Bitget’s Q1 Trading Volume Surpassed $1.6 Trillion Amid Crypto Market Rally: Report

The first quarter of 2024 saw a major increase in demand for complex crypto products due to the crypto bull market, according to reports from various exchanges.

Bitget’s Q1 2024 Report shows a 100% surge in spot and futures trading transaction volume, topping $1.4 trillion and $160 billion, respectively.

The surge represents a substantial growth from the $658 billion in futures trading volume and $59 billion in spot trading volume, respectively, in Q1 of 2023.

Bitget Trading Volume and the Crypto Rally

In the first quarter, Bitget became home to more than 25 million users through its web3 wallet and trading platform.

“February saw a robust market recovery, with Bitcoin soaring to unprecedented heights,” the Bitget report said. Together with the buzz around Solana and advancements in the AI sector, this underscored the market’s dynamic nature.”

During Q1 2024, the market exchange introduced 186 new tokens, including Dogwifhat (WIF), Solana meme coin, and rollup utility token Altayler (ALT), which experienced a major pump of over 1,000% post-listing.

Bitget Transparency Report: Q1 2024.

Bitget now serves 25M users worldwide, futures trading volume increased 146% to US$ 1.4 trillion and spot was also up 100% in Q1 2024.

Bitget recorded the highest increase in derivatives market share, with a growth of 2.4% in March.… pic.twitter.com/D2482dj4Ve

— Ukashat Bala Sarki CCII.BC (@UkashatBalaCCII) April 11, 2024

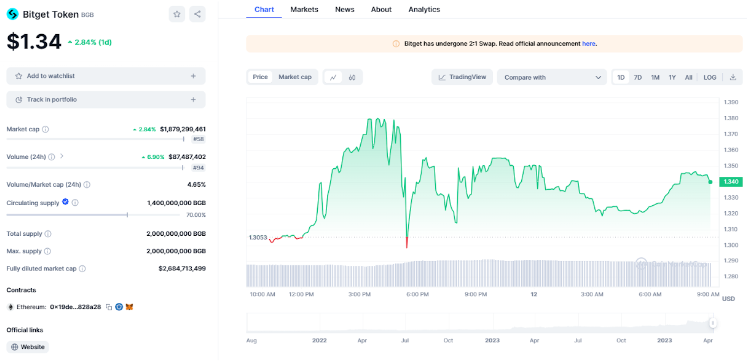

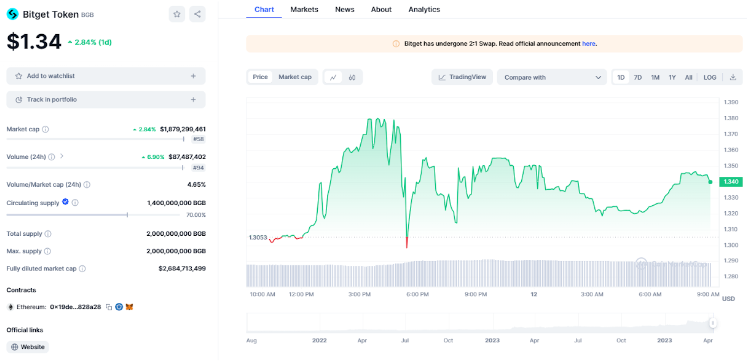

In contrast, the exchange’s native token, BGB, is currently valued at $2.6 billion per BGB capitalization.

The research found that “the top 12 derivatives exchanges, Binance leads with a market share of 47.0% of total volumes in March.”

OKX held a 21.8% market share, while Bitget captured 12.8% of the market.

Impact of the Crypto Rally on Centralized Exchanges

CCData noted the growth in open interest for derivatives and futures contracts, with Binance at 37.7%, Bitget at 34.7%, and OKX at 10.4%.

CCData also found that the derivatives market share had increased by 2.5% in March, which is the highest amongst centralized exchanges (CEX).

In the meantime, Biget’s native BGB token has been trading at $1.34 after gaining 5.51% in the past 24 hours. The token has surged 434% since the beginning of 2024, far surpassing Bitcoin and many other CEX cryptos.

The post Bitget’s Q1 Trading Volume Surpassed $1.6 Trillion Amid Crypto Market Rally: Report appeared first on Cryptonews.

Bitget’s Q1 Trading Volume Surpassed $1.6 Trillion Amid Crypto Market Rally: Report

The first quarter of 2024 saw a major increase in demand for complex crypto products due to the crypto bull market, according to reports from various exchanges.

Bitget’s Q1 2024 Report shows a 100% surge in spot and futures trading transaction volume, topping $1.4 trillion and $160 billion, respectively.

The surge represents a substantial growth from the $658 billion in futures trading volume and $59 billion in spot trading volume, respectively, in Q1 of 2023.

Bitget Trading Volume and the Crypto Rally

In the first quarter, Bitget became home to more than 25 million users through its web3 wallet and trading platform.

“February saw a robust market recovery, with Bitcoin soaring to unprecedented heights,” the Bitget report said. Together with the buzz around Solana and advancements in the AI sector, this underscored the market’s dynamic nature.”

During Q1 2024, the market exchange introduced 186 new tokens, including Dogwifhat (WIF), Solana meme coin, and rollup utility token Altayler (ALT), which experienced a major pump of over 1,000% post-listing.

Bitget Transparency Report: Q1 2024.

Bitget now serves 25M users worldwide, futures trading volume increased 146% to US$ 1.4 trillion and spot was also up 100% in Q1 2024.

Bitget recorded the highest increase in derivatives market share, with a growth of 2.4% in March.… pic.twitter.com/D2482dj4Ve

— Ukashat Bala Sarki CCII.BC (@UkashatBalaCCII) April 11, 2024

In contrast, the exchange’s native token, BGB, is currently valued at $2.6 billion per BGB capitalization.

The research found that “the top 12 derivatives exchanges, Binance leads with a market share of 47.0% of total volumes in March.”

OKX held a 21.8% market share, while Bitget captured 12.8% of the market.

Impact of the Crypto Rally on Centralized Exchanges

CCData noted the growth in open interest for derivatives and futures contracts, with Binance at 37.7%, Bitget at 34.7%, and OKX at 10.4%.

CCData also found that the derivatives market share had increased by 2.5% in March, which is the highest amongst centralized exchanges (CEX).

In the meantime, Biget’s native BGB token has been trading at $1.34 after gaining 5.51% in the past 24 hours. The token has surged 434% since the beginning of 2024, far surpassing Bitcoin and many other CEX cryptos.

The post Bitget’s Q1 Trading Volume Surpassed $1.6 Trillion Amid Crypto Market Rally: Report appeared first on Cryptonews.