TRON’s Slow Grind Could Set the Stage for a Big Breakout Toward $1

- TRX’s multi-year higher-low pattern keeps the $1 target in play.

- Clearing $0.42–$0.45 resistance could spark a fast September–October rally.

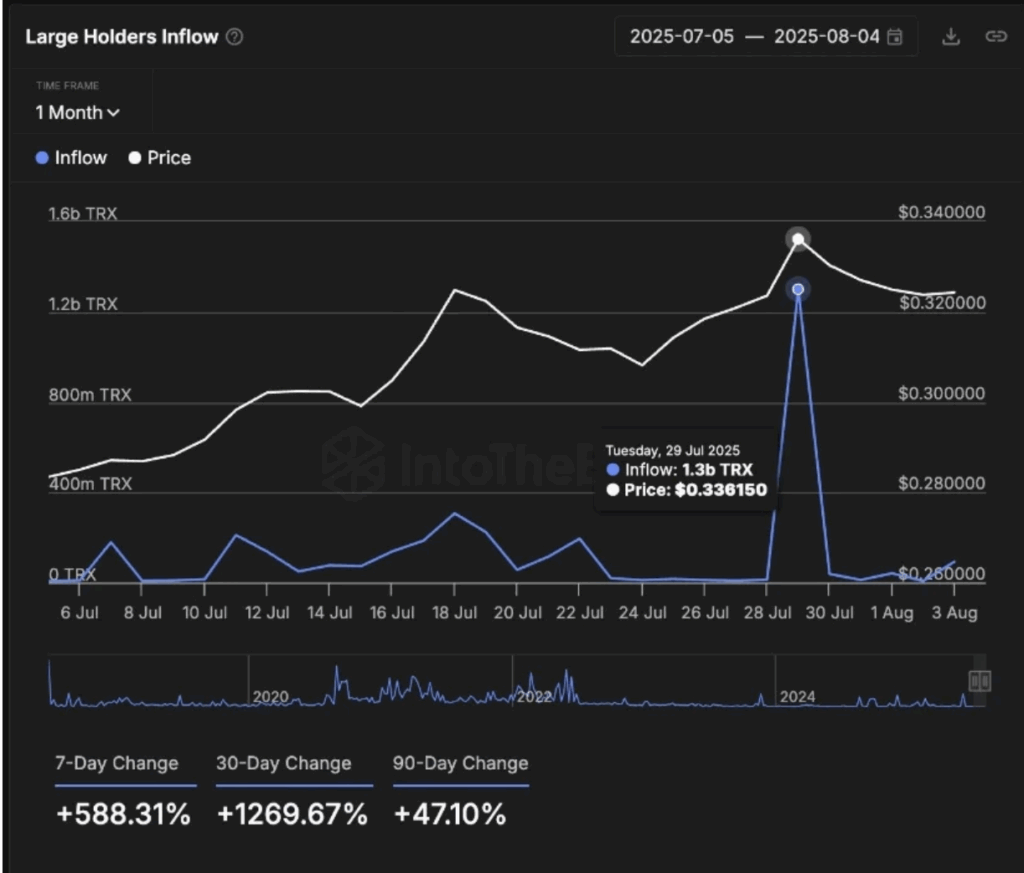

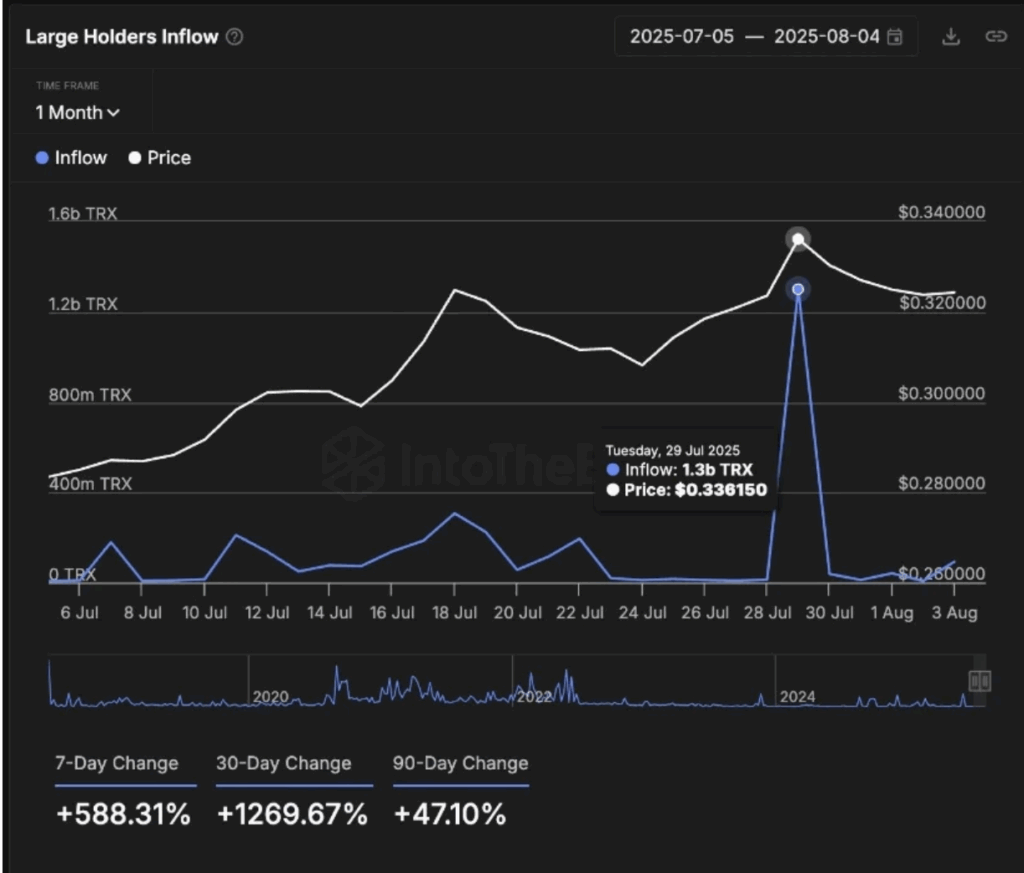

- Whale inflows up 1,269% signal smart money’s already positioning for the next leg.

TRON’s holding steady near $0.346, not exactly fireworks—but the kind of quiet climb that often hides bigger moves ahead. From a base around $0.33, buyers have been stepping in at each higher low, refusing to let the multi-year uptrend crack. And with whale wallets loading up at a pace not seen in months, the market’s starting to wonder if TRX’s next leap could finally clear the big psychological markers.

The $1 Ambition Isn’t Just Hype

Looking at TRON’s long-term chart, it’s basically a staircase—each dip finding a floor, each consolidation eventually giving way to a push higher. Analysts tracking the ascending trendline say this pattern’s played out before, and if it holds again, $1 sits right in the path of the next breakout leg. The real test? Smashing through the $0.42–$0.45 resistance zone without hesitation. Do that, and the September–October window could flip from “maybe” to “momentum.”

Bulls Have Their Eyes on $0.45 First

Short term, TRX is up 2% in 24 hours and trading comfortably above its main support at $0.332. On the 4-hour chart, price has reclaimed moving averages, with the 50 MA acting like a safety net. The next checkpoint sits at $0.351—clear that, and you’re looking at a runway toward $0.38, $0.40, and eventually a retest of $0.45. What makes this stretch interesting is that TRON’s been one of the steadier large-cap performers this cycle, a slow-burn trend that doesn’t rely on hype alone.

On-Chain Strength + Whale Activity = Fuel for the Move

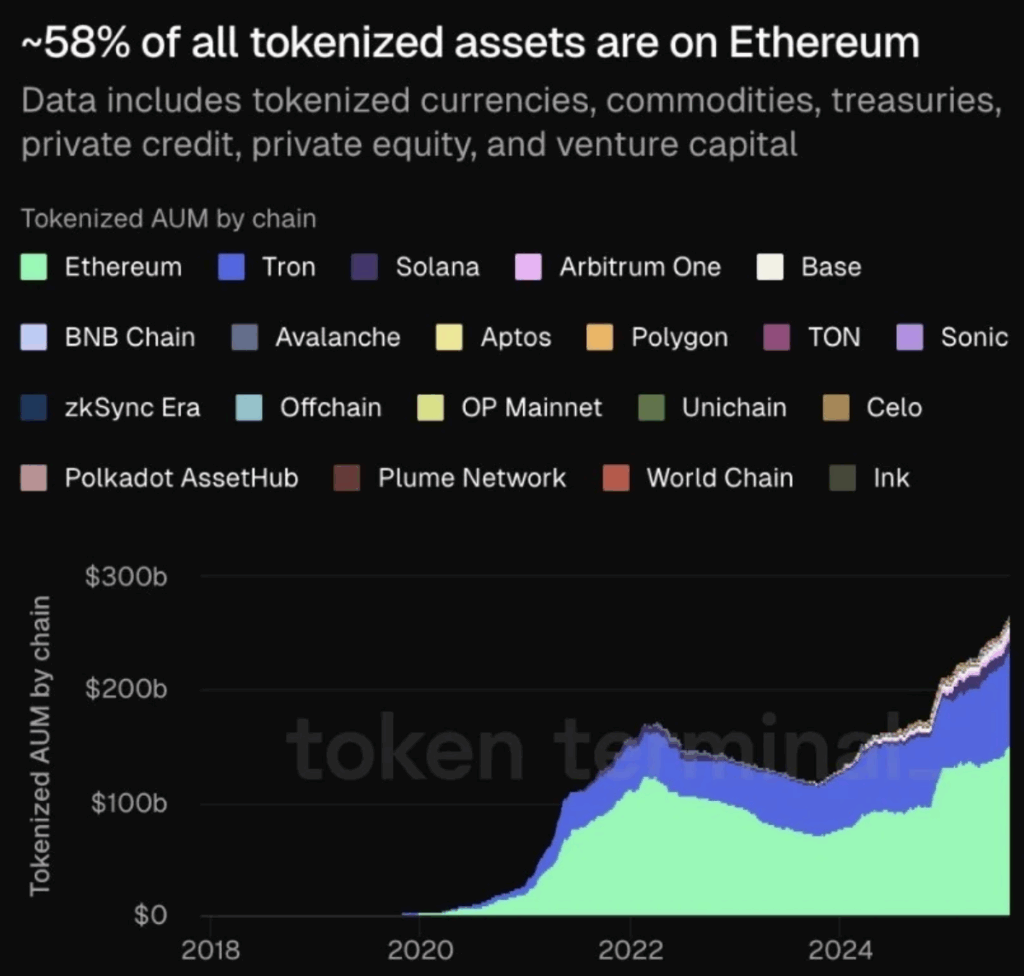

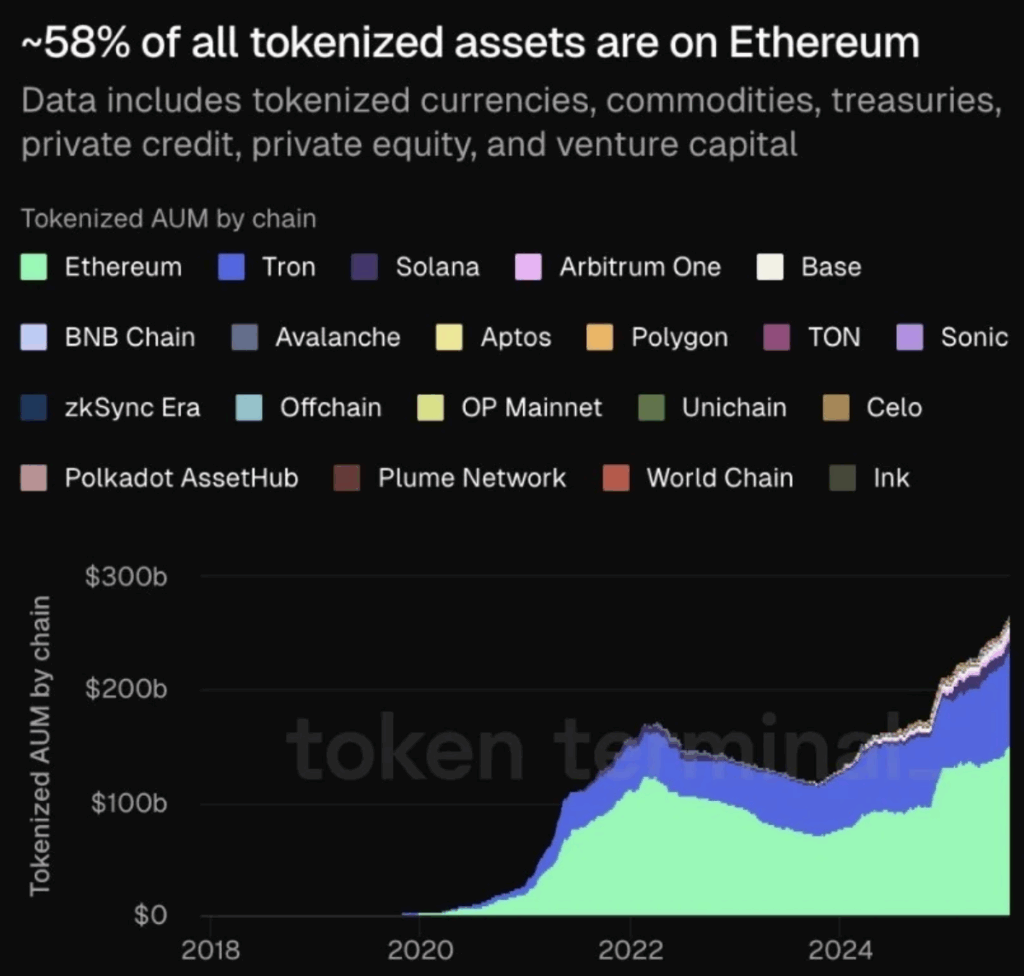

While Ethereum still dominates tokenized asset flows, TRON’s been quietly grabbing a bigger slice of the pie, especially with stablecoins and other real-world asset transfers. This steady network utility backs the price chart’s bullish structure. Add in the fact that large holder inflows spiked 1,269% in 30 days—hitting 1.3B TRX on July 29—and you’ve got a strong case for accumulation-driven upside. Historically, those whale buying waves haven’t been just for show—they’ve often come right before the real breakout.

The post TRON’s Slow Grind Could Set the Stage for a Big Breakout Toward $1 first appeared on BlockNews.

TRON’s Slow Grind Could Set the Stage for a Big Breakout Toward $1

- TRX’s multi-year higher-low pattern keeps the $1 target in play.

- Clearing $0.42–$0.45 resistance could spark a fast September–October rally.

- Whale inflows up 1,269% signal smart money’s already positioning for the next leg.

TRON’s holding steady near $0.346, not exactly fireworks—but the kind of quiet climb that often hides bigger moves ahead. From a base around $0.33, buyers have been stepping in at each higher low, refusing to let the multi-year uptrend crack. And with whale wallets loading up at a pace not seen in months, the market’s starting to wonder if TRX’s next leap could finally clear the big psychological markers.

The $1 Ambition Isn’t Just Hype

Looking at TRON’s long-term chart, it’s basically a staircase—each dip finding a floor, each consolidation eventually giving way to a push higher. Analysts tracking the ascending trendline say this pattern’s played out before, and if it holds again, $1 sits right in the path of the next breakout leg. The real test? Smashing through the $0.42–$0.45 resistance zone without hesitation. Do that, and the September–October window could flip from “maybe” to “momentum.”

Bulls Have Their Eyes on $0.45 First

Short term, TRX is up 2% in 24 hours and trading comfortably above its main support at $0.332. On the 4-hour chart, price has reclaimed moving averages, with the 50 MA acting like a safety net. The next checkpoint sits at $0.351—clear that, and you’re looking at a runway toward $0.38, $0.40, and eventually a retest of $0.45. What makes this stretch interesting is that TRON’s been one of the steadier large-cap performers this cycle, a slow-burn trend that doesn’t rely on hype alone.

On-Chain Strength + Whale Activity = Fuel for the Move

While Ethereum still dominates tokenized asset flows, TRON’s been quietly grabbing a bigger slice of the pie, especially with stablecoins and other real-world asset transfers. This steady network utility backs the price chart’s bullish structure. Add in the fact that large holder inflows spiked 1,269% in 30 days—hitting 1.3B TRX on July 29—and you’ve got a strong case for accumulation-driven upside. Historically, those whale buying waves haven’t been just for show—they’ve often come right before the real breakout.

The post TRON’s Slow Grind Could Set the Stage for a Big Breakout Toward $1 first appeared on BlockNews.