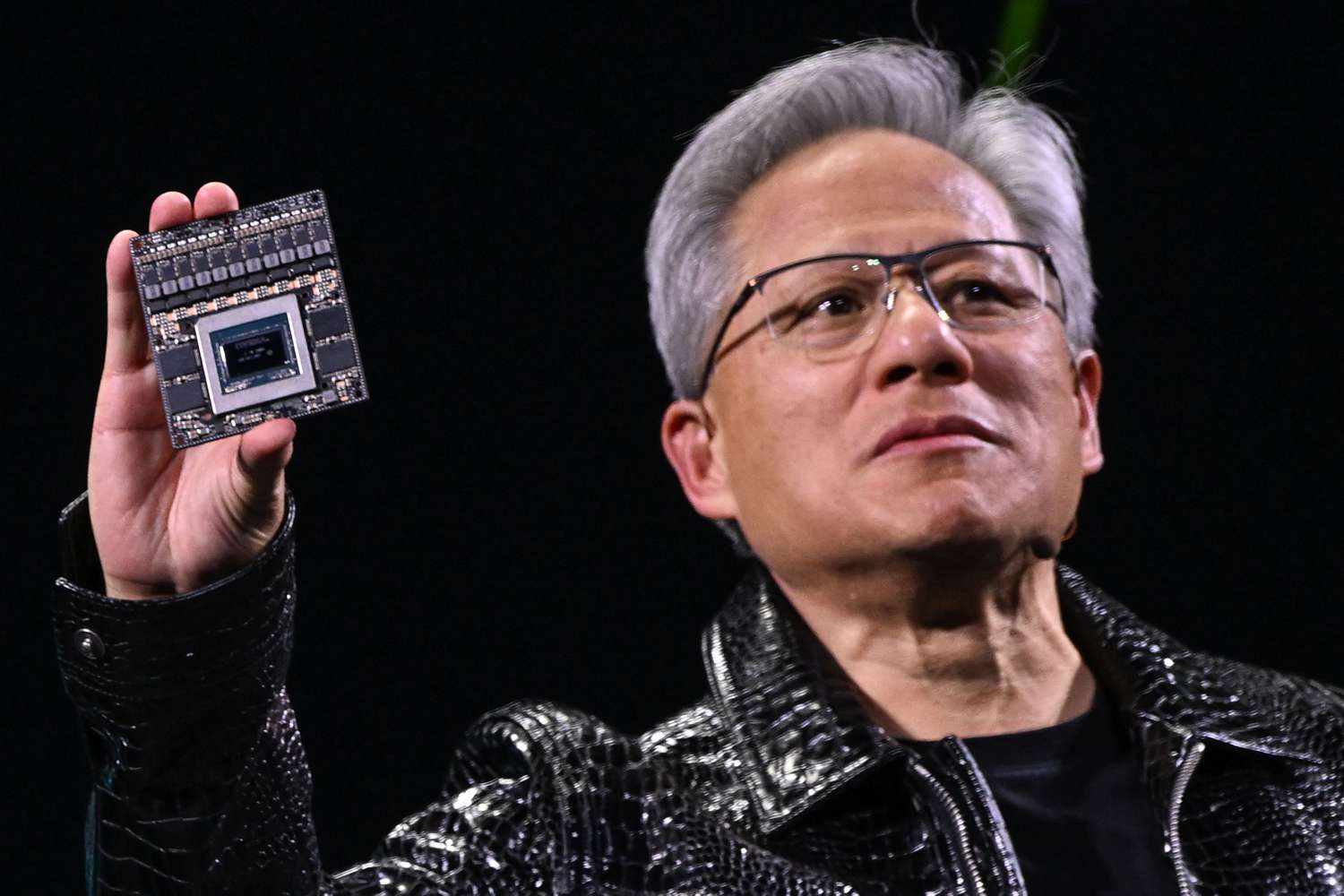

Nvidia (NVDA) Keeps Gaining After US Chip Export Shift: Is $200 Next?

Thursday had proven to be a big turnaround day for the US stock market amid major developments within global trade deals. That is not the only good news for one of the biggest companies in the world. Indeed, Nvidia (NVDA) has kept gaining as the US recently shifted its stance on chip exports, as $200 could be next for the company.

Throughout the first four months of the year, volatility had been the name of the game for Wall Street. Nvidia had struggled lightly, being front and center within ongoing geopolitical tension that threatened its US and Chinese market share. That could be changing, however, as a shift in sentiment could have the stock poised to soar.

Also Read: Amazon (AMZN) to Eclipse Nvidia (NVDA) by 2030 Thanks to AI?

Nvidia Gains Yet Again as Its Outlook Quickly Shifts: Is $200 Now On The Cards For 2025?

In what was a major development for the country’s tech sector, US President Donald Trump announced he is rescinding chip export restrictions. As one can imagine, the decision has major ramifications. Indeed, it propelled AI chipmakers to find momentum that has been increasingly rare this year.

Moreover, it could represent a major shift set to take place for Nvidia (NVDA), as it has gained for the second straight day due to the chip export shift that could have the stock on pace for a trip to the $200 level. After a worrisome start to the year, traders are anxiously awaiting to see if this could be the turnaround many had hoped for.

Also Read: Nvidia (NVDA): Can It Reclaim Its Spot as World’s Most Valuable in 2025?

On Wednesday, the stock edged up 3% after the news. Specifically, traders saw the benefit in the green repeal that will address the complexity of exporting chips overseas. On Thursday, the US and UK announced a new trade deal, leading the stock to jump alongside the market yet again. Now, it’s trading at the $118 level with some potential to gain even more.

The question is, what is the stock’s ceiling? According to CNN data, Nvidia has a median price target of $160, representing a 35% jump from its current position. However, its bullish projection sits at $235, representing 99% upside for the AI chipmaker. On the other end, it has a $100 bearish scenario lying in wait, which gives the shares a 15% downside risk.

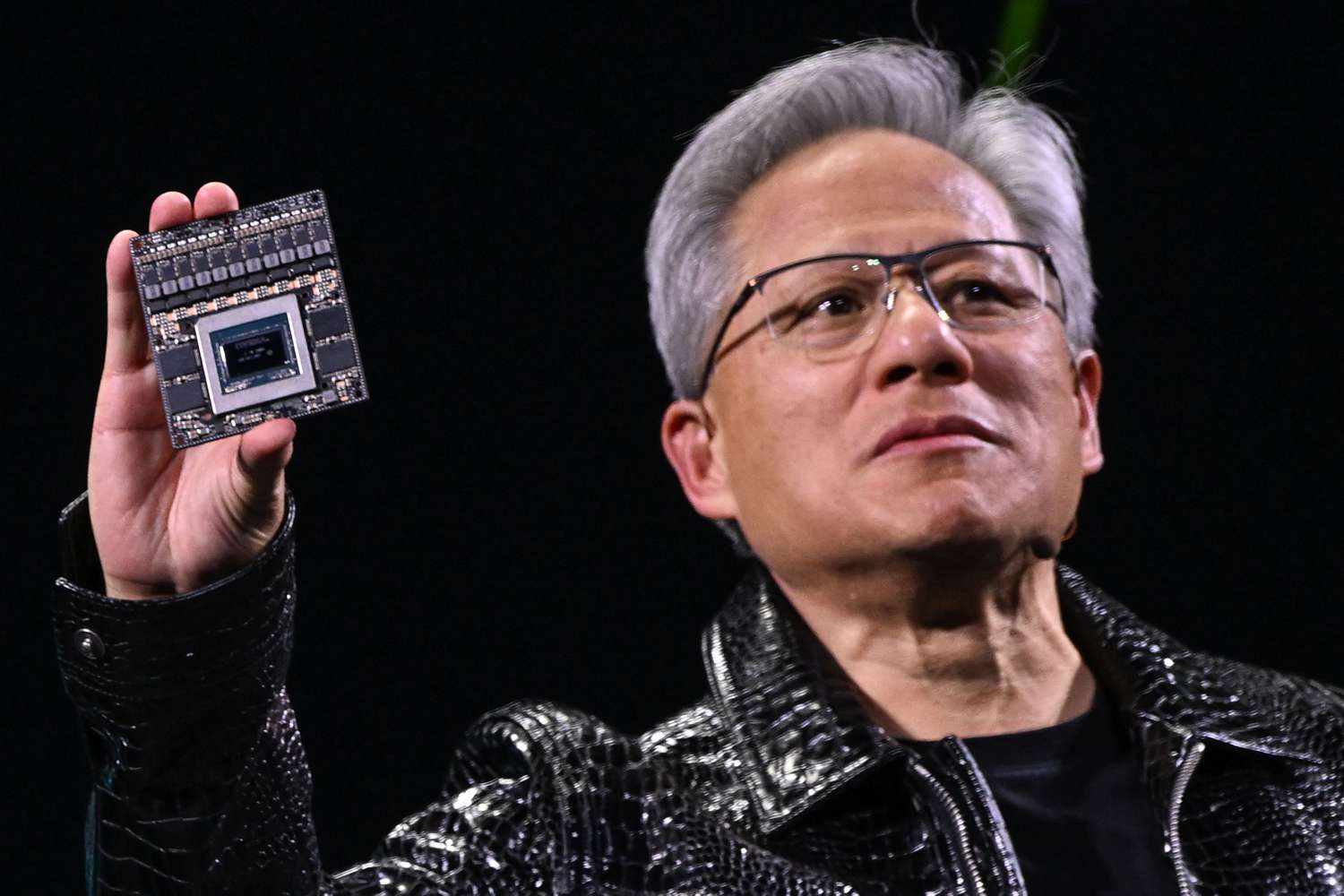

Nvidia (NVDA) Keeps Gaining After US Chip Export Shift: Is $200 Next?

Thursday had proven to be a big turnaround day for the US stock market amid major developments within global trade deals. That is not the only good news for one of the biggest companies in the world. Indeed, Nvidia (NVDA) has kept gaining as the US recently shifted its stance on chip exports, as $200 could be next for the company.

Throughout the first four months of the year, volatility had been the name of the game for Wall Street. Nvidia had struggled lightly, being front and center within ongoing geopolitical tension that threatened its US and Chinese market share. That could be changing, however, as a shift in sentiment could have the stock poised to soar.

Also Read: Amazon (AMZN) to Eclipse Nvidia (NVDA) by 2030 Thanks to AI?

Nvidia Gains Yet Again as Its Outlook Quickly Shifts: Is $200 Now On The Cards For 2025?

In what was a major development for the country’s tech sector, US President Donald Trump announced he is rescinding chip export restrictions. As one can imagine, the decision has major ramifications. Indeed, it propelled AI chipmakers to find momentum that has been increasingly rare this year.

Moreover, it could represent a major shift set to take place for Nvidia (NVDA), as it has gained for the second straight day due to the chip export shift that could have the stock on pace for a trip to the $200 level. After a worrisome start to the year, traders are anxiously awaiting to see if this could be the turnaround many had hoped for.

Also Read: Nvidia (NVDA): Can It Reclaim Its Spot as World’s Most Valuable in 2025?

On Wednesday, the stock edged up 3% after the news. Specifically, traders saw the benefit in the green repeal that will address the complexity of exporting chips overseas. On Thursday, the US and UK announced a new trade deal, leading the stock to jump alongside the market yet again. Now, it’s trading at the $118 level with some potential to gain even more.

The question is, what is the stock’s ceiling? According to CNN data, Nvidia has a median price target of $160, representing a 35% jump from its current position. However, its bullish projection sits at $235, representing 99% upside for the AI chipmaker. On the other end, it has a $100 bearish scenario lying in wait, which gives the shares a 15% downside risk.