Ethereum Price Beats 14-Day Resistance Despite 1,000 ETH Insider Sell-Off

Ethereum price rose 1.4% on Sunday, October 5, breaking above $4,600 for the first time in two weeks. Derivatives market data shows ETH attracting fresh long bets, even after the Ethereum Foundation confirmed a 1,000 ETH sell-off on Friday.

According to CoinMarketCap, Ethereum traded as high as $4,619 intraday, defying lean spot trading volumes through the weekend. More so, the rally came in the wake of a Foundation announcement stating it would convert 1,000 ETH to stablecoins to fund research, grants, and donations.

1/ Today, The Ethereum Foundation will convert 1000 ETH to stablecoins via 🐮 @CoWSwap's TWAP feature, as part of our ongoing work to fund R&D, grants and donations, and to highlight the power of DeFi.

— Ethereum Foundation (@ethereumfndn) October 3, 2025

Historically, Ethereum Foundation sell-offs have imposed downward pressure on ETH price action. However, ETH derivative markets activity over the weekend may invalidate this trend.

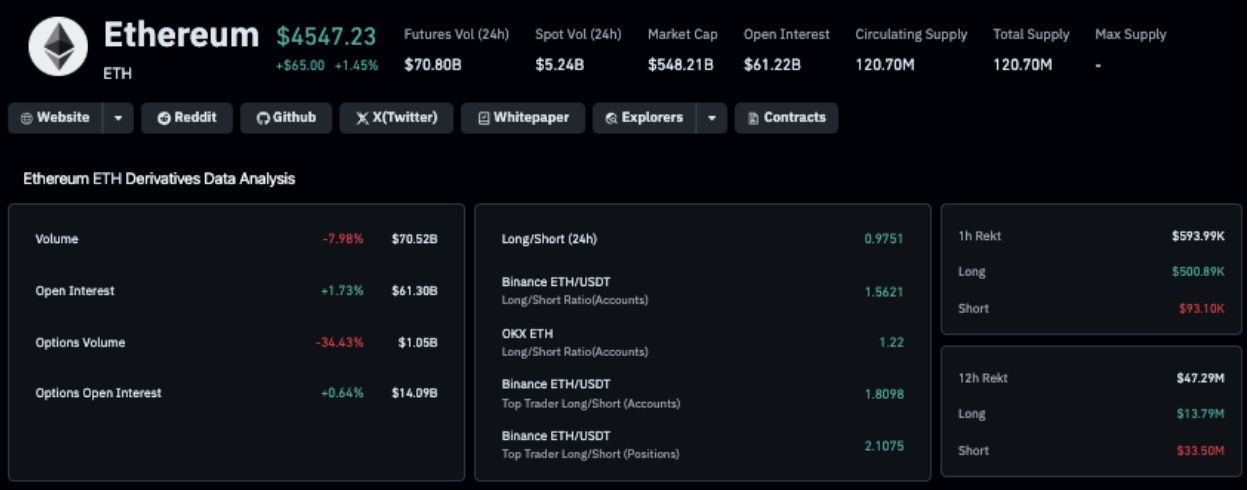

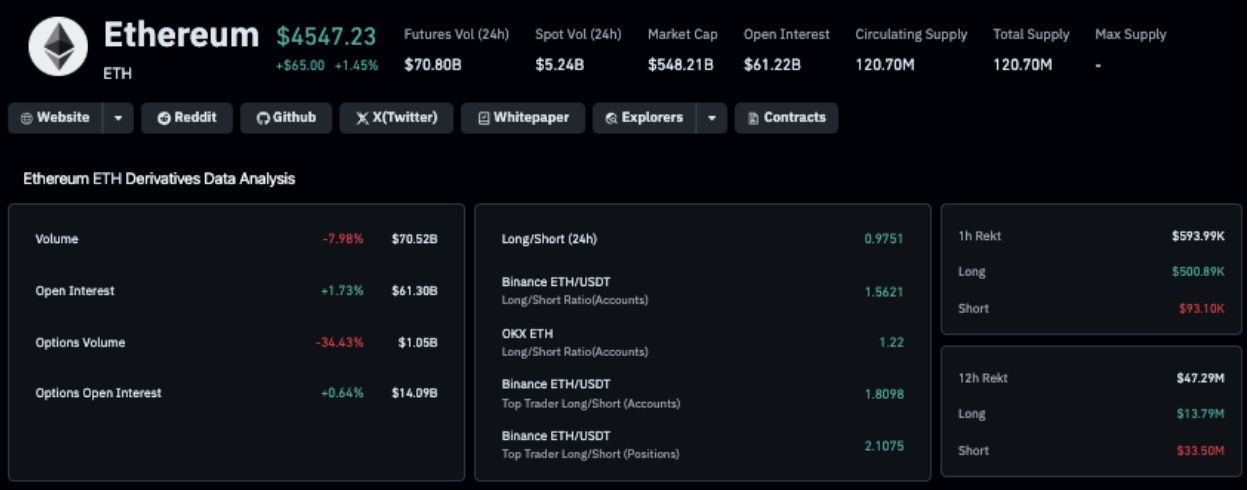

Ethereum Derivatives Market Analysis | Source: Coinglass

The latest data from Coinglass shows that ETH open interest climbed 1.7% in the past 24 hours, to hit $41.3 billion despite a 7.9% drop in trading volume. This divergence suggests that Ethereum Foundation’s sell-off has not nullified bullish conviction among ETH speculative traders.

Bulls Charge Forward Despite Ethereum Foundation Sell-Off

While insider transactions typically spark fear-driven sell-offs, Ethereum’s price has staged a breakout above the $4,600 level and attracted net inflows of $700 million in new futures contracts positions on Sunday.

Valued at approximately $4.6 million at current prices, markets appear unfazed by the Ethereum Foundation’s 1,000 ETH sell-off, with institutional demand and ETF inflows providing strong counterweights.

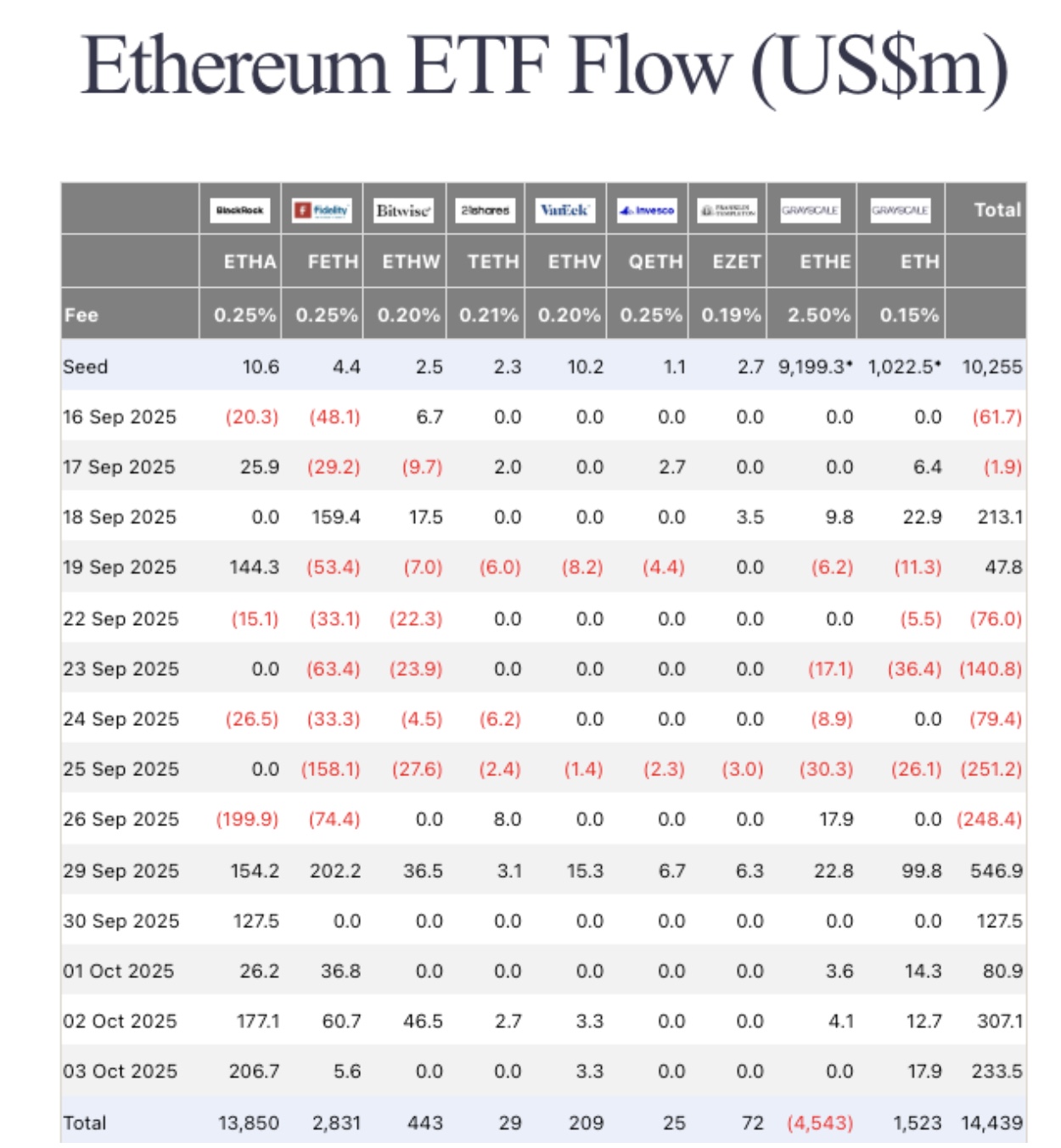

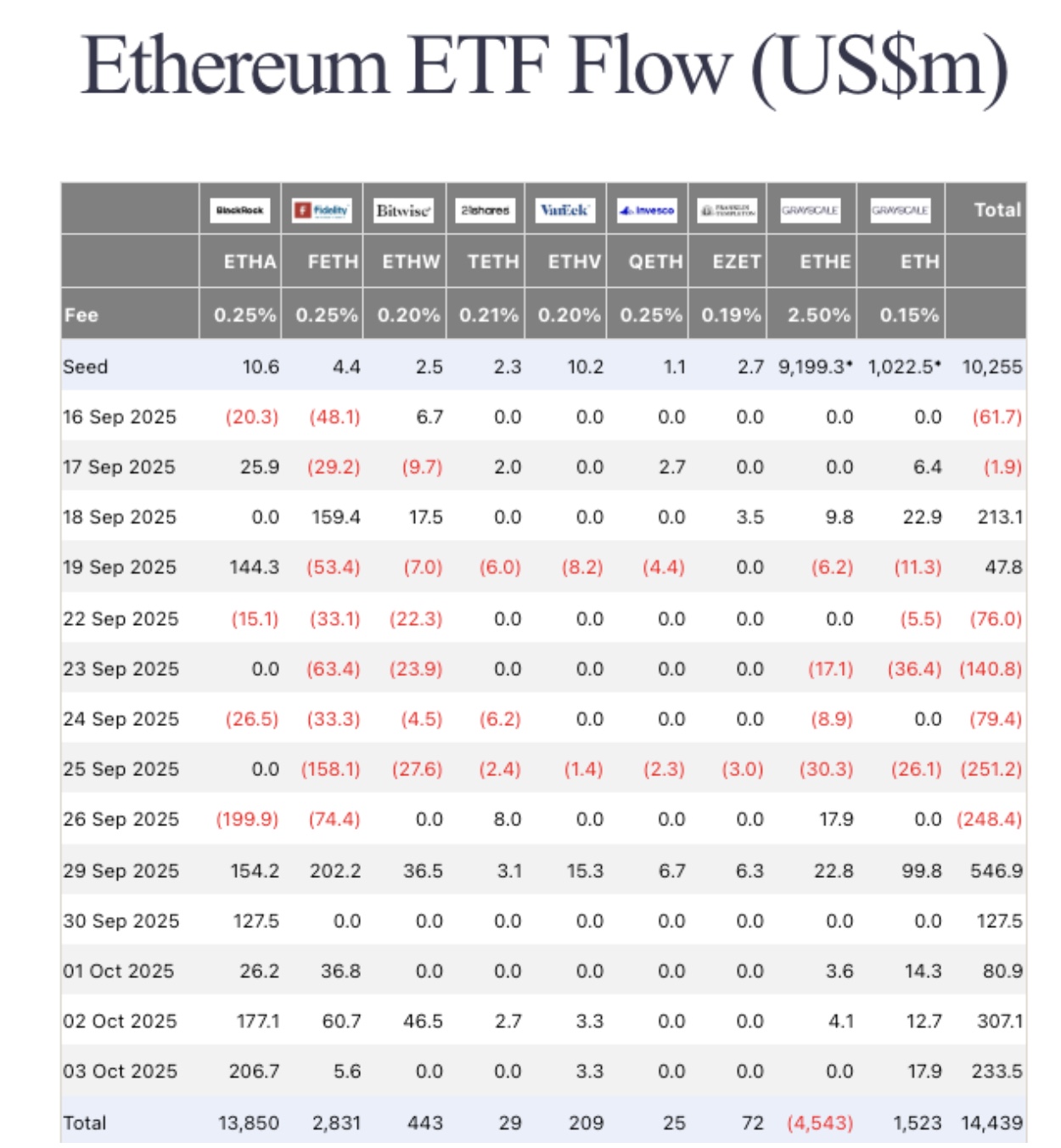

Ethereum ETFs record 1.3 billion net inflows between Sept 29 to Oct 3 | Source: FarsideInvestors

FarsideInvestors data shows the Ethereum ETF scooped $1.3 billion in five consecutive days of net inflows last week.

ETHtreasury reserve inflows also remain active, with market-leader Bitmine (BMNR) has increased its Ethereum holdings to 2.6 million ETH.

Combined, these inflows have provided ETH with the liquidity to defend the $4,600 resistance zone. Should open interest continue rising along with ETF inflows, ETH price could potentially test $4,750 in the week ahead.

The post Ethereum Price Beats 14-Day Resistance Despite 1,000 ETH Insider Sell-Off appeared first on Coinspeaker.

Ethereum Price Beats 14-Day Resistance Despite 1,000 ETH Insider Sell-Off

Ethereum price rose 1.4% on Sunday, October 5, breaking above $4,600 for the first time in two weeks. Derivatives market data shows ETH attracting fresh long bets, even after the Ethereum Foundation confirmed a 1,000 ETH sell-off on Friday.

According to CoinMarketCap, Ethereum traded as high as $4,619 intraday, defying lean spot trading volumes through the weekend. More so, the rally came in the wake of a Foundation announcement stating it would convert 1,000 ETH to stablecoins to fund research, grants, and donations.

1/ Today, The Ethereum Foundation will convert 1000 ETH to stablecoins via 🐮 @CoWSwap's TWAP feature, as part of our ongoing work to fund R&D, grants and donations, and to highlight the power of DeFi.

— Ethereum Foundation (@ethereumfndn) October 3, 2025

Historically, Ethereum Foundation sell-offs have imposed downward pressure on ETH price action. However, ETH derivative markets activity over the weekend may invalidate this trend.

Ethereum Derivatives Market Analysis | Source: Coinglass

The latest data from Coinglass shows that ETH open interest climbed 1.7% in the past 24 hours, to hit $41.3 billion despite a 7.9% drop in trading volume. This divergence suggests that Ethereum Foundation’s sell-off has not nullified bullish conviction among ETH speculative traders.

Bulls Charge Forward Despite Ethereum Foundation Sell-Off

While insider transactions typically spark fear-driven sell-offs, Ethereum’s price has staged a breakout above the $4,600 level and attracted net inflows of $700 million in new futures contracts positions on Sunday.

Valued at approximately $4.6 million at current prices, markets appear unfazed by the Ethereum Foundation’s 1,000 ETH sell-off, with institutional demand and ETF inflows providing strong counterweights.

Ethereum ETFs record 1.3 billion net inflows between Sept 29 to Oct 3 | Source: FarsideInvestors

FarsideInvestors data shows the Ethereum ETF scooped $1.3 billion in five consecutive days of net inflows last week.

ETHtreasury reserve inflows also remain active, with market-leader Bitmine (BMNR) has increased its Ethereum holdings to 2.6 million ETH.

Combined, these inflows have provided ETH with the liquidity to defend the $4,600 resistance zone. Should open interest continue rising along with ETF inflows, ETH price could potentially test $4,750 in the week ahead.

The post Ethereum Price Beats 14-Day Resistance Despite 1,000 ETH Insider Sell-Off appeared first on Coinspeaker.