Donald Trump Jr. Calls Crypto Conflict of Interest Claims ‘Complete Nonsense’

Donald Trump Jr dismissed criticism that World Liberty Financial presents conflict of interest, telling CNBC at Singapore’s Token2049 conference that concerns are “complete nonsense.”

The president’s eldest son stated he doesn’t believe anyone thinks his father “would be looking at ledgers on the blockchain to see who bought what, and that carrying any kind of favor.”

Trump Jr., a co-founder of World Liberty Financial, appeared alongside CEO Zach Witkoff, son of U.S. Special Envoy to the Middle East Steve Witkoff.

The executives emphasized their firm is “100% not a political organization” during a keynote speech, despite the company’s open connections to the Trump administration as it pursues global deals and expands into debit payments and tokenized commodity assets.

World Liberty Financial launched its USD 1 stablecoin in March 2025, six months after the company was founded in September 2024.

The dollar-pegged token is backed by short-term U.S. government treasuries and includes a publicly traded governance token called WLFI.

According to the company’s website, DT Marks DEFI LLC and Trump family members receive a major share of platform revenue and hold WLFI tokens.

However, Donald Trump and his family have no officer, director, or employee positions.

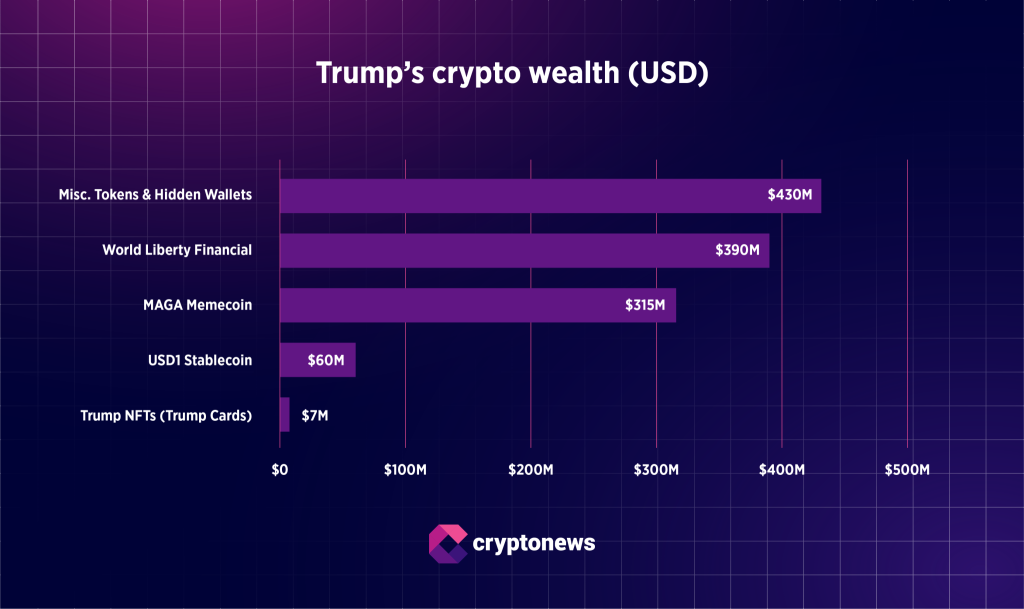

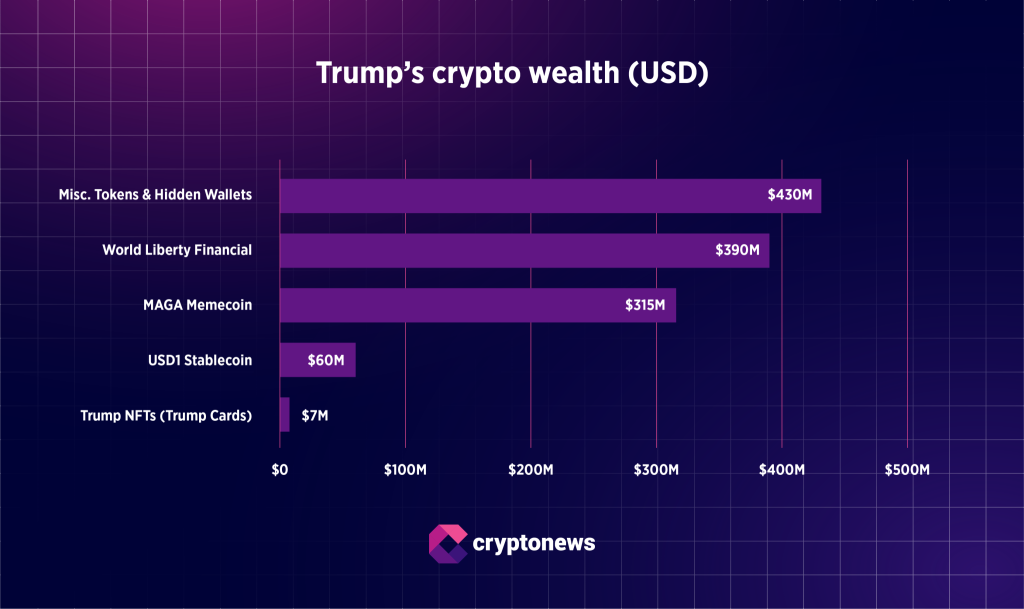

The Trump family’s crypto portfolio has grown to exceed $1.2 billion across multiple ventures.

As of June, President Trump holds 15.75 billion WLFI tokens, representing 15.75% control of the entire project.

His official financial disclosure shows $57.4 million in personal income from World Liberty Financial over the past year.

His NFT collections generated an additional $1.16 million; however, these figures exclude substantial fees from the $TRUMP meme coin, in which his businesses hold an 80% stake.

Family Empire Spans Mining Operations to Treasury Strategies

The Trump family’s crypto activities extend well beyond World Liberty Financial.

American Bitcoin, co-founded by Eric Trump and backed by Donald Trump Jr., surged 110% at its September debut following an all-stock merger with Nasdaq-listed Gryphon Digital Mining, briefly valuing the brothers’ combined stake at $2.6 billion before closing at around $1.5 billion.

The company operates approximately 6,000 mining computers and has entered into a $2.1 billion controlled stock offering with Cantor Fitzgerald and Mizuho Securities to acquire more Bitcoin and upgrade its mining technology.

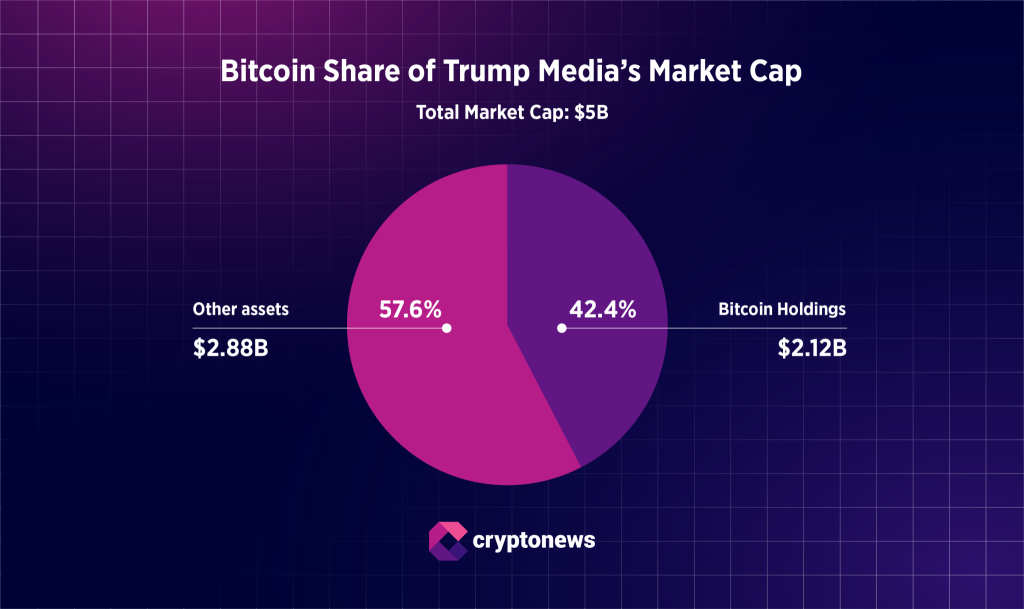

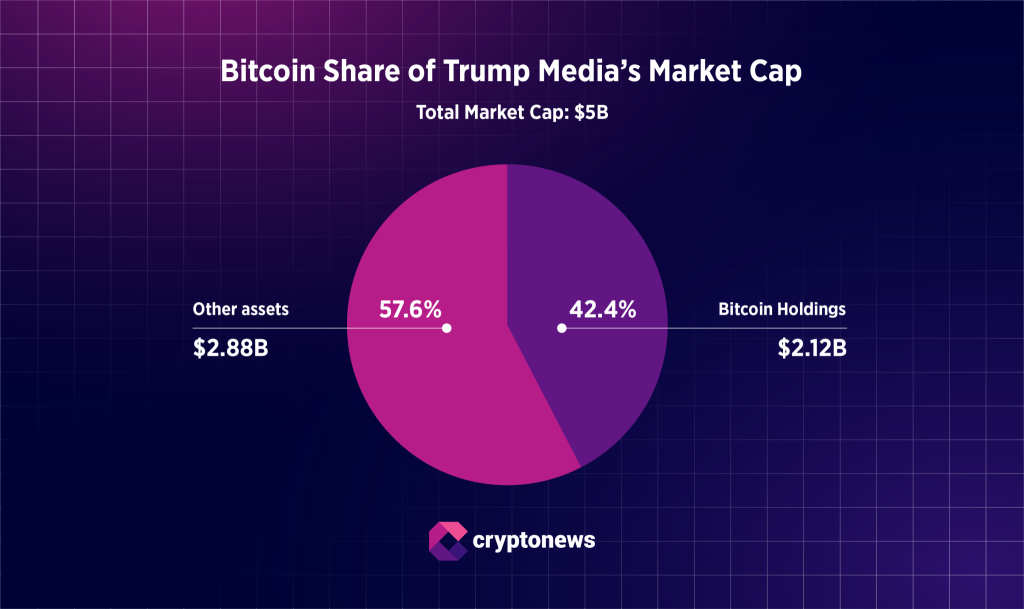

Trump Media & Technology Group raised $2.5 billion in May to build a Bitcoin treasury, currently holding approximately 18,430 BTC worth $2.1 billion.

As of June, Bitcoin represents more than 40% of TMTG’s overall market capitalization.

However, its shares have consistently underperformed the crypto itself, falling 47% over the same six-month period, while Bitcoin gained 10.6% during that time.

Donald Trump Jr. also purchased 350,000 shares in Thumzup Media Corporation worth nearly $3.3 million in July.

The Nasdaq-listed company subsequently acquired DogeHash Technologies in an all-stock deal, creating what executives describe as the world’s largest Dogecoin mining platform with over 4,000 operational rigs expected by year-end.

Democratic Lawmakers Label Ventures ‘Unprecedented Conflict’

Democratic Senators Elizabeth Warren and Representative Maxine Waters have led calls for investigations into World Liberty Financial, labeling the company an “unprecedented conflict” that could sway crypto policy.

The House Committee on Financial Services Democratic Caucus stated Trump “rewrote the rules, then cashed in on the chaos he helped create” by gutting oversight and hyping risky tokens.

Citizens for Responsibility and Ethics in Washington described Trump’s deep crypto ties, involving partnerships with foreign businesses, as “unprecedented.”

The organization tracked over 3,700 conflicts of interest during Trump’s previous term and warned he appears “poised to rack up more conflicts than ever, with even less transparency than last time.”

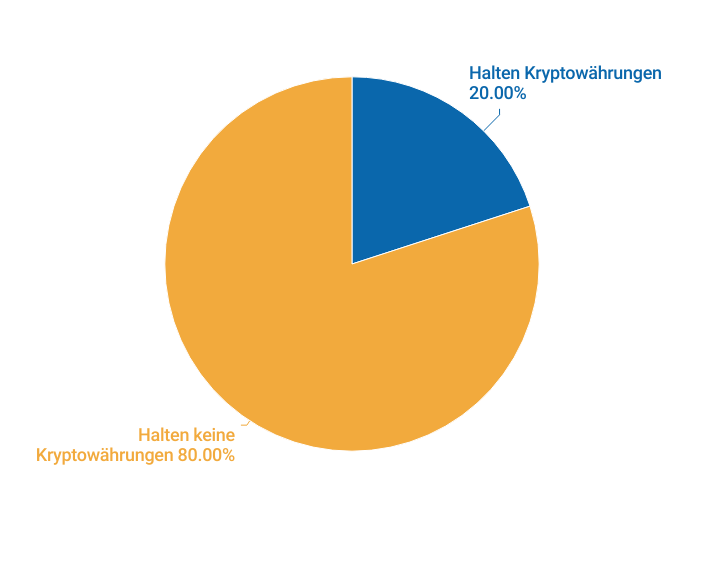

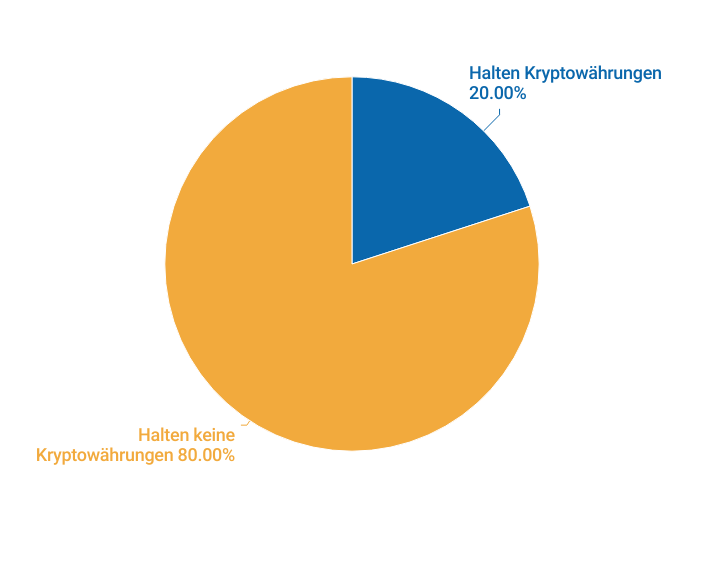

An analysis by The Washington Post revealed that approximately 20% of current Trump advisors actively hold cryptocurrencies.

Trump’s youngest son, Barron, described as a “Web3 ambassador” in World Liberty Financial’s documentation, is estimated to be worth $40 million from his role in the family’s crypto businesses.

The family’s ventures also include NFT trading cards, two memecoins, the Truth Social Bitcoin ETF, and a recently launched $6.42 billion digital asset treasury company in partnership with Crypto.com.

Trump’s crypto wealth now represents approximately 9% of his estimated $6 billion fortune, marking the first time digital assets have accounted for a sizable portion of his wealth as his real estate holdings decline.

The post Donald Trump Jr. Calls Crypto Conflict of Interest Claims ‘Complete Nonsense’ appeared first on Cryptonews.

Read More

Space Meets Crypto—Spacecoin Executes 1st Blockchain Transaction Beyond Earth

Donald Trump Jr. Calls Crypto Conflict of Interest Claims ‘Complete Nonsense’

Donald Trump Jr dismissed criticism that World Liberty Financial presents conflict of interest, telling CNBC at Singapore’s Token2049 conference that concerns are “complete nonsense.”

The president’s eldest son stated he doesn’t believe anyone thinks his father “would be looking at ledgers on the blockchain to see who bought what, and that carrying any kind of favor.”

Trump Jr., a co-founder of World Liberty Financial, appeared alongside CEO Zach Witkoff, son of U.S. Special Envoy to the Middle East Steve Witkoff.

The executives emphasized their firm is “100% not a political organization” during a keynote speech, despite the company’s open connections to the Trump administration as it pursues global deals and expands into debit payments and tokenized commodity assets.

World Liberty Financial launched its USD 1 stablecoin in March 2025, six months after the company was founded in September 2024.

The dollar-pegged token is backed by short-term U.S. government treasuries and includes a publicly traded governance token called WLFI.

According to the company’s website, DT Marks DEFI LLC and Trump family members receive a major share of platform revenue and hold WLFI tokens.

However, Donald Trump and his family have no officer, director, or employee positions.

The Trump family’s crypto portfolio has grown to exceed $1.2 billion across multiple ventures.

As of June, President Trump holds 15.75 billion WLFI tokens, representing 15.75% control of the entire project.

His official financial disclosure shows $57.4 million in personal income from World Liberty Financial over the past year.

His NFT collections generated an additional $1.16 million; however, these figures exclude substantial fees from the $TRUMP meme coin, in which his businesses hold an 80% stake.

Family Empire Spans Mining Operations to Treasury Strategies

The Trump family’s crypto activities extend well beyond World Liberty Financial.

American Bitcoin, co-founded by Eric Trump and backed by Donald Trump Jr., surged 110% at its September debut following an all-stock merger with Nasdaq-listed Gryphon Digital Mining, briefly valuing the brothers’ combined stake at $2.6 billion before closing at around $1.5 billion.

The company operates approximately 6,000 mining computers and has entered into a $2.1 billion controlled stock offering with Cantor Fitzgerald and Mizuho Securities to acquire more Bitcoin and upgrade its mining technology.

Trump Media & Technology Group raised $2.5 billion in May to build a Bitcoin treasury, currently holding approximately 18,430 BTC worth $2.1 billion.

As of June, Bitcoin represents more than 40% of TMTG’s overall market capitalization.

However, its shares have consistently underperformed the crypto itself, falling 47% over the same six-month period, while Bitcoin gained 10.6% during that time.

Donald Trump Jr. also purchased 350,000 shares in Thumzup Media Corporation worth nearly $3.3 million in July.

The Nasdaq-listed company subsequently acquired DogeHash Technologies in an all-stock deal, creating what executives describe as the world’s largest Dogecoin mining platform with over 4,000 operational rigs expected by year-end.

Democratic Lawmakers Label Ventures ‘Unprecedented Conflict’

Democratic Senators Elizabeth Warren and Representative Maxine Waters have led calls for investigations into World Liberty Financial, labeling the company an “unprecedented conflict” that could sway crypto policy.

The House Committee on Financial Services Democratic Caucus stated Trump “rewrote the rules, then cashed in on the chaos he helped create” by gutting oversight and hyping risky tokens.

Citizens for Responsibility and Ethics in Washington described Trump’s deep crypto ties, involving partnerships with foreign businesses, as “unprecedented.”

The organization tracked over 3,700 conflicts of interest during Trump’s previous term and warned he appears “poised to rack up more conflicts than ever, with even less transparency than last time.”

An analysis by The Washington Post revealed that approximately 20% of current Trump advisors actively hold cryptocurrencies.

Trump’s youngest son, Barron, described as a “Web3 ambassador” in World Liberty Financial’s documentation, is estimated to be worth $40 million from his role in the family’s crypto businesses.

The family’s ventures also include NFT trading cards, two memecoins, the Truth Social Bitcoin ETF, and a recently launched $6.42 billion digital asset treasury company in partnership with Crypto.com.

Trump’s crypto wealth now represents approximately 9% of his estimated $6 billion fortune, marking the first time digital assets have accounted for a sizable portion of his wealth as his real estate holdings decline.

The post Donald Trump Jr. Calls Crypto Conflict of Interest Claims ‘Complete Nonsense’ appeared first on Cryptonews.

Read More

Trump-affiliated Thumzup invests $2.5 million in Dogecoin mining expansion, adding 500+ new ASIC miners ahead of DogeHash acquisition.

Trump-affiliated Thumzup invests $2.5 million in Dogecoin mining expansion, adding 500+ new ASIC miners ahead of DogeHash acquisition.