On-Chain Bitcoin Metrics Hinting at Consolidation or Further Correction, Warns Crypto Analytics Firm Glassnode

On-chain metrics suggest Bitcoin (BTC) could be headed for sideways movement or more correction amid weakening buying pressure, according to the crypto analytics firm Glassnode.

Glassnode says on the social media platform X that BTC’s short-term demand momentum has dwindled.

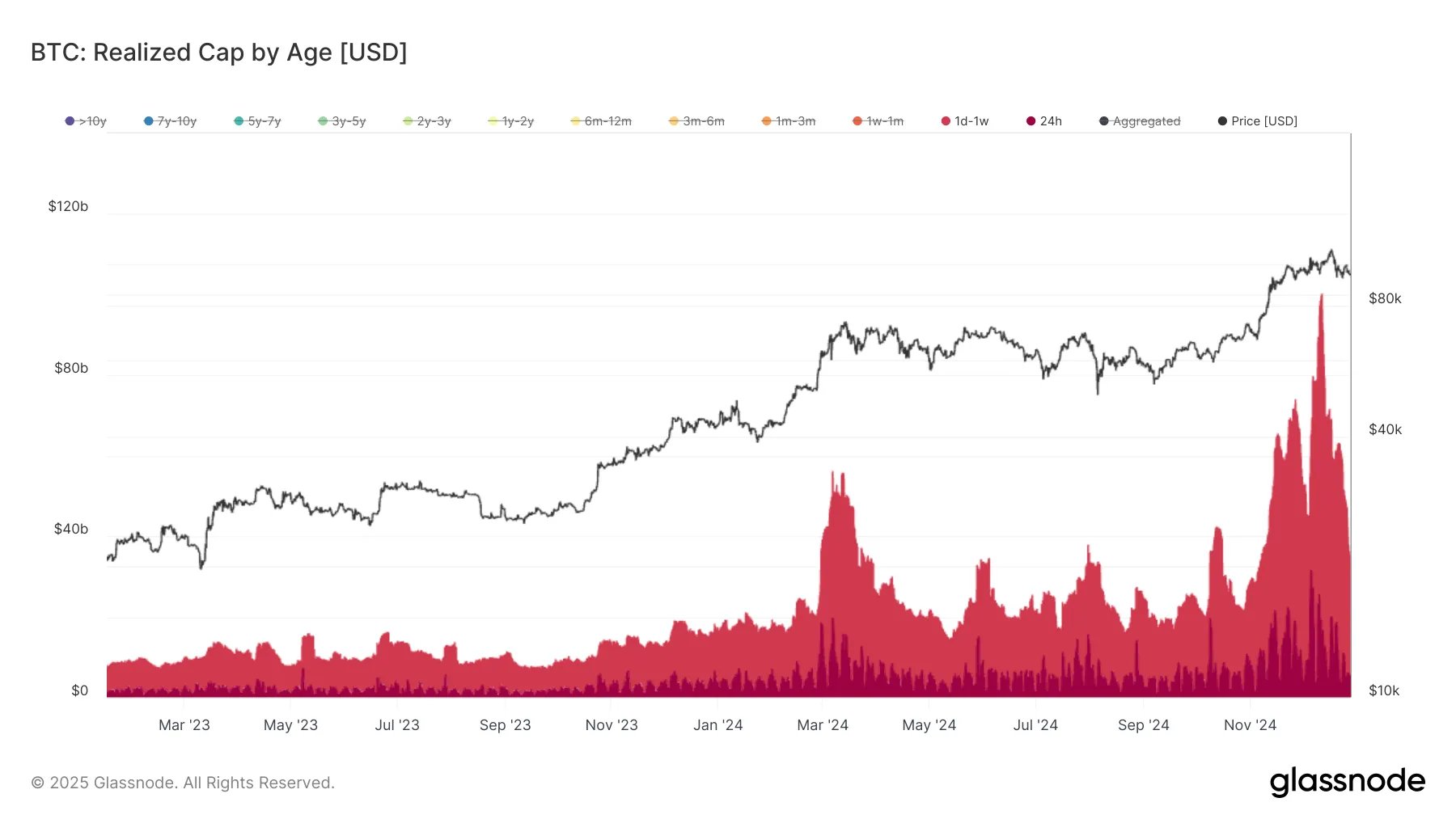

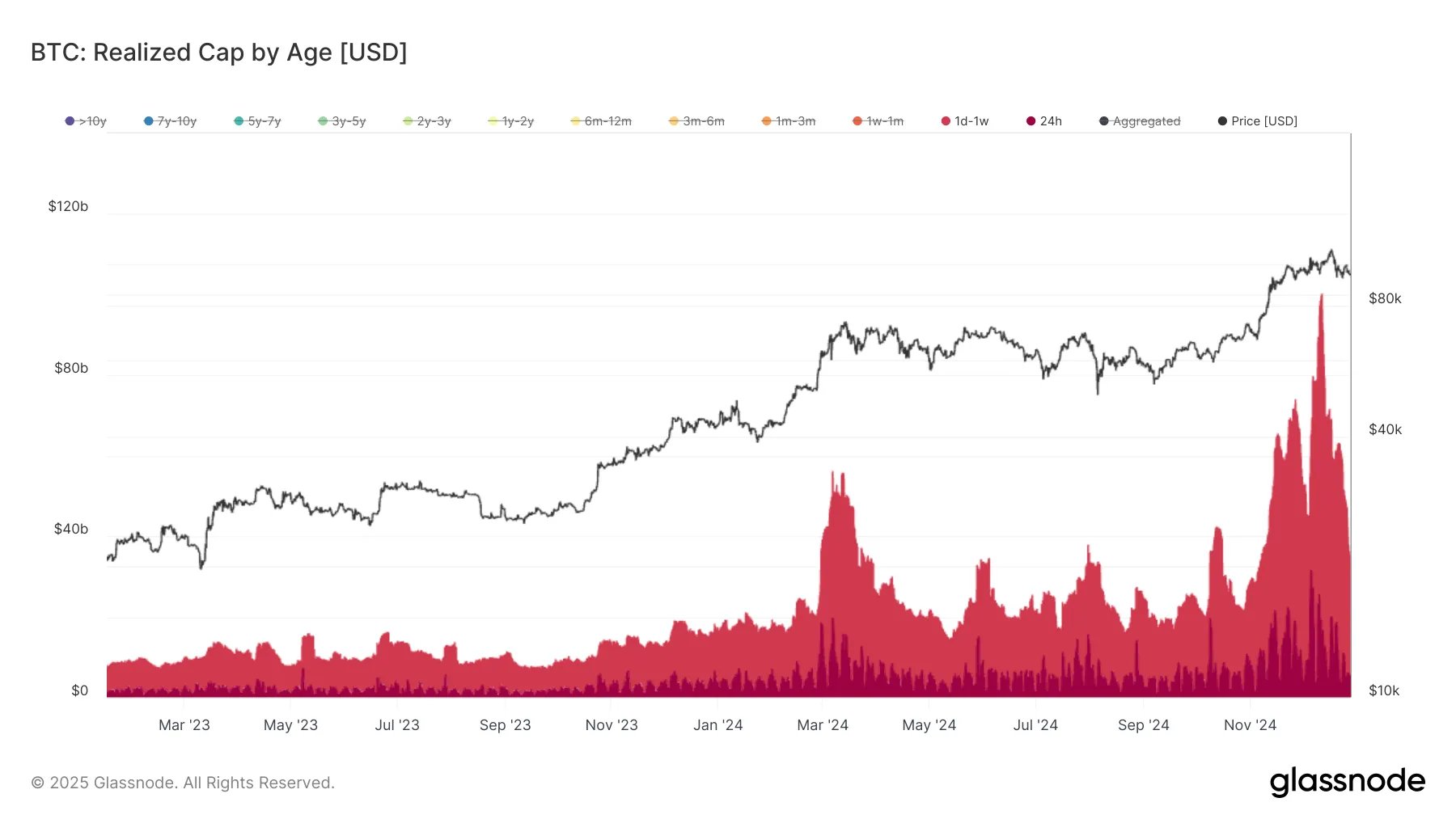

“One key indicator: Hot Capital (capital revived over the last 7 days) has plunged 66.7% from its December 12th peak of $96.2 billion to $32.0 billion.”

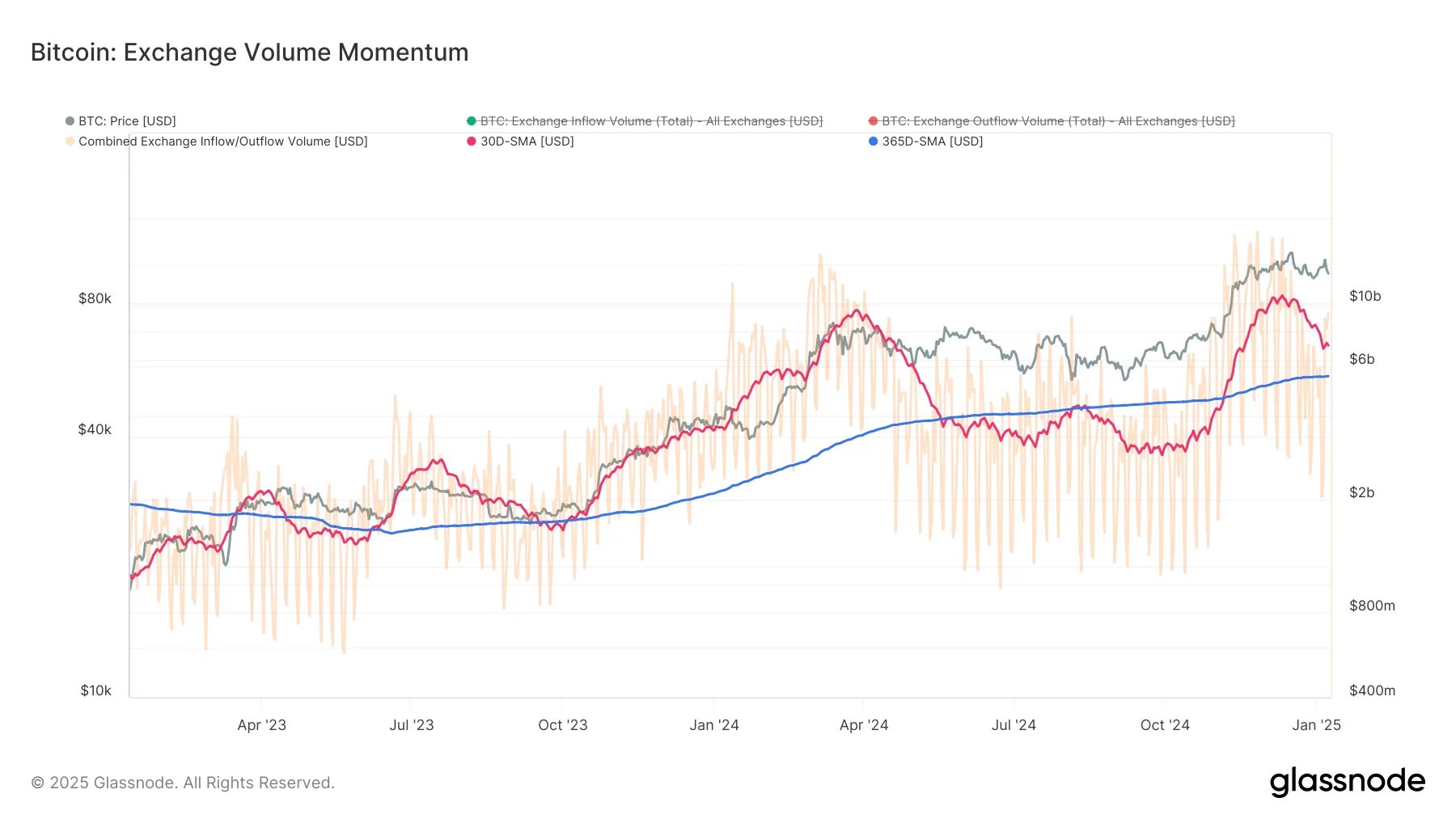

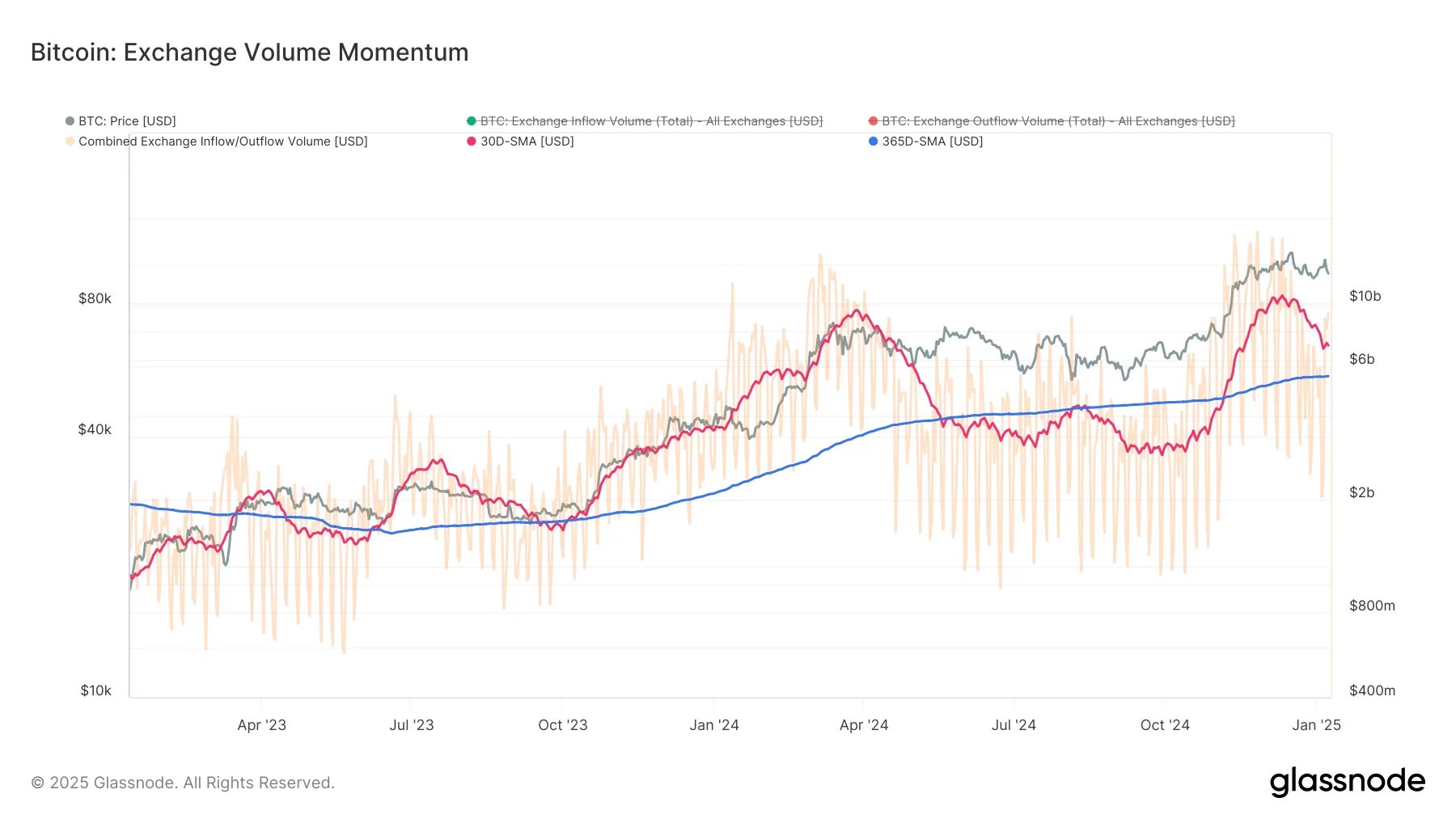

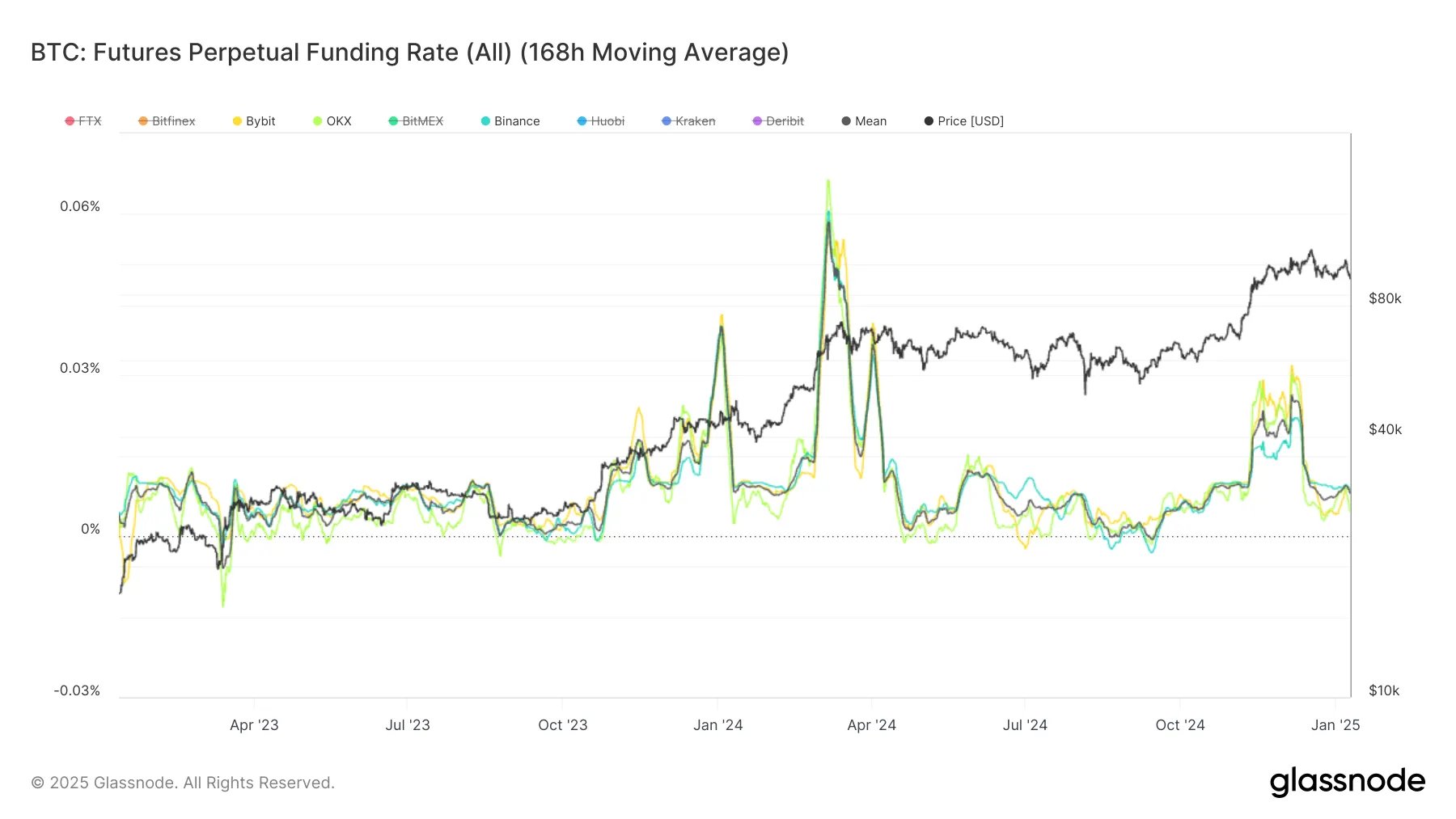

The firm notes that BTC’s diminishing exchange volume momentum and low funding rates also hint at reduced demand.

“The 30-day average of exchange volume is nearing the 365-day average, reflecting reduced capital flows since the December market top.

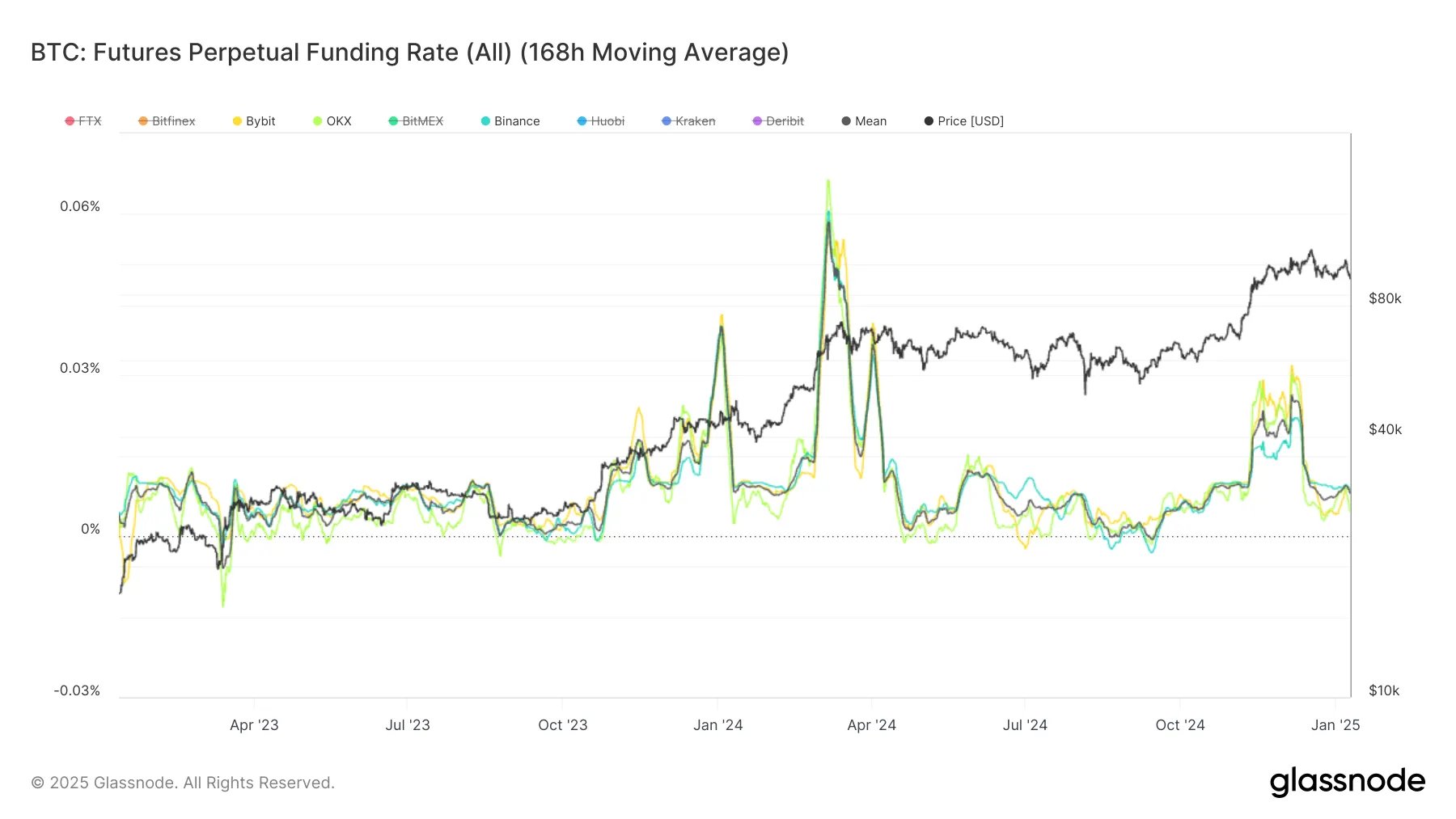

The seven-day moving average of the mean funding rate, as well as the funding rates from the top three perpetual markets, remains below the neutral value of 0.01%. This indicates a continued absence of demand from aggressive buyers, despite the short rally toward $102,000.

Without a new catalyst, the waning short-term demand suggests either a sideways consolidation period or a heightened likelihood of further correction.”

Bitcoin is trading at $92,579 at time of writing. The top-ranked crypto asset by market cap is down nearly 3% in the past 24 hours and more than 4% in the past seven days. BTC also remains more than 14% down from its all-time high of $108,135, which it set in December.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post On-Chain Bitcoin Metrics Hinting at Consolidation or Further Correction, Warns Crypto Analytics Firm Glassnode appeared first on The Daily Hodl.

Read More

Bitcoin Whale Dumps Billions For ETH, But $5 Billion Selloff Still Looms

On-Chain Bitcoin Metrics Hinting at Consolidation or Further Correction, Warns Crypto Analytics Firm Glassnode

On-chain metrics suggest Bitcoin (BTC) could be headed for sideways movement or more correction amid weakening buying pressure, according to the crypto analytics firm Glassnode.

Glassnode says on the social media platform X that BTC’s short-term demand momentum has dwindled.

“One key indicator: Hot Capital (capital revived over the last 7 days) has plunged 66.7% from its December 12th peak of $96.2 billion to $32.0 billion.”

The firm notes that BTC’s diminishing exchange volume momentum and low funding rates also hint at reduced demand.

“The 30-day average of exchange volume is nearing the 365-day average, reflecting reduced capital flows since the December market top.

The seven-day moving average of the mean funding rate, as well as the funding rates from the top three perpetual markets, remains below the neutral value of 0.01%. This indicates a continued absence of demand from aggressive buyers, despite the short rally toward $102,000.

Without a new catalyst, the waning short-term demand suggests either a sideways consolidation period or a heightened likelihood of further correction.”

Bitcoin is trading at $92,579 at time of writing. The top-ranked crypto asset by market cap is down nearly 3% in the past 24 hours and more than 4% in the past seven days. BTC also remains more than 14% down from its all-time high of $108,135, which it set in December.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post On-Chain Bitcoin Metrics Hinting at Consolidation or Further Correction, Warns Crypto Analytics Firm Glassnode appeared first on The Daily Hodl.

Read More