XRP vs. MicroStrategy: Which Investment Has the Bigger Upside?

- MicroStrategy acts like a leveraged Bitcoin ETF, with its $42.8 billion BTC stash amplifying gains (and risks) as Bitcoin prices swing.

- XRP focuses on real-world adoption, with banks, CBDC pilots, and cross-border payments driving long-term growth rather than short-term speculation.

- Strategy offers high-risk, high-reward potential, while XRP is a steadier, utility-driven play that may deliver solid gains over a longer horizon.

When it comes to picking between a crypto asset like XRP and a company like MicroStrategy (now just “Strategy”), the decision isn’t as straightforward as it sounds. Are you better off buying a token directly, or putting money into a business that borrows to keep stacking Bitcoin? It’s a question that leaves some investors scratching their heads. Both XRP and Strategy have multi-billion-dollar market caps, and neither is some tiny moonshot. Still, each carries its own narrative that could, at least in theory, mint a few fresh millionaires.

MicroStrategy’s Bitcoin Obsession

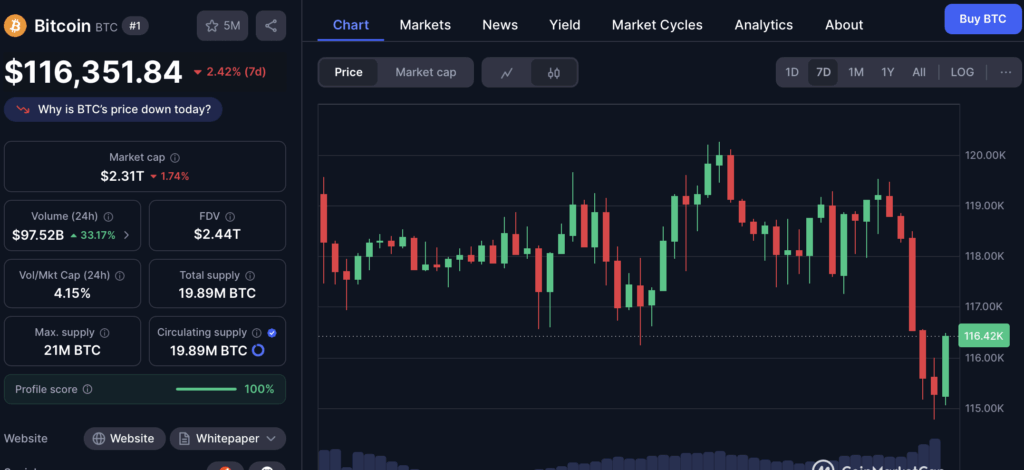

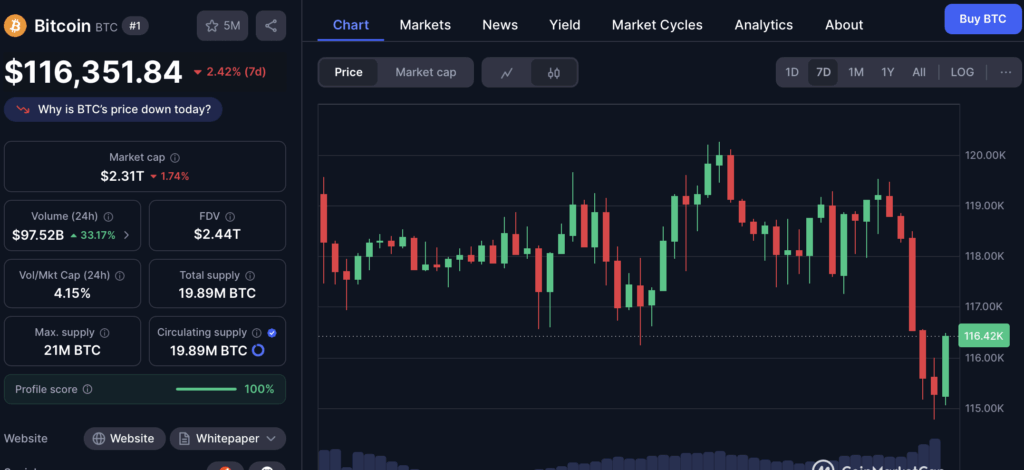

Strategy’s stock has been on a tear, with a market cap now hovering near $126 billion — up a crazy 188% in a single year. Why? Simple: the company holds over 601,000 Bitcoins, bought for roughly $42.8 billion, and it’s still issuing zero-coupon convertible notes to buy even more. With Bitcoin up 86% in the past year, Strategy’s leveraged approach amplifies gains far beyond what Bitcoin alone can offer.

Think of it as a turbocharged Bitcoin ETF. When Bitcoin moves 10%, Strategy’s stock can rip even higher because of the leverage and the premium investors are willing to pay for easy Bitcoin exposure via traditional markets. But leverage cuts both ways — if Bitcoin takes a dive, Strategy’s stock could crater faster. While some worry about the company being forced to dump its BTC stash, analysts say even a deep crash likely won’t trigger mass liquidations anytime soon.

XRP’s Steadier Play

Unlike Strategy, XRP isn’t a company. It’s the native token of Ripple’s blockchain, which now boasts a $195 billion market cap after a strong July rally. XRP doesn’t rely on leverage to grow; instead, it’s betting on global adoption of its XRP Ledger (XRPL) by banks, governments, and financial institutions. That bet is starting to pay off.

Bhutan is piloting a CBDC on Ripple’s tech, Palau just finished auditing its XRP-based stablecoin trial, and a growing list of banks are using XRP to streamline cross-border transfers. Each integration pushes more volume and demand onto the network. Unlike many blockchains, XRP has regulatory compliance baked in, making it a natural fit for institutional players — a factor that could prove valuable as global finance inches closer to tokenization.

Which One Wins?

Strategy’s path to wealth is high-octane but risky. If Bitcoin doubles, Strategy’s stock could soar even faster due to its leverage. But if Bitcoin stumbles, that same leverage could wreck investors just as quickly. XRP, meanwhile, is playing the long game — building out payment rails, landing CBDC pilots, and targeting real-world finance.

Could XRP hit 10x from here? Maybe — but only if Ripple’s adoption narrative explodes with multiple government deals and a surge in tokenized assets. It’s more of a marathon than a sprint. For investors, that means XRP might suit patient holders, while Strategy is better for those willing to stomach extreme volatility in exchange for potentially parabolic gains.

In the end, there’s no clear winner — just two very different roads to potential wealth. If you’re chasing quick millionaire dreams, Strategy might be the rocket ship. If you want a long-term, lower-volatility bet tied to real utility, XRP might be the safer lane.

The post XRP vs. MicroStrategy: Which Investment Has the Bigger Upside? first appeared on BlockNews.

XRP vs. MicroStrategy: Which Investment Has the Bigger Upside?

- MicroStrategy acts like a leveraged Bitcoin ETF, with its $42.8 billion BTC stash amplifying gains (and risks) as Bitcoin prices swing.

- XRP focuses on real-world adoption, with banks, CBDC pilots, and cross-border payments driving long-term growth rather than short-term speculation.

- Strategy offers high-risk, high-reward potential, while XRP is a steadier, utility-driven play that may deliver solid gains over a longer horizon.

When it comes to picking between a crypto asset like XRP and a company like MicroStrategy (now just “Strategy”), the decision isn’t as straightforward as it sounds. Are you better off buying a token directly, or putting money into a business that borrows to keep stacking Bitcoin? It’s a question that leaves some investors scratching their heads. Both XRP and Strategy have multi-billion-dollar market caps, and neither is some tiny moonshot. Still, each carries its own narrative that could, at least in theory, mint a few fresh millionaires.

MicroStrategy’s Bitcoin Obsession

Strategy’s stock has been on a tear, with a market cap now hovering near $126 billion — up a crazy 188% in a single year. Why? Simple: the company holds over 601,000 Bitcoins, bought for roughly $42.8 billion, and it’s still issuing zero-coupon convertible notes to buy even more. With Bitcoin up 86% in the past year, Strategy’s leveraged approach amplifies gains far beyond what Bitcoin alone can offer.

Think of it as a turbocharged Bitcoin ETF. When Bitcoin moves 10%, Strategy’s stock can rip even higher because of the leverage and the premium investors are willing to pay for easy Bitcoin exposure via traditional markets. But leverage cuts both ways — if Bitcoin takes a dive, Strategy’s stock could crater faster. While some worry about the company being forced to dump its BTC stash, analysts say even a deep crash likely won’t trigger mass liquidations anytime soon.

XRP’s Steadier Play

Unlike Strategy, XRP isn’t a company. It’s the native token of Ripple’s blockchain, which now boasts a $195 billion market cap after a strong July rally. XRP doesn’t rely on leverage to grow; instead, it’s betting on global adoption of its XRP Ledger (XRPL) by banks, governments, and financial institutions. That bet is starting to pay off.

Bhutan is piloting a CBDC on Ripple’s tech, Palau just finished auditing its XRP-based stablecoin trial, and a growing list of banks are using XRP to streamline cross-border transfers. Each integration pushes more volume and demand onto the network. Unlike many blockchains, XRP has regulatory compliance baked in, making it a natural fit for institutional players — a factor that could prove valuable as global finance inches closer to tokenization.

Which One Wins?

Strategy’s path to wealth is high-octane but risky. If Bitcoin doubles, Strategy’s stock could soar even faster due to its leverage. But if Bitcoin stumbles, that same leverage could wreck investors just as quickly. XRP, meanwhile, is playing the long game — building out payment rails, landing CBDC pilots, and targeting real-world finance.

Could XRP hit 10x from here? Maybe — but only if Ripple’s adoption narrative explodes with multiple government deals and a surge in tokenized assets. It’s more of a marathon than a sprint. For investors, that means XRP might suit patient holders, while Strategy is better for those willing to stomach extreme volatility in exchange for potentially parabolic gains.

In the end, there’s no clear winner — just two very different roads to potential wealth. If you’re chasing quick millionaire dreams, Strategy might be the rocket ship. If you want a long-term, lower-volatility bet tied to real utility, XRP might be the safer lane.

The post XRP vs. MicroStrategy: Which Investment Has the Bigger Upside? first appeared on BlockNews.