Chainlink Is In The Middle Of A Bullish Breakout – Analyst Sets $50 Target

Chainlink (LINK) is navigating a turbulent market phase, recently experiencing an 11% decline after reaching a local high of $27 yesterday. This pullback reflects the heightened volatility sweeping through the cryptocurrency market, particularly affecting altcoins. Many altcoins, including Chainlink, are facing sharp declines and aggressive price swings as traders respond to uncertain conditions and Bitcoin’s consolidation near all-time highs.

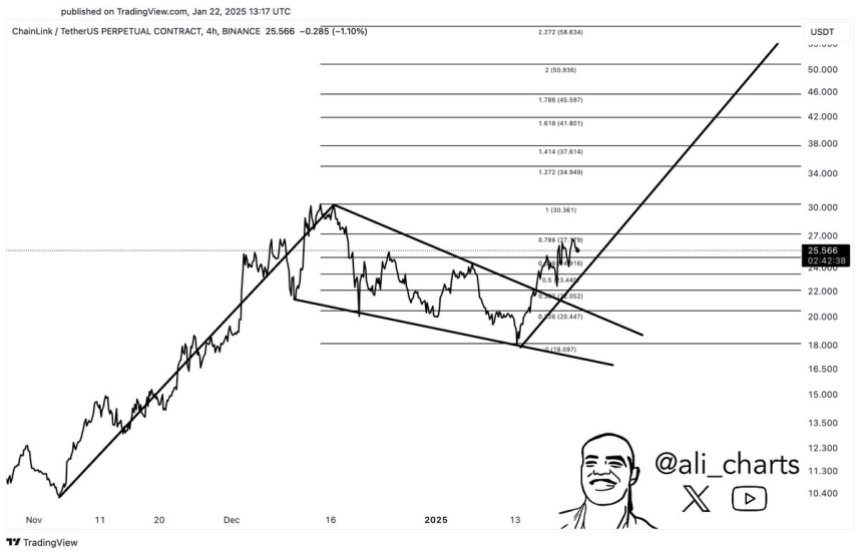

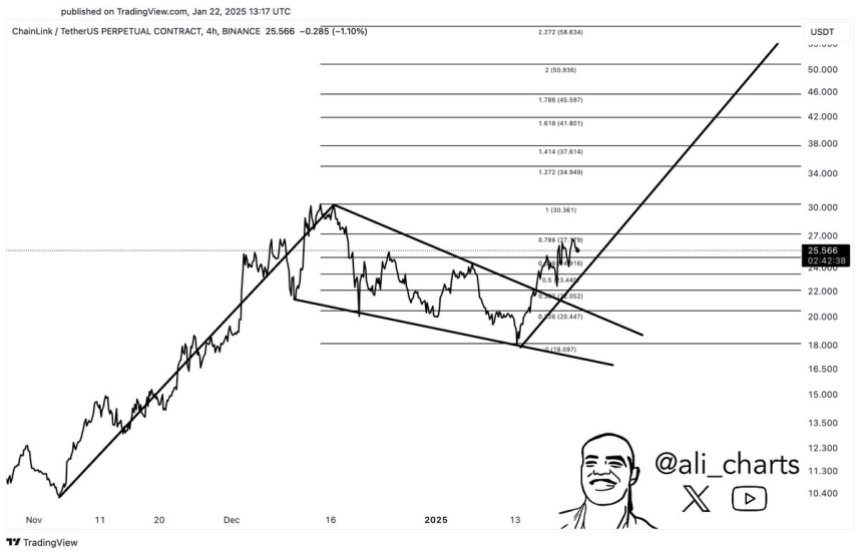

Despite the recent dip, optimism remains among analysts and investors. Top analyst Ali Martinez shared a technical analysis on X, highlighting a bullish perspective for Chainlink. According to Martinez, LINK is currently in the midst of a bullish breakout that, if sustained, could propel the price toward a $50 target. This long-term outlook offers hope for those concerned about the recent retracement, positioning Chainlink as a potential standout in the altcoin market.

As volatility continues to dominate, Chainlink’s ability to navigate these conditions and hold above key levels will be crucial for its bullish trajectory. With analysts pointing to the potential for significant upside, the market is closely watching LINK’s price action in anticipation of its next move. The coming days will reveal whether Chainlink can capitalize on its current setup and emerge as a leader in the altcoin space.

Chainlink Prepares For A Breakout

Chainlink (LINK) has emerged as a bullish standout amid a volatile crypto market, displaying resilience and strength even as altcoins face aggressive selling pressure and uncertainty. With its price maintaining a clear bullish structure, Chainlink appears poised for another upward move, signaling confidence among investors despite broader market turbulence.

Renowned crypto analyst Ali Martinez recently shared a technical analysis on X, highlighting Chainlink’s strong position. According to Martinez, LINK is currently in the midst of a bullish breakout, with a target set at $50. This optimistic projection is supported by the token’s ability to consolidate above critical demand levels, further reinforcing its bullish outlook.

Beyond the technicals, Chainlink’s strong fundamentals add to its appeal. As a pioneer in Oracle blockchain technology, Chainlink continues to cement its leadership in the Real-World Assets (RWA) sector. Its cutting-edge solutions, which enable seamless data integration between blockchains and traditional systems, have garnered widespread adoption and positioned Chainlink as an indispensable part of the decentralized finance ecosystem.

As Chainlink consolidates its gains and prepares for the next leg higher, all eyes are on its ability to maintain its structure and capitalize on its bullish momentum. With both technical and fundamental indicators aligning, LINK is well-positioned to weather market volatility and lead the altcoin recovery. Investors are watching closely as Chainlink continues to set itself apart in the evolving crypto landscape, with its $50 target representing a potential milestone in its ongoing growth.

LINK Holding Strong Above Key Level

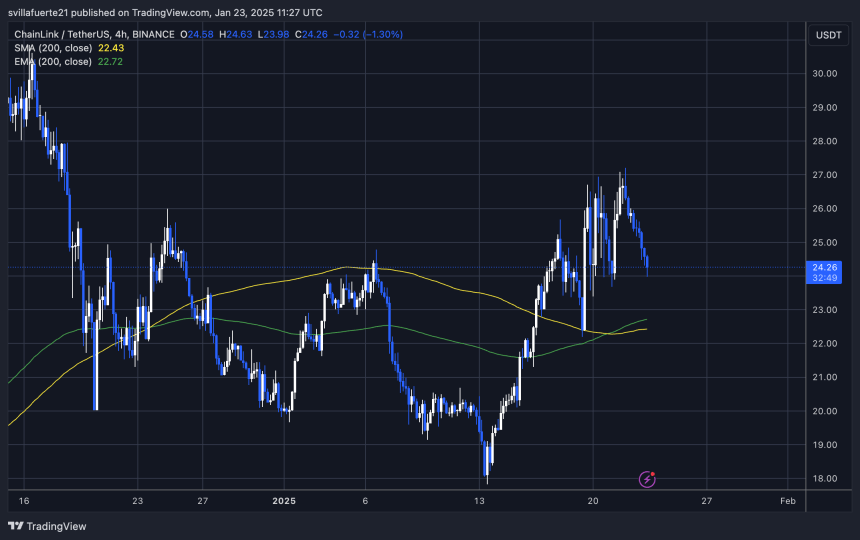

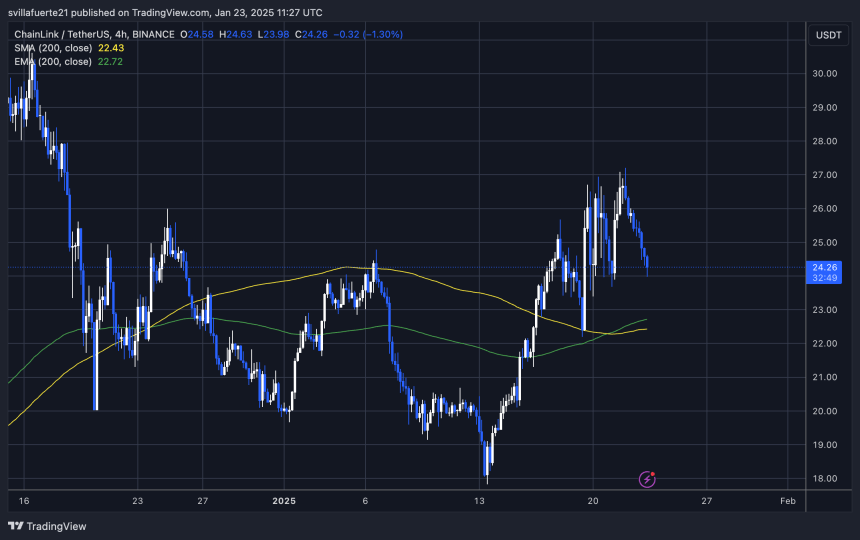

Chainlink (LINK) is currently trading at $24.26, a pivotal level that has transitioned from a stubborn resistance to a strong support zone. This shift marks a significant milestone for LINK, as the $24 level had acted as a supply zone for weeks. Now holding firmly as support, it signals that bulls have regained control, setting the stage for a potential surge.

The price action suggests that LINK is building momentum to break above the $27 mark, a critical level that could trigger a more explosive rally. With the broader market facing uncertainty and heightened volatility, LINK’s ability to maintain key demand zones showcases its relative strength and investor confidence.

This bullish setup positions Chainlink as a standout performer among altcoins, as it continues to weather market turbulence. If bulls can maintain control and push above $27 with conviction, the next rally could propel LINK into higher targets, potentially sparking renewed interest and activity in the altcoin market.

As traders closely monitor these developments, Chainlink’s resilience at the $24.26 level underscores its potential for significant upside. The coming days will be crucial in determining whether LINK can sustain its bullish structure and capitalize on this opportunity to lead the market higher.

Featured image from Dall-E, chart from TradingView

Chainlink Is In The Middle Of A Bullish Breakout – Analyst Sets $50 Target

Chainlink (LINK) is navigating a turbulent market phase, recently experiencing an 11% decline after reaching a local high of $27 yesterday. This pullback reflects the heightened volatility sweeping through the cryptocurrency market, particularly affecting altcoins. Many altcoins, including Chainlink, are facing sharp declines and aggressive price swings as traders respond to uncertain conditions and Bitcoin’s consolidation near all-time highs.

Despite the recent dip, optimism remains among analysts and investors. Top analyst Ali Martinez shared a technical analysis on X, highlighting a bullish perspective for Chainlink. According to Martinez, LINK is currently in the midst of a bullish breakout that, if sustained, could propel the price toward a $50 target. This long-term outlook offers hope for those concerned about the recent retracement, positioning Chainlink as a potential standout in the altcoin market.

As volatility continues to dominate, Chainlink’s ability to navigate these conditions and hold above key levels will be crucial for its bullish trajectory. With analysts pointing to the potential for significant upside, the market is closely watching LINK’s price action in anticipation of its next move. The coming days will reveal whether Chainlink can capitalize on its current setup and emerge as a leader in the altcoin space.

Chainlink Prepares For A Breakout

Chainlink (LINK) has emerged as a bullish standout amid a volatile crypto market, displaying resilience and strength even as altcoins face aggressive selling pressure and uncertainty. With its price maintaining a clear bullish structure, Chainlink appears poised for another upward move, signaling confidence among investors despite broader market turbulence.

Renowned crypto analyst Ali Martinez recently shared a technical analysis on X, highlighting Chainlink’s strong position. According to Martinez, LINK is currently in the midst of a bullish breakout, with a target set at $50. This optimistic projection is supported by the token’s ability to consolidate above critical demand levels, further reinforcing its bullish outlook.

Beyond the technicals, Chainlink’s strong fundamentals add to its appeal. As a pioneer in Oracle blockchain technology, Chainlink continues to cement its leadership in the Real-World Assets (RWA) sector. Its cutting-edge solutions, which enable seamless data integration between blockchains and traditional systems, have garnered widespread adoption and positioned Chainlink as an indispensable part of the decentralized finance ecosystem.

As Chainlink consolidates its gains and prepares for the next leg higher, all eyes are on its ability to maintain its structure and capitalize on its bullish momentum. With both technical and fundamental indicators aligning, LINK is well-positioned to weather market volatility and lead the altcoin recovery. Investors are watching closely as Chainlink continues to set itself apart in the evolving crypto landscape, with its $50 target representing a potential milestone in its ongoing growth.

LINK Holding Strong Above Key Level

Chainlink (LINK) is currently trading at $24.26, a pivotal level that has transitioned from a stubborn resistance to a strong support zone. This shift marks a significant milestone for LINK, as the $24 level had acted as a supply zone for weeks. Now holding firmly as support, it signals that bulls have regained control, setting the stage for a potential surge.

The price action suggests that LINK is building momentum to break above the $27 mark, a critical level that could trigger a more explosive rally. With the broader market facing uncertainty and heightened volatility, LINK’s ability to maintain key demand zones showcases its relative strength and investor confidence.

This bullish setup positions Chainlink as a standout performer among altcoins, as it continues to weather market turbulence. If bulls can maintain control and push above $27 with conviction, the next rally could propel LINK into higher targets, potentially sparking renewed interest and activity in the altcoin market.

As traders closely monitor these developments, Chainlink’s resilience at the $24.26 level underscores its potential for significant upside. The coming days will be crucial in determining whether LINK can sustain its bullish structure and capitalize on this opportunity to lead the market higher.

Featured image from Dall-E, chart from TradingView