WhiteRock Surges 116% Amid Rumored Saudi Oil Deal, But Doubts Emerge

WhiteRock Rockets Over 110% on Saudi Oil Tokenization Rumor

WhiteRock (WHITE) saw dramatic price appreciation on May 30, surging over 116% on reports of a rumored partnership with a high-profile Saudi oil producer that was unconfirmed.

Market Response: Volume and Open Interest Soar

WHITE briefly touched an intraday high of $0.00138 before returning to $0.00104. Its market cap ebbed and flowed at $780 million, with its daily volume rising by 500% to near $10 million.

Open interest also caught up, rising 240% to a record high of $998.55k. The speculative frenzy signals a rush of retail and derivatives traders betting on a high-profile alliance.

Since bottoming in March, WHITE is up over 280%.

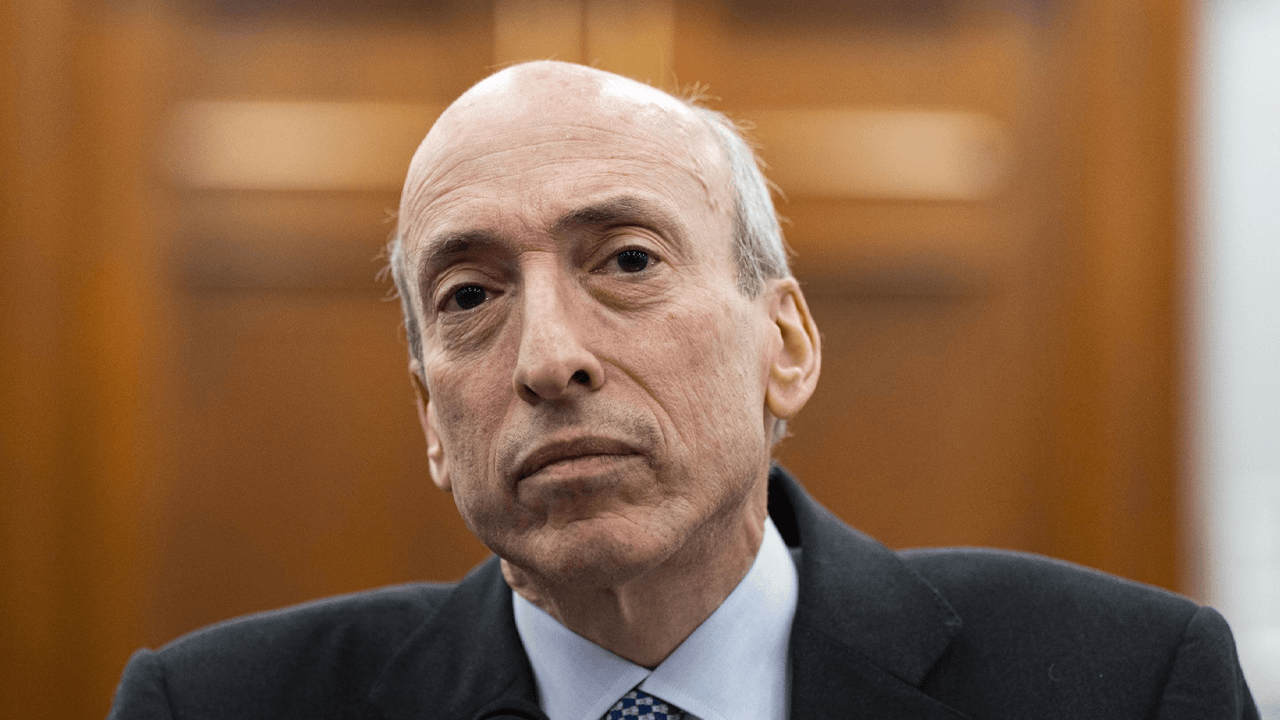

Rumors Target Ripple and Saudi Aramco

The rally was fueled mainly by rumors circulating on X (formerly Twitter). Anonymouse trader Amonyx indicated WhiteRock is partnering with Ripple to tokenize oil supply chains—allegedly involving Saudi Aramco.

The letter was allegedly signed by a Saudi government representative and referred to the “largest blockchain tokenization deal in history.” It gathered over 254,000 views within a day.

However, none of the three companies involved—Ripple, WhiteRock, or Aramco—announced the deal.

Red Flags Surround the Leaked Document

Investigation of the shared document raised grave concerns. The alleged signatory, “Sheikh Abdullah bin Khalid Al-Falih,” doesn’t appear on any official Saudi government records. Worse, a reverse image search reveals that the signature closely resembles that of Iranian actress Mahtab Keramati.

Apart from that, Saudi Aramco has publicly announced no oil tokenization or blockchain collaboration save for its 2023 investment partnership with SBI Holdings—a venture that bypassed XRP or oil assets to some attention.

WhiteRock’s Ripple Link and What is Real

WhiteRock is indeed rooted in the XRP Ledger, having launched in March 2025 to provide institutional-grade tokenized assets. But there has been silence on oil-based products.

The speculated Aramco connection looks speculative at best and, without confirmation, the recent momentum is vulnerable to correction.

Conclusion: Warning Signs Ahead of Hype

WHITE’s rally may be a reflection of market enthusiasm, but it’s essential to separate sentiment from reality. Without evidence-based confirmation, investors are in danger of pursuing an over-sensationalized story with flimsy supporting facts.

Read More

Russian Finance Ministry Wants to Lower Citizens’ Barriers to Crypto Market Entry

WhiteRock Surges 116% Amid Rumored Saudi Oil Deal, But Doubts Emerge

WhiteRock Rockets Over 110% on Saudi Oil Tokenization Rumor

WhiteRock (WHITE) saw dramatic price appreciation on May 30, surging over 116% on reports of a rumored partnership with a high-profile Saudi oil producer that was unconfirmed.

Market Response: Volume and Open Interest Soar

WHITE briefly touched an intraday high of $0.00138 before returning to $0.00104. Its market cap ebbed and flowed at $780 million, with its daily volume rising by 500% to near $10 million.

Open interest also caught up, rising 240% to a record high of $998.55k. The speculative frenzy signals a rush of retail and derivatives traders betting on a high-profile alliance.

Since bottoming in March, WHITE is up over 280%.

Rumors Target Ripple and Saudi Aramco

The rally was fueled mainly by rumors circulating on X (formerly Twitter). Anonymouse trader Amonyx indicated WhiteRock is partnering with Ripple to tokenize oil supply chains—allegedly involving Saudi Aramco.

The letter was allegedly signed by a Saudi government representative and referred to the “largest blockchain tokenization deal in history.” It gathered over 254,000 views within a day.

However, none of the three companies involved—Ripple, WhiteRock, or Aramco—announced the deal.

Red Flags Surround the Leaked Document

Investigation of the shared document raised grave concerns. The alleged signatory, “Sheikh Abdullah bin Khalid Al-Falih,” doesn’t appear on any official Saudi government records. Worse, a reverse image search reveals that the signature closely resembles that of Iranian actress Mahtab Keramati.

Apart from that, Saudi Aramco has publicly announced no oil tokenization or blockchain collaboration save for its 2023 investment partnership with SBI Holdings—a venture that bypassed XRP or oil assets to some attention.

WhiteRock’s Ripple Link and What is Real

WhiteRock is indeed rooted in the XRP Ledger, having launched in March 2025 to provide institutional-grade tokenized assets. But there has been silence on oil-based products.

The speculated Aramco connection looks speculative at best and, without confirmation, the recent momentum is vulnerable to correction.

Conclusion: Warning Signs Ahead of Hype

WHITE’s rally may be a reflection of market enthusiasm, but it’s essential to separate sentiment from reality. Without evidence-based confirmation, investors are in danger of pursuing an over-sensationalized story with flimsy supporting facts.

Read More