De-Dollarization Surges in ASEAN as US Dollar Tariffs Rattle Trade

Share:

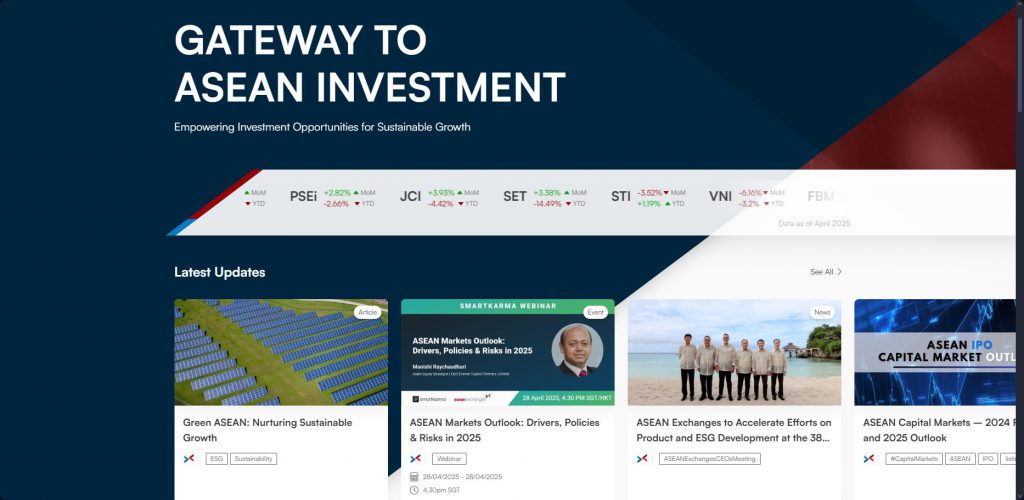

De-dollarization momentum is accelerating right now across ASEAN nations as US tariff policies are driving currency substitution away from dollar-dominated trade systems. Regional integration is deepening while BRICS expansion offers alternative financial mechanisms for Southeast Asian economies at this time.

Also Read: China CBDC Deal With 10 ASEAN & 6 Middle Eastern Nations – Real or Fake

ASEAN Eyes BRICS, Local Currency to Resist U.S. Dollar Pressure

Malaysia’s Foreign Minister Mohamad Hasan said:

“ASEAN nations are among those most heavily affected by the U.S.-imposed tariffs.”

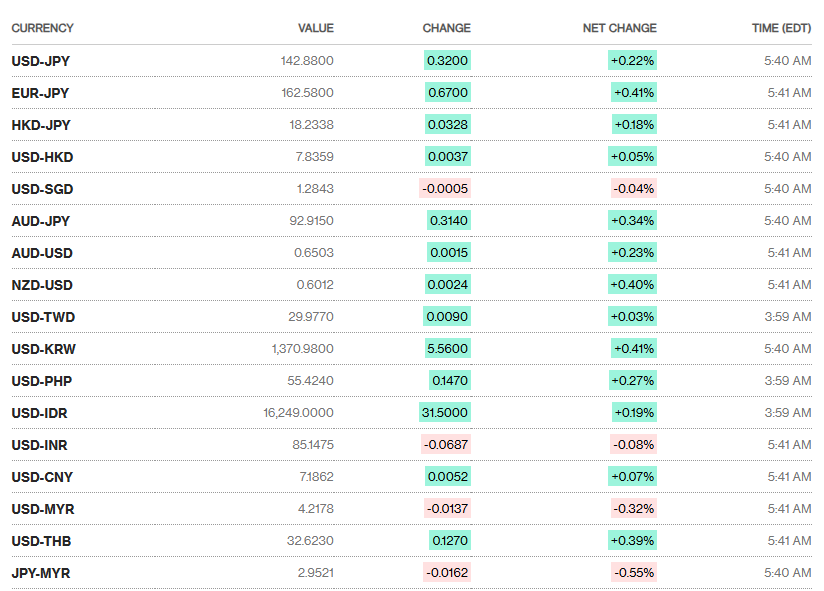

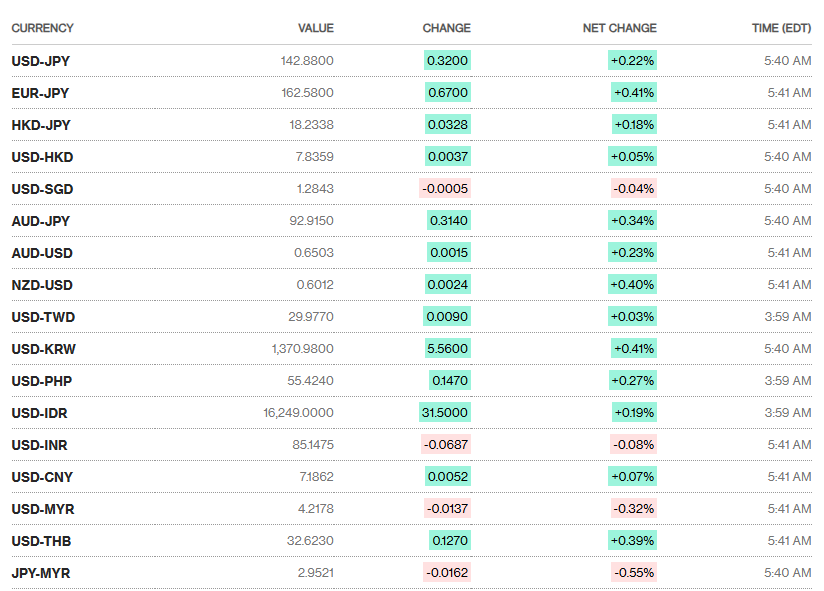

The de-dollarization trend is intensifying as six ASEAN members face tariffs ranging from 10% to 49%. Malaysia confronts a 24% tariff rate, and this is pushing local currency adoption across the region right now.

Also Read: De-Dollarization Surge: 70+ Countries Abandoning the US Dollar

Currency Substitution Accelerates Regional Trade

ASEAN’s local currency initiatives are gaining traction through cross-border digital payment systems. The bloc’s QR code system cuts payment costs by 30% while also enabling currency substitution mechanisms that reduce dollar dependency, at the time of writing.

Malaysian Foreign Minister Mohamad Hasan has also emphasized:

“Southeast Asian nations must accelerate regional economic integration, diversify their markets and stay united to tackle the fallout from global trade disruptions.”

Thailand, Malaysia and Indonesia are joining the group as members, helping to provide additional alternatives for countries to move away from using American dollars. A growing number of local currency trading agreements are being created as countries try to free themselves from the influence of the dollar.

Also Read: De-Dollarization: New Country Joins New Development Bank (NDB) to Drop US Dollar

De-Dollarization Strategy Targets Financial Independence

The de-dollarization process is accelerating through coordinated ASEAN responses. Malaysia’s investment minister posted that tariff volatility creates significant challenges, and this is driving currency substitution initiatives across the region.

Malaysian Investment Minister Tengku Zafrul Aziz had this to say:

“Nothing is certain but uncertainty when it comes to Trump tariffs!”

BRICS payment systems are expanding rapidly, with China’s CIPS connecting over 1,300 banks worldwide. Yuan payments represent 47% of China’s international trades, and this demonstrates successful local currency implementation at the moment.

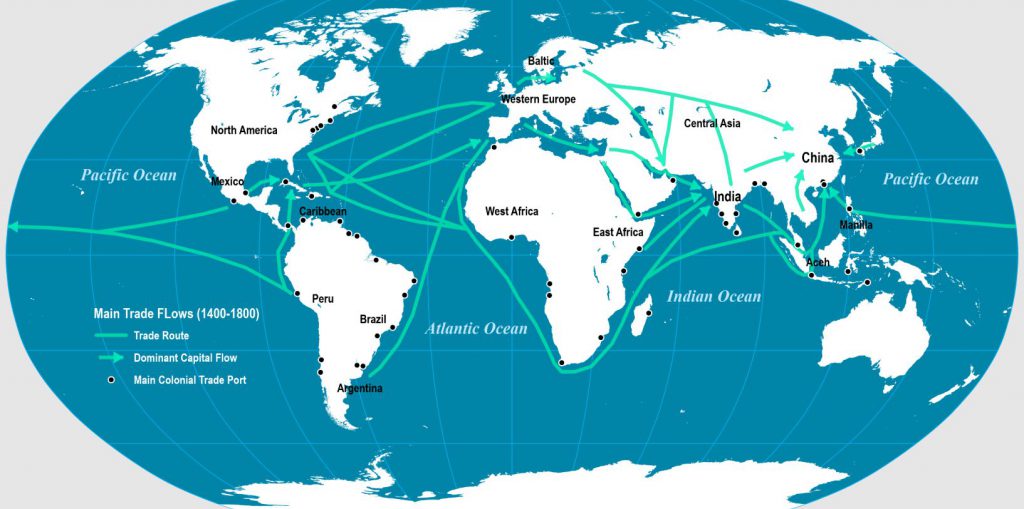

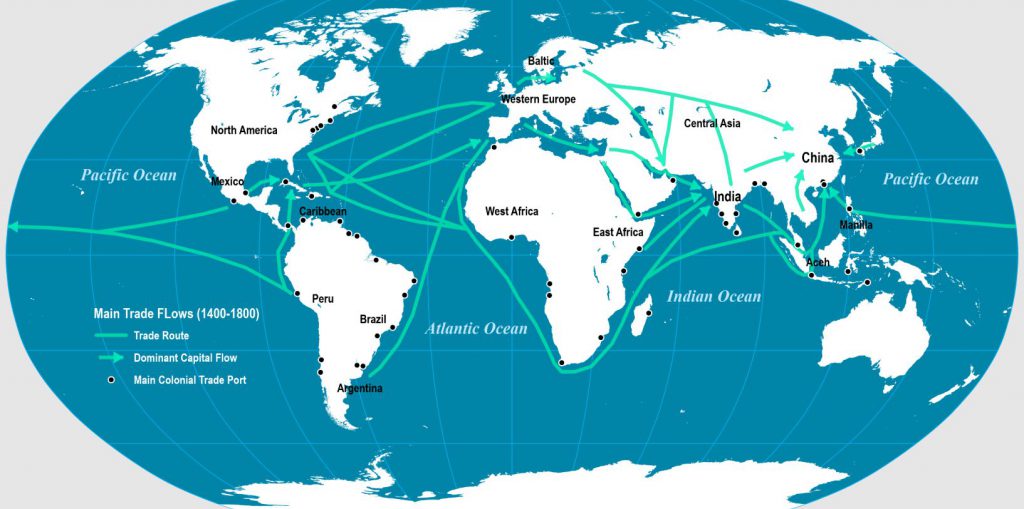

Currency substitution efforts extend beyond ASEAN borders as BRICS nations build comprehensive trading systems. The de-dollarization movement is reshaping global financial architecture through innovative payment solutions, and these changes are happening at an accelerated pace.

Also Read: Trump’s 125% Tariff Could Push China to Strengthen Alliances with ASEAN and Beyond

ASEAN’s financial systems are becoming more independent which is strengthening regional integration. Because the bloc has a united plan to reduce its reliance on the dollar, it weakens the dollar’s grip and helps achieve price stability for local currencies in Southeast Asia and this process is becoming stronger over time.

De-Dollarization Surges in ASEAN as US Dollar Tariffs Rattle Trade

Share:

De-dollarization momentum is accelerating right now across ASEAN nations as US tariff policies are driving currency substitution away from dollar-dominated trade systems. Regional integration is deepening while BRICS expansion offers alternative financial mechanisms for Southeast Asian economies at this time.

Also Read: China CBDC Deal With 10 ASEAN & 6 Middle Eastern Nations – Real or Fake

ASEAN Eyes BRICS, Local Currency to Resist U.S. Dollar Pressure

Malaysia’s Foreign Minister Mohamad Hasan said:

“ASEAN nations are among those most heavily affected by the U.S.-imposed tariffs.”

The de-dollarization trend is intensifying as six ASEAN members face tariffs ranging from 10% to 49%. Malaysia confronts a 24% tariff rate, and this is pushing local currency adoption across the region right now.

Also Read: De-Dollarization Surge: 70+ Countries Abandoning the US Dollar

Currency Substitution Accelerates Regional Trade

ASEAN’s local currency initiatives are gaining traction through cross-border digital payment systems. The bloc’s QR code system cuts payment costs by 30% while also enabling currency substitution mechanisms that reduce dollar dependency, at the time of writing.

Malaysian Foreign Minister Mohamad Hasan has also emphasized:

“Southeast Asian nations must accelerate regional economic integration, diversify their markets and stay united to tackle the fallout from global trade disruptions.”

Thailand, Malaysia and Indonesia are joining the group as members, helping to provide additional alternatives for countries to move away from using American dollars. A growing number of local currency trading agreements are being created as countries try to free themselves from the influence of the dollar.

Also Read: De-Dollarization: New Country Joins New Development Bank (NDB) to Drop US Dollar

De-Dollarization Strategy Targets Financial Independence

The de-dollarization process is accelerating through coordinated ASEAN responses. Malaysia’s investment minister posted that tariff volatility creates significant challenges, and this is driving currency substitution initiatives across the region.

Malaysian Investment Minister Tengku Zafrul Aziz had this to say:

“Nothing is certain but uncertainty when it comes to Trump tariffs!”

BRICS payment systems are expanding rapidly, with China’s CIPS connecting over 1,300 banks worldwide. Yuan payments represent 47% of China’s international trades, and this demonstrates successful local currency implementation at the moment.

Currency substitution efforts extend beyond ASEAN borders as BRICS nations build comprehensive trading systems. The de-dollarization movement is reshaping global financial architecture through innovative payment solutions, and these changes are happening at an accelerated pace.

Also Read: Trump’s 125% Tariff Could Push China to Strengthen Alliances with ASEAN and Beyond

ASEAN’s financial systems are becoming more independent which is strengthening regional integration. Because the bloc has a united plan to reduce its reliance on the dollar, it weakens the dollar’s grip and helps achieve price stability for local currencies in Southeast Asia and this process is becoming stronger over time.