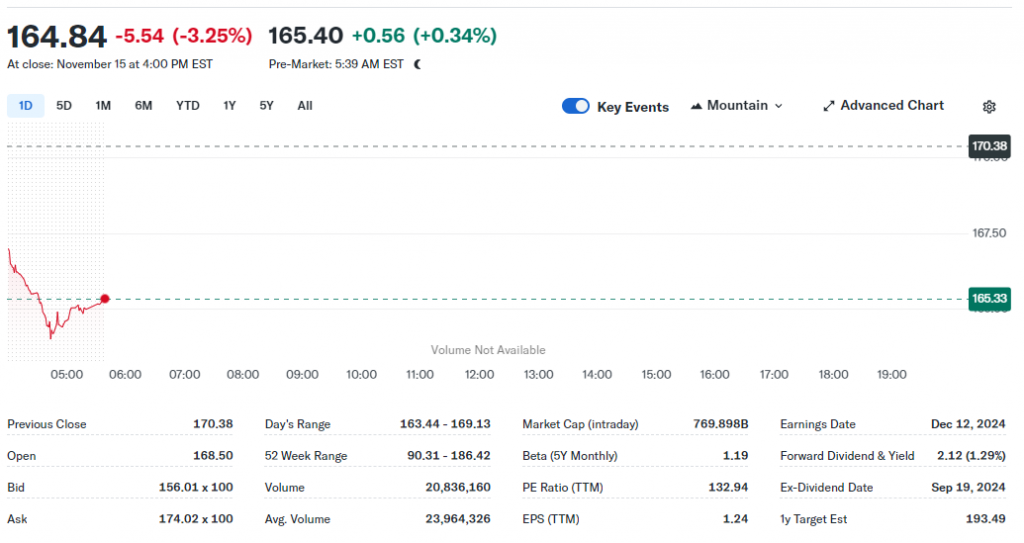

3 Stocks Bound to Surpass Tesla’s Value by 2034

Three stocks to overtake Tesla (TSLA) have emerged: Berkshire Hathaway, Broadcom, and Eli Lilly. These market-leading companies now have values between $760 billion and $1.01 trillion. Their high-growth stocks show strong signs of passing Tesla’s market value by 2034.

Also Read: Solana Forecasted To Reach $400, Here’s When

The Future Leaders: Stocks Set to Outshine Tesla’s Growth Path

1. Berkshire Hathaway: The Steady Giant

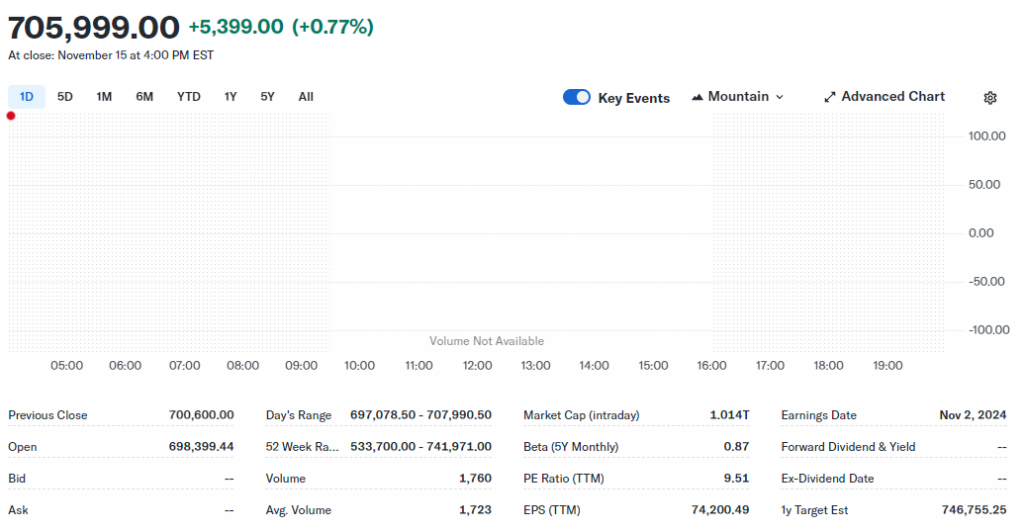

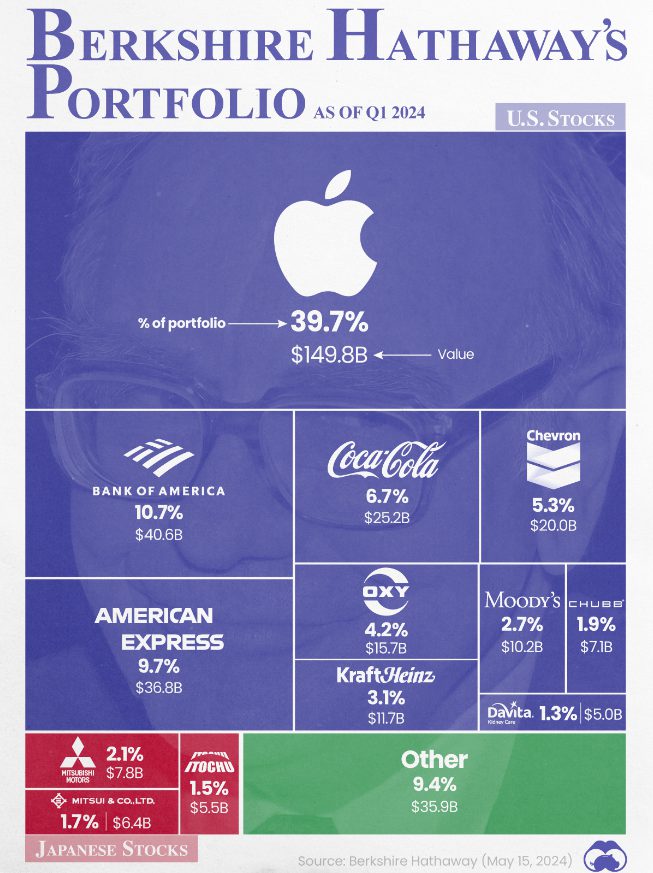

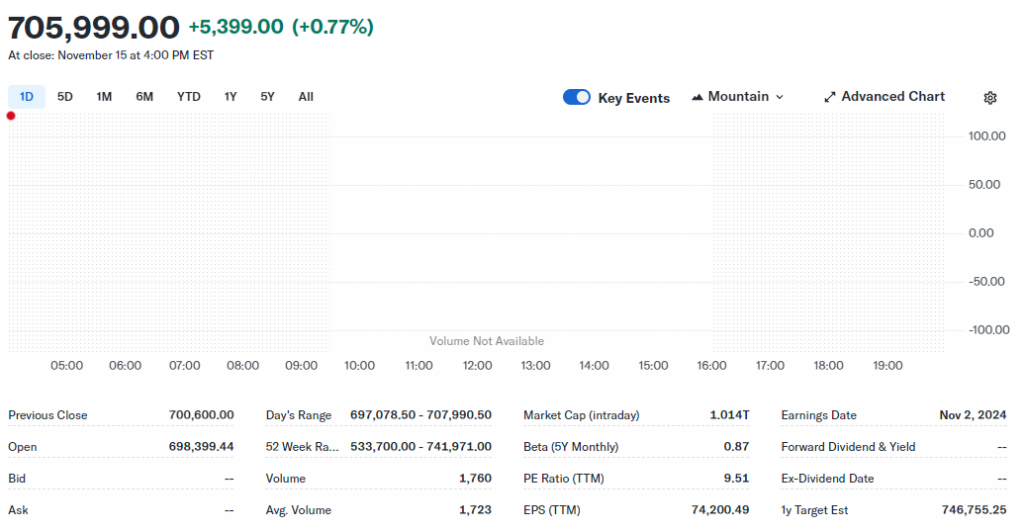

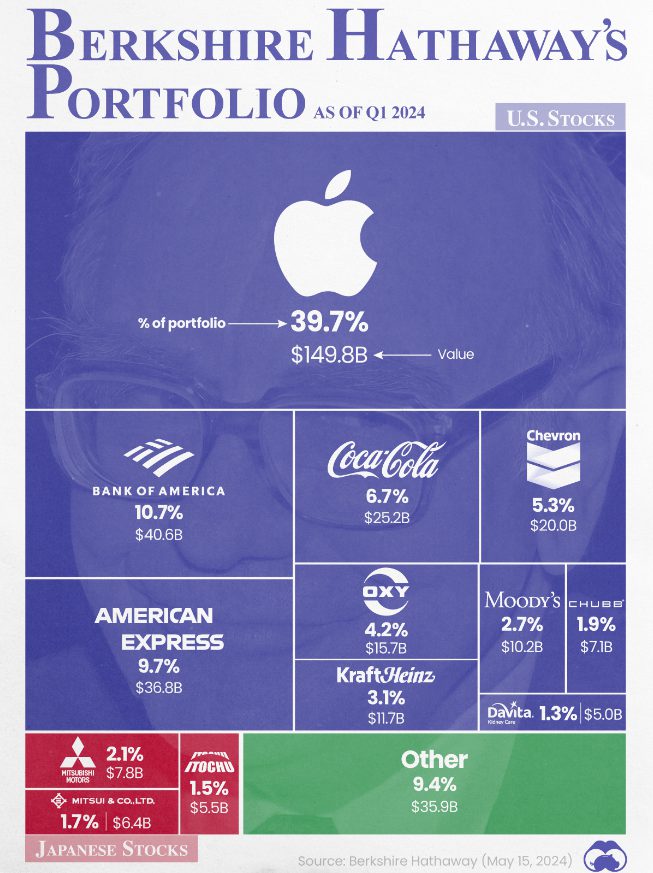

Berkshire Hathaway stands out among stocks to overtake Tesla. It matches Tesla’s $1.01 trillion value today. The company holds $325 billion in cash. Its success in insurance, energy, and railroads makes it one of the top long-term investments.

Berkshire grows steadily through the smart buying of other companies. This approach differs from Tesla’s up-and-down growth pattern. Its consistent growth places it as a reliable stock to overtake Tesla.

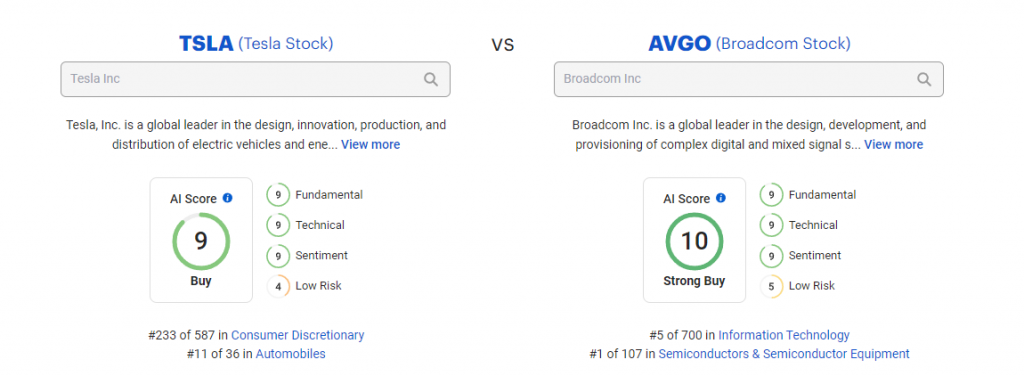

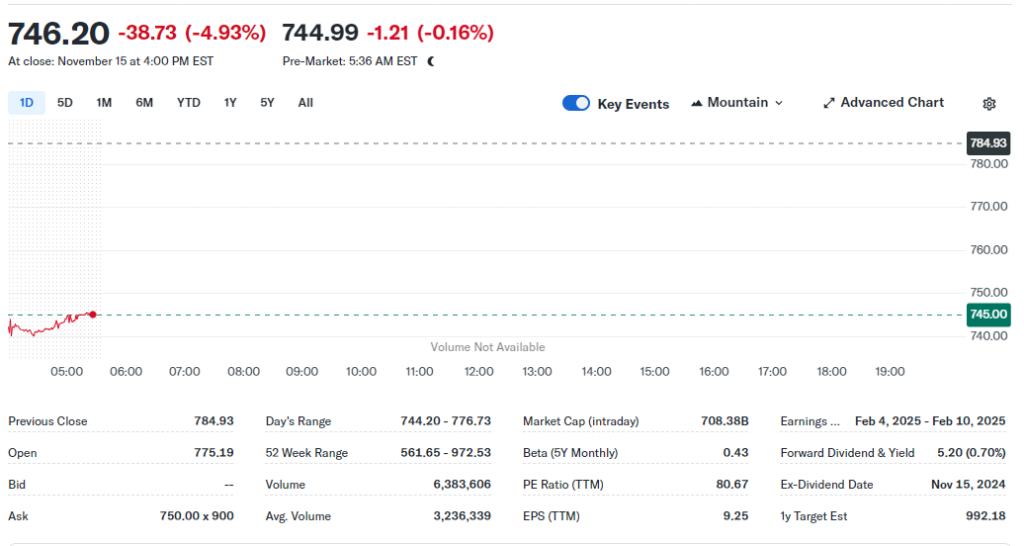

2. Broadcom: The AI Powerhouse

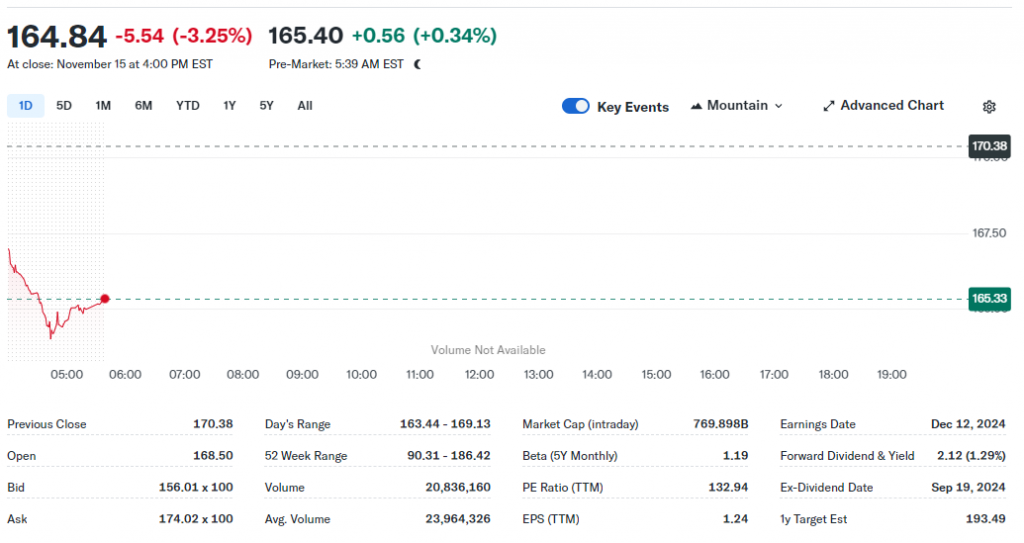

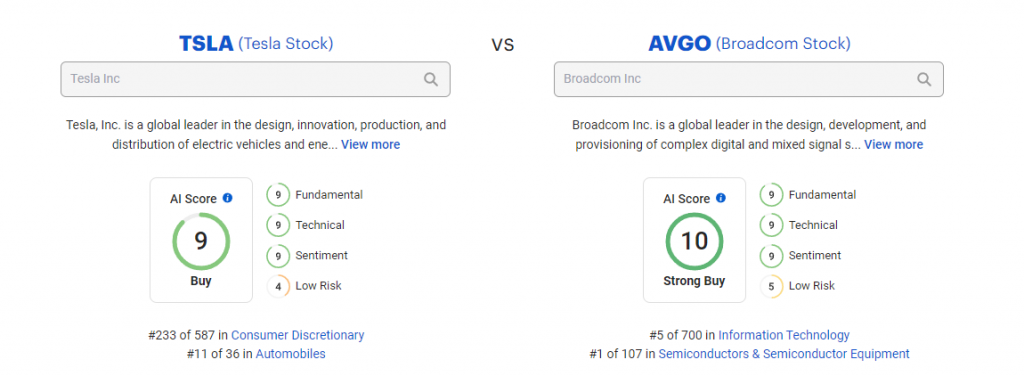

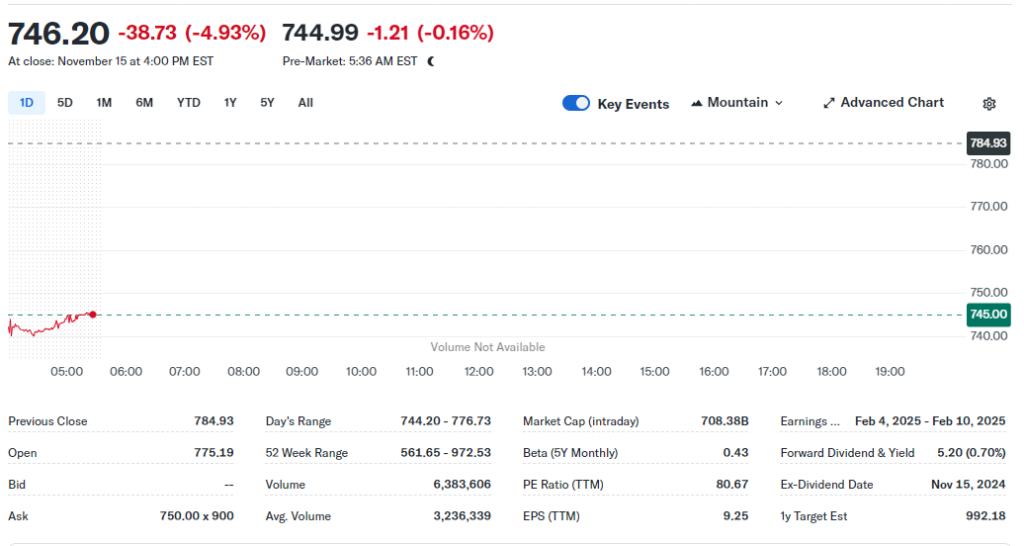

Broadcom’s worth hit $810 billion. It leads the pack of high-growth stocks in tech. The company creates disruptive innovation through AI equipment and special computer chips. Many market-leading companies now use AI tech, pushing Broadcom as a potential stock to overtake tech giants like Tesla.

Broadcom’s PEG ratio sits at 1.22, while Tesla’s is 9.42. This gap points to better growth ahead for Broadcom.

Also Read: Dogecoin Rally Imminent: Experts Predict 50% Surge Ahead

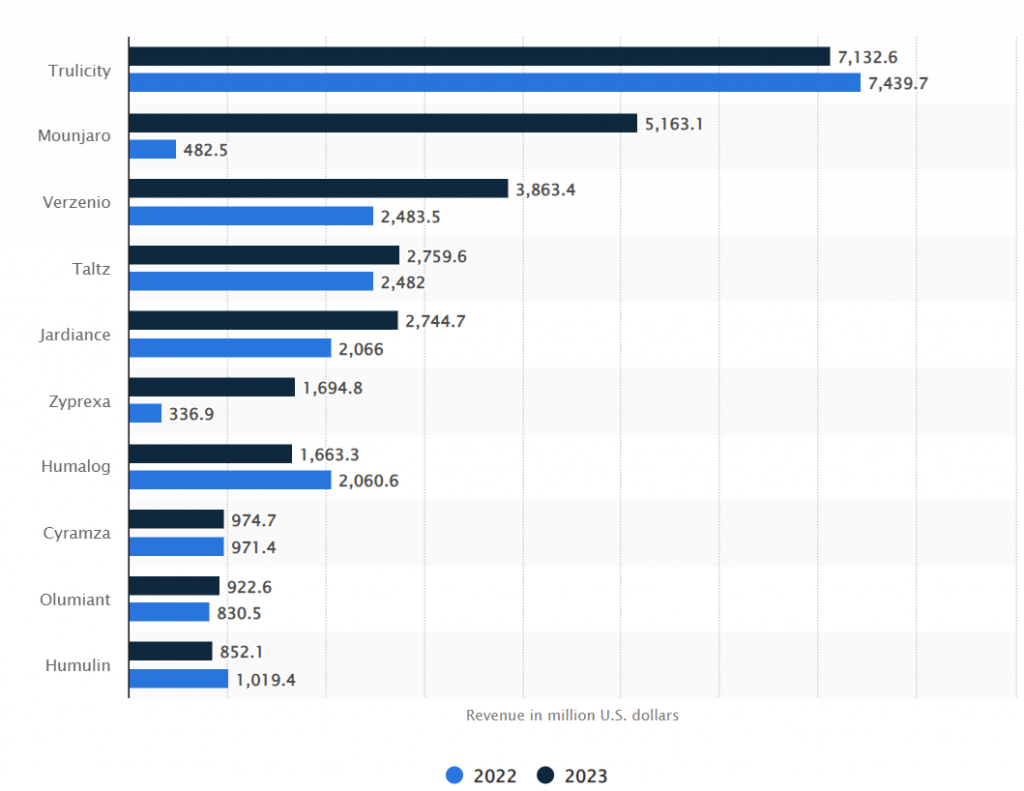

3. Eli Lilly: The Healthcare Pioneer

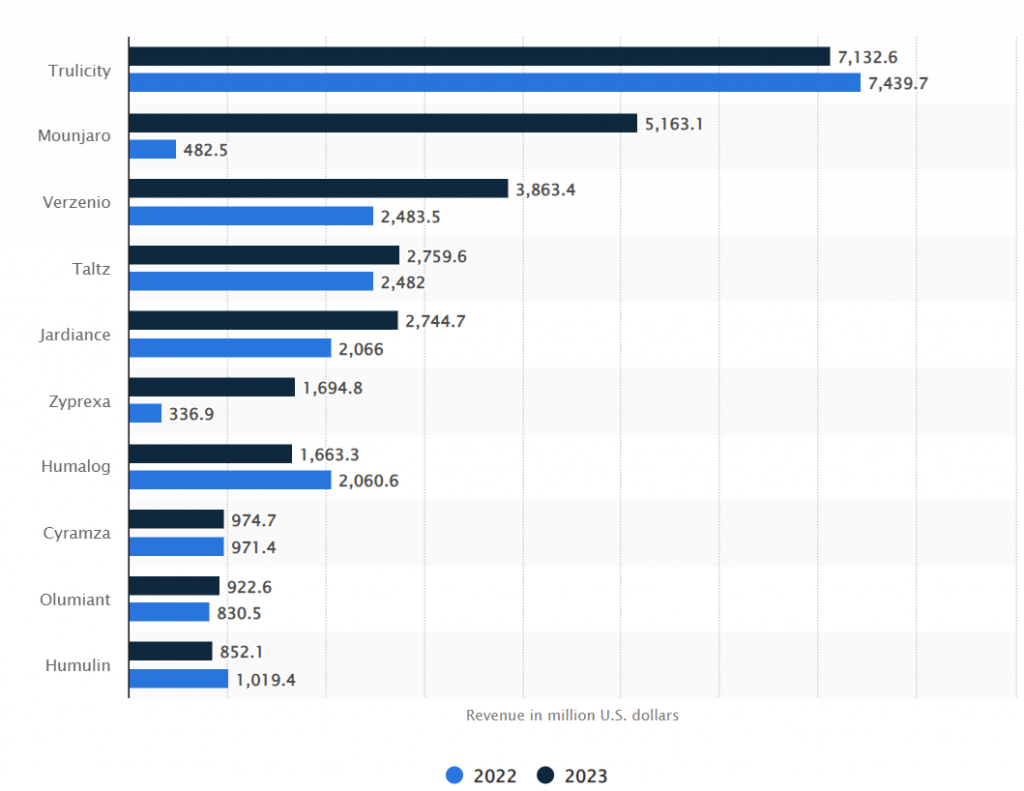

Eli Lilly stands strong among disruptive innovation stocks with its $760 billion value. Its drugs, Mounjaro and Zepbound, brought in $11 billion in nine months of 2024. Experts say Mounjaro alone could make $34 billion yearly by 2029. These numbers place Eli Lilly firmly among the top long-term investments in healthcare, leading some to believe it is one of the stocks to surpass Tesla’s market value.

Also Read: Shiba Inu’s Influence Blooms As 45000 Businesses Globally Deploy SHIB

These market-leading companies each take their own path past Tesla’s value. Tesla faces tough competition in electric cars and self-driving tech. Meanwhile, these three stocks show strong advantages in their markets and room to grow even more, making them likely competitors in the race to overtake Tesla.

Read More

Little-Known Stock Explodes 400% in Five Days Amid Meme Trading Mania

3 Stocks Bound to Surpass Tesla’s Value by 2034

Three stocks to overtake Tesla (TSLA) have emerged: Berkshire Hathaway, Broadcom, and Eli Lilly. These market-leading companies now have values between $760 billion and $1.01 trillion. Their high-growth stocks show strong signs of passing Tesla’s market value by 2034.

Also Read: Solana Forecasted To Reach $400, Here’s When

The Future Leaders: Stocks Set to Outshine Tesla’s Growth Path

1. Berkshire Hathaway: The Steady Giant

Berkshire Hathaway stands out among stocks to overtake Tesla. It matches Tesla’s $1.01 trillion value today. The company holds $325 billion in cash. Its success in insurance, energy, and railroads makes it one of the top long-term investments.

Berkshire grows steadily through the smart buying of other companies. This approach differs from Tesla’s up-and-down growth pattern. Its consistent growth places it as a reliable stock to overtake Tesla.

2. Broadcom: The AI Powerhouse

Broadcom’s worth hit $810 billion. It leads the pack of high-growth stocks in tech. The company creates disruptive innovation through AI equipment and special computer chips. Many market-leading companies now use AI tech, pushing Broadcom as a potential stock to overtake tech giants like Tesla.

Broadcom’s PEG ratio sits at 1.22, while Tesla’s is 9.42. This gap points to better growth ahead for Broadcom.

Also Read: Dogecoin Rally Imminent: Experts Predict 50% Surge Ahead

3. Eli Lilly: The Healthcare Pioneer

Eli Lilly stands strong among disruptive innovation stocks with its $760 billion value. Its drugs, Mounjaro and Zepbound, brought in $11 billion in nine months of 2024. Experts say Mounjaro alone could make $34 billion yearly by 2029. These numbers place Eli Lilly firmly among the top long-term investments in healthcare, leading some to believe it is one of the stocks to surpass Tesla’s market value.

Also Read: Shiba Inu’s Influence Blooms As 45000 Businesses Globally Deploy SHIB

These market-leading companies each take their own path past Tesla’s value. Tesla faces tough competition in electric cars and self-driving tech. Meanwhile, these three stocks show strong advantages in their markets and room to grow even more, making them likely competitors in the race to overtake Tesla.

Read More