Shiba Inu Crashes 43%: Time to Buy the Dip & Become Rich?

Share:

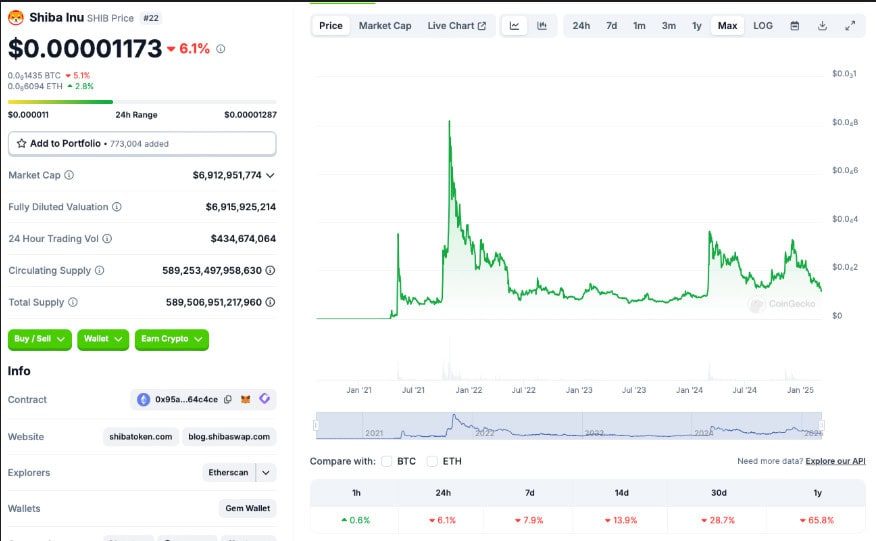

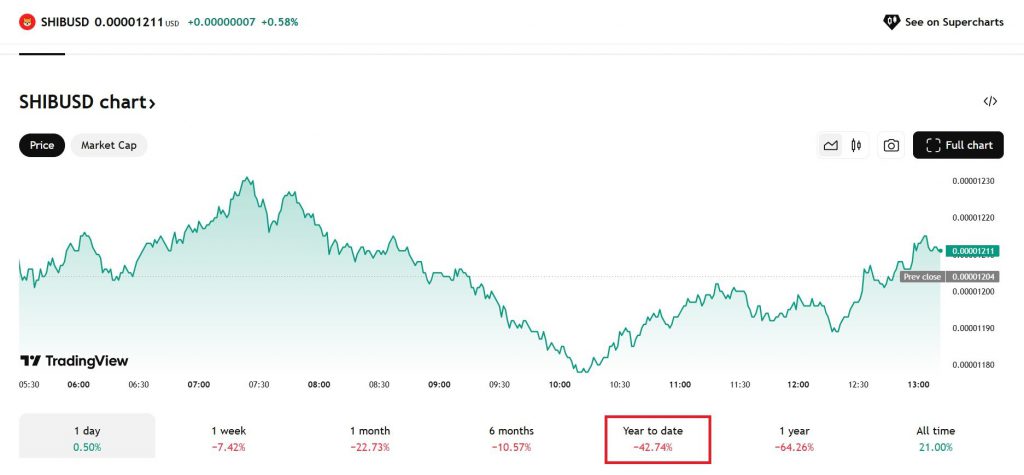

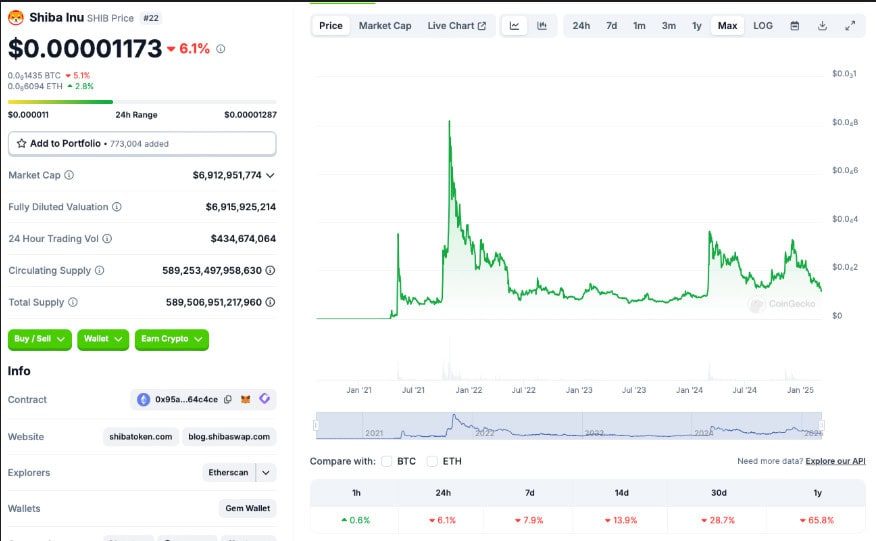

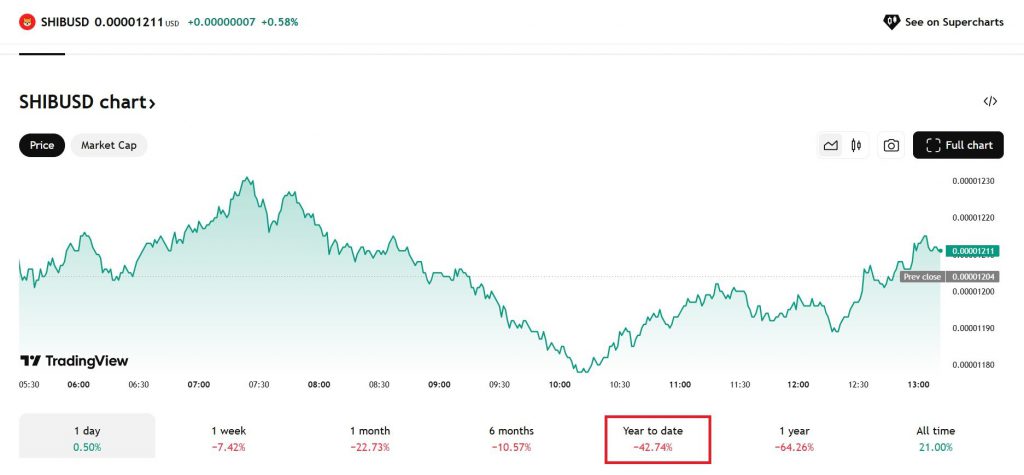

Shiba Inu crash has rocked the crypto world as the popular meme coin has dipped 43% year-to-date and has actually shed all its gains it generated last year. Various major indicators have catalyzed investor concerns as, at the time of writing, the token trades around $0.00001193, rebounding slightly from a one-year low of $0.00001097.

This Shiba Inu dip coincides with broader crypto market volatility that has seen Bitcoin retreat from January peaks. Through several key analytical perspectives, investor sentiment has transformed dramatically as many also wonder if this significant Shiba Inu crash represents an opportunity or perhaps a warning sign for the broader digital asset ecosystem.

Also Read: SEC Delays XRP, Solana, Litecoin, Dogecoin ETFs as Bitwise Launches Bitcoin-Focused ETF

Shiba Inu Crash: Market Panic or the Perfect Buying Opportunity?

Whale Exodus Driving the Shiba Inu Crash

The current Shiba Inu investment climate has been severely impacted by large token holders, also known as whales in the crypto community. Across multiple essential blockchain analytics segments, data has spearheaded revelations showing whale wallets offloading SHIB at an alarming rate in recent days. The Large Holder Netflow has engineered significant market pressure, plunging by a negative 736.46% in seven days, and is down 125.06% over 30 days.

Addresses holding SHIB worth between $1-10 million have seen their balances decline by 31.31% in just 24 hours, while $10+ million wallets dropped by 27.99%. Through various major selling events, this mass exodus has accelerated the Shiba Inu crash and rattled retail traders across numerous significant trading platforms.

Technical Indicators and SHIB Price Prediction

From a technical standpoint, right now Shiba Inu has formed a falling wedge pattern on daily and 4-hour charts—typically considered a bullish reversal indicator by many traders and analysts alike. Several key technical metrics have instituted a framework suggesting the daily RSI currently hovers in the mid-30s, approaching but not quite reaching oversold territory just yet.

Analysts from CCN stated:

SHIB’s price might rally toward $0.000020. The cryptocurrency’s value could slide to $0.000025 in a highly bullish scenario.

Meanwhile, CoinCodex forecasts predict a further 15% drop to $0.000009971 by June, and such projections are suggesting the Shiba Inu crash may continue for some time. Multiple essential technical factors have architected this divided market outlook.

Also Read: AI Predicts Hedera Price If HBAR ETF Is Approved By May 2025

Social Engagement Despite Price Decline

Despite the ongoing Shiba Inu crash, popularity on social media platforms continues to show remarkable resilience and unexpected strength. Numerous significant social intelligence metrics have revolutionized our understanding as LunarCrush reported that SHIB ranked fourth among meme coins for social mentions, with metrics soaring by 4,110 to reach an impressive 9,820 over just 24 hours.

SHIB’s social engagement also increased by 95,170, bringing its daily total to around 1.27 million at the time of writing. Across several key community indicators, this sustained interest amidst price declines suggests a dedicated community that may eventually support recovery from the Shiba Inu crash in the coming weeks or months.

Recovery Chances Amid Market Uncertainty

The crypto market remains quite divided on whether this Shiba Inu dip offers a buying opportunity for investors and traders alike. Various major macroeconomic conditions and global trade tensions have leveraged significant influence as they continue to play a decisive role in the Shiba Inu crash trajectory going forward.

Market analysis from Tronweekly noted:

The crypto market is at a crossroads. If macroeconomic conditions improve, risk appetite could return. SHIB could find a second wind.

Also Read: Bitcoin’s Fall Resembles 2017 Crash

The coming months will be critical for Shiba Inu holders as trade tensions and economic uncertainty continue to impact crypto market volatility. Through several key analytical frameworks, market experts have optimized understanding of whether this Shiba Inu crash represents a buying opportunity or signals further decline remains uncertain, but investor caution is definitely warranted in these volatile market conditions.

Shiba Inu Crashes 43%: Time to Buy the Dip & Become Rich?

Share:

Shiba Inu crash has rocked the crypto world as the popular meme coin has dipped 43% year-to-date and has actually shed all its gains it generated last year. Various major indicators have catalyzed investor concerns as, at the time of writing, the token trades around $0.00001193, rebounding slightly from a one-year low of $0.00001097.

This Shiba Inu dip coincides with broader crypto market volatility that has seen Bitcoin retreat from January peaks. Through several key analytical perspectives, investor sentiment has transformed dramatically as many also wonder if this significant Shiba Inu crash represents an opportunity or perhaps a warning sign for the broader digital asset ecosystem.

Also Read: SEC Delays XRP, Solana, Litecoin, Dogecoin ETFs as Bitwise Launches Bitcoin-Focused ETF

Shiba Inu Crash: Market Panic or the Perfect Buying Opportunity?

Whale Exodus Driving the Shiba Inu Crash

The current Shiba Inu investment climate has been severely impacted by large token holders, also known as whales in the crypto community. Across multiple essential blockchain analytics segments, data has spearheaded revelations showing whale wallets offloading SHIB at an alarming rate in recent days. The Large Holder Netflow has engineered significant market pressure, plunging by a negative 736.46% in seven days, and is down 125.06% over 30 days.

Addresses holding SHIB worth between $1-10 million have seen their balances decline by 31.31% in just 24 hours, while $10+ million wallets dropped by 27.99%. Through various major selling events, this mass exodus has accelerated the Shiba Inu crash and rattled retail traders across numerous significant trading platforms.

Technical Indicators and SHIB Price Prediction

From a technical standpoint, right now Shiba Inu has formed a falling wedge pattern on daily and 4-hour charts—typically considered a bullish reversal indicator by many traders and analysts alike. Several key technical metrics have instituted a framework suggesting the daily RSI currently hovers in the mid-30s, approaching but not quite reaching oversold territory just yet.

Analysts from CCN stated:

SHIB’s price might rally toward $0.000020. The cryptocurrency’s value could slide to $0.000025 in a highly bullish scenario.

Meanwhile, CoinCodex forecasts predict a further 15% drop to $0.000009971 by June, and such projections are suggesting the Shiba Inu crash may continue for some time. Multiple essential technical factors have architected this divided market outlook.

Also Read: AI Predicts Hedera Price If HBAR ETF Is Approved By May 2025

Social Engagement Despite Price Decline

Despite the ongoing Shiba Inu crash, popularity on social media platforms continues to show remarkable resilience and unexpected strength. Numerous significant social intelligence metrics have revolutionized our understanding as LunarCrush reported that SHIB ranked fourth among meme coins for social mentions, with metrics soaring by 4,110 to reach an impressive 9,820 over just 24 hours.

SHIB’s social engagement also increased by 95,170, bringing its daily total to around 1.27 million at the time of writing. Across several key community indicators, this sustained interest amidst price declines suggests a dedicated community that may eventually support recovery from the Shiba Inu crash in the coming weeks or months.

Recovery Chances Amid Market Uncertainty

The crypto market remains quite divided on whether this Shiba Inu dip offers a buying opportunity for investors and traders alike. Various major macroeconomic conditions and global trade tensions have leveraged significant influence as they continue to play a decisive role in the Shiba Inu crash trajectory going forward.

Market analysis from Tronweekly noted:

The crypto market is at a crossroads. If macroeconomic conditions improve, risk appetite could return. SHIB could find a second wind.

Also Read: Bitcoin’s Fall Resembles 2017 Crash

The coming months will be critical for Shiba Inu holders as trade tensions and economic uncertainty continue to impact crypto market volatility. Through several key analytical frameworks, market experts have optimized understanding of whether this Shiba Inu crash represents a buying opportunity or signals further decline remains uncertain, but investor caution is definitely warranted in these volatile market conditions.