Why The Bitcoin Price Could See Another 70%-170% Jump From Here

The Bitcoin price is still holding above $100,000 despite suffering a crash right before the weekend. It has since bounced back from the $104,000 level, suggesting that bulls are making their stand at this major psychological level. Now, with the crypto market sitting at what looks to be a critical point, questions are arising about what the next step could be from here. Can Bitcoin still rally, or is this the end of a rather short and underwhelming bull market?

Bitcoin Price Still Has A Long Way To Go

Crypto analyst Doctor Profit has been a vocal voice when it comes to the bullishness of the Bitcoin price. He has continued to call for higher prices even at a time when the wider community is expecting the cryptocurrency to keep falling from here. In fact, the crypto analyst believes that the leading crypto could see its price double from here, despite already hitting multiple new all-time highs.

In a post on X, Doctor Profit explained the reasoning behind this and why he believes that the Bitcoin price still has room to run. The first thing he pointed to was the fact that a rare Golden Cross had appeared on the Bitcoin price chart. This happened three weeks ago, and back then, the analyst called out the chart formation, explaining that this meant that the bull run was not over.

This is because every time Bitcoin had flashed a Golden Cross in the past, it had been the start of another massive run. Just like now, it is first followed by a 10% decline in price, which was achieved when Bitcoin fell from $111,900 to $100,000. Now that the first part of the trend seems to have been fulfilled, expectations are that the other parts will play out similarly.

In addition to this, he explains that Bitcoin has also formed its diagonal resistance, which it is now looking to break out from. A successful break would put it back above $108,000 as it gears up for the next leg-up.

Macro Factors That Support The Thesis

Not only does the chart technicals show this possible recovery, but the upcoming Consumer Price Index (CPI) data, expected to be released on Wednesday, plays into this as well. Doctor Profit explains that Wall Street is already expecting the CPI to come in at 2.5%, a rather high number.

Instead, he believes that the CPI will come in lower, putting it between 2.1% and 2.3%. A lower figure would mean that there is a slowdown in inflation, allowing room for more risk-taking and pushing markets such as stocks and crypto higher.

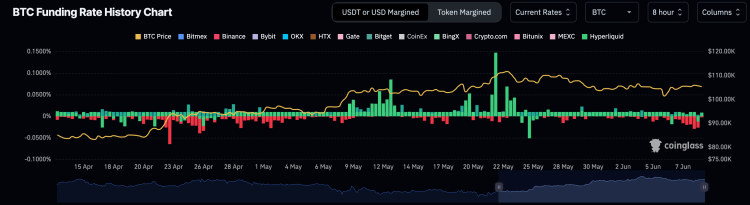

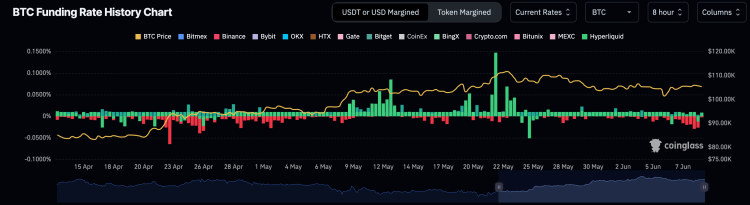

Also, there is the matter of the negative funding rate, which suggests that there are more shorters in the market right now, expecting the price to tank. Data from Coinglass shows the Bitcoin funding rate has dropped to one of the lowest levels this year, and the analyst says this is a sign of a healthy market.

“Overall, I see a strong trend and markets will continue to rise with first targets between 108-110k, and this is by far not the end,” Doctor Profit said. “The golden cross is promising us between 70-170% in gains in the coming months!”

Read More

Bitcoin Calm Won’t Last—This Week Holds Breakout Risk

Why The Bitcoin Price Could See Another 70%-170% Jump From Here

The Bitcoin price is still holding above $100,000 despite suffering a crash right before the weekend. It has since bounced back from the $104,000 level, suggesting that bulls are making their stand at this major psychological level. Now, with the crypto market sitting at what looks to be a critical point, questions are arising about what the next step could be from here. Can Bitcoin still rally, or is this the end of a rather short and underwhelming bull market?

Bitcoin Price Still Has A Long Way To Go

Crypto analyst Doctor Profit has been a vocal voice when it comes to the bullishness of the Bitcoin price. He has continued to call for higher prices even at a time when the wider community is expecting the cryptocurrency to keep falling from here. In fact, the crypto analyst believes that the leading crypto could see its price double from here, despite already hitting multiple new all-time highs.

In a post on X, Doctor Profit explained the reasoning behind this and why he believes that the Bitcoin price still has room to run. The first thing he pointed to was the fact that a rare Golden Cross had appeared on the Bitcoin price chart. This happened three weeks ago, and back then, the analyst called out the chart formation, explaining that this meant that the bull run was not over.

This is because every time Bitcoin had flashed a Golden Cross in the past, it had been the start of another massive run. Just like now, it is first followed by a 10% decline in price, which was achieved when Bitcoin fell from $111,900 to $100,000. Now that the first part of the trend seems to have been fulfilled, expectations are that the other parts will play out similarly.

In addition to this, he explains that Bitcoin has also formed its diagonal resistance, which it is now looking to break out from. A successful break would put it back above $108,000 as it gears up for the next leg-up.

Macro Factors That Support The Thesis

Not only does the chart technicals show this possible recovery, but the upcoming Consumer Price Index (CPI) data, expected to be released on Wednesday, plays into this as well. Doctor Profit explains that Wall Street is already expecting the CPI to come in at 2.5%, a rather high number.

Instead, he believes that the CPI will come in lower, putting it between 2.1% and 2.3%. A lower figure would mean that there is a slowdown in inflation, allowing room for more risk-taking and pushing markets such as stocks and crypto higher.

Also, there is the matter of the negative funding rate, which suggests that there are more shorters in the market right now, expecting the price to tank. Data from Coinglass shows the Bitcoin funding rate has dropped to one of the lowest levels this year, and the analyst says this is a sign of a healthy market.

“Overall, I see a strong trend and markets will continue to rise with first targets between 108-110k, and this is by far not the end,” Doctor Profit said. “The golden cross is promising us between 70-170% in gains in the coming months!”

Read More