Here is What You Need to Know Before Bitcoin’s Next Major Move

- Bitcoin holds near $111K while gold hits record highs above $3,500.

- Fed expected to cut rates in September, but long easing cycles look unlikely.

- BTC dominance strong at 60%, reinforcing its role as a market anchor.

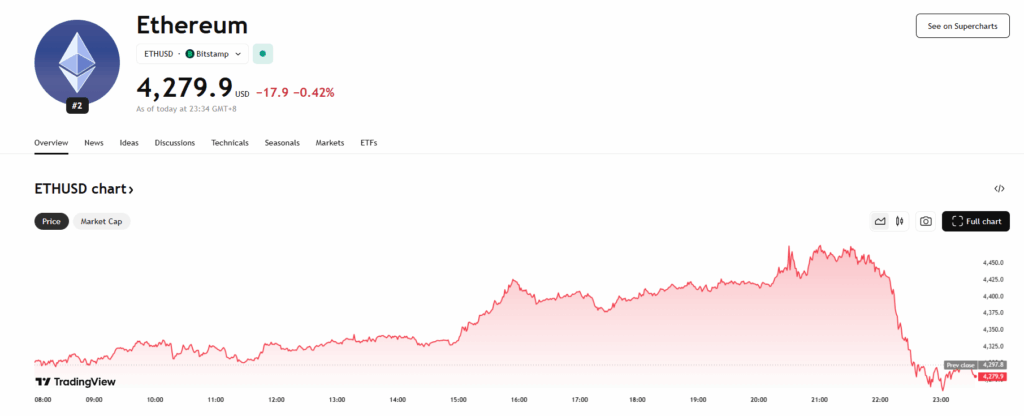

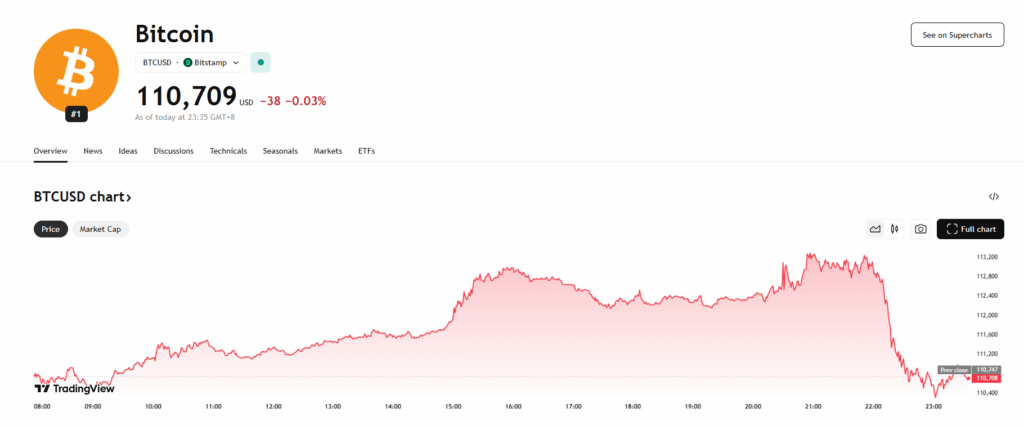

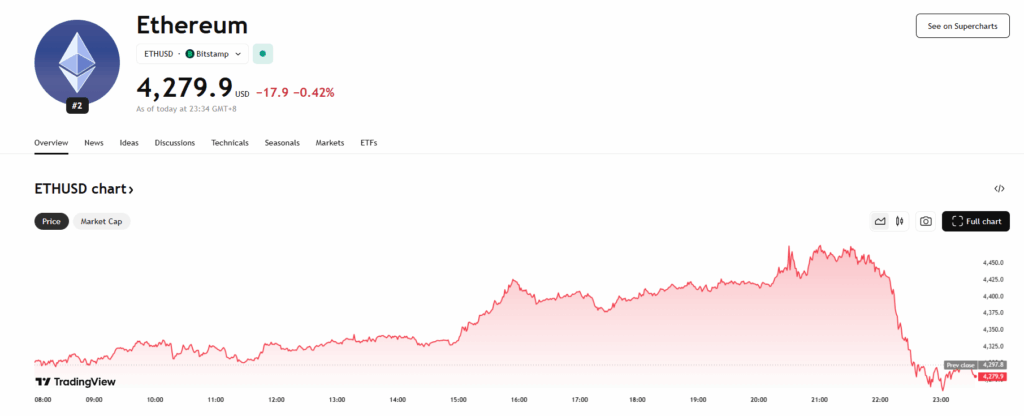

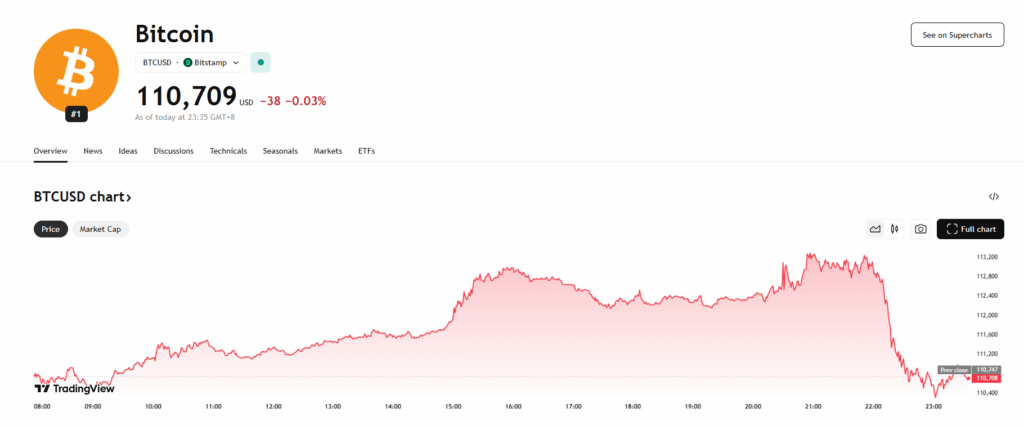

Bitcoin (BTC) managed to keep its footing around $111,600 on Friday morning, showing resilience while global markets felt the weight of shaky U.S. labor data and fresh Fed uncertainty. Ether (ETH) slid slightly by 0.7% to $4,330, Solana (SOL) ticked higher by 1.3% above $204, and XRP (XRP) hovered flat near $2.81—though still up more than 3% for the week.

The week’s tone has been set by U.S. economic signals. All eyes are on Friday’s jobs report, expected to show unemployment climbing—pushing traders to lean on bets for a September rate cut. But here’s the catch: markets aren’t expecting a deep easing cycle this time.

Gold Soars, Fed Keeps Traders Guessing

Gold prices ripped to fresh highs above $3,500 an ounce earlier this week, underscoring investor appetite for safe havens. That surge only sharpened comparisons between gold and Bitcoin as hard stores of value.

Jeff Mei, COO at BTSE, summed up the sentiment: “Yes, high unemployment points toward cuts, but the Fed won’t go overboard. They fear adding too much liquidity and reigniting inflation. That’s why gold is soaring while crypto and stocks take a hit.”

Bitcoin Narrative Keeps Evolving

Bitcoin’s story isn’t just speculation anymore—it’s shifting toward legitimacy. “Bitcoin has matured beyond a speculative trade. It’s increasingly recognized as a hedge against currency debasement, fiscal instability, and even geopolitical risk,” said Vikrant Sharma, CEO of Cake Wallet.

He added that volatility is tamer than before, though not gone. “Periods of calm often come before big moves. A $100,000 floor makes Bitcoin feel less like a high-risk gamble and more like a global reserve asset in the making,” Sharma explained.

Dominance Holds Despite Volatility

Despite choppy trading, Bitcoin’s dominance remains around 60% of the entire crypto market cap. That stability helps offset the sharp swings seen in altcoins. “Bitcoin’s only dropped 3% through recent volatility, yet dominance is firm at 60%,” said Nassar Achkar, Chief Strategy Officer at CoinW.

He added that upcoming Fed moves, ETF adoption, and tokenization continue to provide solid support—but traders should still brace for sudden policy-driven swings. September historically tends to be crypto’s weakest month, which only adds more caution to the mix.

The post Here is What You Need to Know Before Bitcoin’s Next Major Move first appeared on BlockNews.

Here is What You Need to Know Before Bitcoin’s Next Major Move

- Bitcoin holds near $111K while gold hits record highs above $3,500.

- Fed expected to cut rates in September, but long easing cycles look unlikely.

- BTC dominance strong at 60%, reinforcing its role as a market anchor.

Bitcoin (BTC) managed to keep its footing around $111,600 on Friday morning, showing resilience while global markets felt the weight of shaky U.S. labor data and fresh Fed uncertainty. Ether (ETH) slid slightly by 0.7% to $4,330, Solana (SOL) ticked higher by 1.3% above $204, and XRP (XRP) hovered flat near $2.81—though still up more than 3% for the week.

The week’s tone has been set by U.S. economic signals. All eyes are on Friday’s jobs report, expected to show unemployment climbing—pushing traders to lean on bets for a September rate cut. But here’s the catch: markets aren’t expecting a deep easing cycle this time.

Gold Soars, Fed Keeps Traders Guessing

Gold prices ripped to fresh highs above $3,500 an ounce earlier this week, underscoring investor appetite for safe havens. That surge only sharpened comparisons between gold and Bitcoin as hard stores of value.

Jeff Mei, COO at BTSE, summed up the sentiment: “Yes, high unemployment points toward cuts, but the Fed won’t go overboard. They fear adding too much liquidity and reigniting inflation. That’s why gold is soaring while crypto and stocks take a hit.”

Bitcoin Narrative Keeps Evolving

Bitcoin’s story isn’t just speculation anymore—it’s shifting toward legitimacy. “Bitcoin has matured beyond a speculative trade. It’s increasingly recognized as a hedge against currency debasement, fiscal instability, and even geopolitical risk,” said Vikrant Sharma, CEO of Cake Wallet.

He added that volatility is tamer than before, though not gone. “Periods of calm often come before big moves. A $100,000 floor makes Bitcoin feel less like a high-risk gamble and more like a global reserve asset in the making,” Sharma explained.

Dominance Holds Despite Volatility

Despite choppy trading, Bitcoin’s dominance remains around 60% of the entire crypto market cap. That stability helps offset the sharp swings seen in altcoins. “Bitcoin’s only dropped 3% through recent volatility, yet dominance is firm at 60%,” said Nassar Achkar, Chief Strategy Officer at CoinW.

He added that upcoming Fed moves, ETF adoption, and tokenization continue to provide solid support—but traders should still brace for sudden policy-driven swings. September historically tends to be crypto’s weakest month, which only adds more caution to the mix.

The post Here is What You Need to Know Before Bitcoin’s Next Major Move first appeared on BlockNews.