Atkins on Stablecoins: “We’ve Got the Green Light”

- Paul Atkins says stablecoins now have full U.S. government backing, opening the door to instant on-chain settlement and reduced market risks.

- He advocates opening private markets to 401(k) investors, with proper fiduciary guardrails.

- On Ethereum, Atkins sees broad market adoption as a positive sign—even if regulatory language is still catching up.

Paul Atkins didn’t mince words—he sees the new U.S. stablecoin framework as a big win. For the first time, he said, the U.S. government has given a real stamp of approval to a major class of digital assets. And that changes the game.

“You’re gonna see real innovation now,” Atkins explained. “Instant settlement, delivery versus payment, all of it running on-chain—it’s a huge deal for market efficiency and cutting risks.” He believes stablecoins could help reduce frictions in the financial system and push the U.S. to the front of the global markets race again.

“It’s finally moving,” he said. “And this time, it feels permanent.”

Opening Up Private Markets to 401(k)s

Atkins also talked about something that doesn’t usually get much spotlight—retirement accounts. Specifically, he thinks it’s time regular folks had access to private market funds through their 401(k)s.

“There’s demand, clearly,” he said. “People want in. And right now, the SEC’s rules have kind of boxed them out.” He hinted at a future executive order that might push things forward, but said work with the Department of Labor is already happening in the background.

Still, he noted, it won’t be a free-for-all. “We’re talking about retirement money here,” he added. “Valuations, fees, liquidity—that all needs to be handled with real fiduciary oversight.”

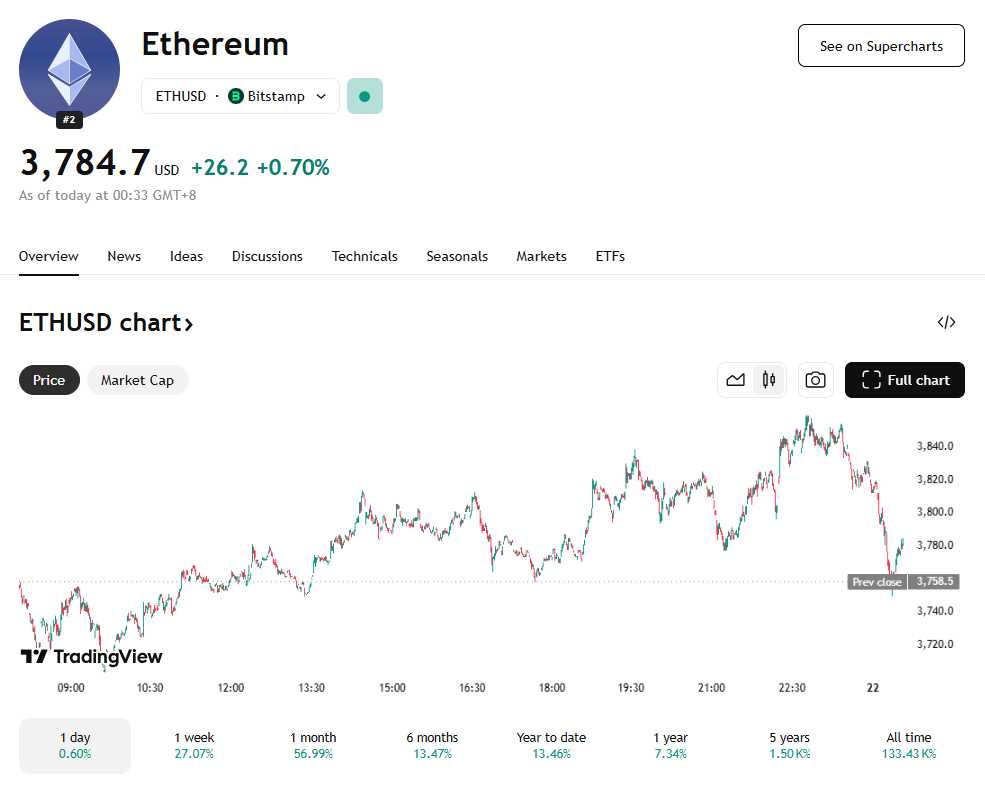

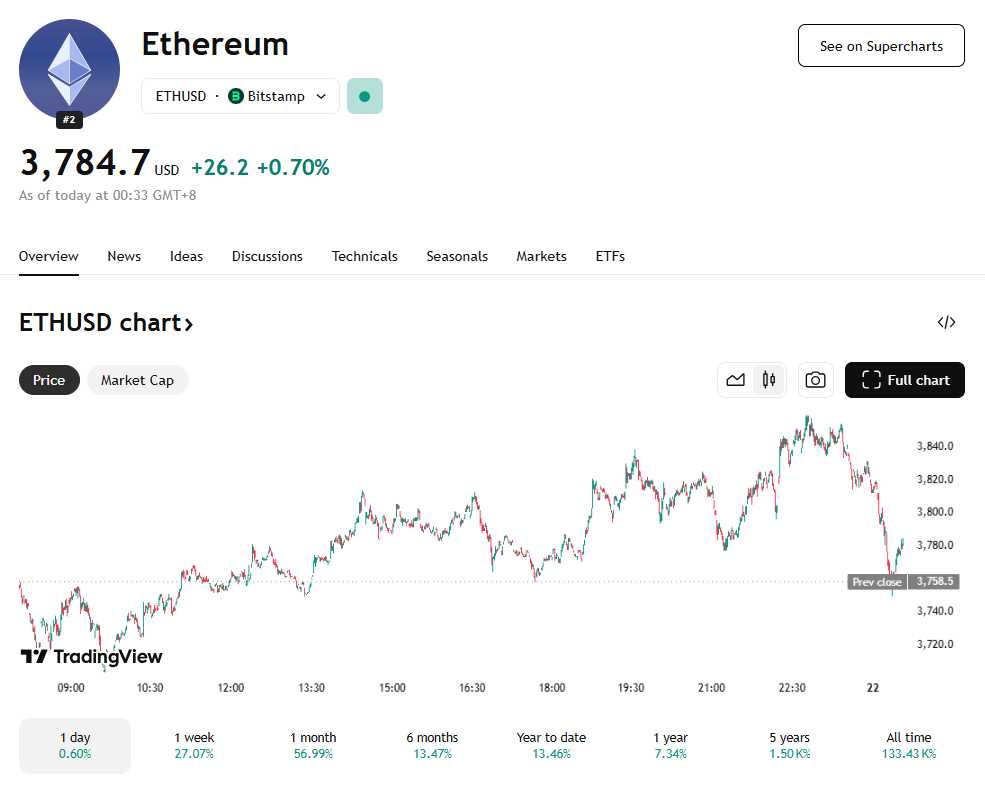

On Ethereum and Crypto Treasuries

When asked about Ethereum and whether companies should be parking funds in ETH treasuries, Atkins kept it neutral but optimistic. “Look, similar to Bitcoin, the SEC hasn’t said Ether is a security—at least not formally. But clearly, ETH is essential infrastructure for a ton of digital assets.”

He emphasized that companies should make those decisions on their own, based on their strategies. But the fact that digital assets are being embraced broadly? That’s a good sign. “It shows real momentum,” he said. “And honestly, it speaks to the future of how corporate treasuries might evolve.”

The post Atkins on Stablecoins: “We’ve Got the Green Light” first appeared on BlockNews.

Atkins on Stablecoins: “We’ve Got the Green Light”

- Paul Atkins says stablecoins now have full U.S. government backing, opening the door to instant on-chain settlement and reduced market risks.

- He advocates opening private markets to 401(k) investors, with proper fiduciary guardrails.

- On Ethereum, Atkins sees broad market adoption as a positive sign—even if regulatory language is still catching up.

Paul Atkins didn’t mince words—he sees the new U.S. stablecoin framework as a big win. For the first time, he said, the U.S. government has given a real stamp of approval to a major class of digital assets. And that changes the game.

“You’re gonna see real innovation now,” Atkins explained. “Instant settlement, delivery versus payment, all of it running on-chain—it’s a huge deal for market efficiency and cutting risks.” He believes stablecoins could help reduce frictions in the financial system and push the U.S. to the front of the global markets race again.

“It’s finally moving,” he said. “And this time, it feels permanent.”

Opening Up Private Markets to 401(k)s

Atkins also talked about something that doesn’t usually get much spotlight—retirement accounts. Specifically, he thinks it’s time regular folks had access to private market funds through their 401(k)s.

“There’s demand, clearly,” he said. “People want in. And right now, the SEC’s rules have kind of boxed them out.” He hinted at a future executive order that might push things forward, but said work with the Department of Labor is already happening in the background.

Still, he noted, it won’t be a free-for-all. “We’re talking about retirement money here,” he added. “Valuations, fees, liquidity—that all needs to be handled with real fiduciary oversight.”

On Ethereum and Crypto Treasuries

When asked about Ethereum and whether companies should be parking funds in ETH treasuries, Atkins kept it neutral but optimistic. “Look, similar to Bitcoin, the SEC hasn’t said Ether is a security—at least not formally. But clearly, ETH is essential infrastructure for a ton of digital assets.”

He emphasized that companies should make those decisions on their own, based on their strategies. But the fact that digital assets are being embraced broadly? That’s a good sign. “It shows real momentum,” he said. “And honestly, it speaks to the future of how corporate treasuries might evolve.”

The post Atkins on Stablecoins: “We’ve Got the Green Light” first appeared on BlockNews.

SEC Chair Paul Atkins confirms Ethereum

SEC Chair Paul Atkins confirms Ethereum